Part 2: China's Transition Story: Decarbonizing High Emitting Sectors

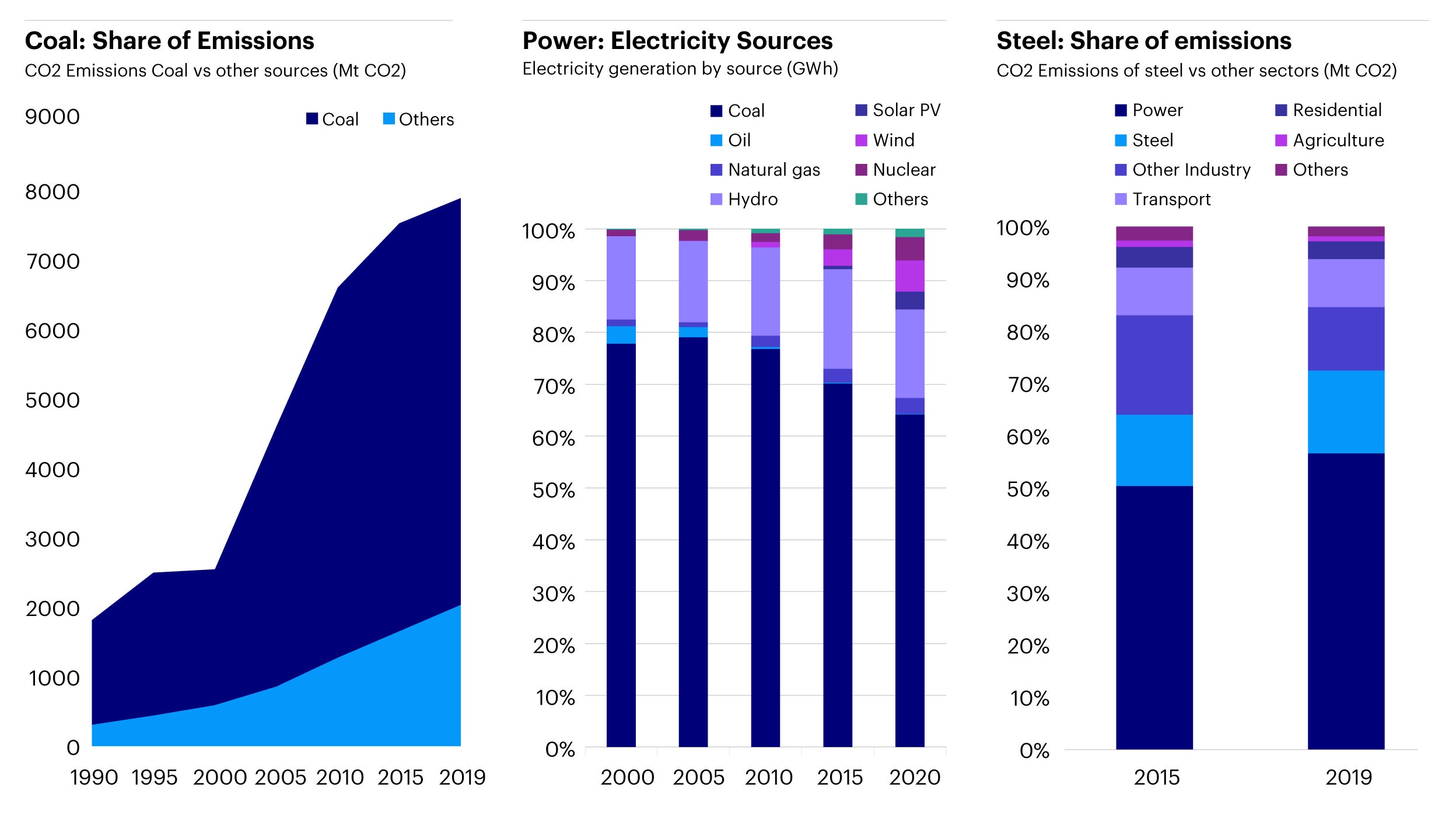

As mentioned in our previous piece, China is still a coal-powered economy today with nearly 80% of emissions1 from coal as fuel source. Given existing reliance on coal, a critical path towards decarbonization requires clear climate transition pathways in high-emitting sectors. In this article, we examine viable options and roadmaps in three key sectors – coal, power, and steel.

Source: IEA Data https://www.iea.org/countries/china; Carbon Brief

1) Coal requires both reduction as well as increasing efficiency and scale

- Coal: While much of China’s energy mix is still dominated by coal, China has actually progressively achieved targets set in 13th Five Year Plan by reducing coal production capacity from more than 70% to ~55-60% in recent years2. For the pathway ahead:

- Coal’s role amidst energy security: In the near term, given energy security, employment and economic development considerations, coal still has a role to play.

- Coal’s reduction pathway: Accordingly, the path forward will include both continued reduction of coal usage while also making coal use cleaner. There might be a consolidation of players and closing of smaller facilities, with a focus on deploying better and cleaner technologies in the remaining facilities.

2) Power transition can be enabled by carbon market forces and scaling renewable technologies

- Power: From IEA analysis, electricity producers account for more than 50% of emissions in China. Decarbonization would be driven by:

- Carbon market push: Power is the sector covered by China’s national Emissions Trading Scheme (ETS) which has provided an additional market and carbon pricing impact on power producers to decarbonize.

- Renewables: China’s National Energy Administration (NEA) previously called for the share of renewables in electricity generation to be increased to 40% by 2030 to meet national decarbonization targets3; of which solar and wind technologies would play a critical role.

- Role of natural gas: There have also been industry discussions on coal to gas switching and the role that gas could play. Currently gas takes up a less than 10% share4 and has lower emissions than coal and greater energy efficiency, however gas as a transitional fuel will probably have a bigger impact in sectors like transportation and chemicals rather than in the power sector.

3] Steel is being impacted by cleaner technologies and policy movements

- Steel: Industrial production accounts for the majority of both energy and coal usage in China. Within which, teel as a sector accounted for near 20% of carbon emissions and near 15% of energy use5 between 2010 and2018 where emissions stemmed from both energy usage and industrial processes to treat iron ore. A pathway to decarbonization could include:

- Electric Arc Furnace (EAF) is a critical technology enabling lower emissions and wastewater to be produced. Currently 90% of China’s steel production still uses traditional furnace technology6 and a shift to EAF can drive significant emissions reductions. Higher cost of adoption is still a concern in part driven by limited scrap supply and also rising power tariffs and electricity prices. Continued growth of EAF can also be driven by measures supporting EAF including policy targets to increase scrap output and supply (e.g. 14th Five Year Plan targets reaching a 30% steelmaking scrap ratio by 20257).

- Increasing steel efficiency: This includes improving energy consumption in steel production such as recovery of excess heat to generate on-site electricity and enhancing material efficiency of end steel usage such as in building and manufacturing8.

- Adopting new technologies: Finally new technologies such as green hydrogen and carbon capture and storage (CCS) provide additional room for decarbonization ahead.

- CBAM Impact: Relatedly, there have also been discussions on the impact of the EU’s Carbon Border Adjustment Mechanism (CBAM) that seeks to equalize the price of carbon between EU products and overseas imports. While this might impact Chinese producers longer-term, within the steel sector, Europe’s share of exports is relatively low and so this will likely have a lower impact on steel relative to other sectors. It might however be interesting to consider broader downstream impacts, such as steel being used in EVs for exports that might face CBAM pressure.

The road ahead: role of technology and policies in sector transition

While each of the high emitting industries would have sectoral requirements, two overarching factors stand out. The first is the importance of technology maturity both in the readiness of deployment as well as costs and economics for adoption. IPCC’s Working Group 3 report of its Sixth Assessment Report in particular highlighted on how rapid cost reductions in areas like solar and batteries have been critical in penetration growth. The second is the impact of macro factors particularly regulations and national as well as global policies. This includes utilizing market measures (such as the anticipated expansion of China’s emissions trading scheme), national targets (such as on renewable share mix) or impact of global policies and factors (such as European CBAM or recent REpowerEU plans) These factors combined can accelerate decarbonization in the high emitting sectors of focus through demand and supply-side measures and create interesting opportunities to invest in sectoral plays and transition leaders. In the next article, we will do a deep dive into investment opportunities in various climate solutions and technologies.