Monthly commodities update

Find out why Commodities performed well in May, with insights into the key macro events and what we think you should be keeping your eyes on in the near term with our latest commodities update.

Recent years have seen ETFs become a key component of Environmental, Social and Governance (ESG) portfolios. By blending innovation with thoughtfulness, we’ve designed our wide range of ESG ETFs to empower investors to choose their own journey through sustainable investing.

Whether your clients simply want to avoid certain companies or industries, or help drive positive change, our wide range of ESG ETFs can help you build portfolios that reflect values that matter to your clients.

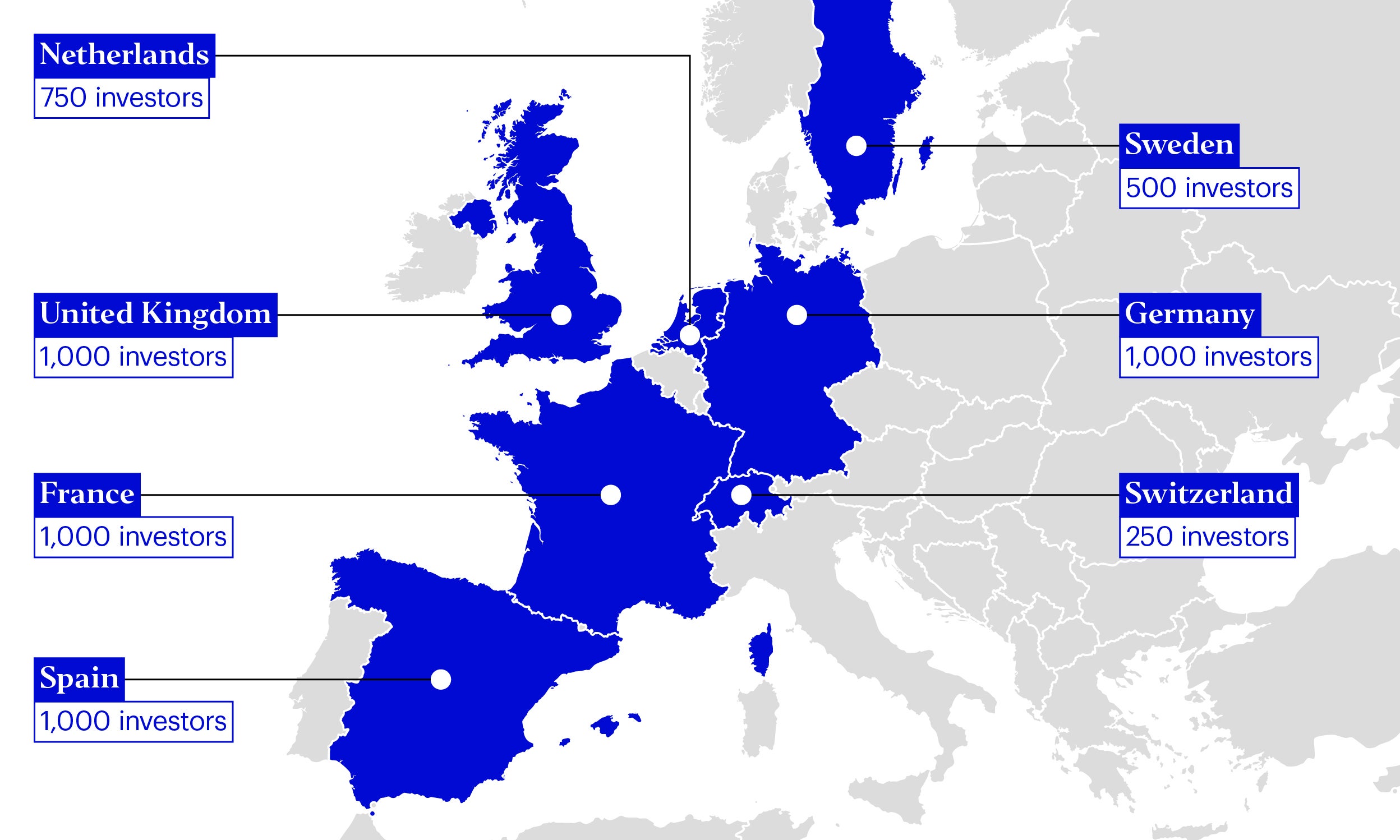

We surveyed investors across Europe on their thoughts on ESG investing and ETFs. Stay informed.

ESG isn't a 'one size fits all' solution. No two investors' wants and needs are exactly the same. Let us help you navigate your ESG journey to finding an ETF that aligns with your values.

ETFs that aim to provide a meaningful improvement in ESG scores by selecting companies, or adjusting their weighting, based on their ESG metrics while aiming for similar risk and return profiles to standard benchmarks.

ETFs that provide broad ESG integration aligned with the objectives of the Paris Agreement, by reducing the weight of companies exposed to climate transition risks and maximising weighting in those with the highest exposure to climate transition opportunities.

ETFs that provide targeted exposure of an ESG-related theme, such as clean energy or more specific segments like solar, wind or hydrogen technologies. These ETFs track indices constructed by specialist firms with expertise in these areas.

ETFs with more specialised ESG-related objectives, for example to meet the specific requirements of an investor or to incorporate a factor-based investment approach.

For complete information on risks, refer to the legal documents. The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested. The Funds intend to invest in securities of issuers that manage their ESG exposures better relative to their peers. This may affect the Funds' exposure to certain issuers and cause the Funds to forego certain investment opportunities. The Funds may perform differently to other funds, including underperforming other funds that do not seek to invest in securities of issuers based on their ESG ratings.

An investment in the fund is an acquisition of units in a passively managed, index tracking fund rather than in the underlying assets owned by the fund. Any investment decision should take into account all the characteristics of the funds as described in the legal documents. For sustainability related aspects, please refer to https://www.invescomanagementcompany.ie/dub-manco.

Monthly commodities update

Find out why Commodities performed well in May, with insights into the key macro events and what we think you should be keeping your eyes on in the near term with our latest commodities update.

Monthly fixed income update

Following the sell-off in April, May was a better month for bond markets and saw strong inflows of US$7.0bn into fixed income ETFs, taking the year-to-date total to US$24.8bn. Read our latest thoughts on how fixed income markets performed and what we think you should be looking out for in the near term.

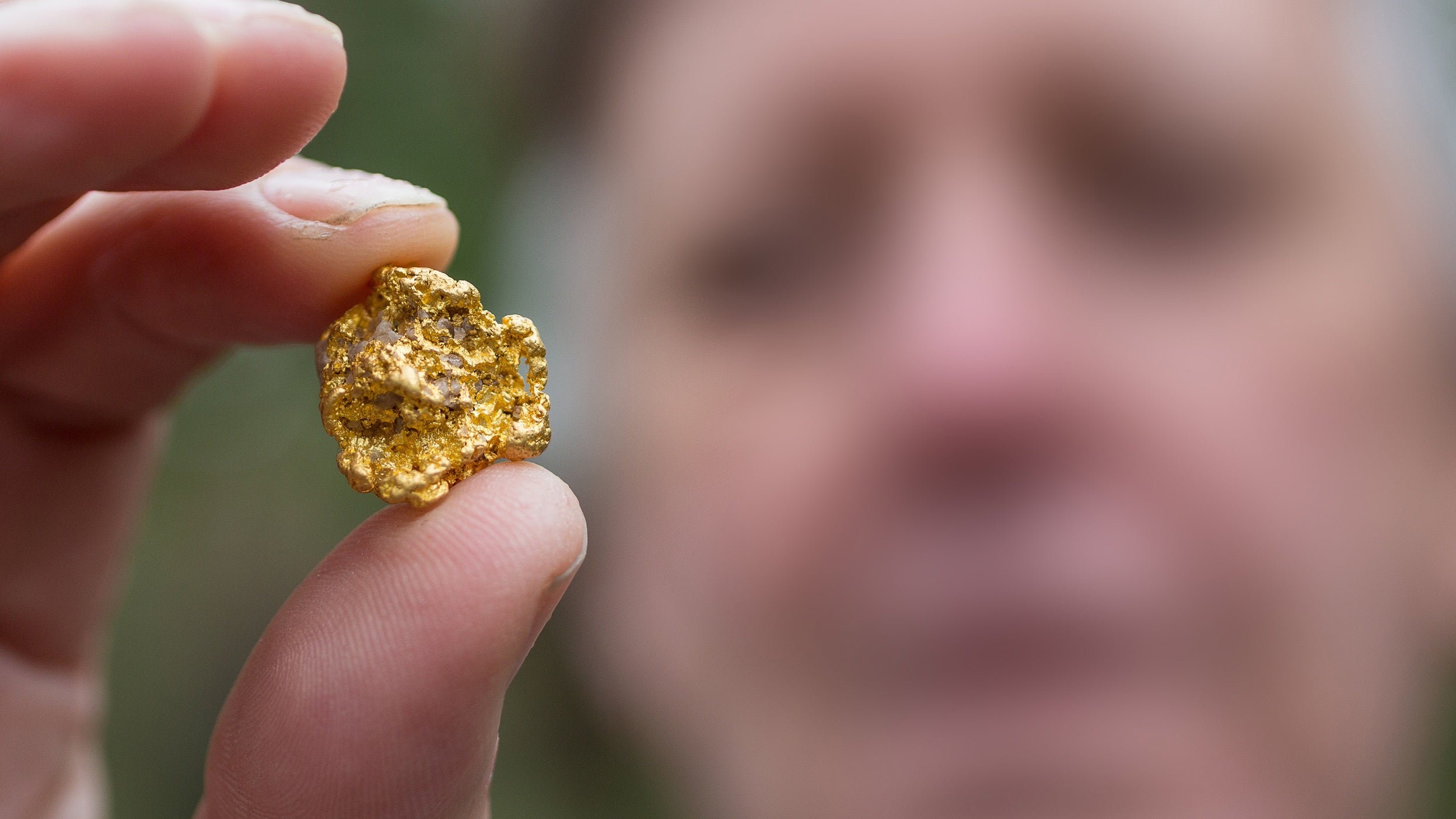

Gold’s supply and demand in Q1 2024

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

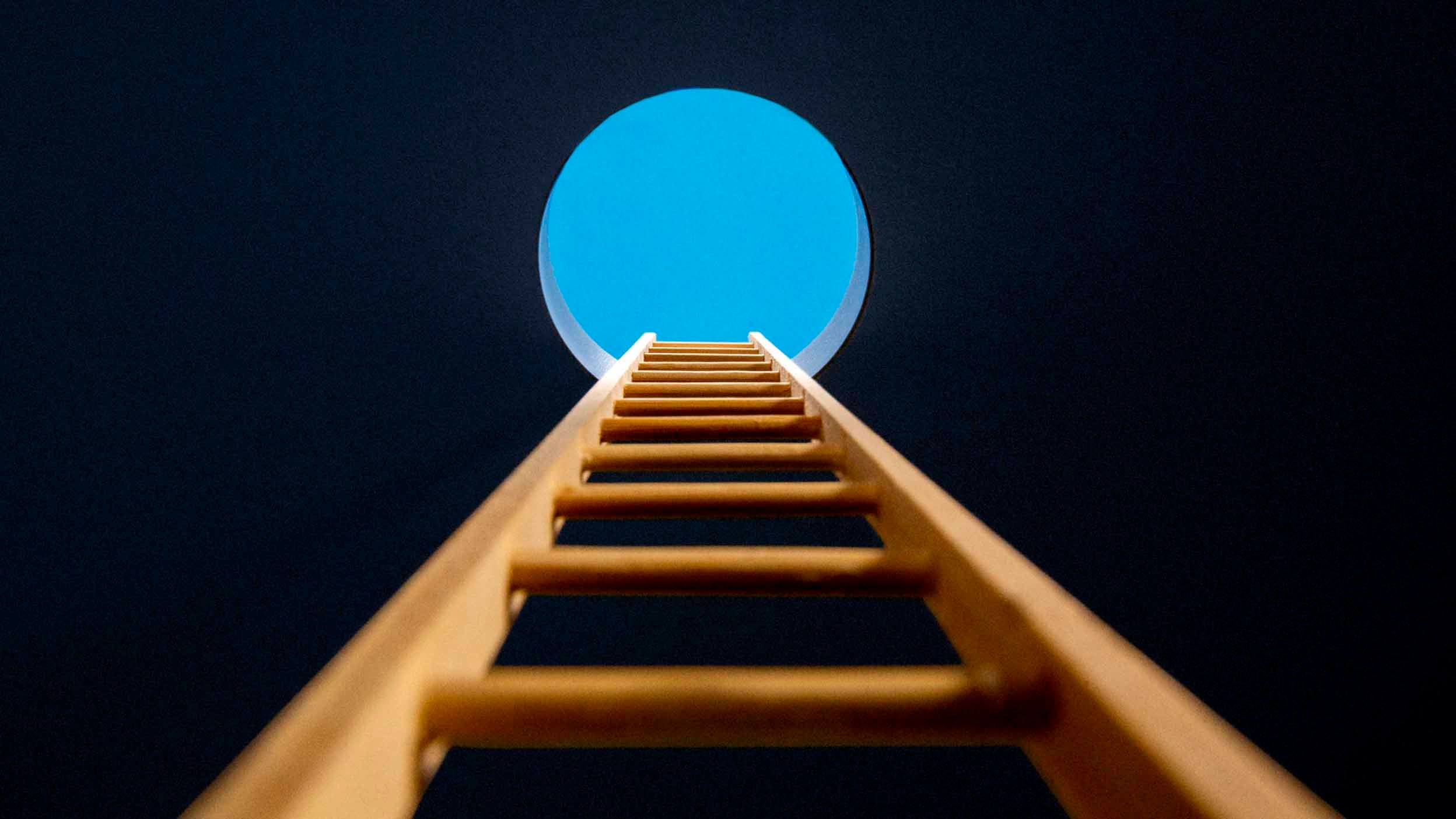

Explore the benefits of laddering

Bond ladders are portfolios of bonds with sequential maturity dates. As bonds reach maturity, the proceeds can be used to fund a specific expense, such as saving for a house or retirement, or reinvested into new bonds with longer maturities.

Climate investing: mitigation and adaptation

Climate change is challenging societies and to address the risks it’s essential we invest in mitigation and adaptation strategies. Find out more.

Monthly commodities update

Find out why Commodities performed well in May, with insights into the key macro events and what we think you should be keeping your eyes on in the near term with our latest commodities update.

Monthly fixed income update

Following the sell-off in April, May was a better month for bond markets and saw strong inflows of US$7.0bn into fixed income ETFs, taking the year-to-date total to US$24.8bn. Read our latest thoughts on how fixed income markets performed and what we think you should be looking out for in the near term.

Gold’s supply and demand in Q1 2024

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

We’re living in an age of disruption, where everything appears to change at lightning speed. Technology is transforming or lives and redefining entire industries. Meanwhile, climate change, declining birth rates, and an aging population are due to reshape society.

These are just some of the ‘megatrends’ at work in the world today with the power to reframe the way we live, what governments prioritize and how businesses operate and succeed.

We offer a broad set of ETFs that seek to capture the opportunities to be found in some of these disruptive themes.

Sign up to discover and receive relevant emails about our ETF offering of over 130 equity, commodity, and fixed income products across a range of strategies.

Our ESG approach is centred around client needs. Most investors choose ESG ETFs for the same reasons they choose any other ETF: simplicity, low costs, transparency, tradability and often for the efficient way it tracks a reference index.

With all of our ESG ETFs designed to meet specific objectives, we provide our clients with complete clarity on their goals and precisely how they aim to deliver that outcome.

Most investors choose ESG ETFs for the same reasons they choose any other ETF: simplicity, low costs, transparency, tradability and often for the efficient way it tracks a reference index. Their growing popularity can be seen in recent flows, as ESG ETFs gathered 50% of all net new assets in the European ETF market in 2021. With each Invesco ESG ETF designed to meet specific objectives, you have complete clarity on the goals and precisely how it will deliver that outcome.

This has been an area of increased focus, with some studies suggesting a positive relationship betweeen a company’s financial and ESG performances. Moreover, some ESG indices have recently outperformed their parent (non-ESG) indices, which is partly due to the sector biases that occur naturally from exclusions, e.g. reduced weighting in energy, but could also be attributed to investors’ placing a “premium” on companies that are successfully managing ESG risks.

Whether or not ESG on its own can drive performance, investors can now find ETFs that have both ESG and financial objectives. You can choose between ESG ETFs that aim for similar returns as the parent index (with meaningful ESG improvement) or that have a greater tolerance for tracking error (with much more ESG improvement).

With environment one of the three ESG pillars, most ESG ETFs will include climate considerations either implicitly or explicitly in the index methodology. Some of our Invesco ESG ETFs go a step further by having specific climate-related goals, such as the Paris-aligned benchmark, reducing overall carbon intensity and/or increasing the amount of green revenues in the portfolio. We also offer thematic ETFs for focused exposure to climate solutions such as clean energy and solar power.

The simple answer is that any ETF that physically holds shares in a company can exercise its rights. All but one of our ESG ETFs replicate their indices by physically holding the shares. Our passive equity ETFs will vote in line with the largest active position held by Invesco, or with our ESG guidelines if no active position is held. Our global ESG team and investment managers engage with companies on key ESG issues, which includes many of those held by our passive ESG ETFs.

We’ve been helping investors incorporate their ESG objectives for the past 35 years and aim to include ESG considerations across all our investment strategies where possible. We believe engagement is one of the most effective mechanisms to reduce risks, maximise returns and have a positive impact on society and the environment. We are also committed to being a good corporate citizen and are signatories to key industry initiatives especially in the fight against climate change.

As ESG continues to grow globally, different regions have made efforts to introduce regulatory standards. Regulation will be a key factor in ensuring that efforts to integrate ESG have a tangible impact. It’ll also help to drive the standardisation of measuring and reporting.

The EU has introduced green taxonomy, Sustainable Finance Disclosure Regulation (SFDR) and most recently, the Sustainable Finance Strategy to provide rules and structure to the way businesses report on their ESG activities.

Greenwashing is when companies portray a public image of sustainability but aren’t taking sufficient or tangible action behind the scenes or undertake other questionable business activities. It could be a global drinks company committing to using 100% recycled plastic but setting no actual target, or a fast fashion brand using sustainable materials but with questionable manufacturing processes.

In the investment industry, it could be excluding obvious companies like tobacco manufacturers from a portfolio but not applying ESG analysis to the rest of it. Greater regulation and efforts to standardise measuring and reporting should help reduce the effects of greenwashing, as well as wider education.

Date as at 30 June 2023 unless otherwise stated.

Costs may increase or decrease as result of currency and exchange rate fluctuations. Consult the legal documents for further information on costs.

For more information on our funds and the relevant risks, please refer to the share class-specific Key Information Documents/Key Investor Information Documents (available in local language), the Annual or Interim Reports, the Prospectus, and constituent documents, available from www.invesco.eu. A summary of investor rights is available in English from www.invescomanagementcompany.ie. The management company may terminate marketing arrangements.

This document is marketing material and is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. This document should not be considered financial advice. Persons interested in acquiring the fund should inform themselves as to (i) the legal requirements in the countries of their nationality, residence, ordinary residence or domicile; (ii) any foreign exchange controls and (iii) any relevant tax consequences. Any calculations and charts set out herein are indicative only, make certain assumptions and no guarantee is given that future performance or results will reflect the information herein. For details on fees and other charges, please consult the prospectus, the Key Information Documents/Key Investor Information Documents and the supplement of each product.

UCITS ETF’s units/shares purchased on the secondary market cannot usually be sold directly back to UCITS ETF. Investors must buy and sell units/shares on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units/shares and may receive less than the current net asset value when selling them.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. For the full objectives and investment policy please consult the current prospectus.

German investors may obtain the offering documents free of charge in paper or electronic form from the issuer or from the German information and paying agent (Marcard, Stein & Co AG, Ballindamm 36, 20095 Hamburg, Germany).

In Israel, the contents of this document are restricted to Qualified Clients (pursuant to the First Schedule to the Israeli Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management Law, 1995) only and are not intended for retail or private investors who are not Qualified Clients.

The publication of the supplement in Italy does not imply any judgment by CONSOB on an investment in a product. The list of products listed in Italy, and the offering documents for and the supplement of each product are available: (i) at etf.invesco.com (along with the audited annual report and the unaudited half-year reports); and (ii) on the website of the Italian Stock Exchange borsaitaliana.it.

The representative for the sub-funds of Invesco Markets plc, Invesco Markets II plc, and the paying agent for the sub-funds across all of these platforms, is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland. The offering documents, articles of incorporation and annual and semi-annual reports may be obtained free of charge from the relevant representative in Switzerland. The ETFs are domiciled in Ireland.

In Switzerland, the Funds are not registered for distribution with the Swiss Financial Market Supervisory Authority (“FINMA”). This document and any document relating to these products may be made available in Switzerland solely to Qualified Investors.The offering of ETFs has not been and will not be notified to the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten/Autorité des Services et Marchés Financiers) nor has this document been, nor will it be, approved by the Financial Services and Markets Authority.

The ETFs may be offered in Belgium only to a maximum of 149 investors or to investors investing a minimum of €250,000 or to professional or institutional investors, in reliance on Article 5 of the Law of August 3, 2012. This document may be distributed in Belgium only to such investors for their personal use and exclusively for the purposes of this offering of ETFs. Accordingly, this document may not be used for any other purpose nor passed on to any other investor in Belgium.