Fixed income ETFs: Enhance and diversify your income

This is the first of a three-part blog series on fixed income ETFs. Part 2 focuses on higher quality fixed income alternatives while part 3 looks at maximizing returns with target maturity ETFs.

Income is a hugely sought after amongst Asian investors given the aging populations of many economies in the region. For investors seeking income, ETFs are useful precision tools to gain exposure to specific segments of fixed income markets while also achieving diversification objectives.

Introduction

After decades of falling yields, fixed income markets rapidly reversed course in 2022 as central banks acted to combat inflation. This dramatic reset has driven yields to levels not seen since the Global Financial Crisis, but still leaves today’s income investors with difficult choices. With stubbornly high inflation, an inverted yield curve and an uncertain future, should bond investors take on more duration risk or credit risk?

ETFs could help investors target the “sweet spot” in the bond market. Here we look at three examples of higher yielding opportunities across the capital structure with differing duration and credit quality exposures and shed light on why ETFs are useful tools to access these strategies.

Finding income opportunities across the capital structure

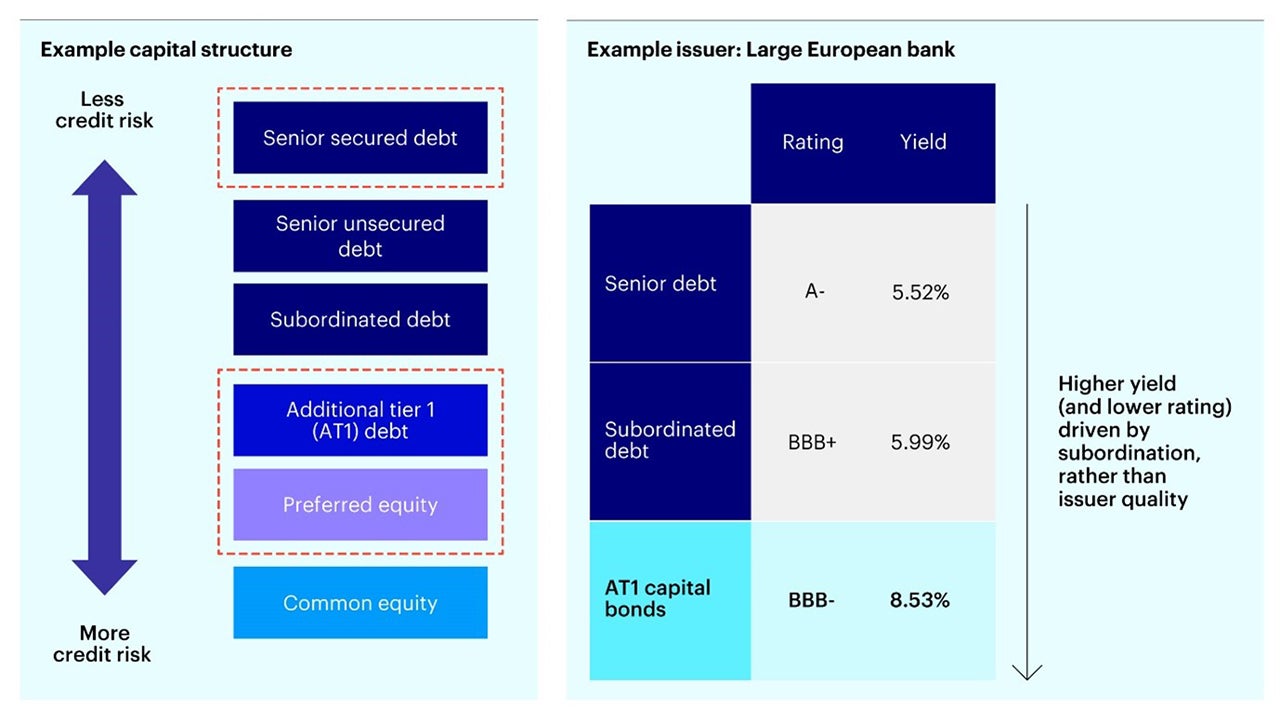

Banks and companies can issue securities across their capital structure, and different levels of seniority mean that certain securities can offer higher yields without compromising on issuer credit quality. Senior loans, Additional Tier 1 (AT1) bonds and preferred shares are non-traditional asset classes that have historically provided higher yields while exhibiting low correlations to traditional fixed income, with lower interest rate risk.

Source: Invesco, Bloomberg, 31 Jul 2023. For illustrative purposes only.

Source: Bloomberg, Aladdin, Invesco as at 15 Aug 2023. Pref (fixed) = fixed rate preferred shares. Pref (var) = variable rate preferred shares. Proxies: USD AT1 - iBoxx USD Contingent Convertible Liquid Developed Market AT1 (8% Issuer Cap) Index, Bank loans – S&P/LSTA U.S. Leveraged Loan 100 Index, Pref (var) - ICE Diversified Variable Rate Preferred & Hybrid Securities Index, Pref (fixed) - ICE BofA Diversified Core Plus Fixed Rate Preferred Securities Net Total Return Index, US High Yield - Bloomberg MSCI USD High Yield Liquid Corporate ESG Weighted SRI Bond Index, US Invt Grade – Bloomberg MSCI USD Liquid Corporate ESG Weighted SRI Bond Index, US Treasuries - Bloomberg US Treasury Index, USD EM Debt – Bloomberg Emerging Markets USD Sovereign Index, Taxable Municipals - ICE BofA US Taxable Municipal Securities Plus Index. An investment cannot be made into an index.

These innovative income securities have several key features that make them attractive to yield-seeking investors:

- Position in the capital structure:

o Senior loans lie at the top of the capital structure and have priority for repayment.

o AT1s and preferred shares are subordinated bonds, which sit lower down in the capital structure.

- Yield characteristics:

o Senior loans have a floating rate feature which benefits in a rising rate environment.

o AT1s and preferred shares typically offer higher yields than more senior debt from the same issuer. These asset classes have generally lower interest rate sensitivity than traditional fixed income.

- Credit quality:

o Senior loans are secured by collateral and are first to be repaid in a default event, which has led to very low historic default rates.

o The yield on an AT1 bond is driven by the subordination and convertibility elements, and not by the creditworthiness of the issuer. As such, the credit quality of a basket of AT1s is typically higher than traditional high yield instruments.

- Low correlation:

o All three innovative income asset classes tend to have low correlations with broad equities and traditional fixed income, making them useful assets for portfolio diversification.

Why consider fixed income ETFs?

For investors looking to gain exposure to these innovative fixed income strategies, we believe ETFs can be an attractive option for several key reasons:

- Targeted nature: ETFs can provide exposure to specific segments of fixed income markets and allow investors to express their views on credit quality, maturity, or geography. This makes ETFs the ideal vehicles for implementing tactical asset allocation decisions.

- Diversification: ETFs offer broad and diversified exposures within these specific fixed income asset classes, which reduces idiosyncratic risks.

- Portfolio management: Experienced portfolio managers handle all ongoing rebalancing needs within the fund. As coupon income is auto reinvested or paid out on a fixed schedule, there is no need for investors to monitor new issues or calls.

- Liquidity: ETFs are traded on exchanges. This creates both liquidity and transparency.

- Efficiency: ETFs are cost-efficient, can be bought and sold quickly, and offer trading flexibility that allows investors to express and fine tune their views.

Investing across the capital structure with securities such as senior loans, AT1s, and preferred shares, can potentially enhance and diversify your income portfolio without compromising on credit quality. ETFs are useful investment tools to target these specific fixed income sectors and provide a simple way for investors to gain broad market exposure to a particular asset class quickly, cheaply, and efficiently.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

FAQs

Senior secured loans, or bank loans, are syndicated loans issued by a group of banks and institutional creditors that provide companies with access to debt capital. The size of the senior loan market was US$ 1.57 trillion in 2022 of which 14% is owned by mutual funds and ETFs.1

One of the key features of senior secured loans is that they are “senior” in the capital structure and “secured” by tangible assets such as property. This results in much high levels of recoveries than unsecured bonds.

Another feature is that senior loans pay a floating rate income, typically offering a spread over a reference rate such as LIBOR (London Interbank Offered Rate) or SOFR (Secured Overnight Financing Rate). This gives the asset class minimal duration risk and a current yield of around 10%.2

Additional Tier 1 bonds, or AT1s, are securities issued by European financial institutions. They are relatively young financial securities, first introduced after the Global Financial Crisis. They were designed to prevent contagion in the financial sector by acting as a readily available source of bank capital in times of crisis.

An AT1 bond will typically have a higher yield than equivalent senior debt from the same issuer, because of its subordinated position in the capital structure. Historically, these bonds have also shown low correlation with both higher rated fixed income and other asset classes.

Preferred shares are hybrid securities that combine characteristics of bonds and equities. For example, as well as having scheduled interest payments, defined par amounts and credit ratings, they are also perpetual (or long dated) in nature and are subordinated within the capital structure.

In the US, some banks issue preferred shares to fulfil similar capital funding requirements as European banks do with AT1s. Preferred shares are typically issued by investment-grade issuers. Their high yields are driven by their subordination – not the riskiness of the issuer. They are issued either with fixed or variable rates.