Part 3: China's Transition Story: Technology Roadmap and Investment Opportunities

In the move towards decarbonization, it is estimated that RMB 3-4 trillion of green investments are required annually to achieve China’s 3060 targets1. Our previous analysis on investing in China also highlights the need for China to spend 5.2% of its annual GDP from 2021 to 2050 both in low emissions energy sources and ways to reduce emissions2. In this piece, we analyze key climate technologies and evaluate the investment outlook ahead.

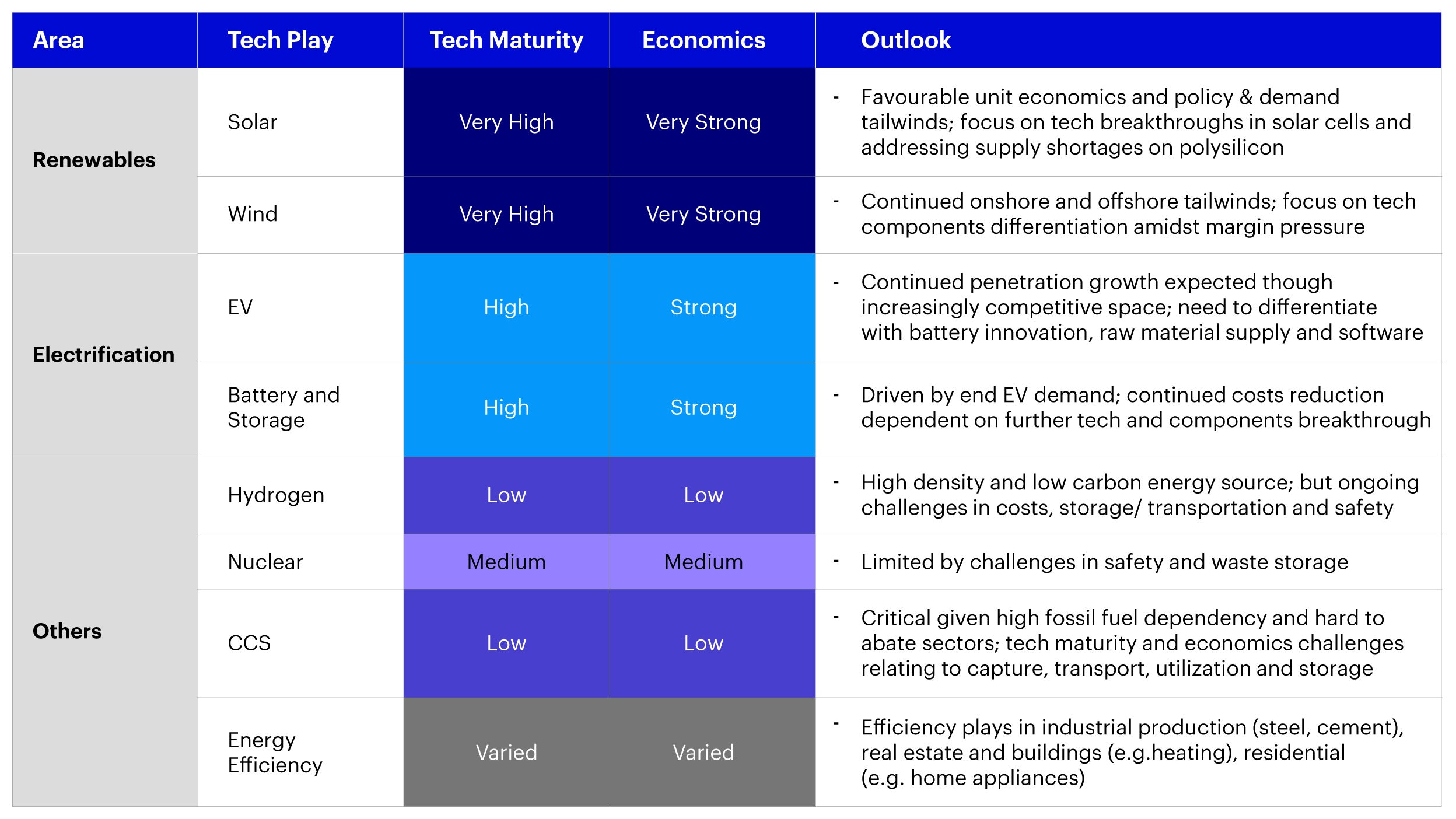

Source: Invesco, for illustrative purposes only.

1) Renewables are mature technologies with favorable economics

- Renewables: Within a decade, solar and wind’s share of power generation in China have increased from minimal to almost 10% in 20203. These clean energy sources will continue to help reduce dependency on coal and fossil fuels while also feeding into reductions in other sectors including electric vehicles and allowing for lower end-to-end carbon emissions. Entering into 2022Q1, global volatility and geopolitical events have resulted in energy and commodity price surges and correspondingly impacted performance of clean energy sectors. However, these events have also highlighted the importance of energy security and scaling up renewables would be a critical hedge against reliance on singular energy sources. EU’s latest REpowerEU plan includes increasing the continent’s renewables 2030 target from 40% to 45%, by adding 1,236GW of capacity by 20304, creating tailwinds for potential Chinese exports. Certain limitations still exist, including geographic constraints in certain Chinese regions, seasonal limitations and day-to-night limitations. To that end, energy storage would be a critical enabler for further share increase, particularly to balance power distribution during peak and low demand periods and ensure greater stability.

- Solar: IPCC analysis has shown up to 85% declines in solar costs in past decade5 helping to drive sector growth across both utility and commercial segments. Within China, the National Development and Reform Commission and National Energy Administration have continued their policy push for solar projects including the residential market policy scheme or mega base projects in key provinces. Across key components from polysilicon to wafer or cell modules, China has dominant supply chain share between 60% to more than 80% globally6 and the completeness of supply chain will be a sustained competitive advantage. Polysilicon supply shortages could drive price increases in short term but increasing solar demand will likely see capacity growth. Looking ahead, it could be interesting to focus more on the distributed generation segment and in continued technological breakthroughs such as on solar cell efficiency, optimizing wafer size and costs and improving conversion ratios.

- Wind: Similar to solar, wind has seen cost reductions of up to 55% in past decade7. Actual wind installations in China over 2015 to 2020 almost doubled from that of the 13th Five Year plan with more than annual 50GW capacity expected from 14th Five year plan targets8.China also become the largest offshore wind market globally in 20219. The focus ahead should be on technology component players to ensure better wind turbine technology that can be critical to combat margin pressure.

2) Electrification: Rapidly maturing technology; scale adoption through policy and supply chain

- Electrification: Transport as a sector contributes near 10% of total emissions in China and electrification is a clear sectoral roadmap for decarbonization.

- Electric Vehicles (EVs): Within a span of 5 years, China’s share of global EVs increased from about 10% in 2014 to over 50% in 202010 driven by policy measures, digitally savvy consumers and the range of EV options available. Domestic EV penetration is expected to grow to 20% in 202211 well ahead of government’s 2025 20% penetration targets12. Looking ahead, continued focus on improving battery technologies and costs, expanding charging stations and infrastructure, innovating on EV software, and addressing raw materials supply shortage (like nickel and cobalt) would be critical. Additionally, upstream decarbonization of electricity generation and other parts of EV supply chain would be essential to realize full potential of the emissions reduction impact.

- Battery and storage: Batteries are typically the largest component of EV costs (taking up more than a third of costs). IPCC analysis has shown the costs of batteries falling by 85% in the past decade13. Continued innovations across the battery supply chain would be key to continue to drive cost parity whether in scaling up cylindrical batteries or innovations in separators and electrolytes.

3) Wider technologies: Significant potential but further tech breakthrough required

- Others: Various other technologies also could have potential with driving decarbonization with linkages to energy, EVs and other industrial applications. Some areas include:

- Hydrogen: Hydrogen as an energy source has high density, is carbon neutral and has a wide range of potential applications. However, most hydrogen is derived from fossil fuels, while green (or clean) hydrogen from electrolysis represents an insignificant share today. The major challenges include high existing costs of production, issues with storage and transportation infrastructure (particularly as hydrogen is a gas) as well as safety concerns. Applications include development of fuel cells for EVs that can allow for better energy density and mileage and also in industrials like steel and chemicals. Overall, it is a complex supply chain and a combination of technological breakthroughs and policy support will be required to scale this going forward.

- Nuclear: All things considered, costs and economics pertaining to nuclear is less of a concern compared to say hydrogen or CCS. However, the challenges relate to safety concerns and waste storage. Setting up nuclear facilities often involves a high degree of technical knowhow and additional requirements on location as well as community considerations.

- CCS: Carbon capture, utilization, and storage may be important for hard to abate sectors; especially relevant in China given high fossil fuel dependency such as in the power sector given the higher proportion of facilities in the early stage of their lifecycle. Deployment of CCS is affected by high costs including capital expenditure and equipment requirements, challenges in optimizing conditions for capture, difficulties in transporting carbon dioxide due to temperature and pressure constraints, high energy requirements for utilization and a lack of storage capacities at scale.

- Energy Efficiency: Finally, there are a range of other energy efficient plays whether in industrial production (such as EAF in steel or clinker efficiency/ recycling in cement), real estate and buildings (heating and energy savings) or residential (efficient home appliances). Maturity and economics may depend on the technology itself and the sector it is applied to.

Investment Outlook: Towards differentiated segments and leaders further enabled by technology and policy

A pathway to decarbonization requires a variety of technologies especially given different requirements and constraints across different sectors. Correspondingly, the range of technologies are all at different stages of maturity; in more developed spaces the focus is on wider policy support and addressing supply chain bottlenecks like raw materials, transportation, storage, and infrastructure while spaces at earlier stages require greater technology breakthroughs. From an investment perspective, in addition to analyzing the technological maturity and unit economics outlook, the competitive dynamics and moats of differentiation within specific players would also be additional factors to consider. Looking ahead, investing in this space requires moving from a broad-stroke sector approach to identifying differentiated leaders across the value chain.

As mentioned, China’s push for decarbonization may create corresponding investment opportunities and implications relating to climate transition which would require underlying capabilities and approaches. Invesco and Invesco Great Wall’s collaboration with Tsinghua University National Institute of Financial Research Center for Green Finance Research (CGFR) will continue to focus on climate analytical capabilities and transition pathways particularly on high-emitting sectors like coal, power, and steel. Having reliable underlying data relating to carbon emissions is key to investment analysis while sectoral pathways offers helpful guidance on engagement priorities and implications on investments.

Decarbonization requires cross-sectoral transition and taking a technological and sector-based approach together with capabilities in climate data analytics is a helpful starting point to invest in decarbonization.

Footnotes

-

1

China Briefing https://www.china-briefing.com/news/chinas-green-finance-market-policies-incentives-investment-opportunities/

-

2

Invesco https://www.invesco.com/apac/en/institutional/insights/fixed-income/why-china.html

-

3

IEA Analysis

- 4

-

5

UNRIC https://unric.org/en/new-ipcc-report-emissions-can-be-halved-by-2030/

-

6

Bloomberg/ Statista https://www.statista.com/chart/24687/solar-panel-global-market-shares-by-production-steps/

-

7

WEF https://www.weforum.org/agenda/2022/04/ipcc-report-mitigation-climate-change/

-

8

Asia Financial https://www.asiafinancial.com/china-adds-record-wind-power-capacity-as-subsidies-phased-out

-

9

Carbon Brief https://www.carbonbrief.org/china-briefing-27-january-2022-surge-in-offshore-wind-xis-new-speech-ieas-report/

-

10

Nickel Institute https://nickelinstitute.org/en/blog/2022/april/what-differentiates-china-s-ev-market-from-the-others/

-

11

SCMP https://www.scmp.com/business/china-business/article/3163005/electric-cars-account-over-20-cent-chinas-new-vehicle-sales ; https://www.scmp.com/business/companies/article/3124747/electric-vehicles-will-account-three-out-five-new-cars-chinas?module=inline&pgtype=article

-

12

Sina Finance https://finance.sina.com.cn/chanjing/cyxw/2022-04-08/doc-imcwiwst0544591.shtml

-

13

Guardian https://www.theguardian.com/commentisfree/2022/apr/06/scientists-climate-crisis-ipcc-report