Multiple Sources of Income Solutions

Invesco offers multiple sources of income which could potentially generate stable income for your portfolio.

Things to consider when positioning for a potential global easing cycle

Stocks and Bonds stand to benefit

With the fight against inflation bearing fruit – inflation has gradually come down towards central bank targets, investors may start to think about how to position for a global easing cycle.

Both the European Central Bank and Bank of England have cut interest rates earlier this year. The US Federal Reserve (Fed) is expected to cut interest rate before the end of Q3 2024.

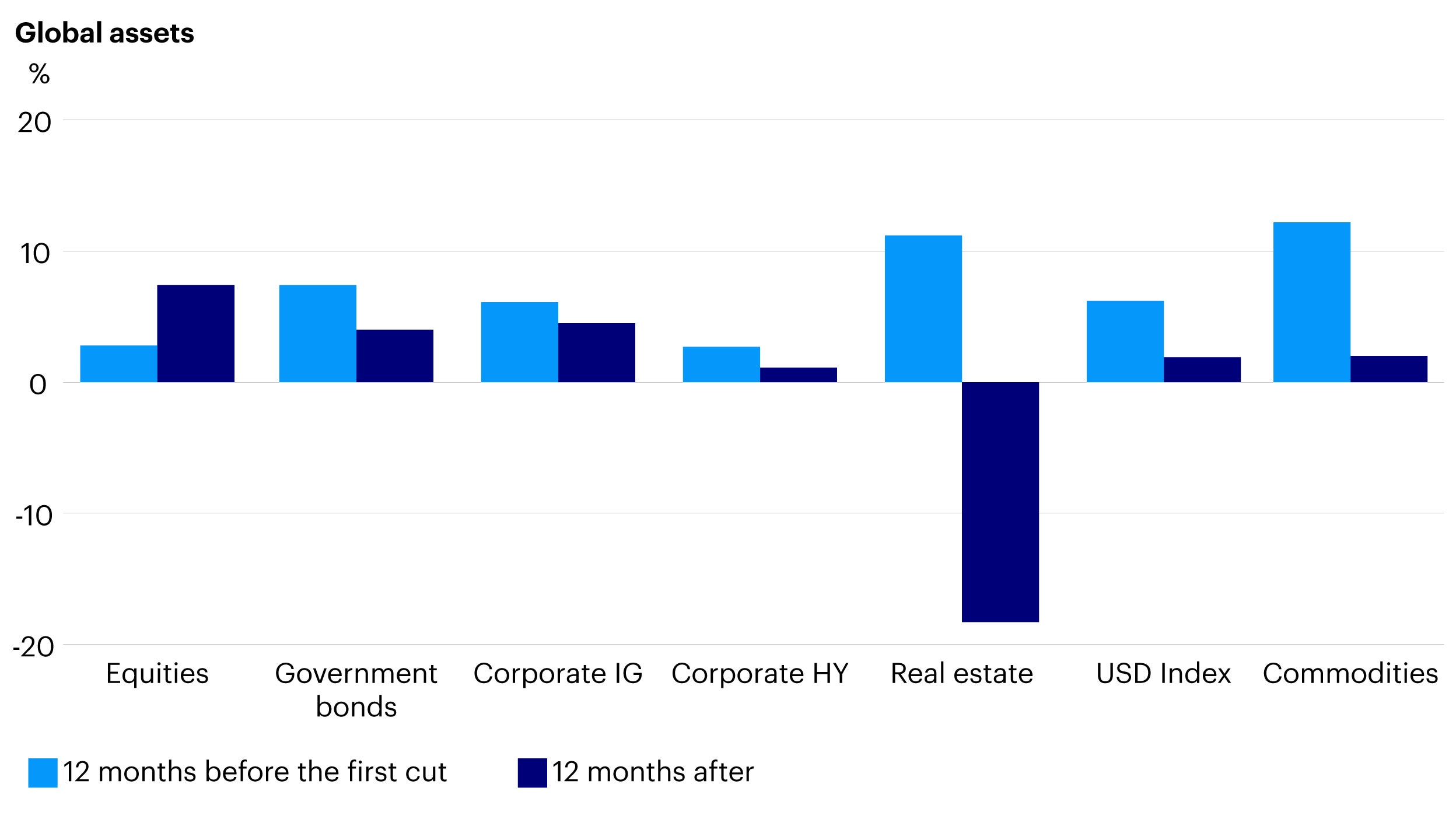

Historically, both stocks and bonds performed well following the first Fed rate cut as investors expect an easing cycle could lead to economic recovery. As such, this may be time for investors to explore the opportunities in global equities and fixed-income.

Notes: Past performance is no guarantee of future results. An investment cannot be made directly in an index. “Corporate IG” = investment grade; “Corporate HY” = high yield. Based on Federal Reserve interest rate cycles since 1974. Please see Appendix for methodology and index definitions. As of May 31, 2024. Sources: ICE, ICE BofA, FTSE Russell, MSCI, S&P GSCI, Refinitiv, LSEG Datastream, and Invesco. For illustrative purposes only.

Bond yields tend to go down along with central bank rate cuts. Investors looking for income may potentially take advantage to lock in the attractive yield in fixed income, e.g. investment grade bonds.

Source: BlackRock Aladdin, as of July 31, 2024 *Bloomberg Global Aggregate Corporate USD Hedged Total Return Index. Past performance is no guarantee of future results. For illustrative purposes only. An investment cannot be made directly in an index.

While historically, stocks and bonds stand to benefit from rate cuts, it is important to diversify geographically (i.e. a global exposure) as 1) The timing and depth of central bank rate cuts will vary by country, 2) Economic recovery may be uneven across the global, 3) Geopolitics and elections may trigger political uncertainties.

Economic recovery may be uneven across the global.

Geopolitics and elections may trigger political uncertainties.

#Diversification does not guarantee a profit or eliminate the risk of loss. There is no guarantee objectives and/or targets will be met.

Focus funds

Invesco offers multiple sources of income which could potentially generate stable income for your portfolio.

Understand Investment Grade Corporate Bonds in 3 Minutes

FED has begun a cycle of interest rate cuts. What is the outlook for the bond market? Which industries or regions are particularly attractive? Lyndon Man, Senior Portfolio Manager, shared his views on the outlook for investment grade corporate bonds.

There will be fund highlights after the Important Information.

Important Information

-

Invesco Global Investment Grade Corporate Bond Fund: The Fund invests primarily in investment grade corporate bonds and intends to achieve, in the medium to long term, a competitive overall investment return with relative security of capital in comparison to equities. Investors should note the liquidity risk, concentration risk of investing in investment grade corporate bonds, volatility risk, risk associated with investments in debt instruments with loss-absorption features including senior non-preferred debts, contingent convertible bonds which are subject to the risk of being written down or converted to ordinary shares upon the occurrence of pre-defined trigger events and may result in a significant or total reduction in the value of such instruments, currency exchange risk, RMB currency and conversion risks of RMB hedged share classes, credit rating risk, general investment risk. Investment in bonds or other fixed income securities is subject to (a) interest rate risk and (b) credit risk (including default risk, downgrading risk and liquidity risk). Financial derivative instruments (FDI) may be used for efficient portfolio management and hedging purpose and for investment purposes. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. As a result of the use of FDI for investment purposes, investors should note the additional/high leverage risk. Also, the active FDI positions implemented by the Fund may not be correlated with its underlying securities positions held by the Fund which may lead to a significant or total loss to the Fund. For certain share class(es), the Fund may at discretion pay dividend out of capital and/or effectively out of capital, which amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per share in respect of such share class after the monthly distribution date. (Note 1) In addition, investors of Monthly Distribution-1 share classes that are currency hedged (MD-1 hedged) should be aware of the uncertainty of relative interest rates. The net asset value of the MD-1 hedged may fluctuate and may significantly differ from other share class due to fluctuation of the interest rate differential between the currency in which the MD-1 hedged is denominated and the base currency of the Fund and may result in greater erosion of capital than other non-hedged share class. (Note 2) The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone.

Invesco Global Income Fund: The Fund invests primarily in a flexible allocation to debt securities and listed global equities. Investors should note the dynamic asset allocation risk, emerging markets risk, risk of investing convertibles/convertible bonds/convertible debts, sovereign debt risk, volatility risk, risk associated with investments in debt instruments with loss-absorption features including senior non-preferred debts, contingent convertible bonds which are subject to the risk of being written down or converted to ordinary shares upon the occurrence of pre-defined trigger events and may result in a significant or total reduction in the value of such instruments, currency exchange risk, RMB currency and conversion risks of RMB hedged share classes, equities risk, credit rating risk, risks related to securities lending transactions, general investment risk, and investment in bonds or other fixed income securities is subject to (a) interest rate risk (b) credit risk (including default risk, downgrading risk and liquidity risk) and (c) risks relating to high yield bonds/non-investment grade bonds and/or un-rated bonds. Financial derivative instruments (FDI) may be used for efficient portfolio management and hedging purpose and for investment purposes. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. As a result of the use of FDI for investment purposes, investors should note the additional/high leverage risk. For certain share class(es), the Fund may at discretion pay dividend out of the capital and/or effectively out of capital, which amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per share in respect of such share class after the monthly distribution date. (Note 1) In addition, investors of Monthly Distribution-1 share class that are currency hedged (MD-1 hedged) should be aware of the uncertainty of relative interest rates. The net asset value of the MD-1 hedged may fluctuate and may significantly differ from other share class due to fluctuation of the interest rate differential between the currency in which the MD-1 hedged is denominated and the base currency of the Fund and may result in a greater erosion of capital than other non-hedged share class. (Note 2) The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone. The investment performances are denominated in EUR. US/HK dollar-based investors are therefore exposed to fluctuations in exchange rates.

Invesco Global Equity Income Fund: The Fund invests primarily in global equities. Investors should note the currency exchange risk, equities risk, volatility risk, and general investment risk. Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund. For certain share class(es), the Fund may at discretion pay dividend out of the capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per share in respect of such share class after the monthly distribution date. (Note 1) In addition, investors of Monthly Distribution-1 share class that are currency hedged (MD-1 hedged) should be aware of the uncertainty of relative interest rates. The net asset value of the MD-1 hedged may fluctuate and may significantly differ from other share class due to fluctuation of the interest rate differential between the currency in which the MD-1 hedged is denominated and the base currency of the Fund and may result in a greater erosion of capital than other non-hedged share class. (Note 2) The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone.

Invesco Global Equity Income Advantage Fund: The Fund invests primarily in a diversified portfolio of global equity securities and equity-linked notes (ELNs) designed to generate high income while providing downside protection as well as equity market upside participation. Investors should note that downside protection does not mean complete elimination of downside risk and is not a guarantee the Fund will not suffer any loss. Investors should note the liquidity risk, credit risk, volatility risk, currency exchange risk, equities risk, RMB currency and conversion risks, general investment risk. Financial derivative instruments (FDI) may be used for efficient portfolio management purposes or to hedge or reduce the overall risk of investments. Risks associated with FDI include counterparty/credit risk, liquidity risk, valuation risk, volatility risk and over-the-counter transaction risk. The leverage element/component of a FDI can result in a loss significantly greater than the amount invested in the FDI by the Fund. Exposure to FDI may lead to a high risk of significant loss by the Fund. For certain share class(es), the Fund may at discretion pay dividend out of the capital and/or effectively out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction of the net asset value per share in respect of such share class after the monthly distribution date. (Note 1) In addition, investors of Monthly Distribution-1 share class that are currency hedged (MD-1 hedged) should be aware of the uncertainty of relative interest rates. The net asset value of the MD-1 hedged may fluctuate and may significantly differ from other share class due to fluctuation of the interest rate differential between the currency in which the MD-1 hedged is denominated and the base currency of the Fund and may result in a greater erosion of capital than other non-hedged share class. (Note 2) The value of the Fund can be volatile and could go down substantially. Investors should not base their investment decision on this material alone.

Fixed income

- Invest in high quality assets - Around 89% of investment grade corporate bonds with an average credit rating of A-.^

- The selected themes - Use thematic approach to identify global investment opportunities, such as the credit cycle difference between Europe and US, financial deleveraging and energy independence.

- Opportunities for monthly income - In November, A (USD)-MD1 Shares and A (HKD)-MD1 Shares yielded 8.00% and 7.98% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

Multi-asset

- Active asset allocation: Active allocation based on portfolio manager's asset allocation framework in different economic conditions. A diversified global portfolio of income producing securities, mainly bonds and equities.

- Opportunities for monthly income - In November, A (USD Hgd)-MD1 Shares yielded 7.76%; A (HKD Hgd)-MD-1 Shares yielded 7.76%.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

- Morningstar 5-star rating: Invesco Global Income Fund A (USD Hgd)-MD1 Shares is Morningstar 5-star rated^^.

Dividend income

- A combination of income and growth - A balanced portfolio with no excessive style or factor bias. It takes both yields and growth potential into consideration.

- Morningstar 4-star rated fund^^ - Good performance with 1st quartile peer group ranking over 1 year, 3 years and 5 years.***

- Opportunities for monthly high income - In November, A (USD)-MD1 Shares and A (HKD)-MD1 Shares yielded 5.35% and 5.37% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

Options income

- A combination of dividends and options income - The breakdown of income is roughly 20% from dividends and 80% from options.# This approach aims for high income with less volatility.

- Opportunities for monthly income - In November, A (USD)-MD1 Shares and A (HKD)-MD1 Shares yielded 7.01% and 7.08% respectively.* (Aims to pay dividend on monthly basis. Dividend is not guaranteed. For MD-1 shares, dividend may be paid out of capital. Please refer to Note 1 and/or Note 2 of the "Important information“.)

- A less volatile portfolio - A highly diversified portfolio of 620 holdings with an aim to reduce volatility. #

Footnotes

-

^Source: Invesco, as of November 30, 2024

*Source: Invesco, as of November 30, 2024 Annualized dividend (%) = (Amount/Share X Frequency) ÷ Price on record date. Upon dividend distribution, the Fund's net asset value may fall on the ex-dividend date. For Frequency, Monthly = 12; Quarterly = 4; Semi-Annually = 2; Annually =1. All distributions below USD 50/AUD 50/HKD 400/RMB 400 will be automatically applied in the purchase of further shares of the same class. Positive distribution yield does not imply a positive return.

^^Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time. Source: ©2024 Morningstar, data as of November 30, 2024.

*** Source: ©2024 Morningstar, data as of July 31, 2024. Peer group = Morningstar EAA Fund Global Equity Income peer group.

#Source: Invesco, as of November 30, 2024. By leveraging various options strategies, investors can potentially generate steady income streams and reduce volatility in an investment portfolio. The most common options trading strategies to generate income are covered calls and cash-secured puts. A covered call involves selling a call option on an underlying asset that you own, and the premium collected from the sale of the call option provides income. Cash-secured puts involve selling a put option on an underlying asset which can allow for purchasing of that asset for a discount from the premium collected of the put sale.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is provided for reference purposes only. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Asset allocation data is derived by Morningstar using full holdings data provided by Invesco. Morningstar Licensed Tools and Content powered by Interactive Data Managed Solutions.

Appendix

The chart shows the total return on global assets in the 12 months before and after the first Fed rate cut in easing cycles since 1974, and the bottom chart shows the same but for US assets. Data doesn’t exist for all assets for every easing cycle. Sources: ICE, ICE BofA, FTSE Russell, MSCI, S&P GSCI, Refinitiv Datastream and Invesco Global Market Strategy Office. Government bonds: Historical and projected yields and returns are based on ICE BofA government bond indices with historical ranges starting on Dec. 31, 1985 for the global and Jan. 30, 1978 for the US indices. Corporate investment grade (IG) bonds: ICE BofA investment grade corporate bond indices with historical ranges starting on Dec. 31, 1996 for the Global and Jan. 31 1973 for the US dollar index. Corporate high-yield (HY) bonds: Bank of America Merrill Lynch High-Yield indices with historical ranges starting on Aug. 29, 1986 for the US dollar, and Dec. 31, 1997 for the Global index. Equities: We use MSCI benchmark indices to calculate projected returns and calculate long-term total returns with historical ranges starting on Dec. 31, 1969 for the Global and US indices. Real estate: We use FTSE EPRA/NAREIT indices with historical ranges starting on Dec. 29, 1989 for the US and Feb. 18, 2005 for the global index. Commodities: Standard and Poor’s Goldman Sachs Commodity Total Return Indices with historical ranges starting on Dec. 31, 1969.