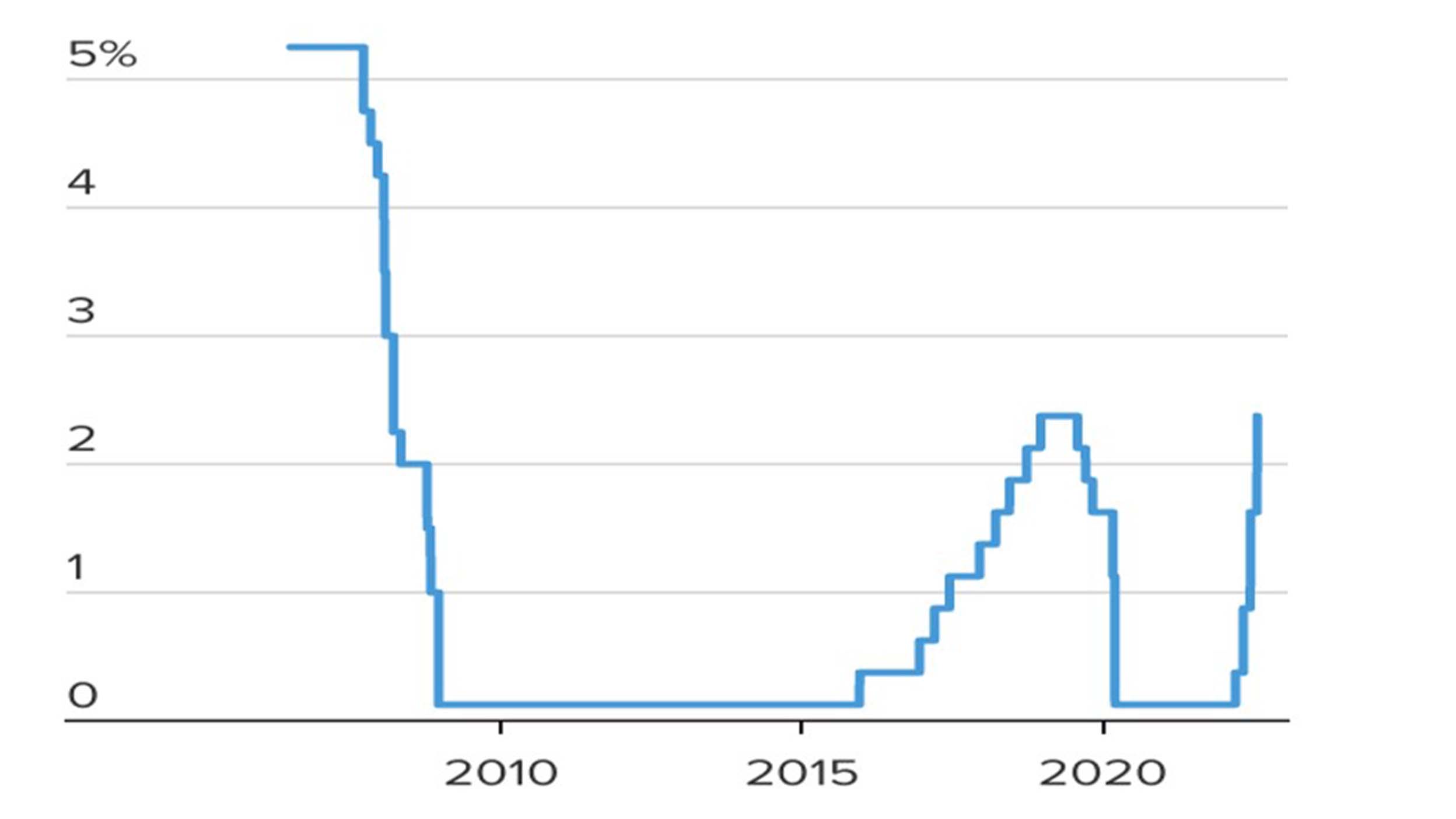

The Federal Reserve raised interest rate by 75 basis points

The FOMC hiked its policy rate by 75bps,1 in line with my forecast.

The big takeaway came during Chair Powell’s press conference – when he emphasized a shift from forward guidance to month-by-month data dependence, which could be viewed as a welcomed development that the Fed wasn’t blindly barreling down a policy tightening path to contain inflation.

Source: CNBC, as of July 27, 2022

The Fed continues to try to thread the needle and avoid making a policy mistake; rebalancing supply and demand through below-potential growth, not recession, is a tall but not impossible order.

Less hawkish than expected

Overall, I believe Powell’s comments could be viewed as less hawkish than expected – he emphasized that the full impact of the rate hikes haven’t been absorbed yet and that the FOMC would react to growth, job market and inflation data – versus a more singular focus on inflation in some recent Fed comments.

This opens the door to the possibility of the Fed shifting gears to a less aggressive tightening path – dependent on monthly inflation and jobs data - and that balance sheet monthly reductions will go up to full speed in September.

The Fed appears to be hinting that they are front-loading the hikes now and could tamper them shortly, perhaps as soon as September.

Even though Powell said another “unusually large” 75bps hike remains on the table, I continue to expect a 50bps hike in September followed by even lower rate hikes in the final two months of the year.

The emphasis and reiteration around the June SEP (summary of economic projections) and Dot Plot indicates the Fed is weighing the downside growth risks, which could provide a bit of relief for market watchers.

The June dot plot assumes the terminal rate at the end of the year at 3.4% and 3.8% at the end of 2023.2

Investment Implications

The less hawkish than expected comments could portend to a near-term softening of the USD and risk assets could rally.

While I continue to be underweight US equities as I believe corporate earnings estimates for 2022 still need to be ratcheted down which means there could be another leg down for equities, I believe that current valuations are becoming more and more appealing.

Though we could be bumping along the bottom in the near-term during this period of earnings consolidation, I believe that pro-risk rally is possible once we have more clarity on when the Fed will hit peak hawkishness, which could be soon in the coming months.

Footnotes

-

1

Source: The Federal Reserve, as of July 27, 2022

-

2

Source: The Federal Reserve, as of July 27, 2022