Latest US inflation and labor data show definitive progress on the inflation fight

This past week’s encouraging US inflation and labor datapoints lead me to believe that the Fed pause is nearly upon us.

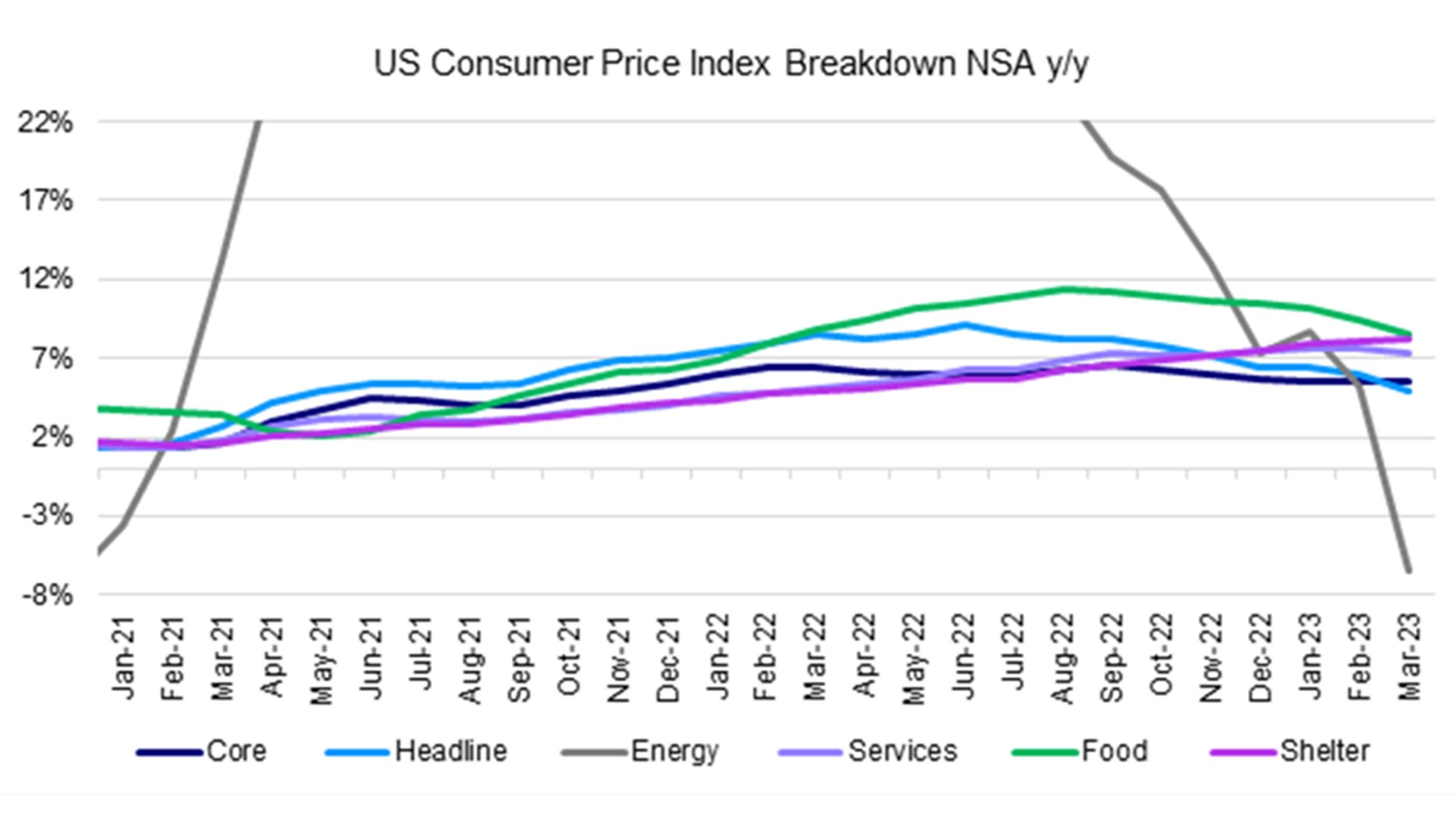

March’s producer price index (PPI) declined -0.5% m/m versus estimates of 0.0% and the monthly core CPI rose 0.385% m/m, below consensus estimates of 0.4%.1

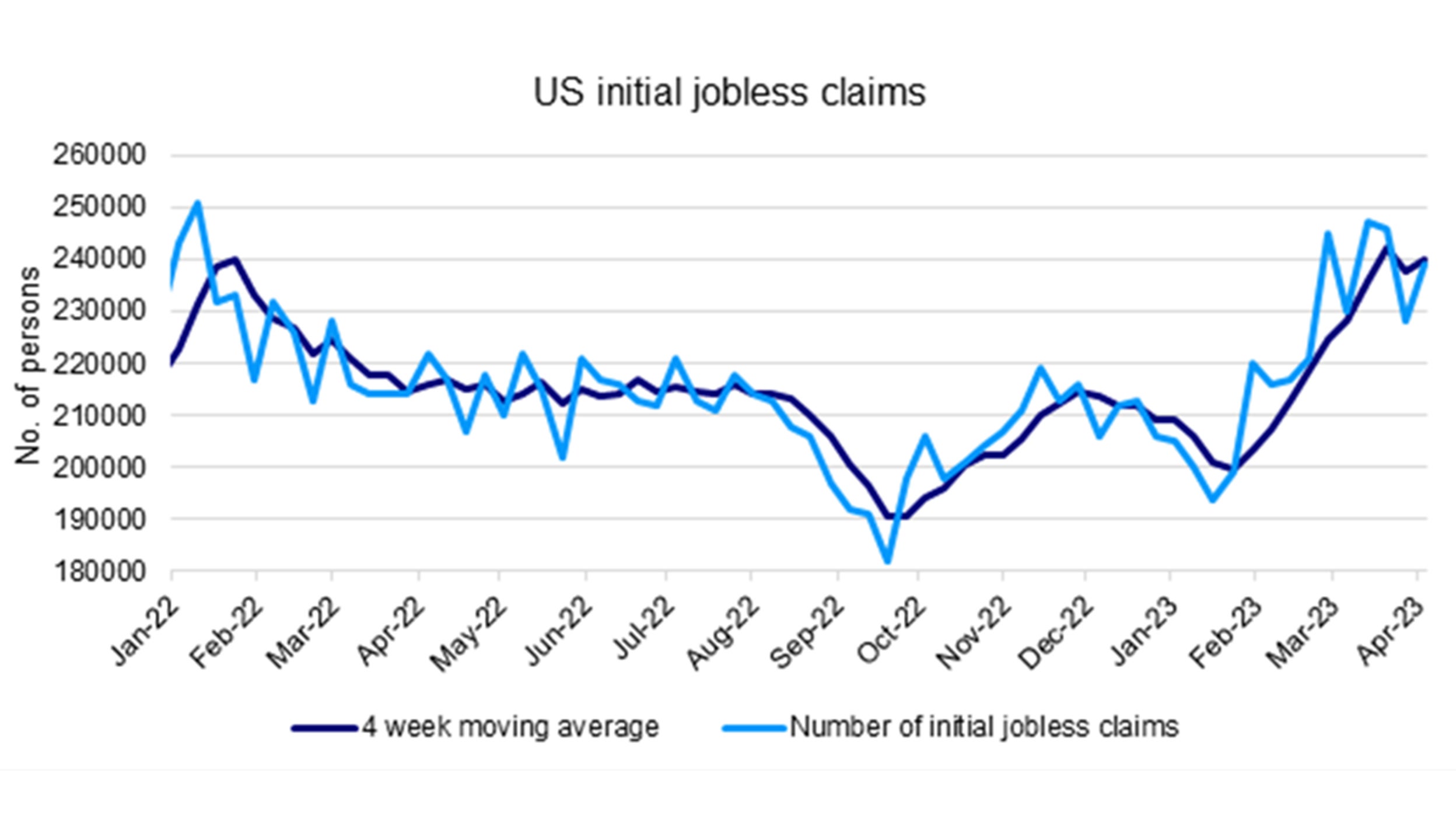

Also, weekly jobless claims for 9th April rose by 11k, slightly above expectations.2 These data points show definitive progress on the inflation fight – core CPI pressures continue to retreat and the labor market continues to rebalance.

Source: U.S. Department of Labor. Data as of 2023 Week 14.

The monthly CPI data reveals that CPI services prices ex-energy and shelter rose 0.4% m/m in March3 and is likely to record similar price increases in the coming months.

I believe that the key to the Fed ending rate hikes is adequate progress on services ex-housing inflation. That’s because non-shelter services prices make up a larger weight in the PCE inflation, and the Fed uses core PCE data as its primary inflationary gauge rather than CPI.

Thus, while March’s core CPI reading showed some progress, core PCE inflation still appears to be around 4.5% y/y (estimated for the month of March)4. This leads me to believe that the Fed still has one more rate hike in store, taking the target range to 5.0-5.25%.

Source: U.S. Bureau of Labor Statistics (BLS). Data as of March 2023.

The Fed also recently published it’s March 2023 FOMC minutes.

Key Takeaways:

- “All” participants agreed that a 25bp hike was appropriate.

- “Many” participants noted that the recent bank stress had led them to “lower their assessments of the [funds rate] that would be sufficiently restrictive.”

- Participants expect a slowdown with more downside risks; Fed staff economists believe it is likely we will go into mild recession although there is more uncertainty about the path ahead for the economy.

- Participants viewed inflation as “unacceptably high” and, in particular, observed “less evidence” of slowing inflation in core services ex-housing.

While it could make sense for the Fed to raise interest rates by another 25bps in its next FOMC meeting in May, it’s likely that this will be the final one.

We have seen concrete signs that inflation is slowing in the last several weeks. Between the PPI, CPI report, weekly jobless claims and the FOMC minutes, I believe the Fed is moving closer to deciding no more rate hikes.