Multi Asset The trouble with insurers

The insurance sector has been on a good run, however, the Multi Asset team believe the sector looks superficially attractive – particularly in this lower for longer interest rate environment.

As part of our investment process, the Multi Asset team meets on a monthly basis to debate our macro view of the world, from which we form our ‘central economic thesis’. It is against this economic backdrop that each idea is tested to see if it has the potential to provide a positive return.

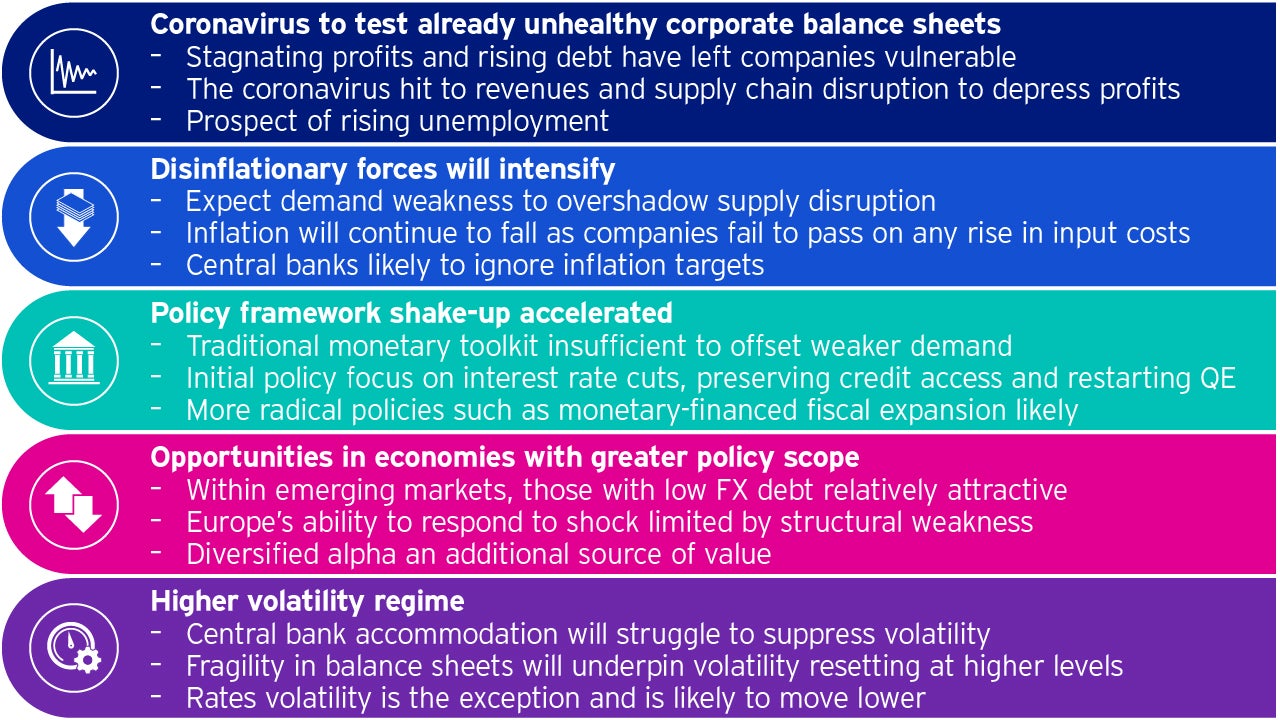

We constantly re-assess the outlook for markets and economies around the world, and this is certainly true in times of market stress. In the latter part of February, we reviewed the potential impact of the coronavirus and adjusted our central economic thesis, below, to reflect this.

There are still several unknowns related to the coronavirus, however the key question remains: does the coronavirus cause a short term contained revenue and supply chain shock or does it accelerate an economic downturn which was already underway?

The strength of balance sheets and the ability for corporates to absorb any disruption to growth and input costs is being put to the test. The key metrics to focus on, in our view, are any signs that balance sheet stress is emerging which will prolong the downturn. We can look to liquidity and funding markets but also corporate behaviour in order to assess whether stresses are indeed starting to emerge. It is also important to monitor whether increased costs are starting to be absorbed by companies due to a lack of pricing power in a slowing demand environment, putting pressure on margins and in turn hampering their ability to invest which will hinder the economic recovery.

Against this backdrop, we believe central banks will try to do whatever it takes to offset weaker demand. This said, given the significant compression in interest rates globally, the traditional monetary toolkit is unlikely to be successful and therefore policy makers will need to start implementing more creative fiscal and monetary measures.

It is important to note that the sourcing of ideas comes first in the fund management process. The central economic thesis is the final hurdle that each idea must overcome in order to be considered for inclusion in one of the team’s Multi Asset strategies.

If an idea fails to produce a positive return in the team’s central economic thesis, the idea will be rejected at this stage of the process. This central economic view, alongside the team’s economic scenario testing, can also be used to help structure an idea or to change the implementation of an idea in order to make sure it best reflects the core view of the team.

As with all the ideas that go into the portfolios, the team can call on the expertise of their Invesco colleagues in forming this central view of the world. The team has access to the views of John Greenwood, Invesco’s renowned chief economist, and this is complemented by regular contacts with external research houses and extensive research by the team itself.

The team’s current central economic thesis recognises trade, politics and the changing influence of monetary policy, which has helped to establish a low growth, low inflation environment. How will the rise of anti-globalisation rhetoric impact global growth? Have the central banks played all their cards? With fiscal policy in focus, what impact can it have on global financial markets and how might it be used to steer local economies?

While the team’s current two- to three-year outlook is their central expectation, the team remains realistic about the fact that it could be wrong. That is why it incorporates extensive scenario testing into its investment process, to make sure its portfolios are as robust as possible in case of unexpected twists and turns.

The insurance sector has been on a good run, however, the Multi Asset team believe the sector looks superficially attractive – particularly in this lower for longer interest rate environment.

In a world of low volatility and low interest rates, it becomes increasingly important to understand the level of risk in an investment portfolio. Standard measures such as statistical volatility are often misleading - we propose using a different metric.