Since it was launched 15 years ago, the Invesco Pan European Structured Equity Strategy has become popular with our clients, offering a proven track record of performance and producing less volatility than its MSCI Europe Index benchmark. However, as the demand for sustainable investing continues to gather momentum, the strategy also needs to keep evolving to meet our clients’ investment needs.

Research and evolution is at the heart of what we do at Invesco Quantitative Strategies (IQS) and has been for more than 30 years. As our research deepens, we constantly evolve alongside our clients, believing there are new risks and opportunities that can provide better protection to the strategy.

In today’s market, investors not only want a reliable alpha-generating strategy – they also want their investments to have a positive impact on the world around us.

That’s why, from the 8th of April, we are taking steps to make changes to the strategy to embed explicit ESG (environmental, social and governance) criteria into the existing factor characteristics for which the strategy is known.

To reflect this change, we have renamed the strategy as the Invesco Sustainable Pan European Structured Equity Strategy.

Part of our ongoing evolutionary process

To give you an example, take the hybrid car: an evolution in the automobile industry with all the perks of traditional cars, but more sustainable. Pure-electric vehicles do not yet have the range of greenhouse gas-emitting incumbents, but more environmentally friendly hybrids do.

Like a hybrid car, the Invesco Sustainable Pan European Structured Equity Strategy now offers all the competitive advantages of its predecessor but in a more sustainable way. It combines proven benefits – such as the multi-factor and low volatility approach – with explicit ESG criteria, and offer the additional benefit of greater diversification.

As the strategy is based on factor characteristics rather than single stocks, we believe additional ESG considerations can be incorporated without compromising the strategy's structure and performance.

Although ESG integration might still be a relatively new concept for some investors, it has been part of the IQS’ offering for over 20 years and been integrated in all layers of the investment process since 2018. Truly ESG-minded investors will, in our view, benefit from our longstanding approach to shareholder engagement and proxy voting in favour of sustainability.

Within IQS, we have been paying particular attention to the environmental aspect of ESG investing and we (and others) believe climate change is one of the most pressing challenges facing our generation and will have a material effect on the world around us.

As a responsible investor, Invesco has committed to supporting and adhering to the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and we are investing in companies that are allocating capital towards the energy transition.

As such, we think the Invesco Sustainable Pan European Structured Equity Strategy offers investors a more sustainable approach to investing in several ways.

A quantitative approach in an ESG framework

We believe our quantitative approach to investing inside an ESG framework can lead to higher equity returns, from both a tilt and momentum perspective. Furthermore, we believe stronger ESG integration also corresponds to lower downside risk, as sustainability risks are often not adequately reflected in asset valuations.

Alongside the strategy's existing low volatility characteristics, greater ESG promotion should result in a more stable defensive portfolio. It will also contribute to the strategy’s broader diversification and increase the contribution from intended factors –momentum, quality, value and low volatility.

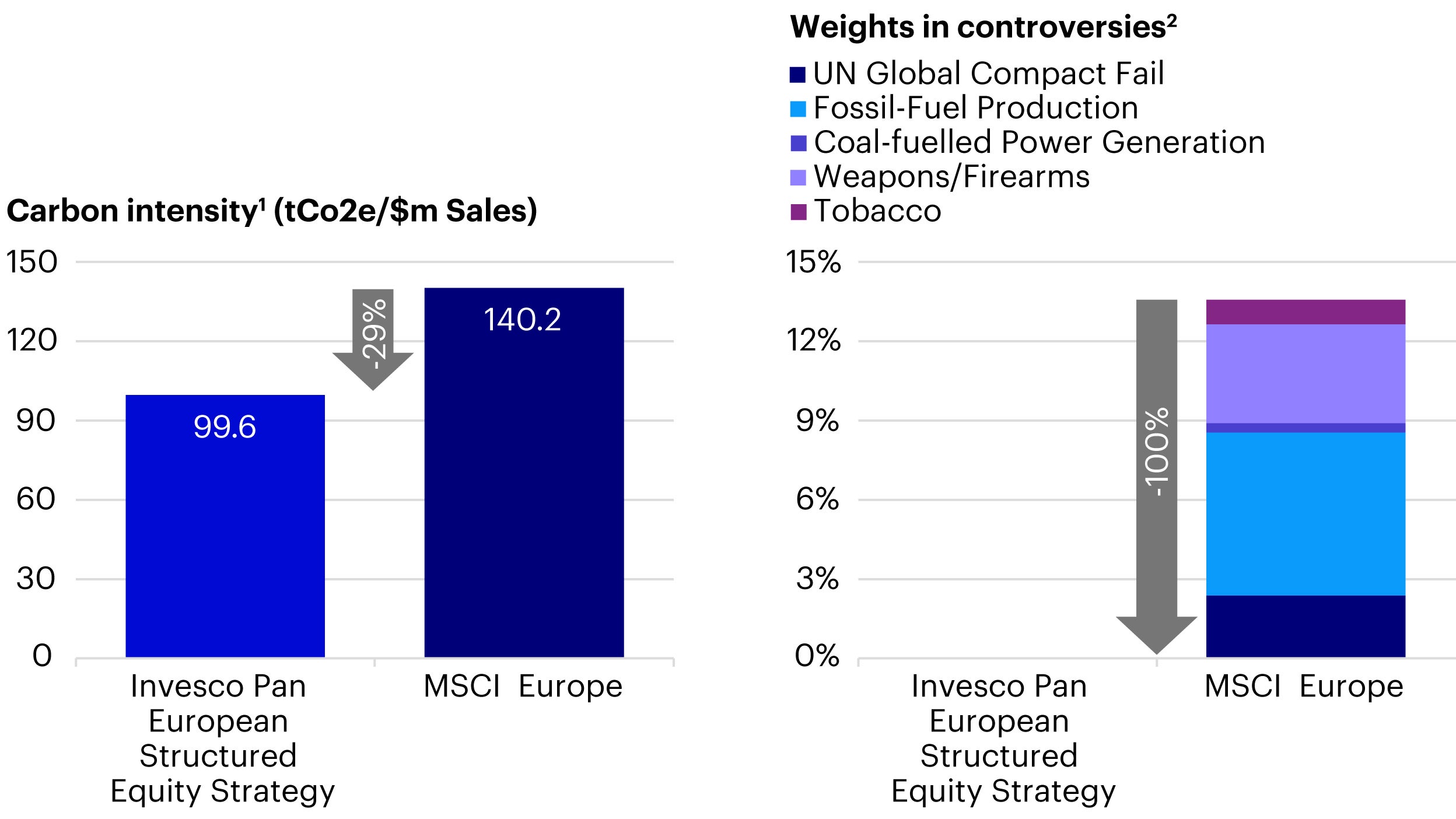

Our approach involves a strict application of ESG metrics, leading to the exclusion of around 50% of ESG laggards from our investment universe. It excludes stocks engaged in controversial activities (e.g., fossil energy sources, weapons, nuclear power, tobacco) and also applies best-in-class screening to highlight energy transition measures for the stocks making the most progress in this area. Finally, a focus on greenhouse gas intensity reduction relative to the benchmark means the strategy has a greener footprint and reduces the risk of stranded assets, such as pure-play energy stocks.