Energy transition in Asia beyond China: India and Korea seize green opportunities

This is the second of a 3-part blog series that looks at the energy transition landscape in Asia beyond China. The first blog focused on the importance of energy security as Asian countries grapple with the global energy crisis that has emerged after Russia’s invasion of Ukraine. This piece covers the inroads that India and South Korea are making into energy transition investments. The third piece in our series will home in on Southeast Asian nations and their focus on green hydrogen and smart grid infrastructure.

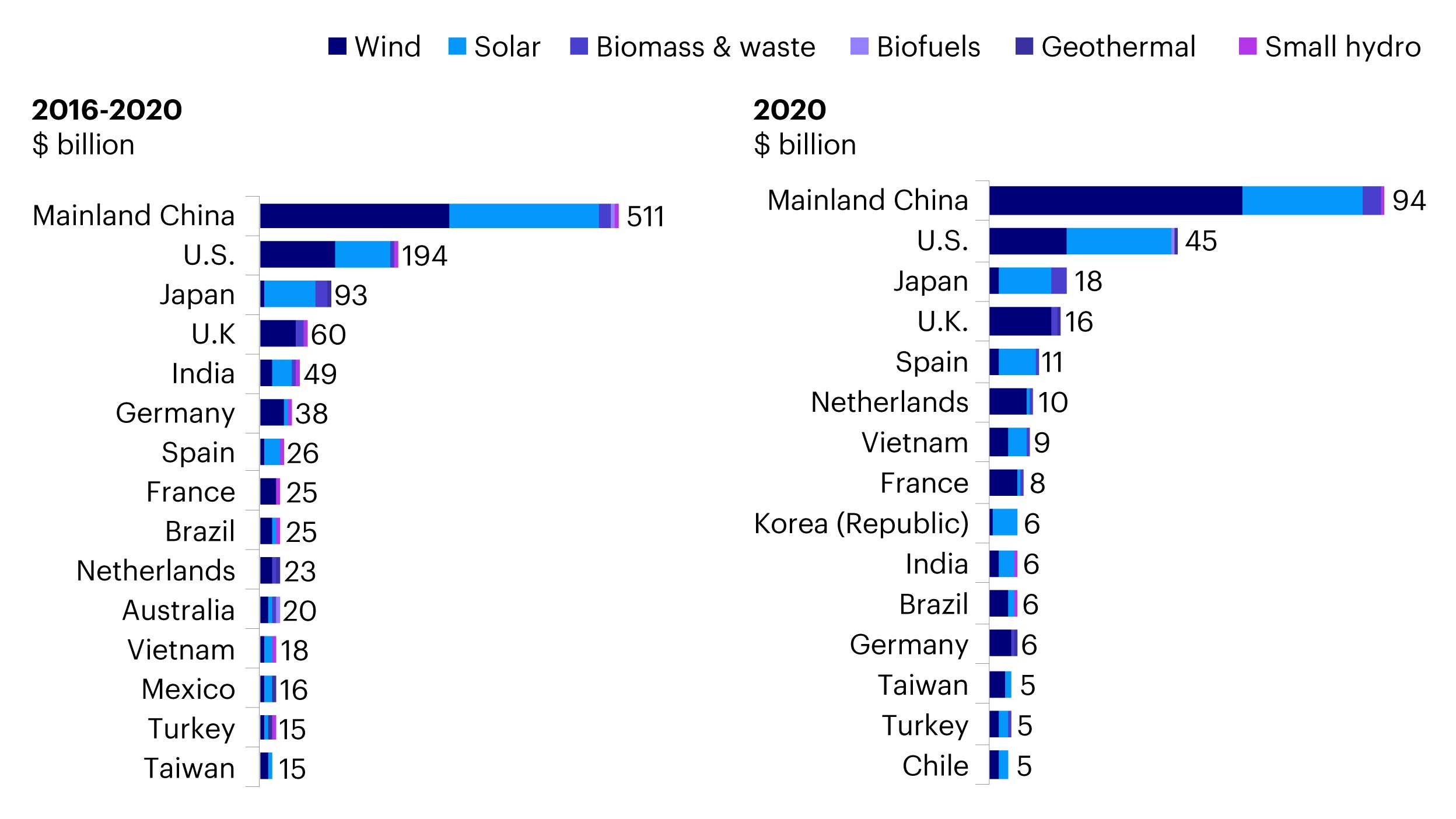

According to BloombergNEF’s latest Climatescope report, 15 countries accounted for 88% of global renewable energy investments in 2020 (Figure 1). Apart from Mainland China and Japan, India and South Korea were among the Asian countries that made this list.1 Overseas and domestic investors are paying attention to these markets for potential investment opportunities, as more and more companies make forays into the renewables space driven by the surge in demand as well as favorable national policy developments.

Source: BloombergNEF, data as of December 2021.

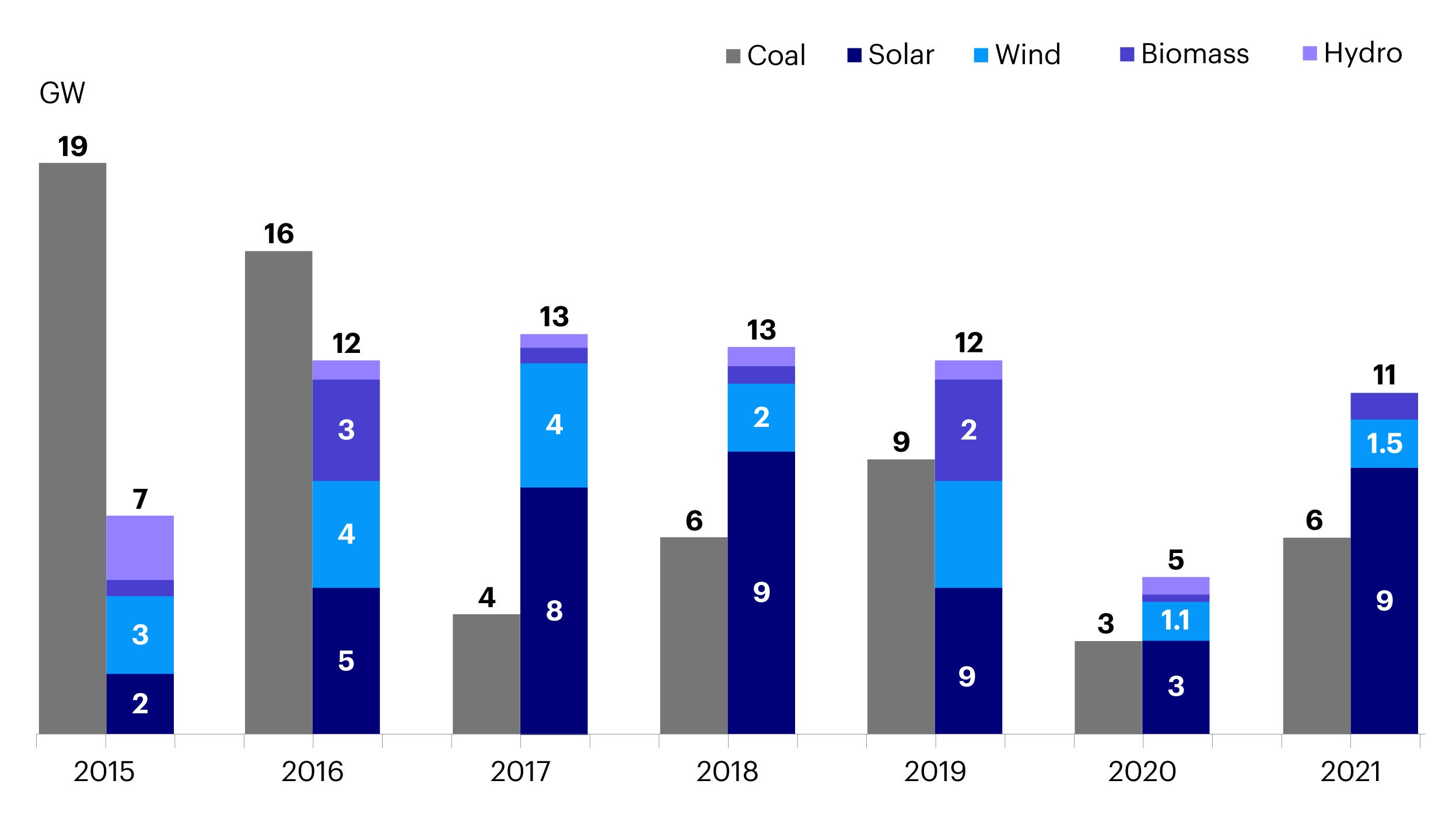

India’s renewable capacity additions have outpaced coal-fired power

Like China, India has been responsible for a large portion of the coal-fired power-generating capacity produced globally over the last decade. However, the country’s coal capacity additions have fallen sharply over time, from 19 GW in 2015 to just 4 GW in 2021. At the same time, the country’s annual renewable energy capacity additions have grown and outpaced coal power.2 The country ranked fourth globally for solar and wind capacity additions during the period from 2011 to 2020.3 Solar power in particular has grown exponentially, reaching 60GW in 2021 from less than 1GW in 2011.4

Source: Bloomberg NEF, Central Electricity Authority, Ministry of New and Renewable Energy.

The speed of renewables growth can be attributed to a combination of improving economics and supportive government policies. At COP26 last year, Prime Minister Narendra Modi called for increasing non-fossil power capacity to 500GW by 2030 (from 158 GW in 2021).5 The latest national emission pledges look to reduce emissions intensity relative to GDP by 45% by 2030 from 2005 levels. There are also talks of launching a local carbon trading market.6

Domestic and foreign players are attracted to the transparency of India’s renewable auction market (the largest in the world) as well as the government’s ambitious targets, which are driving down the cost of clean power. New solar and wind projects in India cost among the lowest in the world because of the increased scale and competition. Thanks to government subsidies, India’s renewable tariffs are also among the lowest in Asia. The Ministry of New and Renewable Energy has recently announced guidelines for production-linked incentives for polysilicon, wafer cells and solar modules, that will further spur scale and drive costs down.7

Last year, India was the most attractive market for energy transition investments in the power sector. On top of more traditional renewable projects, Indian conglomerates are rushing to invest in the production of green hydrogen and supporting ecosystem. Among other areas, they are looking to develop their electrolyzer capacity, particularly given the lack of domestic manufacturers in this space.8

In their initial phase, one renewable energy subsidiary of a major Indian company plans to invest US$50 billion over the next decade to develop a green hydrogen production capacity of 1 million tons per annum by 2030.9 Another conglomerate aims to become one of the most integrated green hydrogen players globally by joining upstream (solar panels), midstream (electrolyzers) and downstream processes to not only power its own refining and chemicals complex, but also to export hydrogen to key markets where it supplies gasoline and diesel, such as Singapore (which expected to have the highest carbon tax in Asia by 2030 at S$80/ton).10

South Korea is promoting the development of a hydrogen economy

South Korea has also been very active in terms of its energy transition journey. The government enacted the Korea Carbon Neutrality Act in March of this year, a national framework for climate transition that includes 2030 targets and climate-responsive budgeting.11 Earlier in 2020, the Green New Deal was announced to scale investments for transition covering renewables, green buildings, and hydrogen.12 Korea’s Emissions Trading Scheme (KETS) also forms a central part of the country’s policy response covering power, transport, and industrial sectors.13

In the long-run, the Korean government has decided to turn hydrogen into the country’s biggest energy source by 2050, by expanding hydrogen-based power generation and increasing the supply of clean hydrogen, with the aim to replace 100% of the fuel currently being used in steel and chemical industries.14 In January 2019, South Korea legislated the world's first hydrogen law (Hydrogen Economy Promotion and Hydrogen Safety Management Act) to promote the development of a hydrogen economy.15 In terms of exports, renewable energy and hydrogen production projects are being launched abroad and the number of hydrogen supply chains are expected to increase to at least 40 by 2050.16

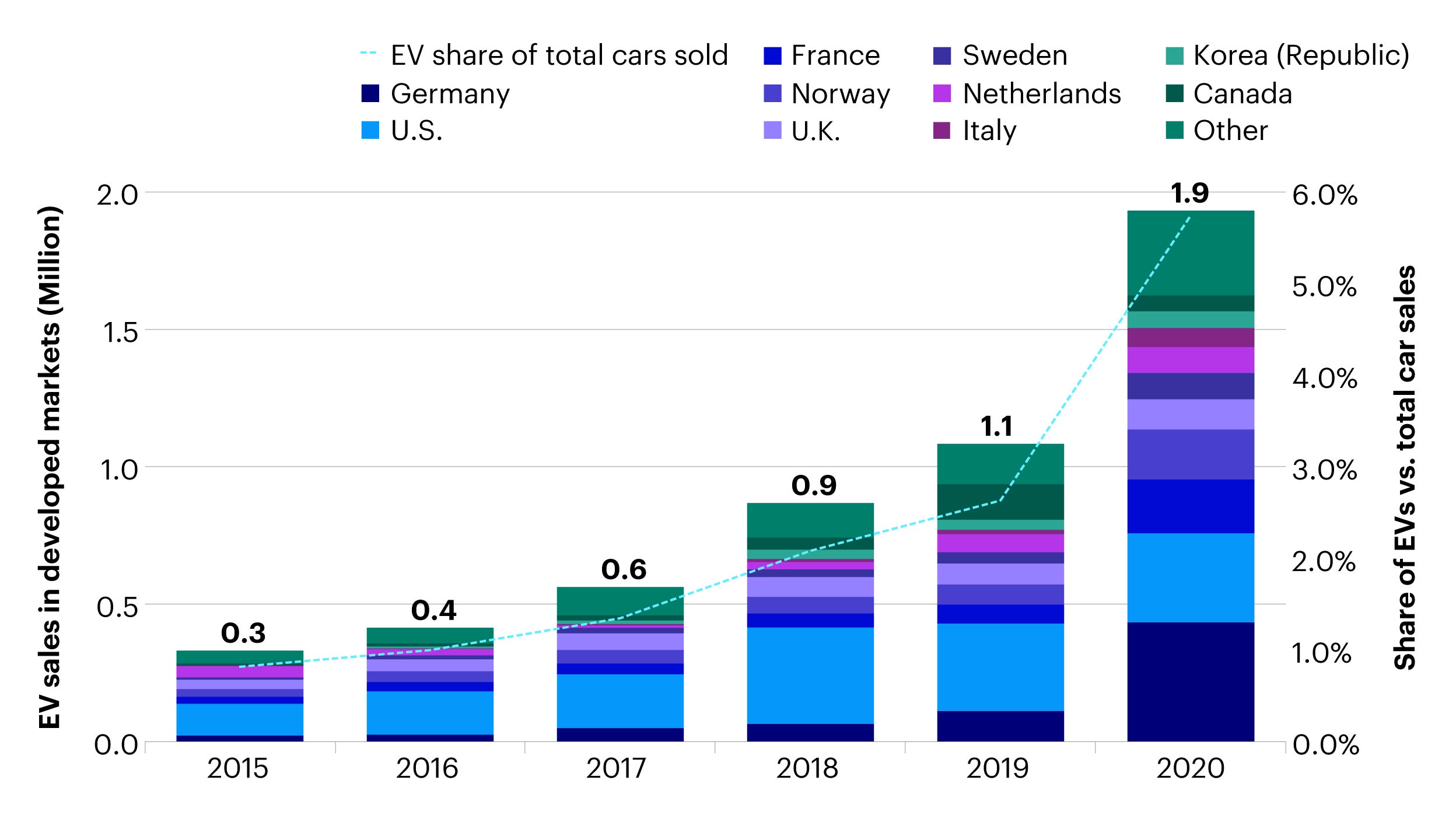

With regards to transportation, policymakers aim to increase the capacity of hydrogen vehicle production and plan to install more than 2,000 hydrogen chargers nationwide. Korea’s large industrial conglomerates have also been very active in the development of electric vehicles (EVs), EV batteries and fuel-cell electric vehicles (FCEVs). One major company is pioneering research into hydrogen fuel cell technology to drive clean transportation and has started construction on their first overseas hydrogen fuel cell system production and sales base located in China which is expected to launch by the end of the year.17

Source: BloombergNEF, 2021.