Investment Outlook Investment outlook 2020

Our investment teams from around the globe outline their expectations for 2020 to help investors plan for the coming year, wherever the markets take us.

Invesco’s Office of Global Factor Investing believes that systematic, evidence-based application of investment factors is part of a permanent trend as these strategies can complement other approaches in achieving client objectives.

The most common client journey starts with factor investing in equities before moving into other asset classes; however, adoption is often client-specific. Heading into 2020, global investors are likely to continue increasing their allocations to factor investing strategies, with experienced factor investors expanding into asset classes beyond equities and increasingly embracing dynamic implementation. Recently, investors have diversified their factor exposures by rebalancing into momentum, quality and low volatility exposures (at the expense of exposure to the value factor) and embraced more custom construction and implementation in accessing factors. Despite performance challenges in some factors in 2018 and 2019, investors’ faith in factor investing overall appears likely to continue to grow.

Factor investing is the selecting and weighting of securities based on objective and observable characteristics of securities that tell us something about expected returns. Recognized investment factors are based on rigorous academic study and are characteristic, quantifiable features of an asset that can be cost-effectively targeted in a diversified portfolio. Critically, a factor needs to be connected to a rational basis to expect the connection to expected returns to continue in the future.

According to Invesco’s 2019 Global Factor Investing Study, released in October 2019,1 nearly half (45%) of the investors surveyed in Asia Pacific, EMEA (Europe, the Middle East and Africa), and North America increased factor allocations in 2018 and 2019, and 59% plan to increase their allocations over the next three years. As a result, average allocations to factor investing strategies have increased from 2018 to 2019 for both institutional (16% to 18%) and wholesale (11% to 14%) investors.

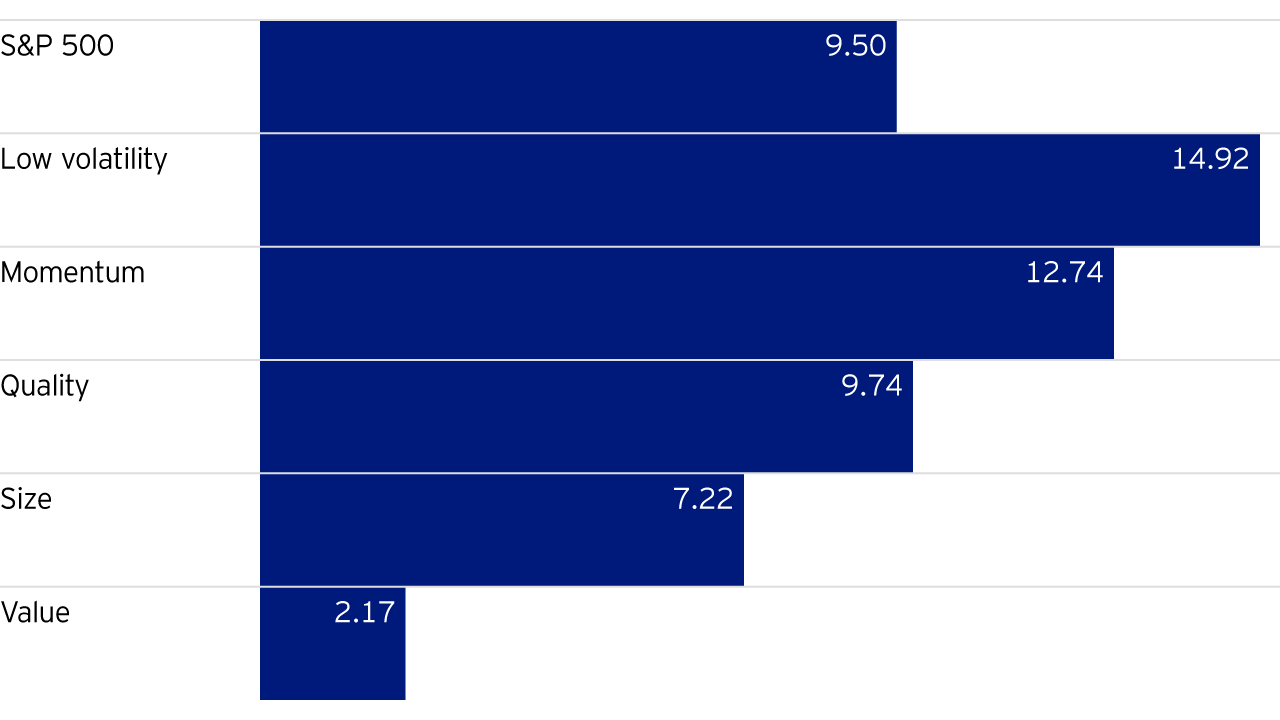

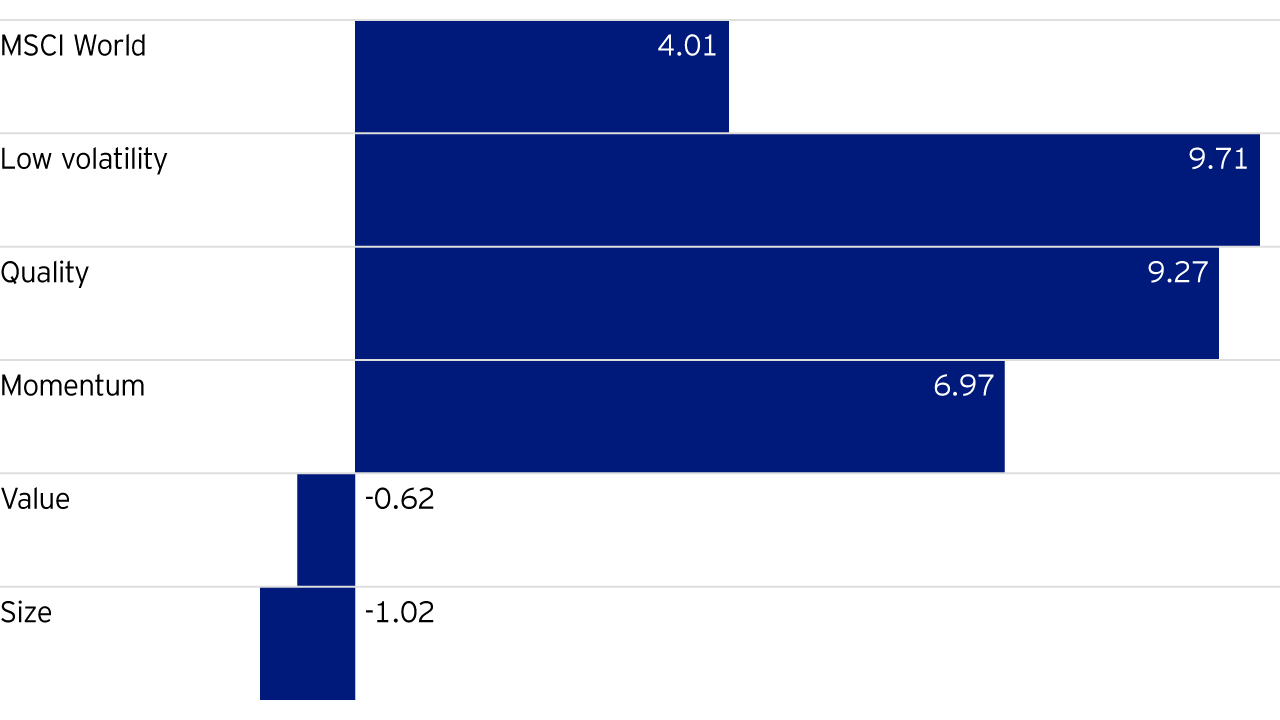

Additionally, 60% to 65% of respondents also reported that their factor investing performance met or exceeded expectations in 2019. This is particularly notable after a period where some style factors, such as value and small size, underperformed relative to market cap-weighted benchmarks (as shown in the figure below). Other style factors, including momentum, low volatility and quality, tended to outperform over the same period.

Multi-factor strategies are an increasingly mainstream tool for portfolio diversification, as different factors are expected to outperform or underperform in different market environments.

Investors surveyed in the 2019 Global Factor Investing Study report making a more active decision about which factors to include and exclude. One of the results is a reduction in exposure to the value factor (one of the first and most widely adopted factors) and a concurrent increase in the use of other factors such as momentum, quality and low volatility. Investors reported a notable rebalancing of equity strategies, with allocations to momentum factors up by 16 percentage points (relative to 2018), quality up 15 percentage points, and low volatility up 6 percentage points, with a 9-percentage-point diminution in allocations to the value factor. Despite the relative underperformance of value in recent years, it continues to have the widest level of support as a factor among both wholesale and institutional investors.

The past 12 months have seen a notable increase in the proportion of respondents who believe factor investing can be extended to fixed income. Some 70% of institutional investors and 78% of wholesalers now view factor investing as being applicable to fixed income. With yields near record lows and around 25% of bonds globally trading with negative yields, attention has turned to alternative ways of adding value from the fixed income asset class. Factor investing may be a solution that could target sources of returns transparently and cost-effectively, even in the current yield-constrained environment.

Factor research continues in fixed income, as do product development activities, to fill a perceived gap in demand for fixed income factor investing strategies. As investors move along the experience curve, demand for fixed income factor strategies will likely increase further.

Our 2019 study also found that a three-to-one majority of factor investors now choose an active implementation approach as opposed to a passive one — with active strategies executed through segregated mandates, commingled mutual funds and exchange traded products. And where investors choose to implement strategies passively via a factor index, almost half of respondents prefer a custom approach to index design. These custom approaches may offer better management of factors and more investor control over factor definitions and metrics.

Investors are taking an appropriately long-term view of their factor exposure, but this does not mean that factor users can afford to take a static approach to their allocations. This is particularly prevalent among the more sophisticated factor investors with longer track records.

In terms of future research into factors, it is worth bearing in mind why factors are expected to be associated with returns above the market: reward for risk, behavioural insight, or market structure. A fair chunk of future research will be dedicated to finding new informational insights on the exploitation of behavioural and market structural insights. While factor timing remains an area of interest, research shows that little can be achieved that is not consumed by a loss in diversification and transaction costs. The last 12 months threw up interesting challenges in terms of portfolio construction, with simplistic approaches often doing better than more sophisticated ones — another area of research.

Looking ahead at market developments, many asset owners report uncertainty about the interaction of factor initiatives and environmental, social, and governance (ESG) considerations. Over a quarter (28%) of institutional investors see ESG as a factor in its own right, while 49% see ESG as a combination of factors. To understand these issues better, asset owners need assistance from external partners, given the complexity of analysis and a lack of readily available data and tools. Integration of ESG considerations into factor approaches is increasingly expected. While most would argue that on historic data ESG factors are not predictors of return, there are specific circumstances in which a positive or negative expectation can be associated with ESG exposures and changes in ESG scores. More importantly, factor investors are looking for the integration of, for example, carbon emissions data in managing portfolios, with an aim of meeting the expectations of end clients that often seek to make an impact with their investments.

Overall, investors are showing a rising commitment to factor investing strategies. The fact that factor allocations are continuing to spread across portfolios suggests factor investing is cementing a strategic footing in investing, not just as a low-cost substitute for traditional active management, but as a more transparent and efficient tool for building a holistic portfolio.

Our investment teams from around the globe outline their expectations for 2020 to help investors plan for the coming year, wherever the markets take us.

Georgina Taylor explains how the Multi Asset team aims to take advantage of opportunities thrown up by anomalies in financial markets in 2020 and beyond.

Despite uncertainties, fundamentals to remain solid.