Fixed Income ETFs: Target higher quality fixed income alternatives

This is the second of a three-part blog series on fixed income ETFs. Part 1 focused on enhancing and diversifying income using ETFs while part 3 looks at maximizing returns with target maturity ETFs.

As rising volatility and higher interest rates impact the broader economy, APAC investors are looking for high quality fixed income alternatives to investment grade (IG) and high yield (HY) bonds. Investing in taxable municipal bonds and high yield fallen angels via ETFs could enhance the credit quality of their bond portfolios.

Introduction

In the first part of our fixed income blog series, we discussed how to access higher yields without compromising issuer quality by looking across the capital structure. The second part of our blog series will focus on how investors can target higher quality alternatives to traditional fixed income. Investors worrying about the current state of the global economy may want to dial back their credit exposure, while remaining invested in the broader fixed income market.

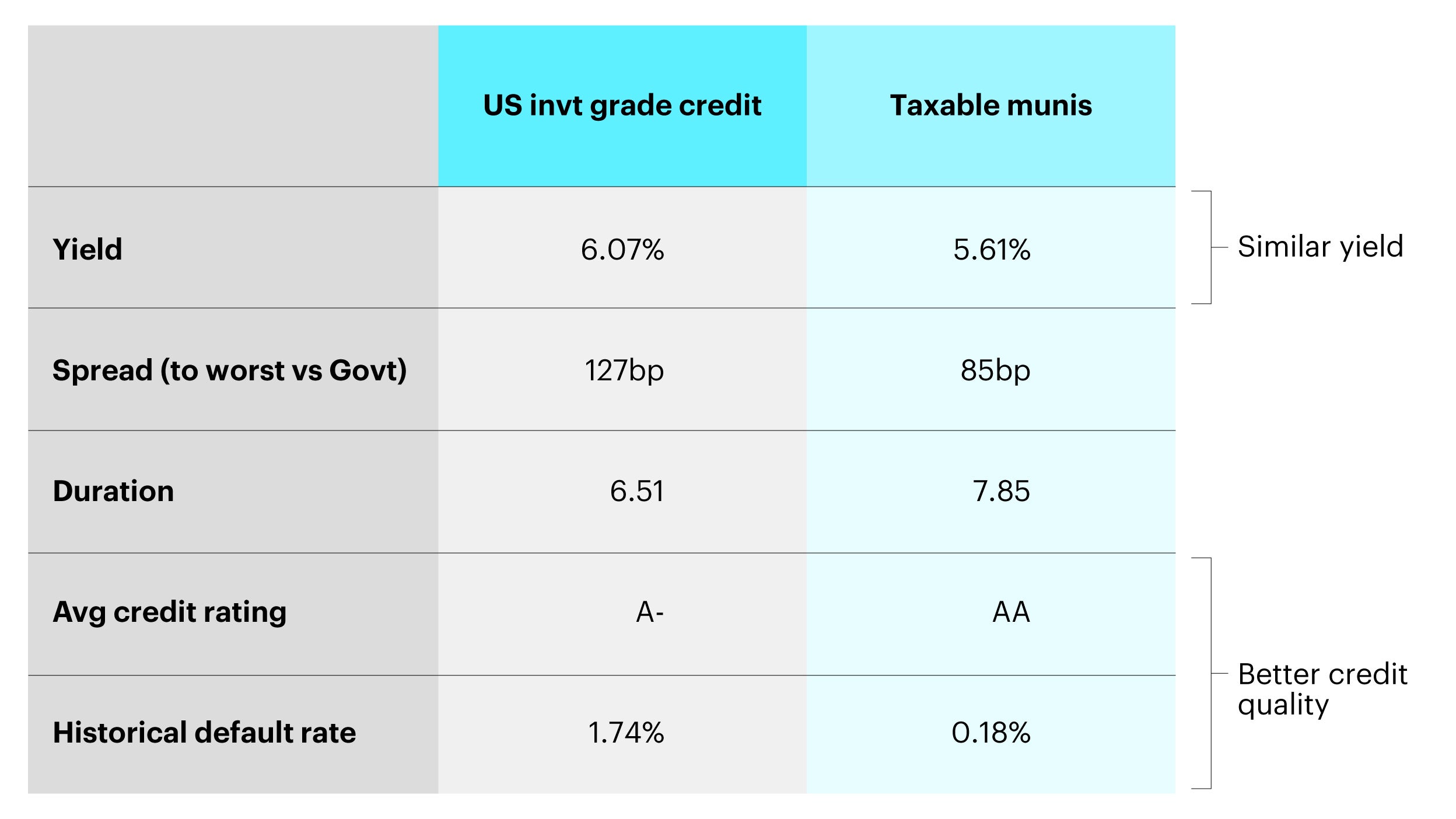

Taxable municipal bonds: a higher quality alternative to investment grade credit

In the case of investment grade credit, a higher quality alternative can be found in US taxable municipal bonds (or “munis”). The characteristics of taxable munis are very similar to US investment grade credit. They offer most of the spread, or yield pick-up, over US Treasuries as US investment grade credit, and perform in a similar manner but, from a credit perspective, taxable munis are superior to traditional IG. The average rating is three notches higher than investment grade credit and the historical default rate for investment grade municipal bonds is just 0.18%, far lower than the 1.74% default rate for investment grade credit.

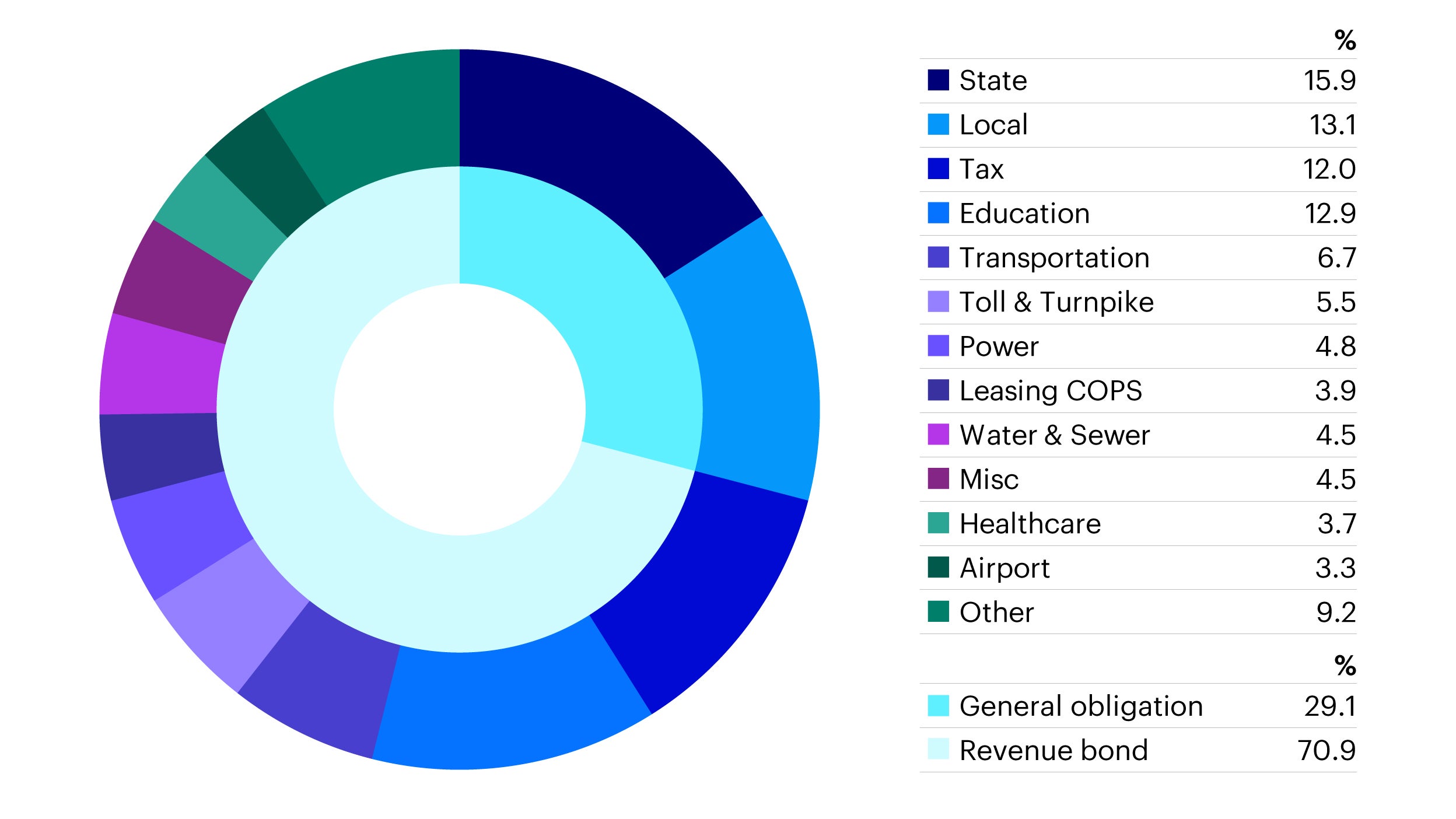

Source: ICE, Invesco, US Securities and Exchange Commission. Weights as at 30 Sep 2023 based on the ICE BofA US Taxable Municipal Securities Plus Index.

Source: Bloomberg, ICE, 30 Sep 2023. Taxable Munis is the ICE BofA US Taxable Municipal Securities Plus Index. Investment Grade Credit is the ICE BofA US Corporate Index. Default rate based on http://www.msrb.org/msrb1/pdfs/MSRB-Muni-Facts.pdf using Moody’s data for 1970-2016.

The taxable municipal bond market has many issuers and over 81,000 issues1, making it very difficult for investors to gain diversified exposure via individual bond purchases. It is also a rather institutional market where access to source the bonds can be difficult unless ticket sizes are large. Liquidity is also often sourced via primary market issuance. Primary market issuance for bonds is the equivalent of an IPO on the equity side. It’s the syndicated raise of funds for an issuer by one or several investment banks. Due to the liquidity, access, and diversification challenges of the muni market, ETFs are arguably the most cost-effective way to gain US municipal exposure. Efficient portfolio management also requires an experienced team with expertise in the unique market structure of the municipal bond market. At Invesco, we have over 15 years of experience in managing municipal bond ETFs and currently have over US $5.5 billion2 under management in municipal bond ETFs.

High yield credit: the fallen angel opportunity

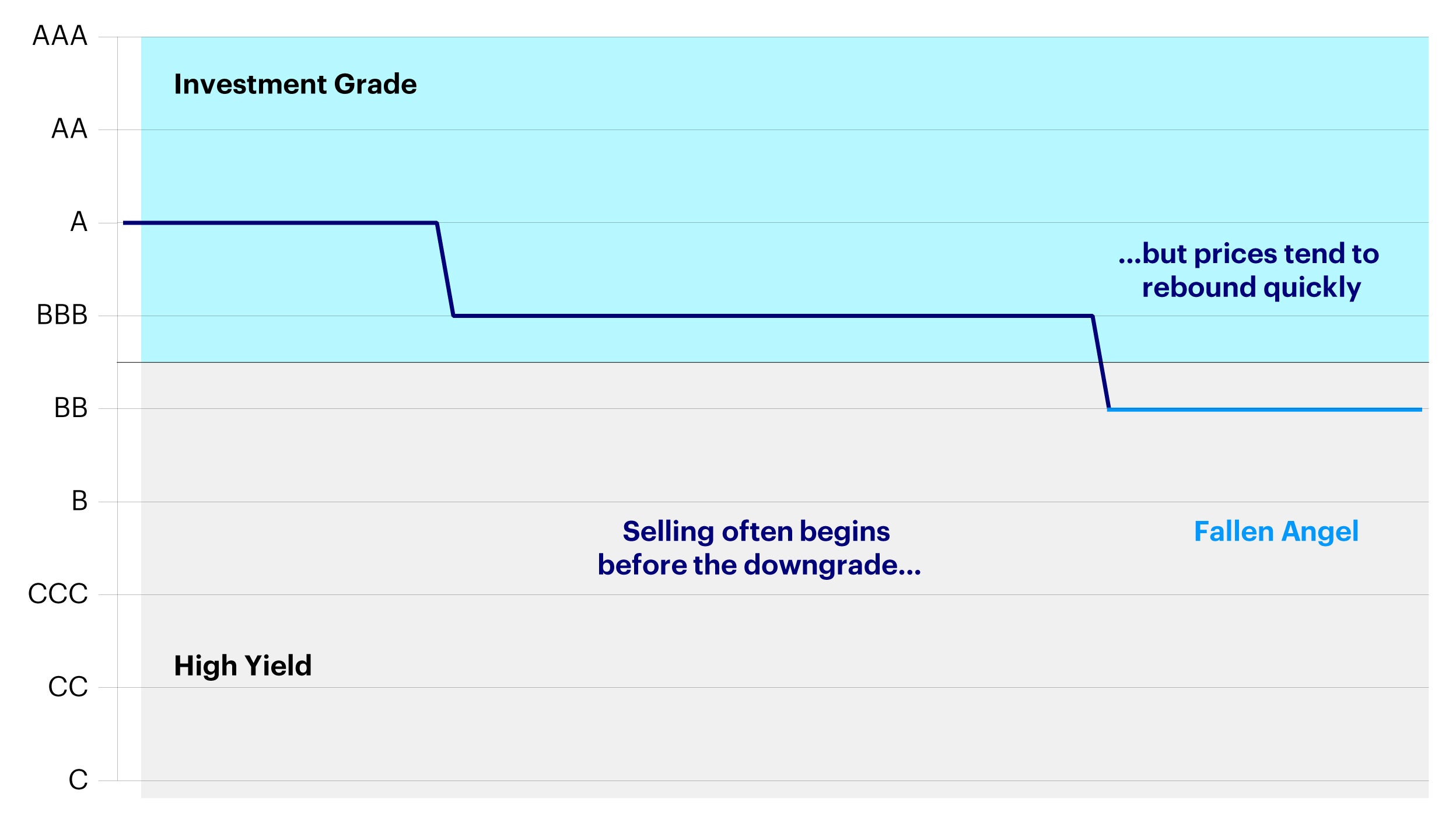

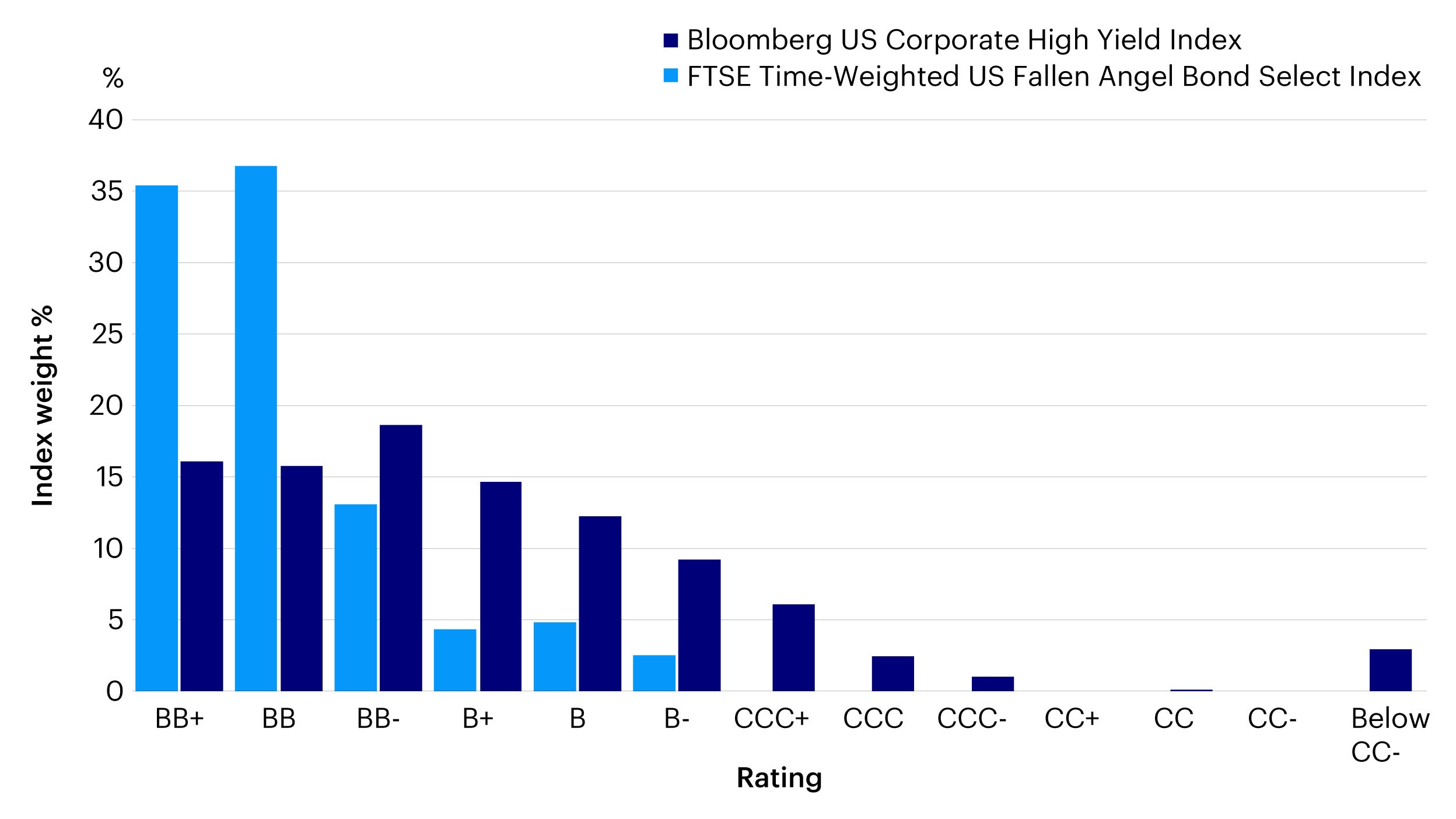

For US high yield credit, we can take a more selectively approach to improve credit quality with high yield fallen angels. By investing in high yield fallen angels, investors can target both income and capital gains. Fallen angels typically generate high income and benefit from a price rebound shortly after downgrade. They also tend to have higher credit quality than the broader US high yield market. 89% of the US fallen angels market is rated above B+, compared to only 46% for the broader US high yield market.3

A smart way to capture the price rebound of fallen angels is use a time-weighted, systematic methodology. For example, the FTSE Time-Weighted US Fallen Angel Bond Select Index uses this approach to efficiently capture the price rebounds of USD-denominated US and Canadian fallen angels, which targets greater capital appreciation in US high yield spreads. ETFs can be a simple and efficient way to access this strategy.

Bonds are added to the index within 30 days of a downgrade to high yield, with weights reducing over time to maximize exposure to any short-term rebound. Individual issuers are capped at 5% and, to enhance liquidity, individual bond weights are capped at three times their market capitalization weight.

How the index seeks to capture the performance of fallen angels:

- Includes bonds within 1-30 days of downgrade and these are held for 60 months.

- Uses time-weighting aimed to best capture price dynamics over the rebound period.

- Higher weights are assigned to bonds that have more recently become fallen angels.

Source: Invesco. For illustrative purposes only.

Source: FTSE, Bloomberg, as at 30 Sep 2023.

Investing in taxable municipal bonds and high yield fallen angels could improve and enhance credit quality in a bond portfolio. Given the broad nature of both investment universes, ETFs are efficient investment tools to target these specific parts of the bond market. Investors can benefit from cost-efficiencies as well as ease and speed of implementation for both tactical and strategic trades.

Taxable municipal bonds are issued by US local governments such as cities, counties, or related agencies to finance local projects. Unlike the more common tax-exempt munis, interest is not subsidised by the federal government. This means that taxable muni yields are higher than tax-exempt munis and more in line with other taxable securities, such as investment grade corporate bonds. This feature makes taxable munis more attractive to non-US investors.

Municipal bonds can be broken down into two categories based on the source of income to service the interest and principal repayments.

- General obligation (GO) munis are backed solely by the credit and taxing power of the issuing jurisdiction, no assets are used as collateral. The amount of taxation for a specific GO may be limited or unlimited. If unlimited, the municipality may increase property taxes to repay bond holders.

- Revenue bonds are supported by the revenue generated by a specific project such as a toll road or local stadium. Proceeds are used to finance specific income generating projects and are not funded by taxpayers.

- A fallen angel is a bond that has been downgraded from investment grade to high yield. The downgrade forces many investors to sell their holdings, often resulting in a pronounced price drop. However, research shows that fallen angels are often oversold and can rebound shortly after the downgrade. As originally higher rated issuers, fallen angels may also be more likely than other high yield bonds to be upgraded. By focusing on fallen angels, investors can potentially benefit from a high income, and from any capital appreciation if the bonds rebound.