Energy transition in Asia beyond China: Where to from here?

This is the first of a 3-part blog series that looks at the energy transition landscape in Asia beyond China. The first blog focuses on the importance of energy security as Asian countries grapple with the global energy crisis that has emerged after Russia’s invasion of Ukraine. In subsequent blogs we will do a deep dive into the developments in renewable investments as well as fossil fuel divestments across major Asian economies. In particular, the second blog will cover the inroads that India and South Korea are making into energy transition investments. The third blog will focus on Southeast Asian nations and their focus on green hydrogen and smart grid infrastructure.

Asia’s Climate Transition Developments

In the past five years, extreme weather events have been occurring at an increasing pace, not to mention the rise in global air and sea temperatures and loss of biodiversity. Countries and companies globally have been acting to combat climate change with an increased sense of urgency. Coming out of COP26 more than 80% of global emissions now have net zero pledges.1 It is also estimated that there are now more than a thousand ESG regulations in effect globally, including more than 200 relevant regulations in Asia, marking a two-fold increase since 2016.2 The increasing public pressure on regulators, asset owners and corporates to take action has caused ESG investments to skyrocket.

Russia’s invasion of Ukraine earlier this year has shifted the global conversation from one of energy transition to energy security. In the short-term, the surge in commodity prices calls to question the viability of governments and companies being able to shift completely away from traditional energy sources. However, at the same time, renewables are increasingly being seen as a long-term hedge against relying on energy imports. Countries that develop their own domestic renewables can improve the stability of their energy supply and control costs by reducing their reliance on fossil fuel inputs that are often subject to price hikes, supply outages and geopolitical risks.

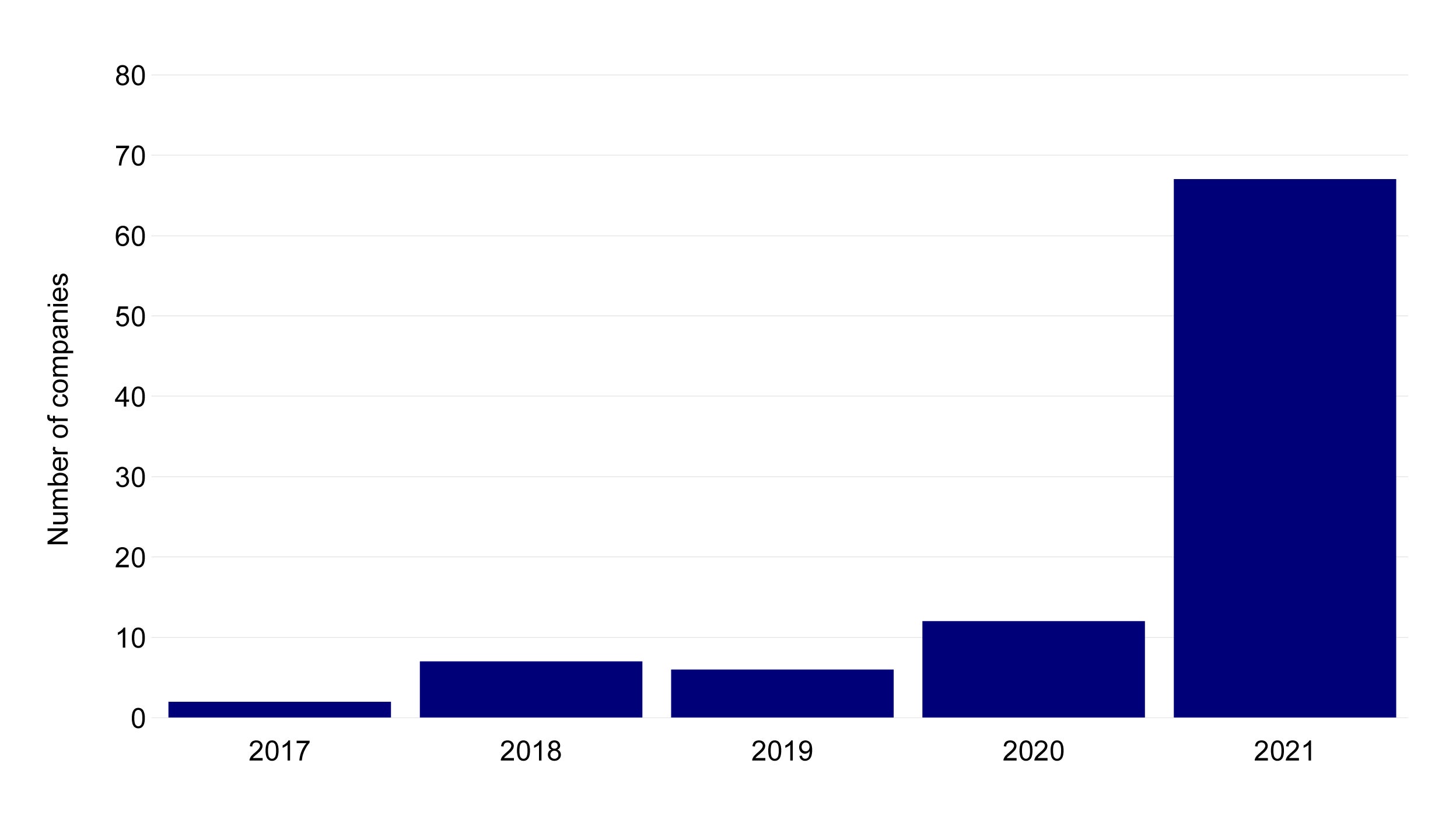

Asia is still the world’s largest carbon dioxide emitter representing over 50% of global emissions in 2021.3 China accounts for half of these emissions however in 2021 was responsible for 35.2% of energy transition investments globally.4 In an earlier blog series by Invesco Fixed Income we covered the sustainable investing landscape in China. Other Asian countries beyond China are also making inroads in improving their renewable energy capacity, specifically in terms of regulatory and corporate actions. There has been exponential growth in the number of Asian companies having committed net-zero targets in recent years (Figure 1).

Source: Science Based Targets Initiative (SBTi); data as of December 2021.

Investment Opportunities and Implications for Asia’s Energy Markets

Asian countries continue to increase their renewable energy capacity

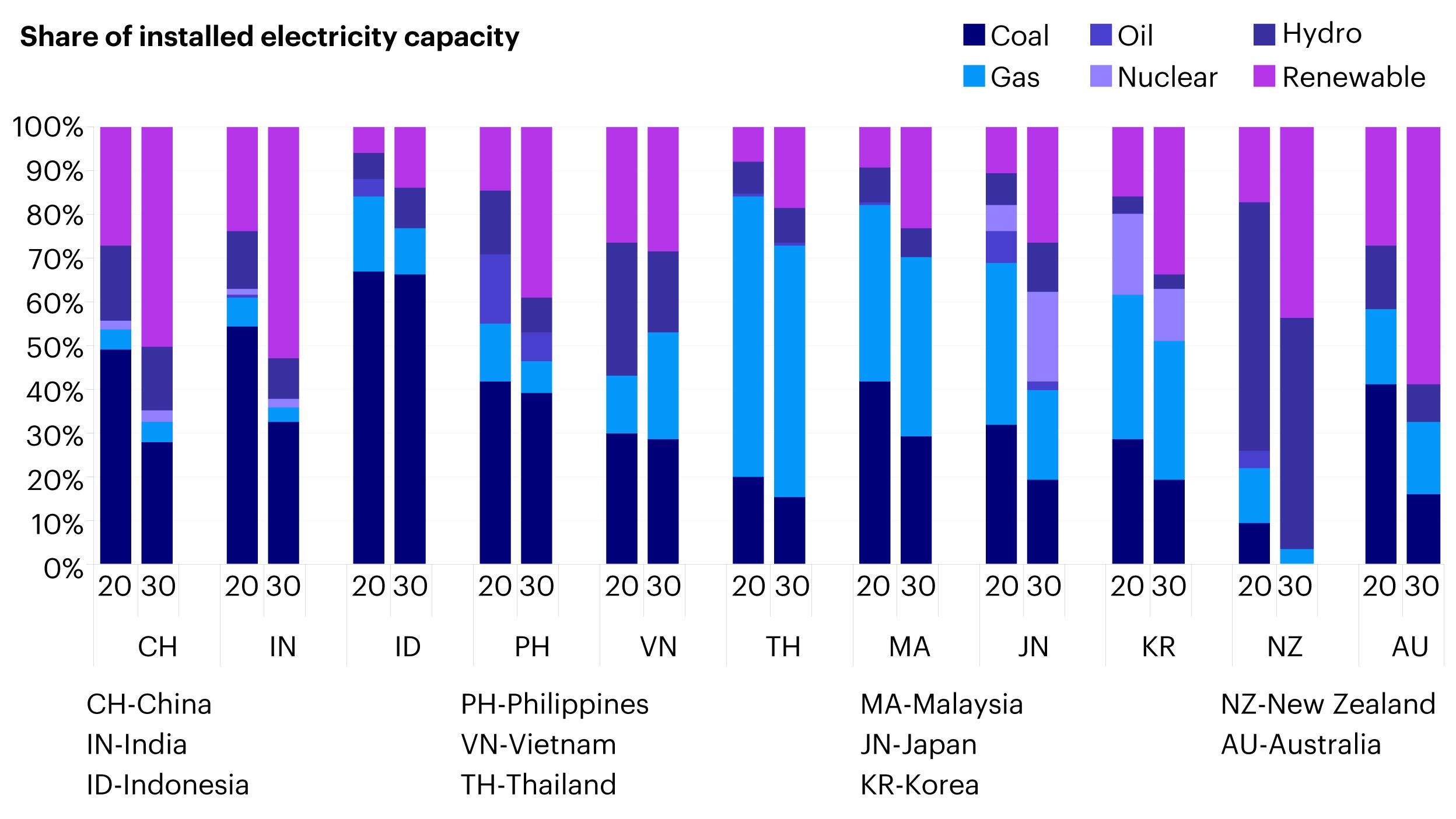

Asian countries boast mature renewable technology markets in areas such as solar, wind and biofuels and have planned substantial renewable energy capacity additions through to 2030 (Figure 2). The cost of renewables have declining considerably over the past decade and governments are also playing a larger role in helping to scale demand and supply by putting in place supportive policies and subsidies to drive adoption. Nonetheless grid infrastructure in some Asian countries is not designed to accommodate the variable nature of renewable power output. Grid upgrading is crucial for countries to store excess output in low power demand periods and better moderate against times of variable supply and output.

Source: Australia Department of Energy, New Zealand Interim Climate Change Committee, Taiwan Bureau of Energy, Sri Lanka Ministry of Power, Bangladesh Ministry of Power, Philippine Department of Energy, Thailand Board of Investment, Malaysia Energy Commission, Global Energy Interconnection Development and Corporation Organisation, Indonesia Ministry of Energy and Natural Resources, Vietnam Ministry of Trade and Industry, Korea Ministry of Trade, Japan Agency for Energy; data as of October 2021. NB: As per convention, we do not include hydroelectric power as a modern renewable. Korea is approved plan from December 2020 that may be adjusted.

The evolution from green electrons to green molecules

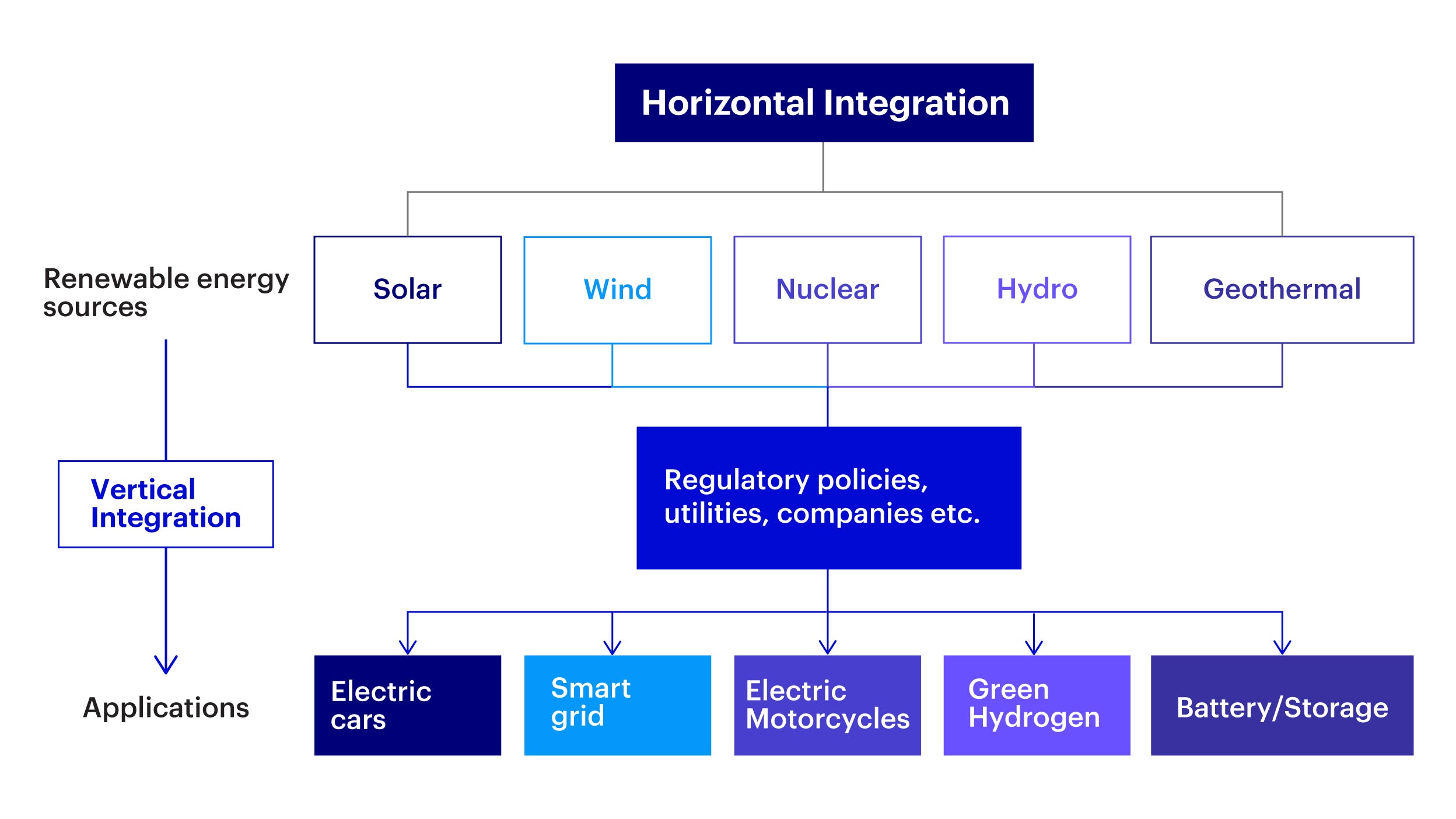

In the longer term the target, and challenge, will be for Asian countries to convert green electrons (power that is generated using renewable sources such as solar, wind and geothermal energy for example) into so-called “green molecules”. This will mean using renewable energy toward real life applications such as in electric vehicles or motorcycles, green hydrogen, batteries, carbon capture and storage (CCS), smart grid, etc. For example, using solar energy to power electric vehicles that can then go on to replace traditional transportation options.

Source: Invesco, for illustrative purposes only.

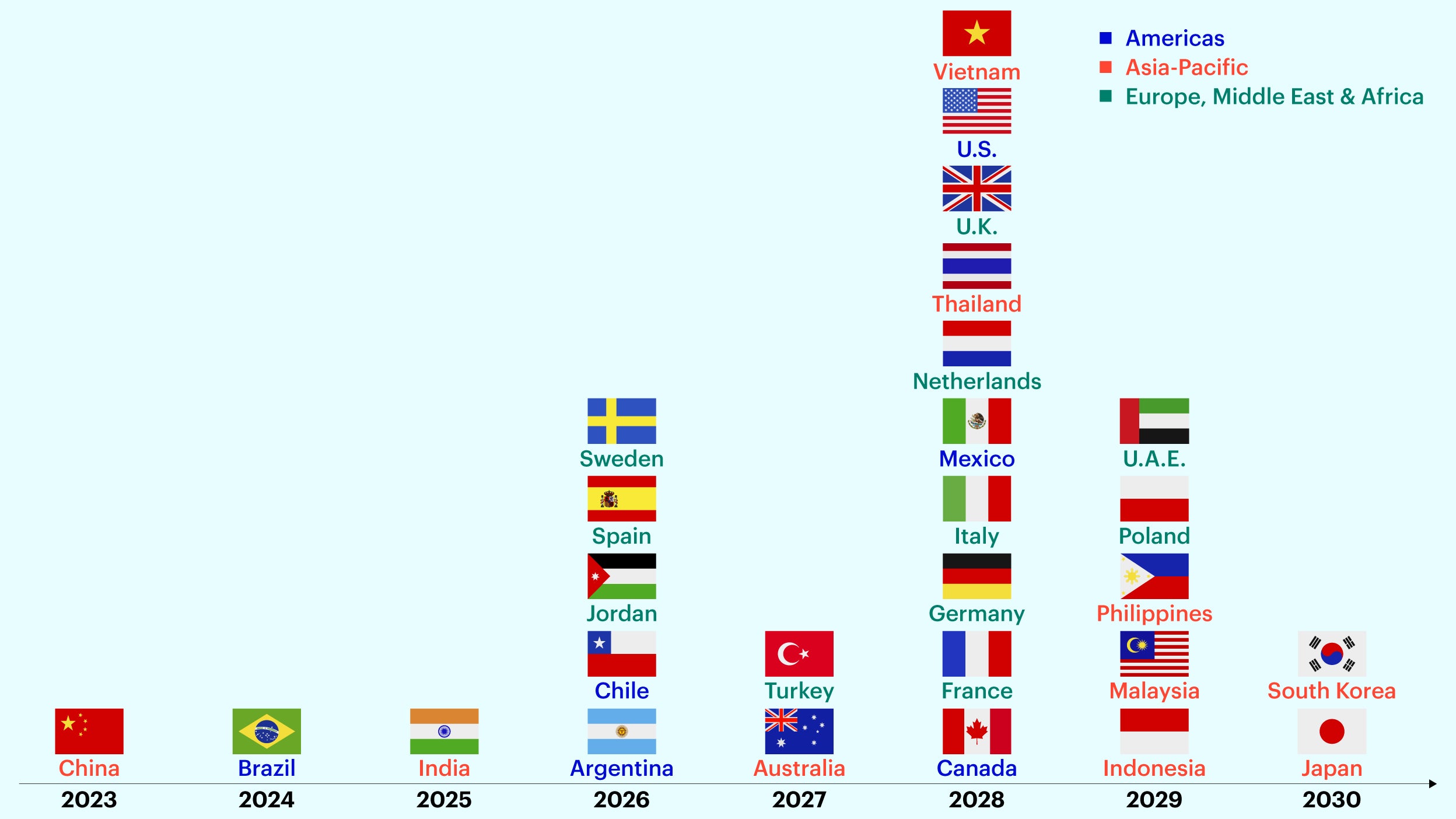

Another key example is green hydrogen, hydrogen produced entirely using renewable energy sources, namely solar or wind (via electrolysis). As an emissions-free fuel, it not only provides power alternatives to heavy industries and transportation but can also in theory be stored indefinitely. The global intergovernmental body Irena (International Renewable Energy Agency) has predicted that green hydrogen production may be the cheaper option relative to blue hydrogen (produced from natural gas with carbon capture and storage) in most key markets by 2030 (Figure 4).5

Investments in hydrogen will have a key impact on industrial markets such as hydrogen-based steels. The key bottlenecks to its development include the current costs of renewable energy, infrastructure such as transportation and the temperature and pressure requirements for hydrogen storage. India, South Korea, and Japan have made the most progress thus far with green hydrogen and have included hydrogen as part of their national carbon reduction policies.6

Source: BloombergNEF, as of November 2021. Flags: Wikimedia. Note: assumes our optimistic alkaline electrolyzer cost scenario (Chinese for China, otherwise western) and 20-year gas price outlook averages. Argentina gas price assumed same as Brazil. Jordan gas prices based on average of oil-indexed LNG, Henry Hub-indexed LNG and spot LNG. Actual prices could differ from this assumption.

From own country to overall regional demand

We are seeing Asian companies shifting away from horizontal and toward vertical integration in their use of renewables by coupling together sectors and adopting new technologies. Companies are studying how to secure stable and abundant renewable energy and how to incorporate renewables into their own business processes. Energy players are also increasingly making green capital expenditure investments and acquisitions.

At the same time, Asian governments are enacting supportive policies to encourage companies to develop green energy technologies by implementing subsidies as well as carbon taxes. While each Asian country is leveraging its own advantages to create commercial opportunities, the target is often not only to fulfil their own demands for carbon reduction but also to create new economic opportunities across the region. For example, Indonesia is looking to leverage its abundant geothermal resources to produce green hydrogen. The government is also heavily supporting the electric motorcycle industry. South Korea and Thailand are eager to develop electric vehicle (EV) and battery technologies with potential regional demand in mind. India has been developing green hydrogen in their heavy industries and plans to sell this to neighboring countries in the long term. Infrastructure that is currently under development such as ASEAN’s integrated energy grid is also being considered to then draw required power from sources such as these to ensure Asia’s overall energy security.

Footnotes

-

1

Zerotracker.net, Data as of February 16th, 2022

-

2

UN PRI

-

3

Asia Development Bank, Morgan Stanley, as of October 2021

-

4

Ranked: The Top 10 Countries by Energy Transition Investment, February 2022, https://www.visualcapitalist.com/ranked-the-top-10-countries-by-energy-transition-investment/

-

5

Irena warns blue hydrogen investments could end up as stranded assets, January 2022, https://www.upstreamonline.com/hydrogen/irena-warns-blue-hydrogen-investments-could-end-up-as-stranded-assets/2-1-1146652

-

6

Growth opportunities arise for green hydrogen in Asia Pacific, August 2021, https://asian-power.com/power-utility/news/growth-opportunities-arise-green-hydrogen-in-asia-pacific