Markets and Economy Consumers – in the driving seat

Buying habits of consumers are becoming more sophisticated

China’s technology sector is challenging the world order.

We see three major catalysts that are propelling China’s technology companies rise to prominence.

Beijing has elevated the need to sharpen China’s technological eminence to a national level with a focus on high-tech infrastructure, for example, 5G, charging stations for new-energy vehicles, data centres and Internet of Things.

These are areas where China already has clear technological advantages and are crucial drivers for the economy as projects in these sectors are likely to bring positive multiple effects to the economy. We believe that Chinese tech companies are well placed to benefit further from these developments.

Import substitution is another major trend, initially driven by China’s desire to reduce foreign technology reliance and to spur product innovation. While China still has gaps to fill in terms of cutting-edge technological capabilities, intensifying geopolitical tensions and the US’ restrictions on chip sales to Chinese only reinforce China’s determination to be more self-sufficient.

For example, it was reported in the Global Times that Beijing was thinking of raising investment in the integrated-circuit sector and speed up import substitution of chips in a bid to achieve the goal of mass-producing 7-nanometer semiconductors in two years, which could motivate Chinese companies to replace imported chips with domestic ones earlier than planned.

From a domestic consumption angle, a rising wave of nationalism and patriotism is also stoking domestic demand for homegrown products.

We see this import substitution as a combination of rising innovation and quality of Chinese products, trade tensions, rising nationalism and patriotism to reduce foreign exports.

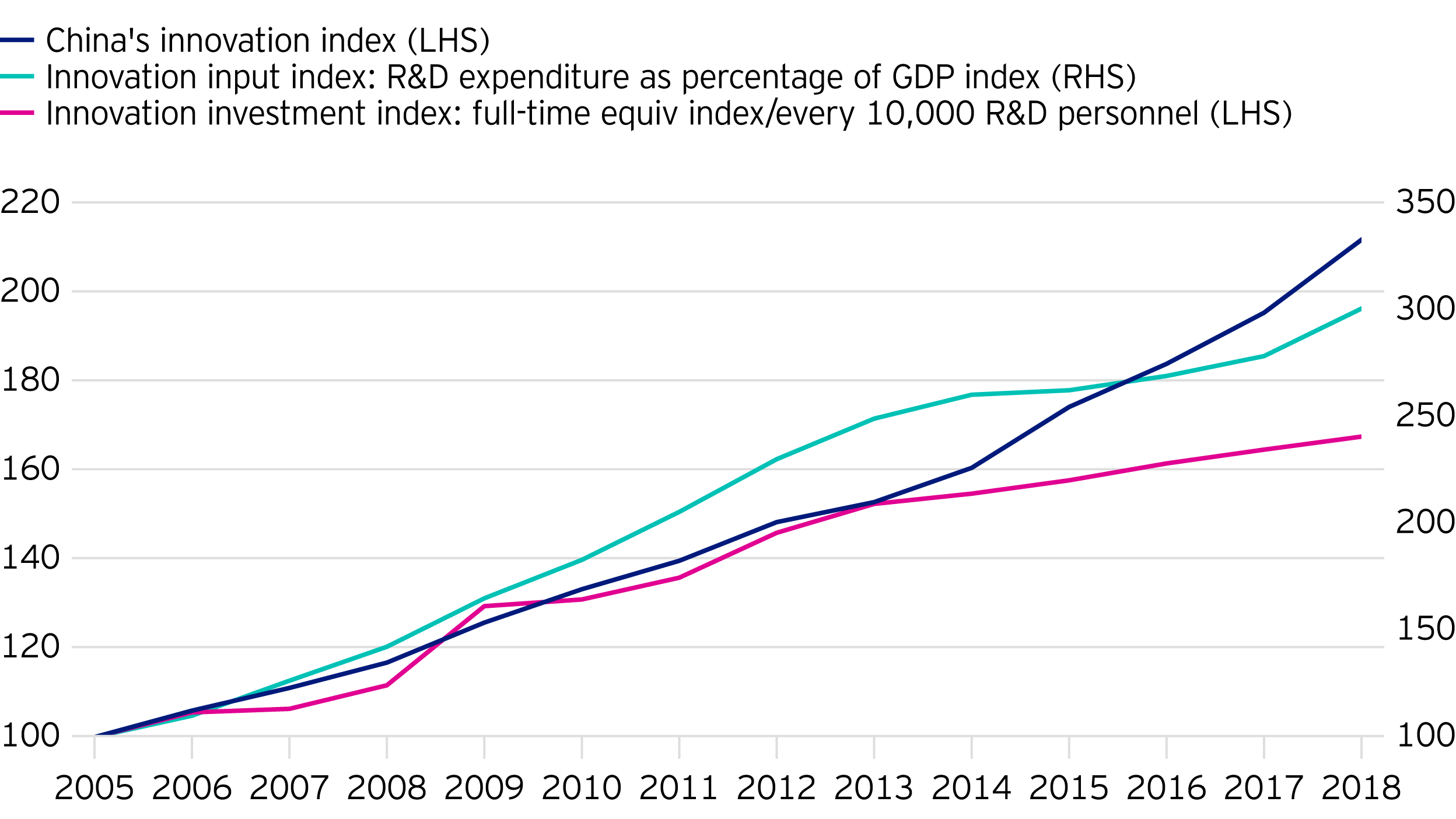

Deep funding into research and development (R&D) and bringing products to the market more quickly are key to China’s technological advancement. Already China is ahead of the US in filing patents in areas such as telecommunications, optics, electrical machinery and energy.

Increasing investment into R&D is also expanding its talent pool in technology. A study by the World Economic Forum reported that China had 4.7 million new STEM (science, technology, engineering and mathematics) graduates in 2016 while the US had only 568,000.

Technology is increasingly shaping our futures but what impact is digitalisation having on consumer behaviour?

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.