Fixed Income

Progress on the Belt and Road Initiative

Since first endorsed by President Xi in 2013, the BRI has expanded and evolved.

As the first country to emerge from the pandemic, China is one of the better-positioned major economies to extend financial support to emerging market countries. It is also in China’s interest, since most Chinese BRI loans were extended to emerging market countries.

We have already witnessed Chinese direct lending, including a concessionary loan of USD500 million granted to Sri Lanka upon request to fight the virus.1 We expect China to continue to provide financial support to emerging market countries going forward. That being said, conditions vary in different countries and individual domestic policies, types of governance, levels of corruption, and debt levels are important when making investment decisions.

It has been reported that China has written off interest on some bilateral loans with partner countries. China has also given some borrowers more time to repay or made other concessions. The Kyrgyzstan government, for example, announced in April that China had agreed to reschedule USD1.7 billion of debt repayments.2 Notably, these relatively less developed countries are also receiving emergency financing and debt relief from major international organizations, such as the IMF and World Bank (Figure 1).

We expect China and other international organizations to provide debt relief or renegotiation to selected emerging market countries in the future. However, we do not expect debt write-offs to discourage Chinese lending activity. Most funding was conducted through Chinese policy banks and government support for investment in participating Belt and Road countries remains high. From an investment perspective, we believe China’s support and that of key international organizations is a positive factor that will benefit Belt and Road countries.

We expect BRI projects to become more economically viable as China increases its efforts to improve their sustainability, transparency and governance. Measures like the Debt Sustainability Framework and the inclusion of multilateral participants will likely benefit Belt and Road countries and projects over time.

We believe environmental, social and governance (ESG) factors will be critical to the long-term economic development of emerging market countries where the level of socio-economic development, degree of political stability and entrenchment of the rule of law can vary significantly. The outbreak of Covid-19 has highlighted the importance of a safe, clean and sustainable environment to reduce systemic health risks.

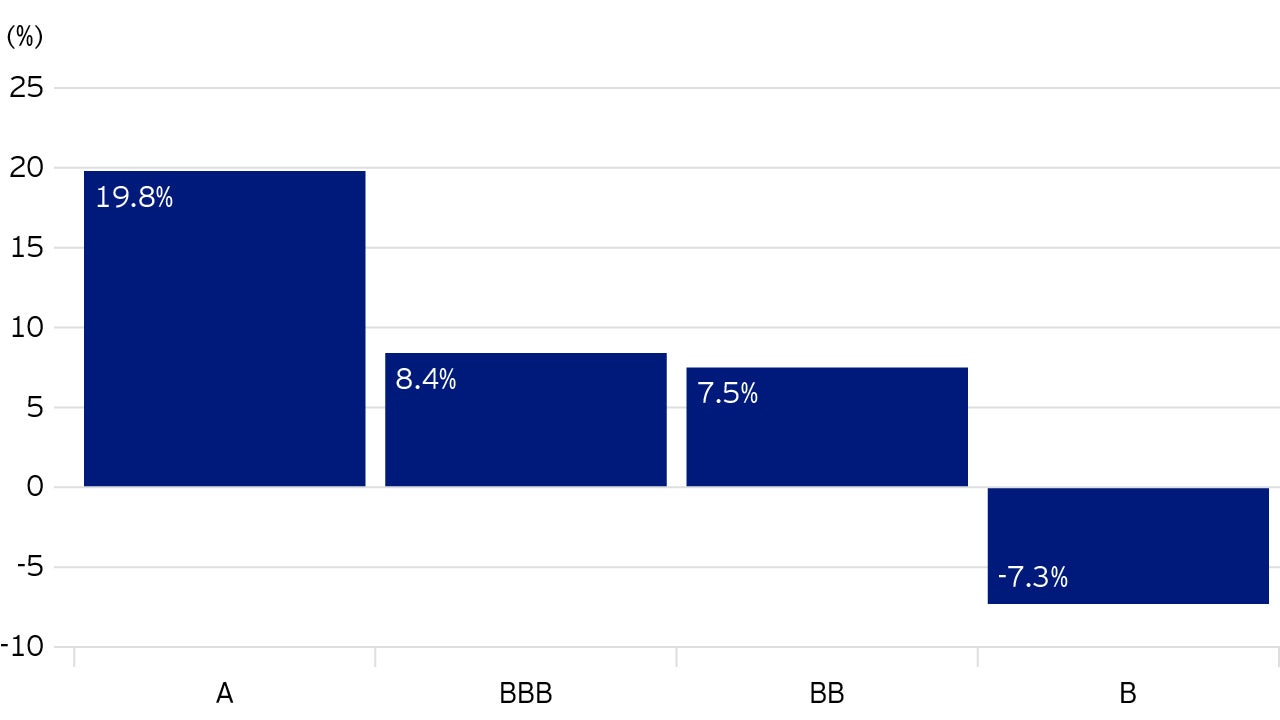

The importance of ESG factors has been reflected in the financial market performance of emerging market sovereign bonds. Over the last three years, the sovereign bonds of countries rated more highly from an ESG perspective have outperformed lower ESG-rated peers (Figure 2). We believe China’s emphasis on ESG factors would be a positive catalyst for the overall development of the Belt and Road universe.

Progress on the Belt and Road Initiative

Since first endorsed by President Xi in 2013, the BRI has expanded and evolved.

The Belt and Road initiative in a post-pandemic world

As the coronavirus spread globally, many countries implemented lockdowns, quarantines and social distancing measures.

1 Source: The New Indian Express, as of March 18, 2020.

2 Source: Barron’s, as of April 29, 2020.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.