FX Pulse: 2025 Q1

Paul Jackson in Invesco’s GMS Office shares his quarterly outlook on the currency markets. Find out more.

USD has started to weaken as policy uncertainty clouds the outlook for the US economy. We expect this to continue. At the same time, we think BOJ tightening will make JPY the strongest major currency.

| Favoured currency | Hedge from | Hedge to | |

| 3M view | JPY, AUD, EUR | USD, HKD | JPY, AUD, GBP |

| 12M view | JPY, EUR, AUD | USD, HKD | JPY, AUD, EUR |

Note: See appendix for currency and central bank abbreviations.

Source: Invesco Global Market Strategy Office

The central bank easing cycle continues, with around 30 central banks cutting interest rates during 2025 Q1 (according to CentralBankRates). Six of them were among our selection of the 10 most traded currencies, while the BOJ again moved in the opposite direction.

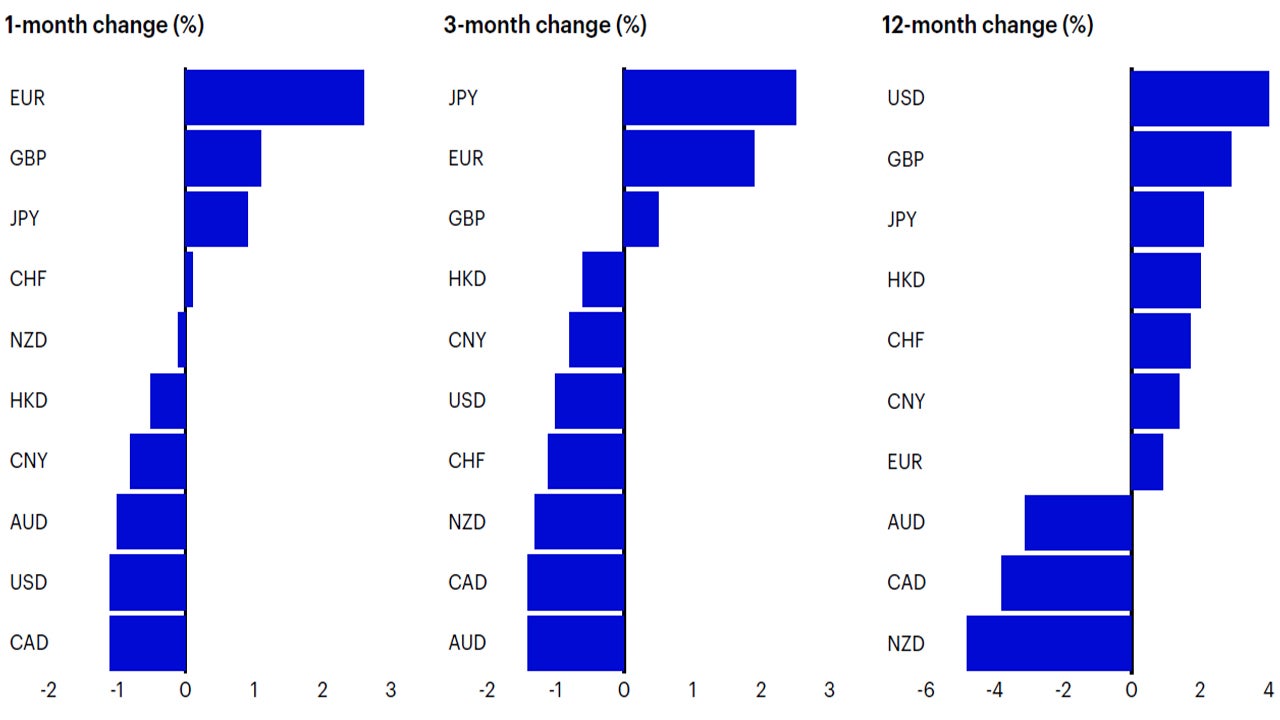

However, central banks having taken a back seat since the inauguration of President Trump, with the flurry of US administration initiatives grabbing the headlines. Indeed, US policy uncertainty indices are at levels only exceeded during the pandemic. The Fed is now less willing to ease (the last rate cut being on 18 December 2024) but US 10-year yields fell by around 35 basis points (bps) during the first quarter of 2025. That decline was almost entirely due to a fall in the real (TIPS) yield, which we think reflects concern about the growth outlook. That was the largest fall in 10-year yields among the 10 major currencies that we follow, with the eurozone and Japan at the other extreme with gains of 37 and 40 bps, respectively. It should then come as little surprise that USD was among the weaker currencies over recent months (see Figure 2), while EUR and JPY were among the strongest. We think there are good reasons for the strength of EUR and JPY.

The eurozone is an unexpected beneficiary of President Trump’s policies, with Europe forced to spend more on its defence (and to build out its capacity to produce military goods). This, along with the plans of the new German coalition to significantly boost infrastructure spending, offers the possibility of a stronger European economy over the medium to long term, which has pushed up bond yields, equity prices and the euro. The UK is also planning to raise military spending and GBP has been consistently strong over all the time periods shown in Figure 2 (partly due to BOE hesitation to ease).

JPY is benefitting from the fact that the BOJ is tightening policy, while most other central banks are easing. Despite the recent rise in Japanese policy rates and 10-year yields, they are still well below those of all other countries (except Switzerland), while inflation is currently higher than in most comparable economies.

The decline in 3-month rates over the last 12 months has been most noticeable in Canada (-226 bps) and New Zealand (-188 bps), which perhaps explains the weakness of their respective currencies over that period. Less obvious is why AUD has been so weak, when its 3-month rates have fallen only 35 bps. That said, the Australian economy has struggled, with GDP growth of only 1.3% in the year to 2024 Q4.

Notes: Past performance is no guarantee of future results. As of 31 March 2025. Based on JP Morgan Nominal Broad Trade Weighted Indices.

Source: JP Morgan, LSEG Datastream and Invesco Global Market Strategy Office

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Paul Jackson in Invesco’s GMS Office shares his quarterly outlook on the currency markets. Find out more.

The Fed has joined the easing party and we expect it to ease more aggressively than other central banks over the next 12 months. Meanwhile, we think BOJ tightening will make JPY the strongest among major currencies.