Invesco Vision platform

Invesco Vision is an advanced portfolio management research and analytics platform explicitly designed to support investors in making better-informed investment decisions that are aligned with achieving their specific investment objectives.

Key features

MODELLING ASSETS AND LIABILITIES

PORTFOLIO OPTIMISATION

PORTFOLIO ANALYTICS

Introduction

At Invesco, we understand investing is both an art and a science. Experience and relevant information are key to successful investment decision-making. However, much of the information investors require to make informed decisions often isn't readily available or evident.

This is why we developed Invesco Vision – a decision support system offering a broad set of capabilities that provides clear insights to guide better portfolio management decisions.

Providing clear insights

The result of years of research and development by the Invesco Investment Solutions team, Invesco Vision is a free service that fosters more productive collaborations with our clients and supports them in more effectively applying their judgment to the portfolios they manage.

Read on more to see a brief overview of Invesco Vision's current capabilities. An accompanying whitepaper provides more detail.

Invesco Vision capabilities - executive summary

Invesco Vision platform whitepaper

Modelling assets and liabilities

Estimating portfolio asset return, risk and correlation expectation is central to portfolio and risk analyses. However, investors face many challenges in determining these estimates.

Using a combination of the BarraOne® fundamental risk factor model (one of the most recognised and respected risk models available in the market) and Invesco’s Capital Market Assumptions, Invesco Vision is able to:

- Develop consistent return estimates for thousands of assets including private investments in a number of currencies

- Model liabilities, in both nominal and real terms

- Develop risk and correlation estimates

- Incorporate regulatory risk model such as Solvency II

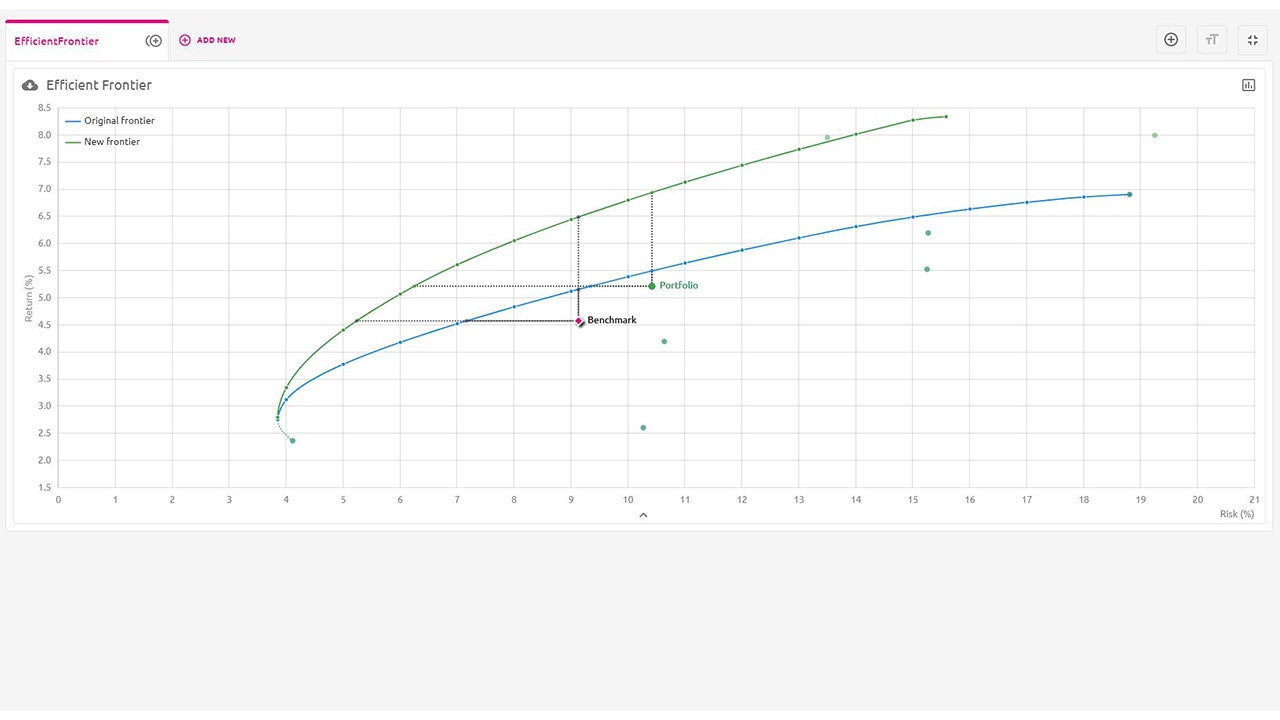

Illustrative efficient frontier analysis

(For illustrative purposes only)

Read more about modelling assets and liabilities

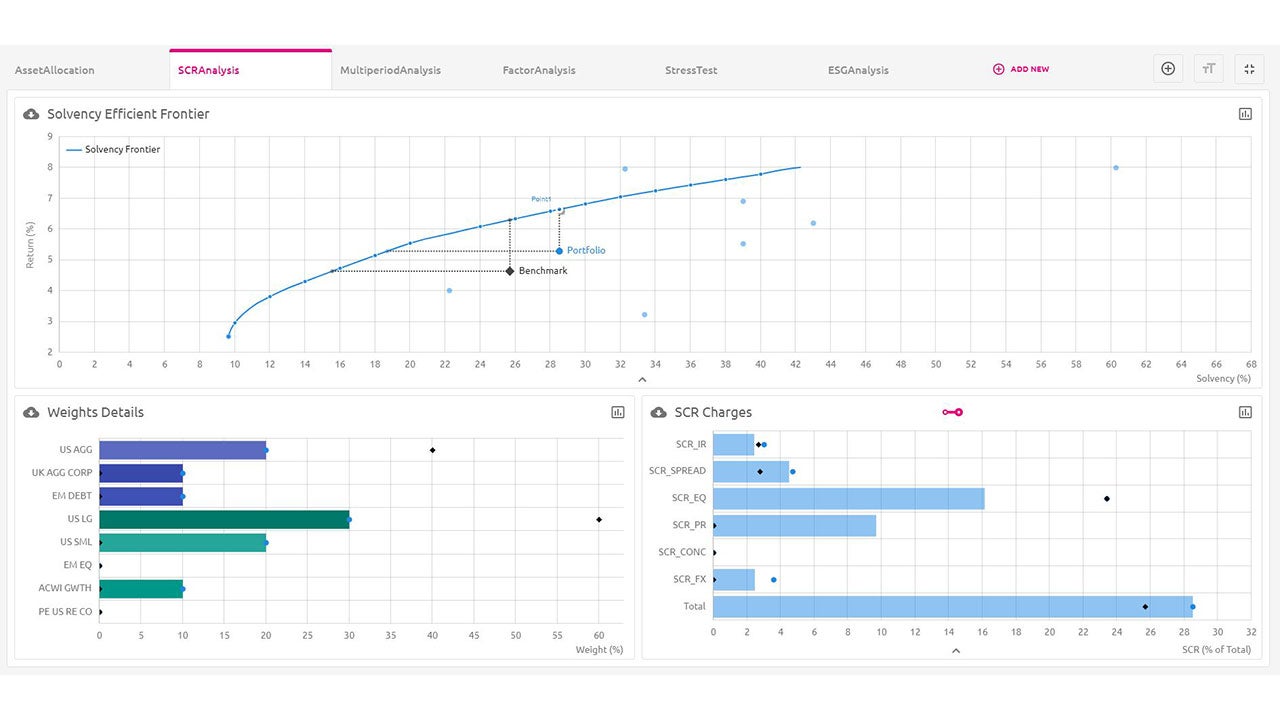

Solvency II case study

Portfolio optimisation

Objectives and preferences can vary widely from one investor to another. In any case, Invesco Vision can address the main challenges of portfolio construction, understanding and choosing acceptable risk-and-return trade-offs, with a variety of portfolio optimisation methods including:-

- Absolute vs relative risk

- Mean Variance Optimisation vs Robust optimisation

- Multi-Period Optimisation

- Cashflow / Liability Matching

- Regulatory concerns such as Solvency ll capital requirements

Illustrative portfolio optimisation

(For illustrative purposes only)

Read more about portfolio optimisation

Portfolio optimisation case study

Portfolio analytics

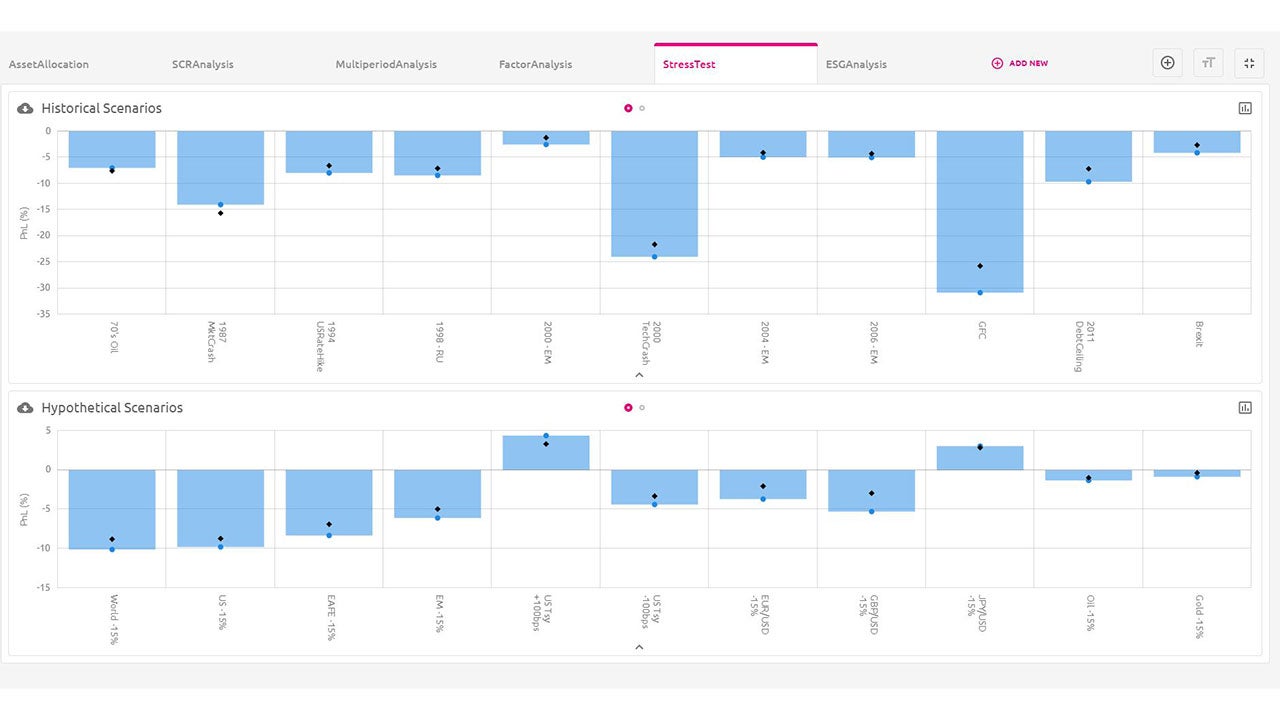

Whether we are creating a new portfolio or evaluating an existing allocation, gaining a better understanding of the specific risk exposures presented can help inform allocation decisions. Invesco Vision includes the following key analytical tools for portfolio evaluation:-

- Identify underlying portfolio risk factor exposures

- Stress test portfolios based on hypothetical and historical scenarios

- Evaluate ESG considerations

Illustrative portfolio optimisation analysis

(For illustrative purposes only)

Vision case studies*

Addressing estimation error in portfolio construction

Solvency II

Addressing currency risk

Evaluating opportunities to improve risk-adjusted returns

Invesco Investment Solutions

With one of the most comprehensive range of capabilities in the industry, our global team of specialists develop outcome-based customised solutions to help achieve investors’ goals.

From robust research and analysis to bespoke investment solutions, our team brings insight and innovation to each client’s portfolio construction process. Our approach starts with a complete understanding of your needs, develop investment approaches specific to your needs while working as an extension of your team.

Learn more about Invesco Investment Solutions

Schedule an Invesco Vision demo

How can we help?

Let us know using this form and one of our specialist team will quickly get back to you.

Footnotes

-

*For illustrative purposes only

Investment risks

- The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

- Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.