ETF Digital assets: Is the bitcoin bull run just getting started?

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

Exchange-traded funds and commodities are a hotbed of innovation and an exciting way for investors to access capital markets. Read our insights on the latest news and developments in this fast moving area.

Five key factors suggest cryptocurrencies may continue their 2024 momentum and see positive performance in 2025.

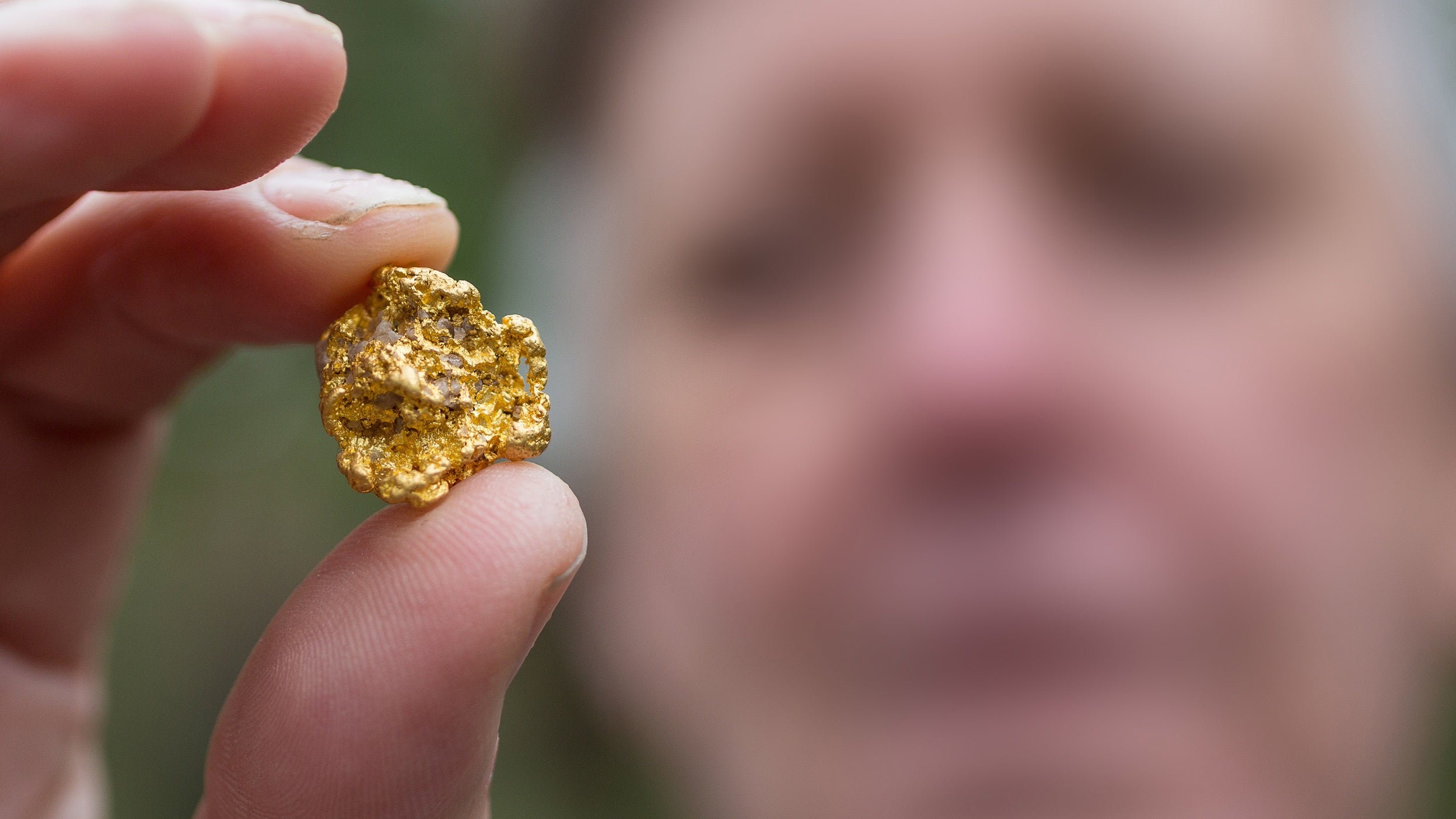

Gold endured a choppy month, hitting a high of US$2,952 before ending February at US$2,858, a gain of 2.1% for the month. Geopolitics continued to play a significant role in the gold price. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

Bond markets generally performed well in February, although there were varying outcomes across different regions. Read our latest thoughts on how fixed income markets fared during the month and what we think you should be looking out for in the near term.

India is one of the strongest growing economies in Asia, driven by digital transformation, robust consumption and expanding exports. Find out more.

As we enter the final quarter of the year, our experts look back at the ‘year of the bond market’ and share their thoughts on the outlook for Fixed Income assets going forward.

The brief stock market correction in July highlighted how quickly market sentiment can change. Although economic fears have since eased, investors are still seeking optimal portfolio strategies. An equal weight version of the MSCI World Index could offer broad global equity exposure while reducing concentration risk compared to a standard market-cap-weighted approach. Read our latest article to find out more.

The crypto market is preparing for the next Bitcoin halving. What does the halving mean and what are the longer-term prospects for investors in Bitcoin?

Explore the case for the Nasdaq-100 index and how its constituents are driving innovation across the global economy.

The Nasdaq-100 is an index that tracks the 100 largest non-financial companies by market capitalization listed on the Nasdaq.

Technology has disrupted just about everything. Learn how innovation is driving something as simple as your favourite cup of coffee.

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

Today, gold plays an important part in some investors’ portfolios, for a variety of reasons. From central banks wanting to diversify their reserves to individuals wanting physical assets that may retain value over time. Find out more.

Blockchain is growing rapidly and faced a difficult 2022. We look back at some of the challenges and look forward to some key developments and innovations in 2023.

Gold has been treasured by people for thousands of years, whether as a means for bartering or as a symbol of wealth, but questions are still being asked particularly around its investment characteristics. Uncover the truth.

As a responsible asset manager, 100% of the gold bars held in the Invesco Physical Gold ETC adhere to the LBMA's Responsible Gold Guidance.