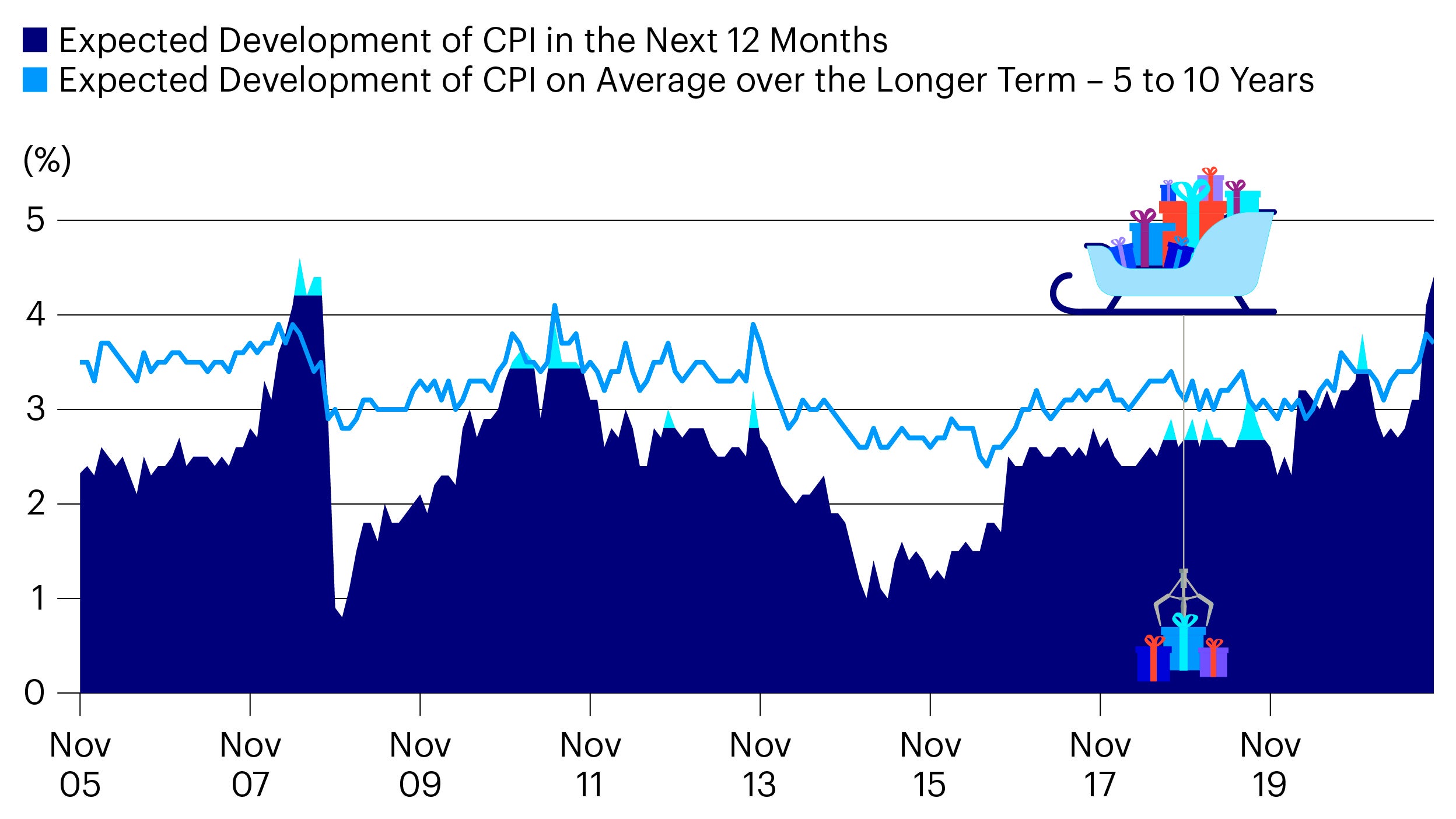

On the first day of Christmas, my true love said to me… this inflation’s not transitory

The UK has experienced a sharp increase in the headline inflation rate this year.

Government bond yields have risen somewhat as this data has come through, but there is potential for yields to rise further if a higher level of inflation persists. As well as depressing gilt prices, this would put upward pressure on other yields.

Government bond markets may be able to adjust slowly to higher inflation without too much disruption (the Goldilocks scenario), but we know that markets don’t always evolve so smoothly.

We believe there is the prospect of a sharper upward move in yields that could easily unsettle credit and equity markets.

While none of this is set in stone, the risk is clearly there. Yields in all fixed income markets are still very low and, against this backdrop, it feels as though a defensive and patient approach is prudent.

In our portfolios, we are defensive in duration and credit.

Source: YouGov and Citi inflation survey, 1 Oct 2021.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Related insights

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.