Part 1: China's Transition Story: China’s State of Decarbonization

As previously shared in Invesco’s whitepaper on “Targeting net zero in Asia”, more than half of global emissions are from Asia as a region1 particularly as Asia is still very coal dependent, with 30-70% of energy mix in coal2. China plays a critical role in moving our world towards decarbonization and achieving net zero. Accounting for more than 25% of global emissions today3, China has been making steady progress in emissions reduction including 3060 national goals announced in September 2020 alongside various other supporting policies.

1) Balanced Transition: Coal dependency implies strong need for balanced transition

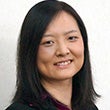

Over the past two decades, China’s share of global emissions has gone up alongside rapid economic growth. This itself is consistent with historical correlation between per capita GDP growth and per capita emissions in other countries. Specifically, China is highly coal dependent, with nearly 80% of its emissions4 from coal being used as a fuel source. China’s development has also been tied to its energy intensive economy, with the electricity sector and industrial sector driving the majority of emissions.

Source: IEA Data https://www.iea.org/countries/china

Given China’s stage of economic development, decarbonization needs to be considered alongside other objectives including economic growth, poverty alleviation, employment and income equality while also reducing fossil fuel reliance and ensuring emissions to peak as soon as possible before moving towards reduction. This is especially as China is still heavily reliant on coal and many coal facilities are still at a younger stage of their lifecycle and are at risk of becoming stranded assets. Premier Li Keqiang previously reiterated in the March 2022 “Two Sessions” the importance of “taking orderly steps” in realizing peak emissions before 2030 and carbon neutrality before 2060. This again emphasizes the importance of just transition and how climate transition must tie in with broader goals such as common prosperity, reducing inequality and strengthening the middle class.

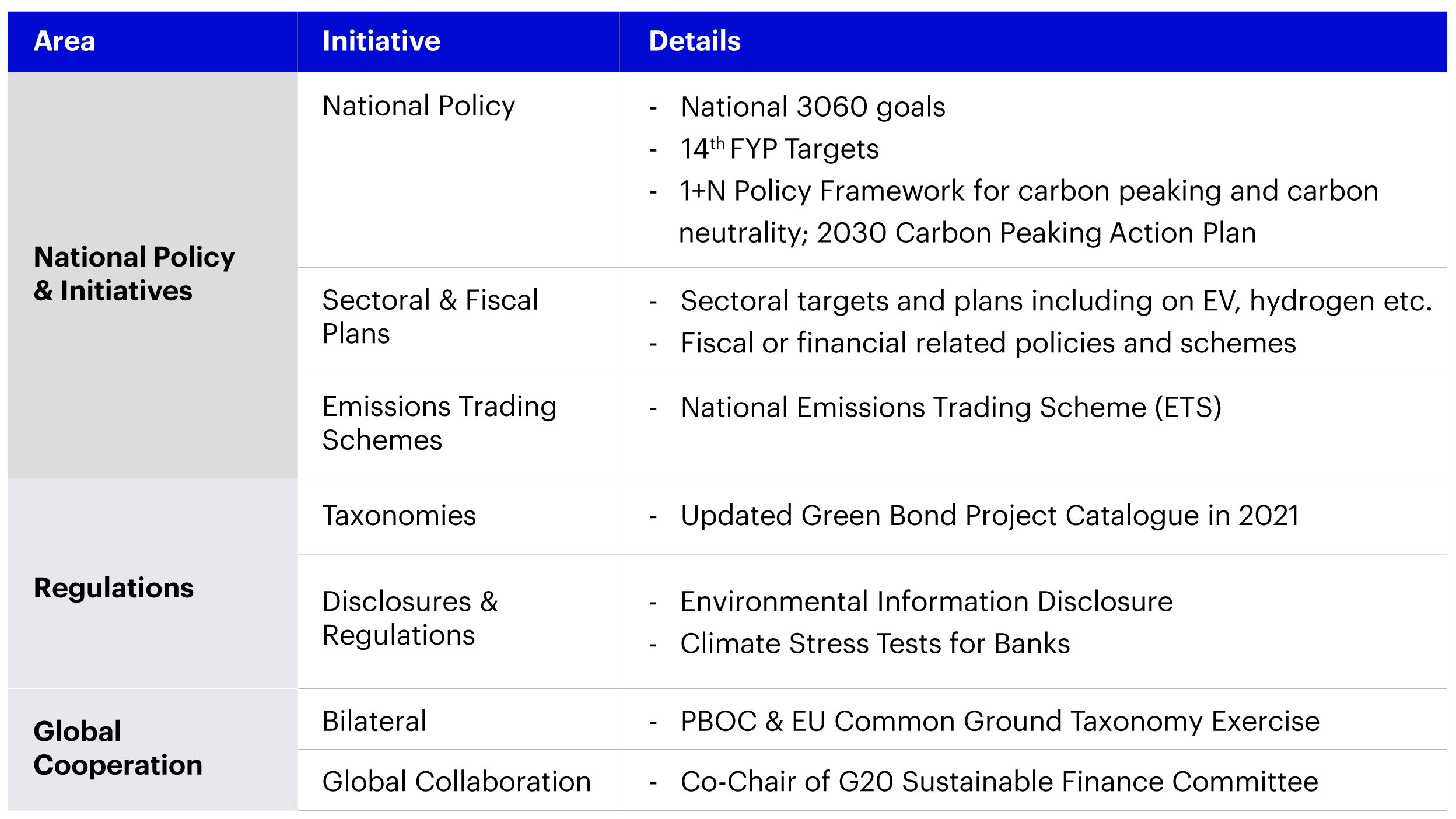

2) Holistic Policy Approach: Broad national goals anchored by whole-of-industry policy approach

China has taken a holistic approach to transition, relying not just on a singular policy but on a myriad of complementing policies addressing different aspects of decarbonization targets, plans and sectors all under the overarching 3060 goals and 1+N framework.

National Policies and Initiatives: These are national goals and policies focused on driving the country towards decarbonization, including:

o National Policies:

- 3060 Goals: Announced by President Xi in September 2020, the goal sets out China’s plans to attain peak emissions before 2030 and carbon neutrality before 2060.

- 14th Five Year Plan: More detailed climate targets were announced during the passing of the 14th Five Year Plan at the Two Sessions in March 2021. These included reducing carbon intensity per GDP by 18%, reducing energy consumption per GDP by 13.5% as well as increasing non-fossil energy share to 20% during the period between 2020 and 20255.

- 1+N Decarbonization Framework: Announced in the leadup to COP26, this sets out an overall framework for carbon peaking and reduction, where the 1 refers to long term 3060 goals while N refers to various plans to achieve peak emissions before 20306.

o Sectoral and Fiscal Plans: Under the 1+N framework, different government departments, subsidiaries, industry associations and bodies have come up with supporting policies. These include:

- Sectoral Policies:

· Renewables: National Energy Agency (NEA)’s mega bases projects plan; residential market policy scheme for solar

· EV: 2030 Carbon Peaking Action Plan target for EVs to reach 40% of new vehicle annual sales in 20307; China Society of Automotive Engineers announced an energy-saving and new EV technology roadmap 2.0 in Oct 20208; plans to scale up charging infrastructure by various municipal governments including Beijing and Shanghai

· Hydrogen: China’s Hydrogen Industry Development Plan with targets on scaling fuel cell vehicles

- Financial Policies: People’s Bank of China (PBOC) announced in November 2021 the setting up of a carbon emissions reduction facility offering lower cost funding to support projects driving emissions reductions or facilitating more efficient use of coal9.

o Emissions Trading Scheme: Launched in July 2021, China’s national carbon emissions trading scheme (ETS) is the world’s largest carbon market by size. Currently focused on power sector, the scheme helps in gradual reduction while also incentivizing the phasing out of inefficient power generation. Going ahead, it is expected that the scheme will expand to cover more sectors.

- Regulations: Alongside national climate policies, regulations also help enhance transparency and promote sustainable investments to further support decarbonization.

o Taxonomies: PBOC issued a new Green Bond Catalogue in April 2021 that building upon the 2020 Catalogue that unified green bond guidelines in China while also having updates on excluding coal and fossil fuels from eligible green bond projects. In parallel, China also has a collaboration with EU to undertake an analysis between taxonomies from the two regions, culminating in the release of the Common Ground Taxonomy (CGT) work in November 2021. These developments create a good point of reference in defining sustainable activities that help facilitate greater adoption of ESG and climate-related investments.

o Disclosures and Regulations: In line with global ESG regulatory push, China has also been gradually increasing ESG related disclosures and requirements. This includes Ministry of Ecology and Environment’s new environmental information disclosures and PBOC’s climate risk stress tests for banks. The China Enterprise Reform and Development Society (CERDS) also released one of the first locally developed Guidance for Enterprise ESG Disclosures. These developments are in parallel to ongoing consultations for International Sustainability Standards Board (ISSB)’s proposals for a global baseline of sustainability reporting standards; with the goal to increase comparability of ESG data and facilitate greater investors’ focus in sustainability investing.

- Global Cooperation: Finally, China has also been taking an active role internationally to help advance global climate agenda. This includes bilateral partnerships such as the CGT exercise with the EU. China is also a co-chair of the G20 Sustainable Finance Study Group and has contributed to the G20 Sustainable Finance Roadmap. These developments further highlight China’s commitment to climate transition and global cooperation which helps to accelerate progress.

Source: Invesco, for illustrative purposes only.

3) Technological Imperative: Technological sectoral roadmaps critical to enable transition

Finally, actual progress in decarbonization requires technological solutions across sectors, particularly high-emitting industries like coal, power and steel and other industrial production. In a subsequent piece we will analyze more about both sectoral transition pathways and technological readiness- looking specifically at maturity and economics. In general, for more less developed technologies, the road ahead lies in continued technology breakthroughs to further improve economics and drive scalability, while more mature technologies would still require policy guidance for wide adoption and the continued building out of supply chain components and infrastructure

As China continues on its transition story, we believe there will be corresponding investment opportunities in new technologies as well as implications for traditional sectors. The upcoming blog in this series seeks to offer an overview into China’s current state of decarbonization, analyzing high-emitting sectors and thematic investment opportunities and synthesizing key capabilities essential for investing in China’s climate transition.

Footnotes

-

1

Asia Development Bank (October 2021) COP26 and the Importance of Climate Action in Asia and the Pacific | Asian Development Bank (adb.org)

-

2

Invesco Targeting Net Zero in Asia https://www.invesco.com/apac/en/institutional/insights/esg/targeting-net-zero-in-asia.html

-

3

BBC https://www.bbc.com/news/world-asia-57018837 ; Climate Watch / IEA Data https://www.climatewatchdata.org/ghg-emissions?source=CAIT

-

4

IEA Data https://www.iea.org/countries/China

-

5

14th Five Year Plan

-

6

China Embassy http://us.china-embassy.gov.cn/eng/zt_120777/ydqhbh/202111/t20211117_10449121.htm

-

7

Yicai https://m.yicai.com/news/101209399.html

-

8

China SAE http://en.sae-china.org/a3967.html

-

9

PBOC The People’s Bank of China Launches the Carbon Emission Reduction Facility (pbc.gov.cn)