Energy transition in Asia beyond China: Southeast Asia’s focus on smart grid, EVs and green hydrogen

This is the third of a 3-part blog series that looks at the energy transition landscape in Asia beyond China. The first blog focused on the importance of energy security as Asian countries grapple with the global energy crisis that has emerged after Russia’s invasion of Ukraine.The second piece covered the inroads that India and South Korea are making into energy transition investments. This final article homes in on Southeast Asian nations and their focus smart grid infrastructure, electric vehicles, and green hydrogen.

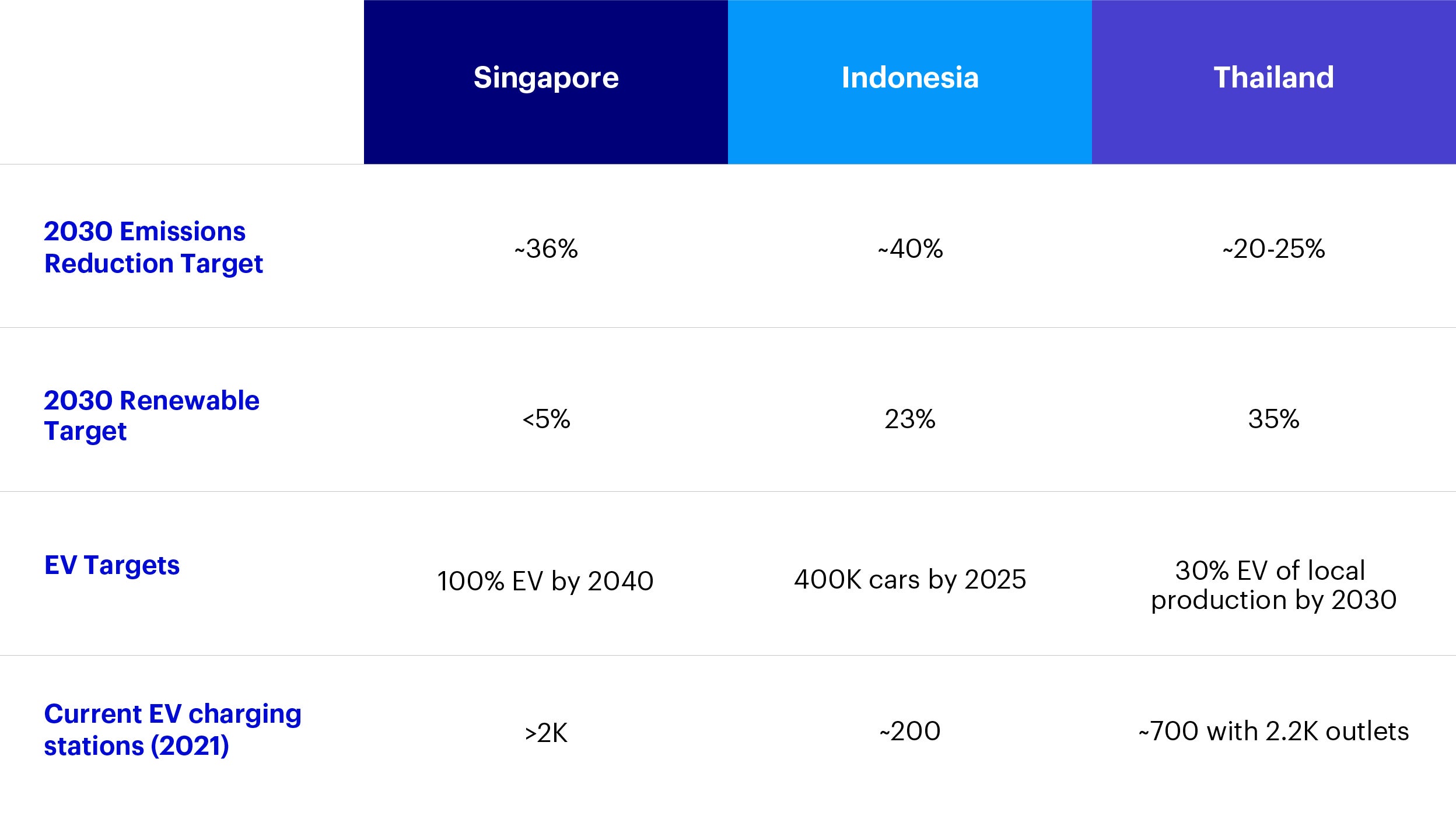

Like most countries globally, Southeast Asian nations are looking at the energy transition landscape and how they can ensure energy security in the future while also adhering to their net zero targets. The landscape for this has been thrown into sharp relief by the current energy crisis resulting from Russia’s invasion of Ukraine. We outline the pathways Singapore, Indonesia and Thailand are taking to shore up their renewable energy reserves in the coming decades.

Source: Morgan Stanley Research, data as of June 2022.

Singapore aims to diversify its power mix and become a hydrogen hub

Singapore’s National Climate Change Secretariat (NCCS) has stated it aims to achieve net zero emissions by 2050. The nation has made significant pledges toward decarbonization including plans for progressive increases in the carbon tax rate from 2024 onward, further development of carbon markets including carbon credits and more policies supporting electric vehicles (EVs) such as EV rebates.

It is widely known that the city-state has limited domestic energy sources. About 95% of its electricity is powered by piped or liquefied natural gas, the former largely imported from Malaysia and Indonesia.1 With no hydro resources, low wind speeds and mean tidal ranges, and geothermal energy not being economically viable, the government faces critical challenges in its pathway to achieving net zero emissions by 2050. Singapore’s Energy Market Authority released a report charting their energy transition plans in March of this year, where they identify two important methods to reduce carbonemissions, first diversifying the power mix into hydrogen and geothermal energy and second by increasing energy efficiency.2

The city-state hopes to import 30% of electricity from low-carbon sources by 2035 by tapping into regional power grids as well as exploring low-carbon solutions such as green hydrogen and carbon capture, utilization, and storage (CCUS).3 Singapore is currently trialing importing clean electricity from Malaysia, Indonesia, and Laos. In June, the Lao PDR-Thailand-Malaysia-Singapore Power Integration Project (LTMS-PIP) commenced, Singapore’s first multilateral electricity trading project. The hope is that projects like this will facilitate plans for larger scale low-carbon electricity imports in the future.4

Singapore’s land constraints mean it is difficult to rely solely on domestic renewables like solar power or hydrogen production. Therefore, the city-state has focused its efforts on leveraging its position as a logistics hub to become a hydrogen hub. While transitioning to hydrogen is going to be expensive and will take time to develop, the government is focused on developing the infrastructure to support this – in early July, the National University of Singapore's Centre for Hydrogen Innovations was opened, a research institute aimed at creating breakthrough technologies to make hydrogen a viable green energy source for the city state.

Indonesia plans for renewable power capacity additions and e-motorcycles

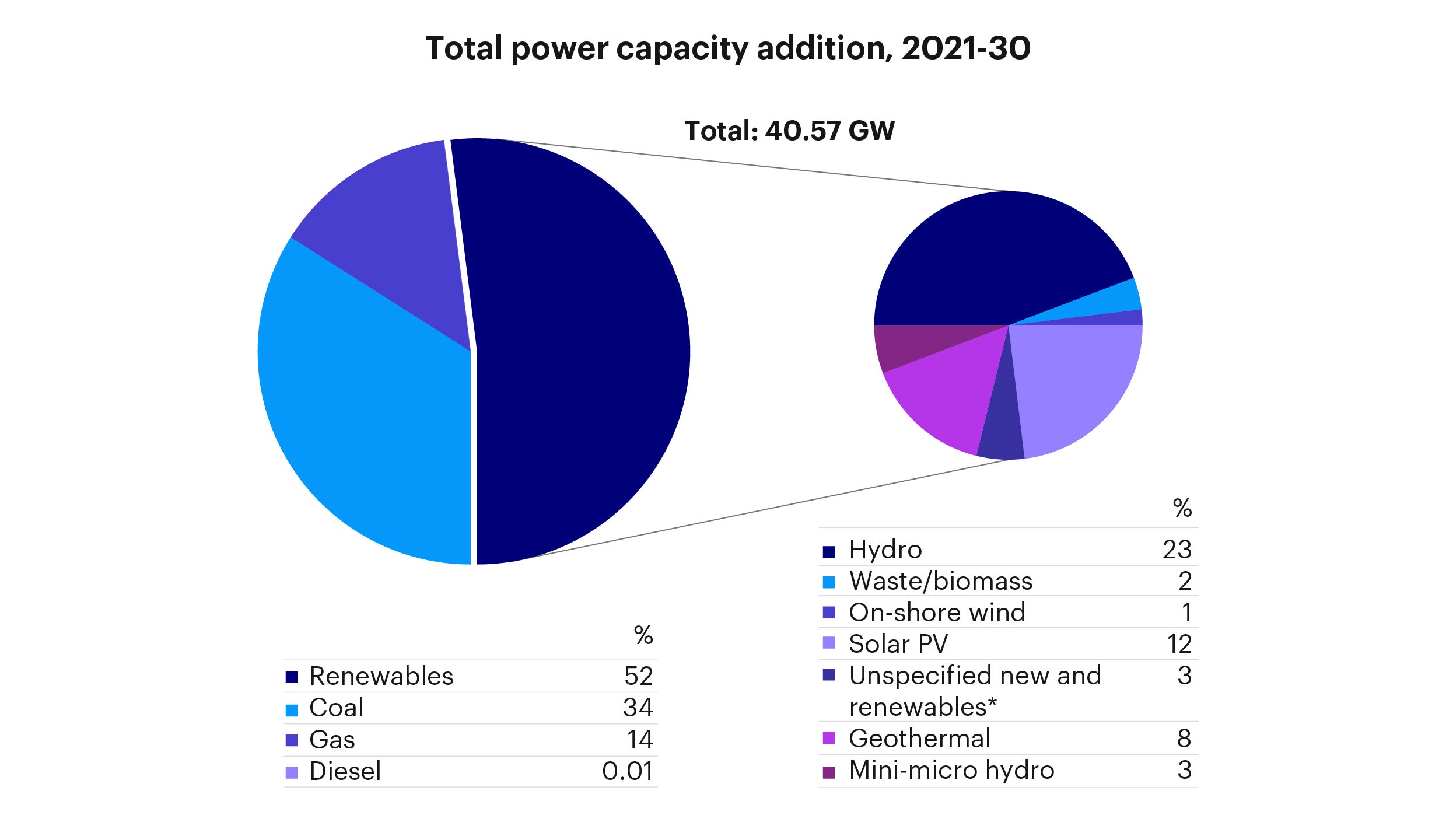

Indonesia plans to achieve a 23% share of renewable energy in the energy mix by 2025 and achieve net-zero emissions by 2060.5 Indonesia’s government and its state electricity provider released the latest Electricity Business Plan (RUPTL) 2021-30 in November of last year. It lays out the country’s power capacity and network development strategy for the next 10 years and marks a turning point as it is the greenest till date. For the first time, renewable energy accounts for half (or 21 GW) of the total expected power capacity additions.6 The state utilities provider will also no longer build new coal power plants, apart from those that are currently in the process of financial closing or construction.

Source: RUPTL 2021-30. Note: * This category includes power generated from new and renewable energy sources to supply baseload and peak load demand. The RUPTL indicates that baseload power plants under this category could cover hybrid renewables and gas power plants whose generation costs are lower than that of coal projects.

With regards to transport, the Indonesian government is planning to put six million units of electric motorcycles on the road nationwide by 2025.7 The e-motorcycle conversion program is also likely to result in employment and upskilling opportunities for the country’s young workforce and is expected to contribute to increases in the production of local components. Local corporates are also focusing on developing adequate EV charging stations to support the growth of the EV sector in the country.8

Thailand ramps up investment in smart grids and electric vehicle production

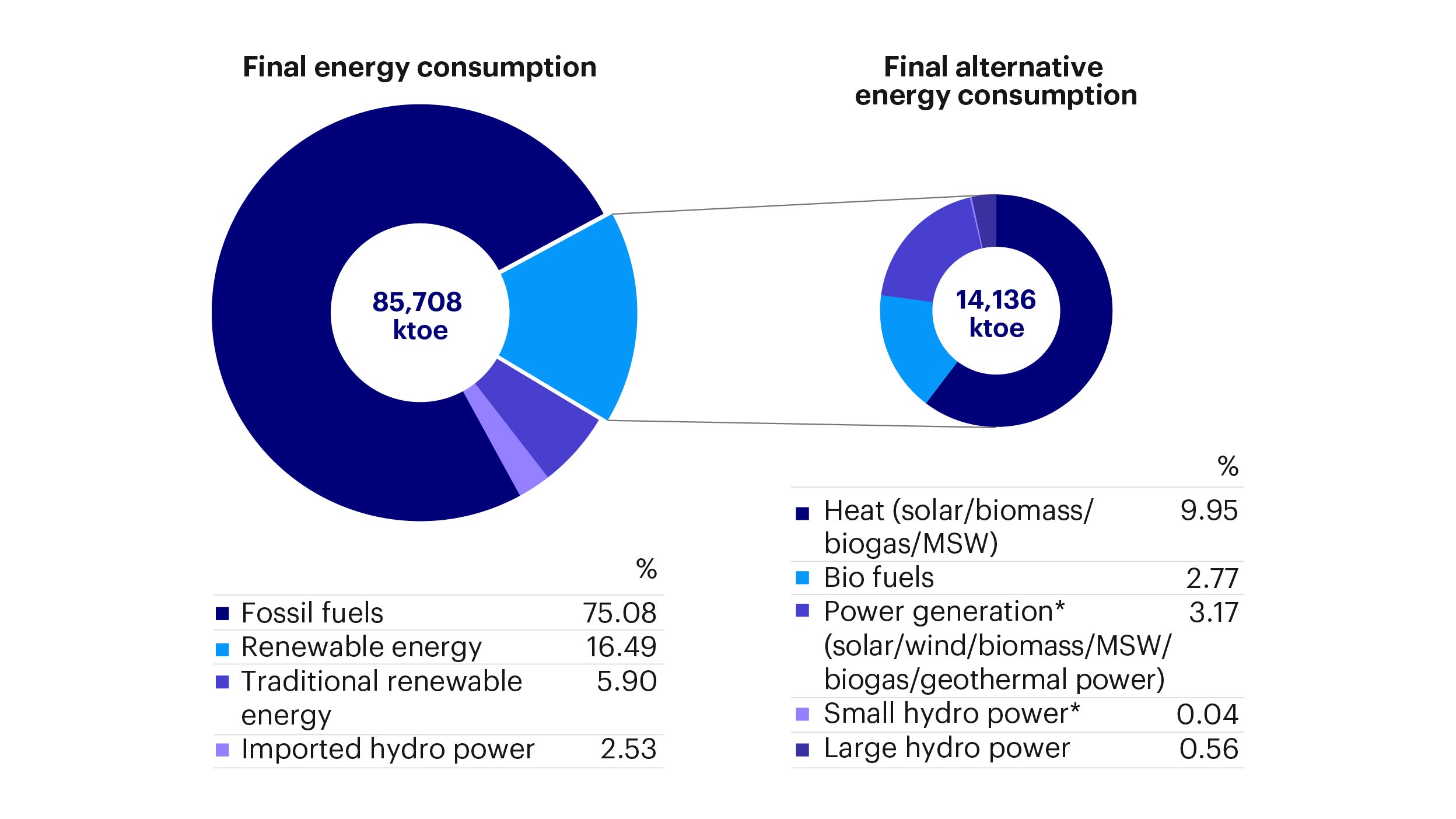

The Thai government has stated that it aims to reach net-zero greenhouse gas emissions by 2065 as well as carbon neutrality by 2050.9 Renewable energy consumption was 16.5% of Thailand’s total energy consumption in 2019 with the most popular sources being solar, biomass, small and large hydropower plants, wind, biogas, and municipal solid waste.10 The government’s goal is to increase this proportion to 30% by 2037 (including imported hydropower) by building more renewable energy power plants over the next two decades.

In June, Japan and Thailand agreed to launch a new energy policy dialogue and implement joint projects to promote decarbonization. This comes after the Japanese government promised to give US $10 billion in financial support to Thailand and other member states of the Association of Southeast Asian Nations for renewable energy, energy efficiency, LNG and other projects that are expected to create new jobs and investment.11

Source: The Department of Alternative Energy Development and Efficiency (DEDE); Note: *Including off-grid power generation.

Thailand’s Ministry of Energy has also stated that smart grids are a national policy priority. State-owned enterprises are expected to invest approximately $6.4 billion in smart grids before 2036 to boost energy supplies, increase efficiency, strengthen grid resilience, and reduce carbon emissions.12

Thailand’s 3030 EV production policy (announced in May 2021) aims to have EVs account for 30% of local vehicle production by 2030. Local demand for EVs in Thailand has been low given the lack of public charging infrastructure and consumer-focused incentives. The Thai government is considering revising import duties for EVs to improve affordability.13 Despite this, EV production has still been gaining momentum due to several factors such as overall component price reduction as well as increased environmental awareness. Large Thai conglomerates are capitalizing on this opportunity to produce EVs by setting up joint ventures with foreign EV component manufacturers and battery providers.

Footnotes

-

1

About Singapore’s Energy Story, March 2022, https://www.ema.gov.sg/ourenergystory

-

2

Charting the energy transition to 2050 – Energy 2050 Committee Report, March 2022, https://www.ema.gov.sg/cmsmedia/Publications_and_Statistics/Publications/Energy-2050-Committee-Report.pdf

-

3

Singapore plans to import 30% of energy from low-carbon sources by 2035, October 2021, https://www.straitstimes.com/singapore/environment/singapore-plans-to-import-30-of-energy-from-low-carbon-sources-by-2035

-

4

Low-carbon hydrogen fuel tech in S'pore could be fully commercialised in 2030, April 2022, https://www.straitstimes.com/singapore/low-carbon-hydrogen-fuel-tech-in-spore-could-be-fully-commercialised-in-2030

-

5

RUPTL 2021-30: PLN steps up ambitions to accelerate clean energy investments in Indonesia, November 2021, https://www.oecd.org/environment/cc/cefim/indonesia/RUPTL-2021-30-PLN-steps-up-ambitions-to-accelerate-clean-energy-investments-in-Indonesia.pdf

-

6

Ibid.

-

7

Indonesia to put six mln e-motorcycles on road by 2025, June 2022,

https://en.antaranews.com/news/236053/indonesia-to-put-six-mln-e-motorcycles-on-road-by-2025

-

8

PLN Targets Completing 580 EV Charging Stations This Year, March 2022,

https://www.theindonesia.id/news/2022/03/19/001500/pln-targets-completing-580-ev-charging-stations-this-year -

9

Thailand brings its carbon neutral, net zero dreams forward by several years, August 2022, https://www.nationthailand.com/in-focus/national/40019511

-

10

Thailand - Renewable Energy, 2021,

https://www.trade.gov/energy-resource-guide-thailand-renewable-energy

-

11

Japan and Thailand to launch new energy initiative for decarbonization, January 2022, https://www.japantimes.co.jp/news/2022/01/13/national/science-health/japan-thailand-decarbonization/

-

12

Ibid.

-

13

Ministry mulls revision of EV import duties, January 2022, https://www.bangkokpost.com/business/2244803/ministry-mulls-revision-of-ev-import-duties