Cathrine de Coninck-Lopez

Investors can’t ignore environmental, social and governance (ESG). In 2023 we’re paying attention to four themes that can help clients to navigate the various complexities.

Amid a challenging data landscape and a growing – regulatory and otherwise - focus on investors’ sustainability preferences, we want to have better conversations on all things ESG.

Other key themes include the social aspect of ESG, the importance of climate adaption and biodiversity, and better understanding the divergent ESG regulations across the globe.

Cathrine de Coninck-Lopez

Investors are increasingly being asked to have a view on how ESG aligns with their investment values. Amid this backdrop, heightened media attention and a greater focus on preventing greenwashing will be key themes in 2023 and beyond.

Themes that Invesco’s Global ESG team are paying particular attention to in 2023 include:

1. Supporting our clients in navigating a complex ESG landscape

Innovation in products and solutions

In 2022 Invesco launched several ESG strategies including net zero and social progress. In 2023, we expect increased interest from our clients in these solutions.

Sturcturing the data landscape

Invesco uses more than 50 different ESG data sources. We understand the challenges around data and in 2022 launched ESGCentral to help our internal and external clients navigate this complexity. In 2023 we expect this to be a key enabler for portfolio disclosure.

The language of ESG

Invesco Consulting surveyed 1,500 financial advisors in the US and provided advice on how to initiate ESG conversations with individual investors. In market discussions on MIFID II Suitability rules, 20-40% of customers tick “yes” for a clear sustainability preference. The Invesco Consulting study found that around 80% of individuals want to hear more about linking their values to investment options.

2. More conversations about (S)ocial

Social issues were part of our dialogue with companies around 40% of the time compared to closer to 60-70% for environmental and governance issuesii. There are good grounds to expect social issues to come to the fore in 2023.

Today, reporting on social issues and management of them globally varies. Data from the World Benchmarking Allianceiii illustrates this. In January 2022, 1,000 companies globally were assessed against 18 social indicators under the broad umbrellas of decent work, ethical behaviours and respecting human rights. The average score was only 5.2 out of 20.

Human rights is another important topic. The EU published its action plan in August 2022 and the US introduced the human rights sourcing legislation, also implemented in the summer of 2022. These developments are putting additional pressure on investors to implement due diligence, which is limited by data availability.

In 2022, we expanded the data on our proprietary ESG research platform, ESGintel. It now includes a children's rights score, which is a proxy for human rights in operations and products and services. This score is generated from the Global Child Forumiv.

Remuneration and a high number of shareholder resolutions are likely to be a theme that we are going to see in the 2023 shareholder voting season. The significant market turmoil could lead companies to issue shares to enable their workforces to receive some compensation for expected reduced cash awards.

Invesco’s policy on voting is that our investment teams will vote their shares with the guidance from the global policy, but subject to their own views of the company performance.

3. Climate adaptation and transition plans

Climate adaptation refers to the ability for people and nature to adapt to climate change risks. In 2022, adaptation finance only represented around 10% of the issued green bond universe. But we are expecting this to grow significantly in 2023 with particular emphasis on use of proceeds for emerging marketsv.

We expect the final issuance of the Taskforce for Nature-related Financial disclosures (TNFD) in 2023, which will provide the base for corporate disclosure expectations on biodiversity. Another key component is the EU sustainable finance disclosure regulation principal adverse impact indicator number 7.

The interplay between climate, biodiversity and food security is significant. The rise of smart food comes with a debate around reduction in biodiversity. In 2023, the EU will allow gene modification in certain crops to ensure food security in the face of climate changevi.

As popularity for biodiversity financing has grown, the connection between potential climate offsets and natural capital is becoming more apparent. Nature-based solutions (NbS) in the form of carbon offsets could help to reduce emissions and increase nature-based resilience. The World Economic Forum reported that NbS could provide 37% of the CO2 mitigation needed by 2030 to maintain global warming within 2°C and at a lower cost than other popular options.

For companies, we’re closely watching the transition plan taskforce which was launched during COP27 in November 2022. The UK Transition Plan Taskforce (TPT) is also in consultation until February 2023. We’ve already seen companies issuing their versions of transition plans and expect more reports in 2023. The TPT, which has a greater focus on the just transitionvii, was launched in April 2022 asks companies to consider:

We expect to see greater consolidation of standards on items such as sustainable investments.

In 2022, firms spent a lot of time implementing the EU Sustainable Finance Disclosure Regulation (SFDR).

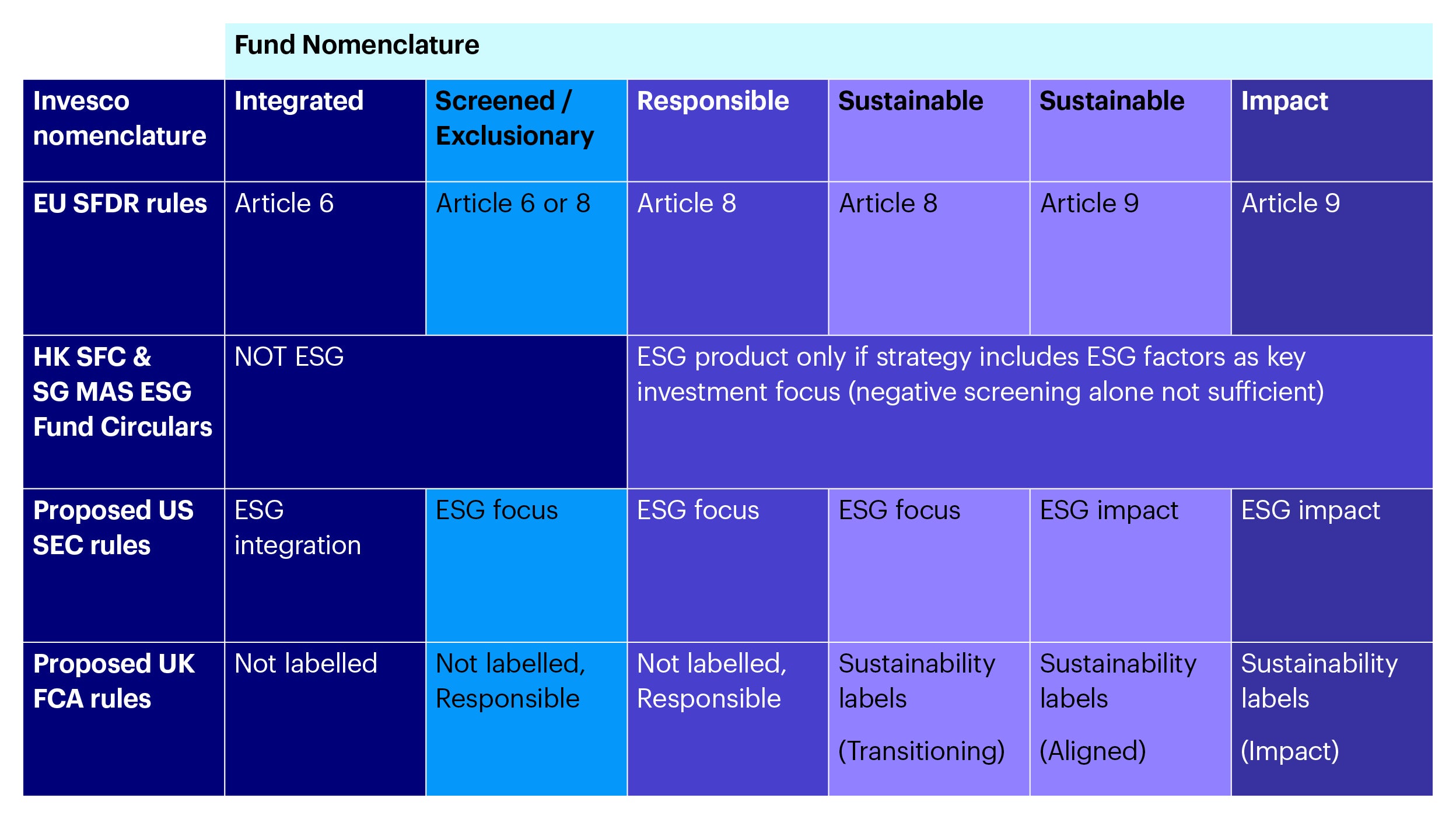

The UK Financial Conduct Authority (FCA) issued its own guidelines for ESG labels and disclosures in Q4 2022 and will be consulting on these into January 2023. The proposed rules are different to SFDR and are more closely aligned to the US Securities and Exchange Commission proposals. These are also expected to be launched during the first half of 2023.

Similarly, the Canadian regulator is setting out its stall on ESG. Within Asia, regulators in Hong and Singapore have released ESG fund disclosure circulars in the past two years.

The way for global firms to navigate these different frameworks is to have a proprietary internal standard that sits across the geographies. At Invesco, we’ve been transparent about how we map definitions and expect to spend more time on education in this area in 2023.

The Markets in Financial Instruments Directive is an EU legislative framework that entered into force on 3 January 2018. It aims to strengthen investor protection and improve the functioning of financial markets to make them more efficient, resilient and transparent. Under the Suitability rules, advisors in Europe are required to ask clients about sustainability preferences.

The Sustainable Finance Disclosure Regulation is a mandatory ESG rule imposed by the EU for asset managers and other financial markets participants. Article 6 covers funds that don’t integrate any sustainability and could include stocks excluded by ESG funds such as coal or tobacco.

Under SFDR, Article 8 covers funds that include binding environmental and social considerations or restrictions. Article 9 funds have sustainable investment as an objective.

A principal adverse impact (PAI) is a factor where the activities of a company or entity may have a negative impact on the environment or society. PAIs are determined by reference to the severity and frequency of the impact, will vary according to sector and geography.

Green investing isn't always easy

The classification of nuclear and natural gas as green within the EU Taxonomy is an example of the challenges of agreeing what it means to be green. Read more

2020 Climate change report: Tracking against climate goals

Invesco’s second Climate change report looks at how to build a climate-resilient future through engaging with others and using frameworks such as the TCFD and the NZAMI. Find out more.

The EU Taxonomy as a Tool to Identify the Opportunities of the Green Industrial Revolution

The EU Green Deal is a transformational project, not only for our environment but also for our economy. The race to Net Zero offers a once-in-a-generation opportunity for Europe to become a leader in the Green Industrial Revolution.

i https://www.invesco.com/us/en/financial-professional/invesco-global-consulting.html

ii Source: Invesco Global ESG team

iii An alliance that works on from the local to the global level to shape private sector contributions towards reaching the Sustainable Development Goals, which are the United Nations' collection of 17 interlinked global goals designed to be a "shared blueprint for peace and prosperity for people and the planet".

iv The Global Child Forum was set up by the Swedish royal family. It aims to bring together global leaders from business, civil society, academia and government in order to spur action for social change around children’s rights. The forum scores over 3,000 companies globally and includes materiality assessments, grievance mechanisms and working-age metrics, among others.

v Full-report-Global-Landscape-of-Climate-Finance-2021.pdf (climatepolicyinitiative.org)

vii The taskforce is being described as the Taskforce for Climate Financial Related Disclosures (TCFD) but with a greater focus on the just transition. This is important because in November 2021 the World Benchmarking Alliance surveyed 180 companies in oil and gas, electric vehicles and automotive manufacturers. It found that the majority of high-emitting companies are failing to demonstrate efforts towards a just transition.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.