Fixed Income ETFs: Maximizing returns with target maturity ETFs

This is the third of a three-part blog series on fixed income ETFs. Part 1 focused on enhancing and diversifying income using ETFs while part 2 looked at higher quality fixed income alternatives.

In today's dynamic and ever-changing financial landscape, finding investment solutions that offer precision, liquidity and predictability is essential. One innovative tool gaining popularity among global investors that looks to meet these objectives is target maturity bond ETFs. These ETFs are designed to simplify the process of building a diversified bond portfolio and can offer a range of benefits.

Target maturity bond ETFs are designed to deliver a bond-like experience for investors, combined with the benefits of exchange traded funds. These ETFs consist of a portfolio of bonds with the same effective annual maturity date. The investment vehicles intend to hold bonds to maturity while offering the potential for monthly income distributions and a final distribution payment at maturity.

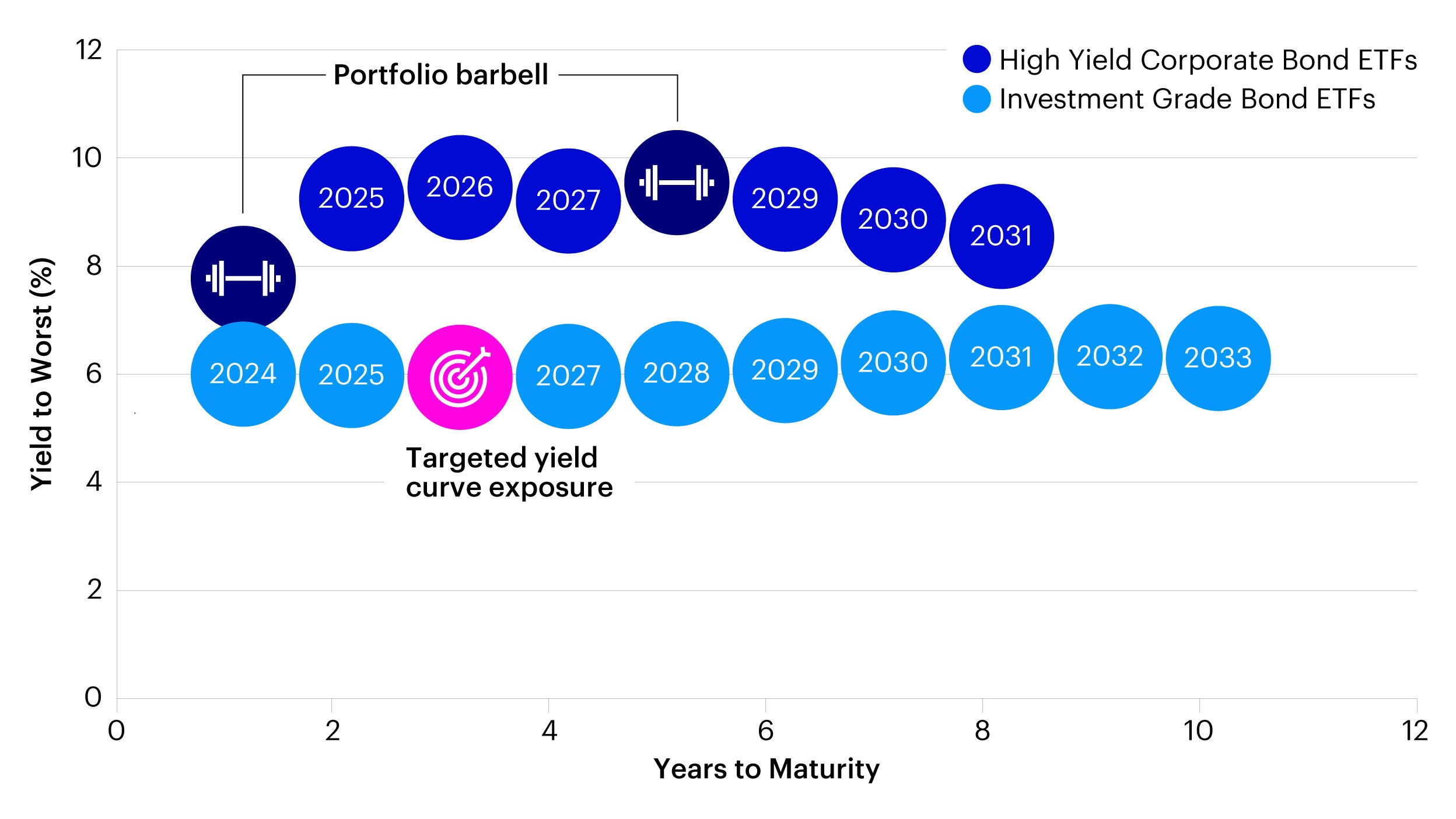

1. Precise duration/maturity targeting

Target maturity ETFs offer investors the ability to precisely target a specific duration and maturity profile. This feature provides a level of predictability that traditional bond funds cannot match. When investing in a target maturity ETF, as with an individual bond, the investor acquires a precise, predictable, constant maturity profile. This makes it easier to match a portfolio duration or future liability target.

Source: Invesco, data as of October 31, 2023. Past performance is no guarantee of future results.

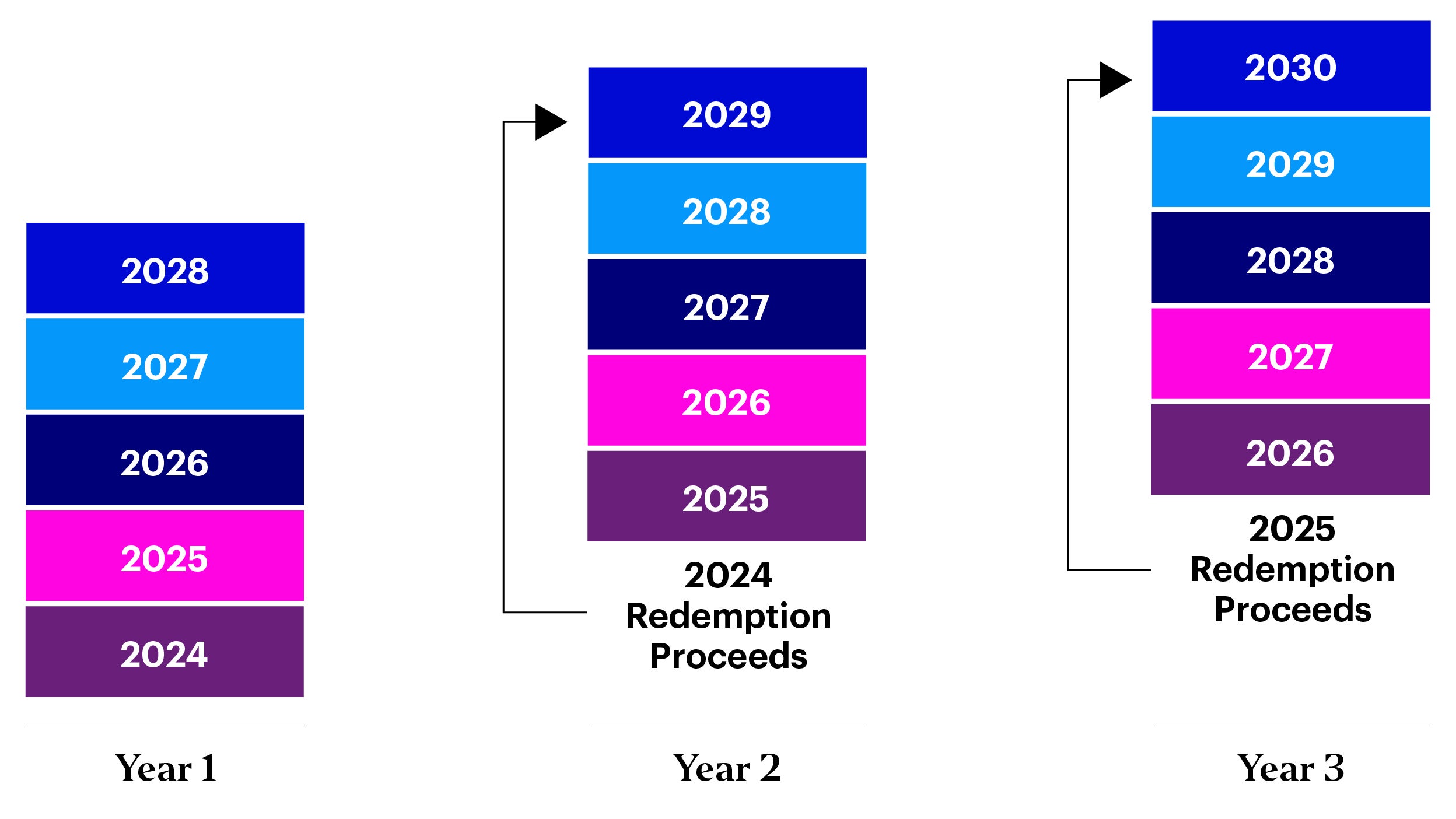

2. Strategic laddering opportunities

Target maturity ETFs can be used strategically to build laddered portfolios. A laddered portfolio consists of bonds with staggered maturities, reducing reinvestment risk while maintaining a consistent income stream. By using target maturity ETFs with various maturity dates, investors can build a ladder across investment grade and high yield bonds to suit their specific financial goals and risk tolerance levels.

Source: Invesco, for illustrative purposes only.

3. Diversification with efficiency

Diversification is fundamental to managing risk in a bond portfolio. Target maturity ETFs can provide this by investing in a diversified basket of bonds within each target maturity portfolio, saving a portfolio manager time and the headache of selecting and trading individual bonds.

4. Liquidity and flexibility

Target maturity ETFs are traded on stock exchanges, providing investors with liquidity and flexibility. Unlike individual bonds, which can be both illiquid and produce significant transaction costs, target maturity ETFs leverage the liquidity and cost advantages of the largest fixed income ETF market makers in the world. This enables investors to have the freedom to adjust their portfolios with easily scalable trade sizes as cash flow and market conditions change.

5. Expert portfolio management

Invesco has a long history of expertise in managing bond ETF portfolios. Our global team of experienced fixed income portfolio managers optimize the ETFs' holdings to ensure consistent tracking of each target maturity index of bonds. With target maturity ETFs, investors can benefit from the expertise of seasoned bond managers without the need for hands-on portfolio management.

6. Interest rate risk mitigation

Interest rate risk is a significant concern for bond investors. When interest rates rise, bond prices typically fall, potentially leading to capital losses. Target maturity ETFs are designed to help mitigate this risk. Each ETF has a final maturity date, and the bonds within the fund mature within the final calendar year of that date. This means that as the ETF approaches its maturity date, the bond holdings mature and run off into cash, driving the fund’s duration steadily towards zero, much like an individual bond.

7. Low cost

Costs are always a consideration when it comes to trading bonds over-the-counter. Target maturity ETFs are known for their cost efficiency. Their expense ratios are typically lower than those of many bond mutual funds or ETFs—enhancing their ability to serve as replacement for holding bonds individually.

8. Income generation

Investors seeking a source of regular income often turn to bonds. Target maturity ETFs offer the benefit of regular interest payments, just like individual bonds. The combination of income generation and portfolio diversification can make these ETFs a useful component of an income strategy.

In conclusion, target maturity ETFs offer investors a unique way to simplify their bond investments, manage risk, and achieve their fixed income portfolio objectives. With precise maturity targeting, diversification, liquidity, and professional management, these investment vehicles can provide a host of benefits to help investors build a more liquid and manageable portfolio. Target maturity ETFs can be used by investors looking to match future liabilities, build a liquidity sleeve, or customize a duration barbell. Their low cost and strategic laddering capabilities further enhance the appeal of these funds, making them a valuable tool for investors looking to maximize visibility and minimize risks in today's market.