Investment outlook Global ETFs - 2020 outlook

Which ETF strategies could help with 2020’s expected challenges?

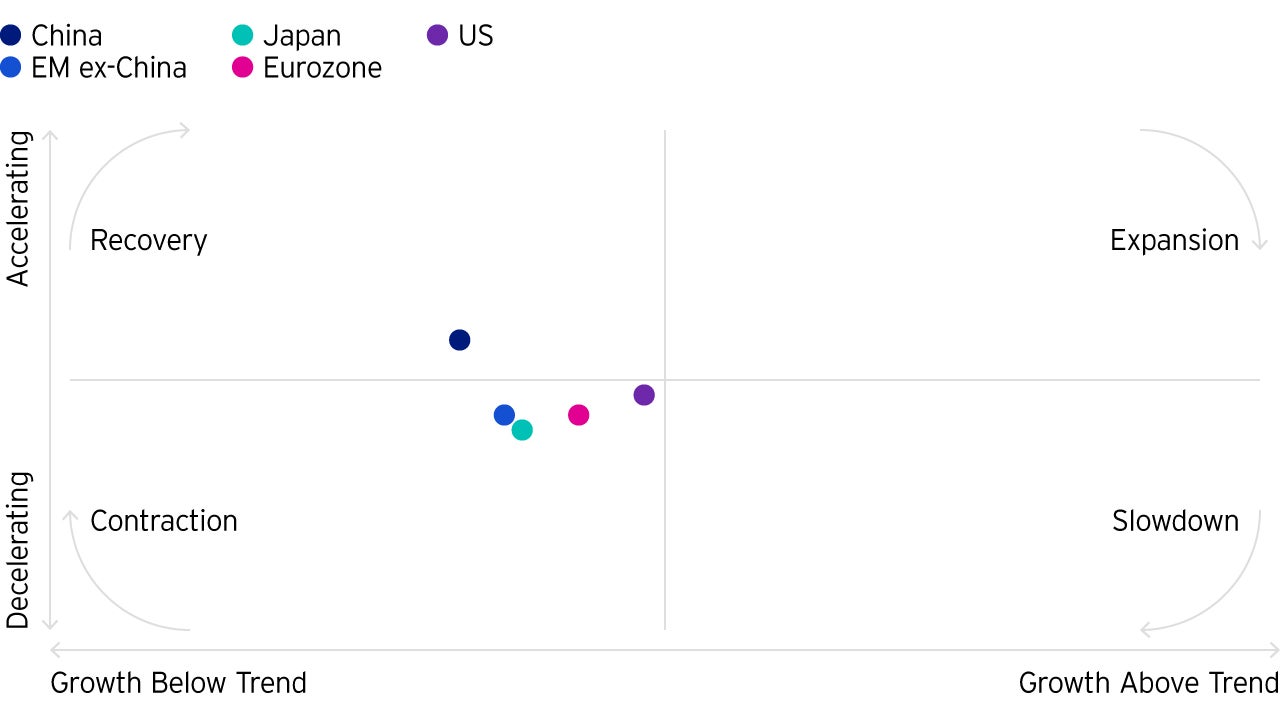

The global economy is rapidly decelerating, and we expect all major regions and countries around the world to grow below trend over the next few quarters, and at least through the first half of 2020. For the past six months, our team’s macro regime framework has indicated that the global business cycle is entering a “contraction” (defined as growth below trend and decelerating), as our proprietary leading economic indicators (LEIs) have fallen sharply across most regions (Figure 1).

Will we see a global recession in 2020? We think it’s unlikely, but we may experience a recession in some parts of the world.

A distinguishing feature of this business cycle is the lack of inflationary pressures. This has allowed central banks to proactively ease policy with a combination of interest rate cuts and renewed asset purchases (i.e., quantitative easing). The large decline in global bond yields has provided meaningful support to equity markets, despite strong deceleration in earnings growth. Our analysis of global market sentiment suggests monetary policy has contributed to the stabilization in global risk appetite which, according to our research, tends to lead inflection points in the global business cycle by a few months, providing today some indication that global growth may stabilize in the next few quarters.

In the near term, we expect a similar convergence in performance among asset classes, with higher quality assets such as government bonds and investment grade credit expected to deliver comparable returns and possibly higher risk-adjusted returns than risky assets, despite low yields.

We think credit markets offer limited capital appreciation potential, but expect a stable environment for carry strategies, given generous lending standards and a supportive policy environment.

Alternative income assets look particularly attractive at this late stage in the economic cycle, in our view, due to higher yields than traditional assets and low correlations to credit and equity markets.

While we believe developed equities outside the US offer more attractive valuations and higher long-term expected returns compared to US equities, cyclical catalysts for this relative outperformance are still missing given the weak macro backdrop in Europe. Hence, we still expect US equities to outperform other developed markets over the next few quarters, at least until the deterioration in European economic data comes to a halt.

On the other hand, we believe that early signs of a cyclical turnaround in emerging economies offer the potential for outperformance of emerging equities relative to developed equities in the medium term, a development that would also be consistent with the more favourable long-term return expectations for the asset class.

The recent improvement in global market sentiment is supportive of pro-cyclical factors such as size and value, which are also supported by cheap valuations.

We hold a neutral view on the US dollar in the near term, despite its expensive valuations across macro frameworks. In our view, a sustained dollar depreciation cycle requires a cyclical rebound in growth outside the US, as a catalyst for a major reversal of private capital flows from the US to the rest of the world. Within currency markets, we expect value and carry to perform well, particularly in emerging markets, given a stable environment for risk appetite.

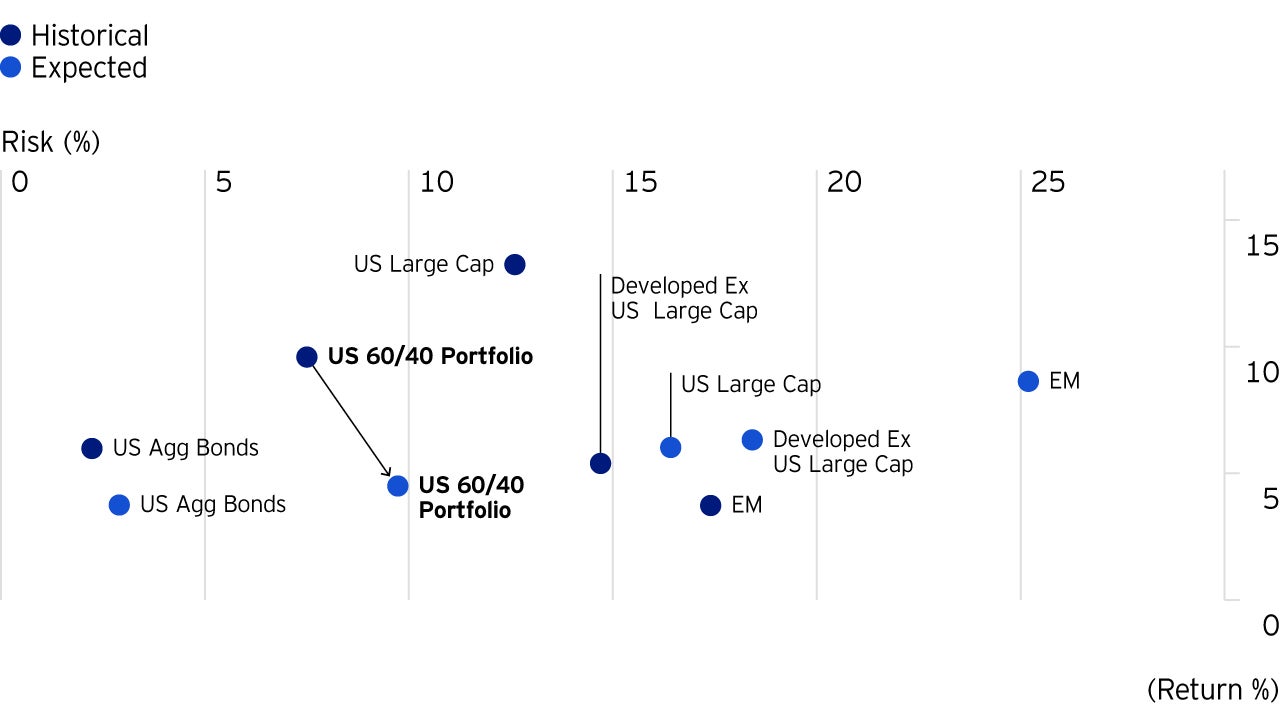

In addition to this near-term view, Invesco Investment Solutions develops Capital Market Assumptions (CMAs)1 that provide long-term estimates for the behaviour of major asset classes globally. The assumptions, which are based on a 10-year investment time horizon, are intended to guide these strategic asset class allocations. Looking out at the long term, the obvious perspective is that we think the next 10 years will be very different from the last 10 years.

Over the last 10 years:

We believe the next decade will be vastly different. After experiencing a downward trend following the Global Financial Crisis and bottoming in early 2018, volatility has begun to trend upwards to what we would consider normalized levels. If volatility continues its current trajectory, we believe investors’ return-oriented goals will face challenges, stressing the importance of diversification.

Therefore, those who rely on a traditional 60/40 asset allocation could face a very different return experience going forward. As shown in Figure 2, we expect a portfolio consisting of 60% S&P 500 Index and 40% Bloomberg Barclays US Aggregate Bond Index to have about half the return and higher risk over the next 10 years than it would have experienced over the past 10 years. A similar experience, but less dramatic experience, is expected for global equities and fixed income.

What’s the answer? We believe diversification can help portfolios weather pockets of uncertainty and can allow investors to find opportunities beyond traditional assets.

For each selected asset class, we develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes. For additional details regarding the methodology used to develop these estimates, please see our white paper Capital Market Assumptions: A building block methodology.

This information is not intended as a recommendation to invest in a specific asset class or strategy, or as a promise of future performance. These asset class assumptions are passive, and do not consider the impact of active management. Assumptions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. Estimated returns can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.

Indices are unmanaged and used for illustrative purposes only. They are not intended to be indicative of the performance of any strategy. It is not possible to invest directly in an index.

The CMAs included are based on Invesco’s return expectations for the asset classes shown. The indices referenced are included as proxies for the asset classes and have been selected because they are well known and are easily recognisable by investors. The inclusion of these indices is not linked to the promotion of any investment products or services.

Investment solutions - learn more

Which ETF strategies could help with 2020’s expected challenges?

Invesco study shows factor investing adoption continues to increase globally

Invesco Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.