Markets and Economy Technology – it’s all the buzz

China’s technology sector is challenging the world order

Structurally, there is a lot of room for growth of China’s healthcare sector.

We believe that demographic trends – an aging population and higher life expectancy – will provide tailwinds for the healthcare sector.

China’s population is aging rapidly, with the number of elderly aged 65 and above at 152.1 million in 2018, representing 11% of the population (Source: World Bank).

According to some estimates, this cohort could more than double to 366 million in 2050, with their share of the total population possibly growing to 26%. (Source: Citi Research, June 2020).

We believe that prospects are looking bright for healthcare amid China’s economic transition.

Structurally, there is a lot of room for growth of China’s healthcare sector.

The country’s total health expenditure accounts for only 5.15% of GDP as of 2017, far below the high-income countries average 12.53%.

China’s healthcare spending - between 2010 to 2018 have been growing at a CAGR of 15.3%, exceeding nominal GDP growth at 13.1%. (Source: Citi Research, June 2020).

Increased levels of urbanisation together with higher levels of incomes are also driving the growth of this sector.

As more people migrate to the cities, they are likely to demand better quality healthcare products and services.

To cater for this growing need, healthcare providers are likely to introduce higher value goods and premium services.

China’s focus on innovation and research and development are giving the healthcare sector a boost.

Not only are healthcare professionals able to reach more patients across a greater number of locations than before, we believe the entire sector is moving up the value chain.

The advent of 5G technology now even paves the way for remote surgeries.

For example, in March 2019, a patient in Beijing suffering from Parkinson’s disease received China’s first 5G-based remote surgery conducted by a surgeon in Hainan, southern China.

While drug producers have driven much of the sector’s growth, we are also seeing pharmaceuticals increase operations such as outsourcing the manufacturing of the drugs.

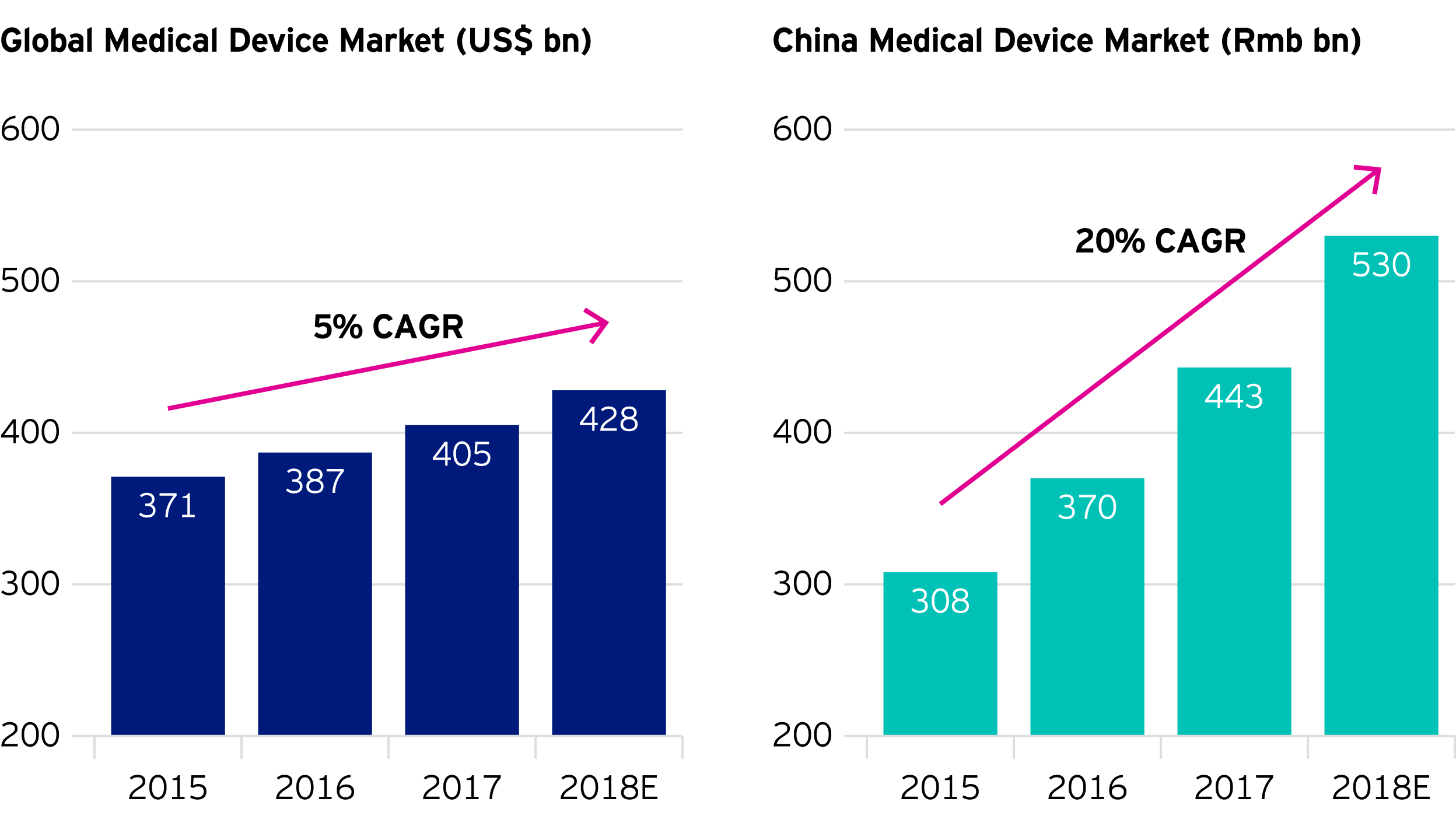

Medical-device makers are also producing higher-value products. This is driving the segment’s superior growth rates versus the rest of the world.

Recent global developments have accelerated the pace of China’s economic transformation.

This is quickly throwing up new opportunities while exposing more unforeseen risks.

As such, we strongly believe in the need to embark on a more forward-looking view on how to uncover opportunities through a deep analysis of available data.

Demographic trends, the rise of China’s middle class, and technological trends are key drivers that we believe will determine the fortunes of Chinese corporates in the medium- to long-term.

Policy determinations to transform China’s economic structure are also important to keep in mind.

Together with how recent geopolitical developments are unfolding, we believe that while the technology, healthcare and consumer sectors are likely to outperform, other areas could see their influence diminish.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This article is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.