Insurance stocks have generally outperformed the broader European equity market over the last decade and continue to offer a high dividend yield that can seem particularly compelling in the current low interest rate environment. However, we believe this lower for longer rate environment could spell trouble for the sector.

Why interest rates matter to insurers

Insurance companies can derive some of their income from the premiums paid by policy holders. If in any given year, payments exceed the cost of any pay outs made, the insurer can make a profit.

However, if the claims exceed the value of the premiums collected, the insurer will make a loss. There is no way for insurers to guarantee that the first scenario will always prevail, and that is why they invest the premiums they receive in the capital markets.

The income they derive from these investments allows insurers to finance their operation, offer policies at low rates and pay out claims. A large amount of an insurer’s investment portfolio consists of interest rate-sensitive assets, such as long-term fixed interest assets.

Should interest rates rise, insurers can gradually re-invest maturing investments at higher yields, which should provide them with a higher investment income. However, should interest rates fall, the opposite would apply.

Insurers employ a variety of ‘immunization’ strategies to reduce the risk of loss in a changing interest rate environment, such as investing in assets that match the long-term nature of their insurance liabilities.

However, a perfect hedge is difficult for insurers to attain, as the duration of their liabilities are often longer than the maximum duration of assets available in the capital markets. This exposes insurers to some level of interest rate risk.

Another challenge insurers face when interest rates change lies in their need to estimate future investment returns and make assumptions on long-term interest rates. This allows them to plan ahead – decide what rate they can guarantee to policy holders, determine what premiums to charge or how much to set aside to close the asset-liability mismatch in their balance sheets.

However, should their estimates diverge dramatically from reality, problems can arise. It could, for example, become more difficult for them to keep promises on guaranteed returns made long ago when rates were high.

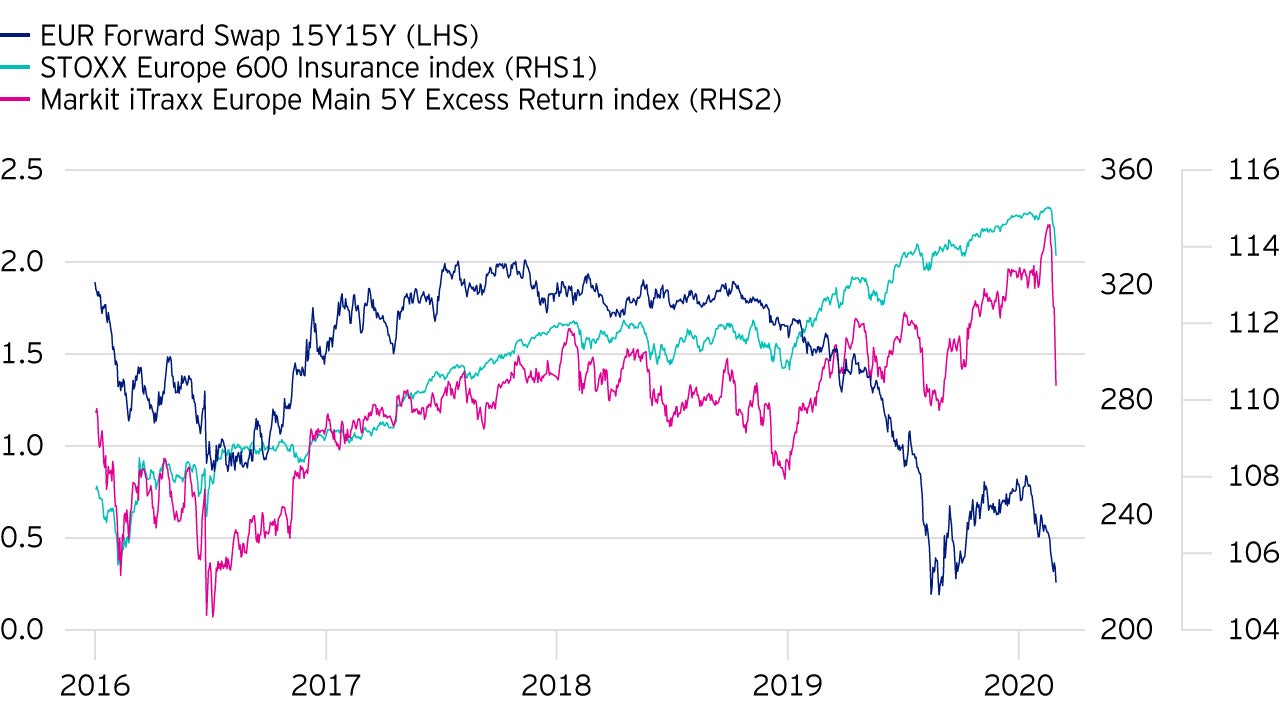

Equity investors tend to extrapolate how changes in the investment landscape could affect their holdings. Hence, given the insurance sector’s sensitivity to interest rates, share prices of insurers tend to rise and fall in concert with interest rate rises. Recent years have seen insurers buy more corporate bonds to help them generate higher yields. As can be seen in Figure 1, this has also made them more sensitive to changes in credit spreads.