Key Takeaways from the FOMC November Meeting

This has been quite an interesting FOMC meeting – we got the interest rate hike that was expected, though markets reacted negatively to new hawkish developments.

The FOMC raised the Fed Fund’s rate by 75bps to 3.75 – 4.0% during the November meeting1, in line with market expectations.

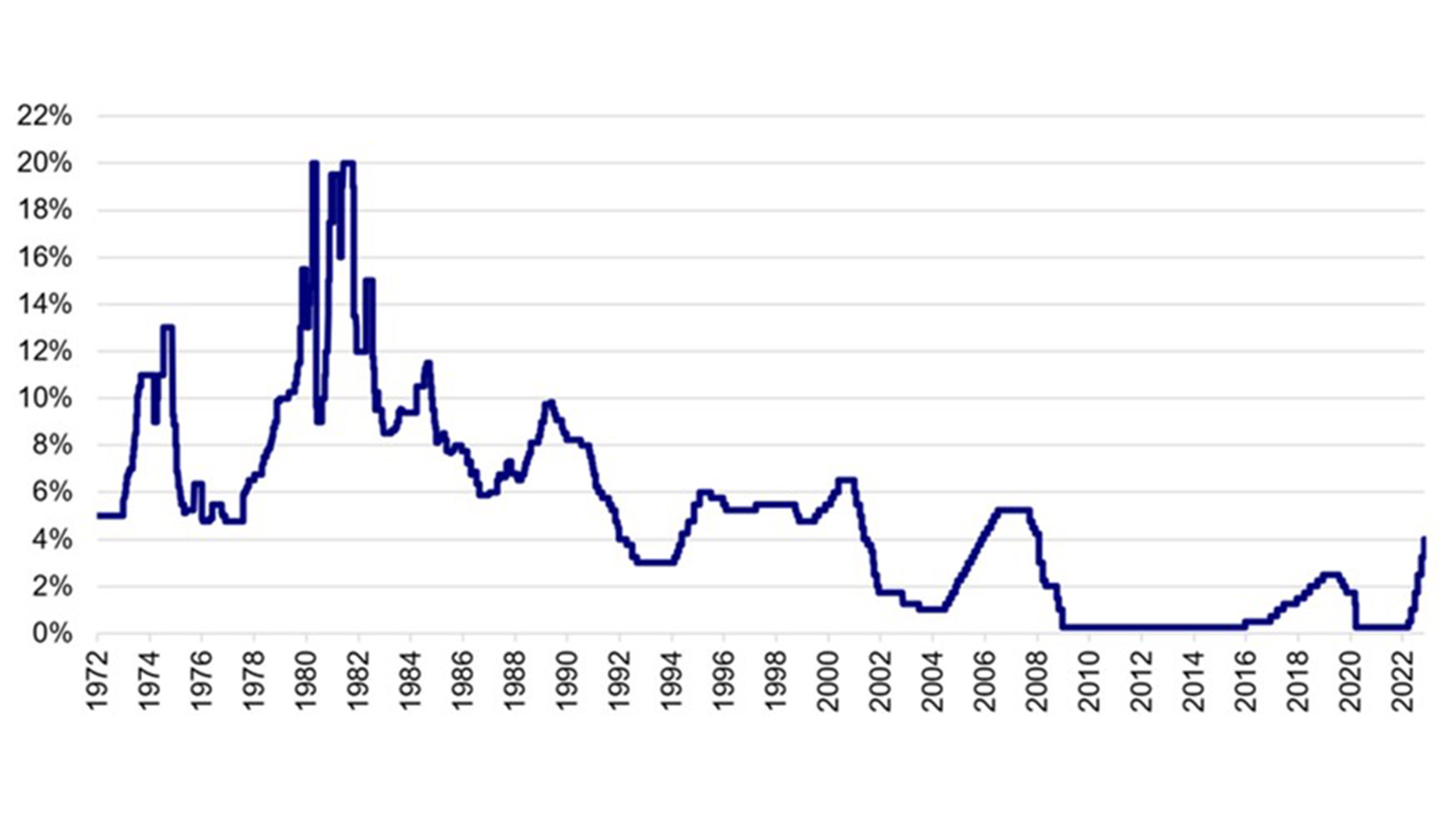

Source: Federal Reserve. Data as of 3 November 2022.

Heading into the meeting, markets have been centered on how the Fed is going to engineer the downshift in its rate hiking path.

Two new statements hinting the path forward

It’s clear that the Fed still has some ways to go in the level of monetary restriction though they may not be comfortable hiking 75bps at each of the coming meetings. And I believe the Fed addressed its path forward with two new statements.

Firstly, the initial Fed statement read that going forward, the FOMC will take into account the “cumulative tightening” and the “lag effects of monetary policy”. This means that the Fed recognizes that it takes time for tightening monetary conditions to take effect before it flows through to the real economy and then to inflation.

This new, if somewhat ambiguous phrase could be interpreted as the Fed saying that they have already tightened monetary conditions by a lot and that they could move at a slower pace going forward.

Markets initially read this new tidbit as a dovish monetary policy tilt towards the pace of tightening and that a downshift in future rate hikes starting in December could be expected.

That dovish sentiment didn’t last long. The second, and more important new tidbit, came out during Chair Powell’s press conference. Powell cleared up any ambiguity left on the table on the path forward for the Fed, in a clearly hawkish direction.

Powell indicated that interest rates would move higher until they reach a level that would be sufficient enough to slowdown the economy.

More importantly, Powell detailed that the terminal rate could be going higher than previously anticipated in the September FOMC meeting – during which the median dot in the dot plot indicated that the year-end 2023 rates would be at 4.5 - 4.75%1.

Powell said, based on the recent labor market data that has come in since the September FOMC meeting, that has shown an “exceedingly tight labor market,” a strong employment cost index and continued wage pressures haven’t really slowed down – inflation could likely be persistently high.

Taking all of this into consideration, Powell guided that the terminal rate – the level that the Fed is comfortable with that is sufficiently restrictive to slowdown the economy to bring inflation down – now looks higher than when the FOMC assessed back in September.

Also during the press conference, Powell reiterated that the risk to the economy is not from the Fed overdoing the rate hikes, but underdoing them.

With mortgage rates in the US hovering around 7%, there have been market concerns that the Fed is barreling down a path towards an over-tightening policy mistake.

Powell challenged that narrative and emphatically detailed that the risk is for the Fed to be behind the curve and have to come out again later if inflation is not adequately tamped down. This means that the FOMC could be more comfortable overshooting policy rates and then come back later to cut rates rather than underdoing them.

Key takeaways

I believe the two key takeaways from the meeting is that the Fed has guided to a possible slowing in the pace of tightening, though Powell would not commit to whether that would begin in December.

More so, Powell emphasized that it’s not really the path that’s important but the destination. The more important takeaway is that the Fed still has a ways to go, and that the final rate level could be higher than previously thought.

Reference:

-

1

Source: Federal Reserve. Data as of 3 November 2022.