Uncommon truths: Why is gold at $3,000?

Gold recently breached $3000, perhaps helped by falling US yields and a weaker dollar. Central bank purchases and geopolitical/economic concerns may also be at work. Enjoy the ride while it lasts.

There is no shortage of questions about gold in investor meetings (there is nothing like rising prices to pique interest!). Around 12 months ago, when gold had gone above $2400, I asked what was driving it in the face of rising real treasury yields and an appreciating dollar. My conclusion was that it was largely down to concerns about geopolitical risks (and perhaps worries about the level of US government debt) but that the price could not continue rising forever. Well, it has continued higher, and is now above $3000.

Supply does not appear to be the issue. According to World Gold Council (WGC) data, the average all-in sustaining cost of gold production had risen from around $1000 per ounce at the end of 2020 to just below $1500 by 2024 Q3. That is a big rise but the WGC estimates that around 90% of gold mines would be profitable at a price of $2000 and that more than 99% would be profitable at a price of $3000 (as of 30 September 2024). Indeed, global supply was up marginally in 2024 (largely due to recycled gold) and has increased by 6% since 2021 and 15% since 2010 (due to increased mine production). The rise in supply should be no surprise when the price is so strong.

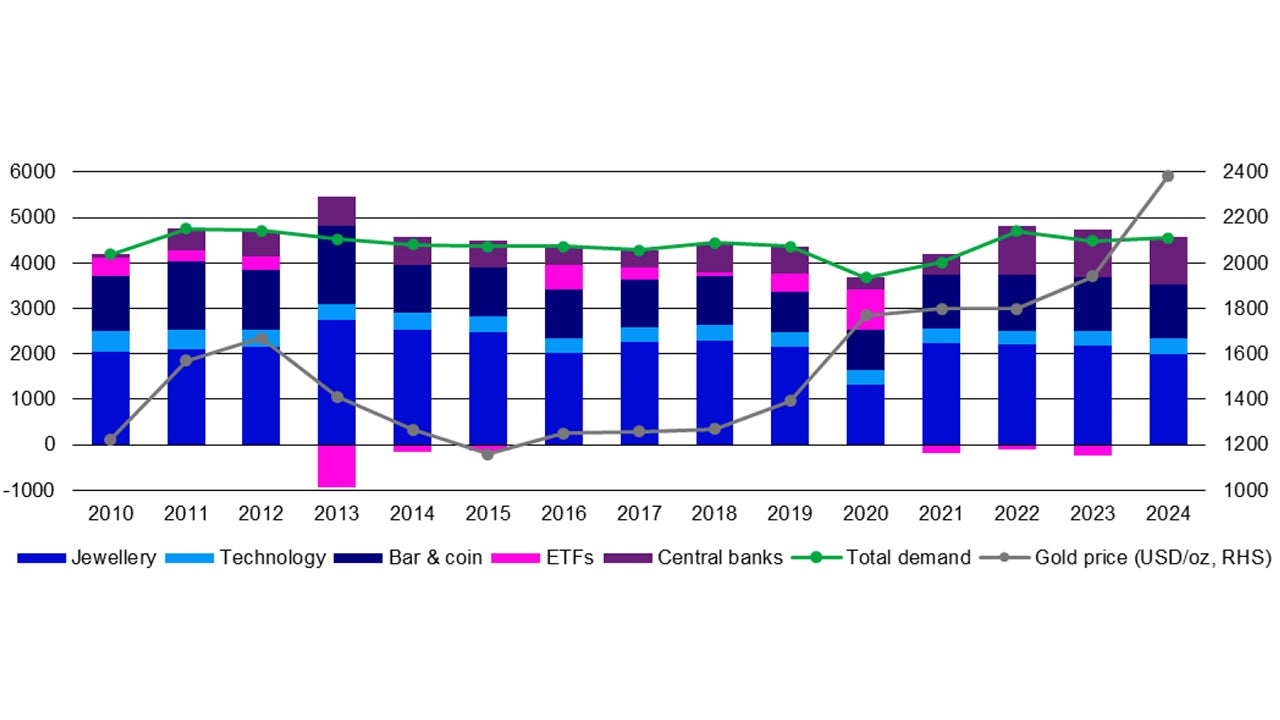

On the other hand, Figure 1 shows that demand for gold has been reasonably stable over the last 15 years (note that I exclude the “OTC & other” component, which is used as a balancing factor to make demand equal supply). There was a dip in demand in 2020, with jewellery purchases presumably limited by pandemic lockdowns. Jewellery demand recovered in 2021, though net ETF purchases turned negative. Full recovery of demand occurred in 2022, driven by large central bank purchases (largely from Russia, we believe). Central bank purchases have eased a bit since then (and spread across a broader range of countries), such that total demand for gold was around 3% lower in 2024 than in 2022. In fact, all components of demand have fallen since 2022, except technology and ETFs, with outflows from the latter being near zero in 2024.

So, with supply up 5% and demand down 3% since 2022, why did the gold price rise by 45% between end-2022 and end-2024 (and by 65% to 19 March 2025)? Perhaps one answer lies in the record net open interest positions on the nine largest gold futures exchanges that have persisted for much of the last 12-18 months (according to WGC data). For sure, this may have something to do with the rise in price (the reporting is in dollar amounts) but COMEX net long positions in tonnes have been elevated over this period (COMEX dominates the data across the reported exchanges). It is my guess that this represents speculative positioning linked to geopolitical uncertainty.

Normally, I would expect most components of demand to be price sensitive. For example, I suppose that jewellery demand would fall when the price rises sharply, as consumers turn to alternatives (this may also help explain the dip in jewellery demand in 2020). I believe the same applies to technology purchases. For example, dentistry use has fallen every year since 2010 and is now only 20% of the 2010 level. However, technology purchases are dominated by electronics uses that are seeing secular growth, though even those businesses are likely to find cheaper alternatives as the price rises (or become more efficient in its use).

Note: Annual data from 2010 to 2024. Total demand is the sum of the categories shown in this chart but doesn’t equal supply as the balancing item (often called “OTC and other” and used to make demand equal supply) is not shown. Gold price is the annual average LBMA gold price. Data is sourced from the World Gold Council Global Demand Trends.

Source: World Gold Council, ICE Benchmark Administration, Metals Focus, Refinitiv GFMS and Invesco Global Market Strategy Office.

The same may not apply to purchases by central banks and investors, with demand sometimes rising with price. When there is discretion, I fear that government and central bank decision makers are as likely as the rest of us to follow momentum. For example, the UK government announced in May 1999 (when gold was at $282) that it was to sell half its gold reserves, just as the yellow metal was reaching the bottom of a 20-year bear market.

When it comes to investors, it is interesting to note that net ETF purchases turned positive in 2024 Q3, having been negative in each of the preceding nine quarters. ETF flows have been positive in every month since May 2024 (except November), and 2025 Q1 looks as though it could be the strongest quarter since 2022 Q1 (when Russia invaded Ukraine). Having been sellers over recent years, investors appear to have thrown in the towel, deciding it is too painful to miss out on this rally. Or has something fundamental changed to persuade them that the outlook for gold is now better?

Figure 2 shows the results of an analysis that seeks to answer that last question, based on data since December 2009. The basic model (“Post-2009, no dummies”) explains the price of gold as a function of the 10-year US TIPS yield, the 10-year US inflation breakeven and a trade weighted index of the US dollar. The model has a number of drawbacks: first, the coefficient on the dollar is positive, which is not what I would expect (those on the real yield (negative) and on inflation (positive) are as expected). Second, the coefficient on the real yield is not statistically significant and the adjusted R-squared is only 0.38. Finally, the model fitted value is currently only $1944.

The alternative model introduces three dummy variables to capture the effect on gold of the presidencies of Donald Trump, the invasion of Ukraine (“Putin”) and the conflict in Gaza (started by the Hamas attack on Israel on 7 October 2023). All three dummy variables have positive coefficients, with t-statistics that suggest statistical significance. Importantly, in this model the coefficient on the dollar is negative (and statistically significant) and the adjusted R-squared is an impressive 0.85. However, the positive coefficient on inflation is not statistically significant and the current model predicted value is still only $2508.

Hence, even the best of these models has a current fair-value that is well below the actual market price. Interestingly, the market price started to diverge from the model with dummy variables in 2024 Q4. Perhaps the gold market is placing a greater geopolitical/debt risk premium upon the second Trump presidency than it did on the first (the Trump dummy has a coefficient of $168, measured across the two terms). Then again, if he confounds the market and brings peace in Ukraine and the Middle East, the consequences for gold could be enormous (the coefficients on the Putin and Gaza dummies suggest the price could fall by around $1600).

Even if these models shouldn’t be taken too seriously when trying to predict the future, it is interesting that they struggle to explain the recent past, including the move above $3000. The price is up 84% in the last 30 months and has never (in the last 150 years) been this high in real terms, whether compared to US CPI or the price of oil. Enjoy the ride while it lasts.

Unless stated otherwise, all data as of 21 March 2025

Note: Past performance is no guarantee of future results. Based on monthly data from December 2009 to March 2025 (as of 19 March 2025). “Gold” is the London bullion market spot price in USD/troy ounce. The two models are based on an econometric analysis using monthly data from December 2009 to February 2025, with the price of gold as the independent variable and the 10-year US TIPS yield, the 10-year US inflation breakeven rate and a trade weighted US dollar index (from JP Morgan) used as explanatory variables. The “Post 2009, with Trump, Putin and Gaza dummies” version includes three dummy variables to coincide with the presidencies of Donald Trump (the dummy turned on in the November of each election year when he won and turned off in the January of the year that he left office), the invasion of Ukraine by Russia (the dummy turned on in March 2022) and the conflict in Gaza (the dummy turned on in October 2023). Source: JP Morgan, LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.