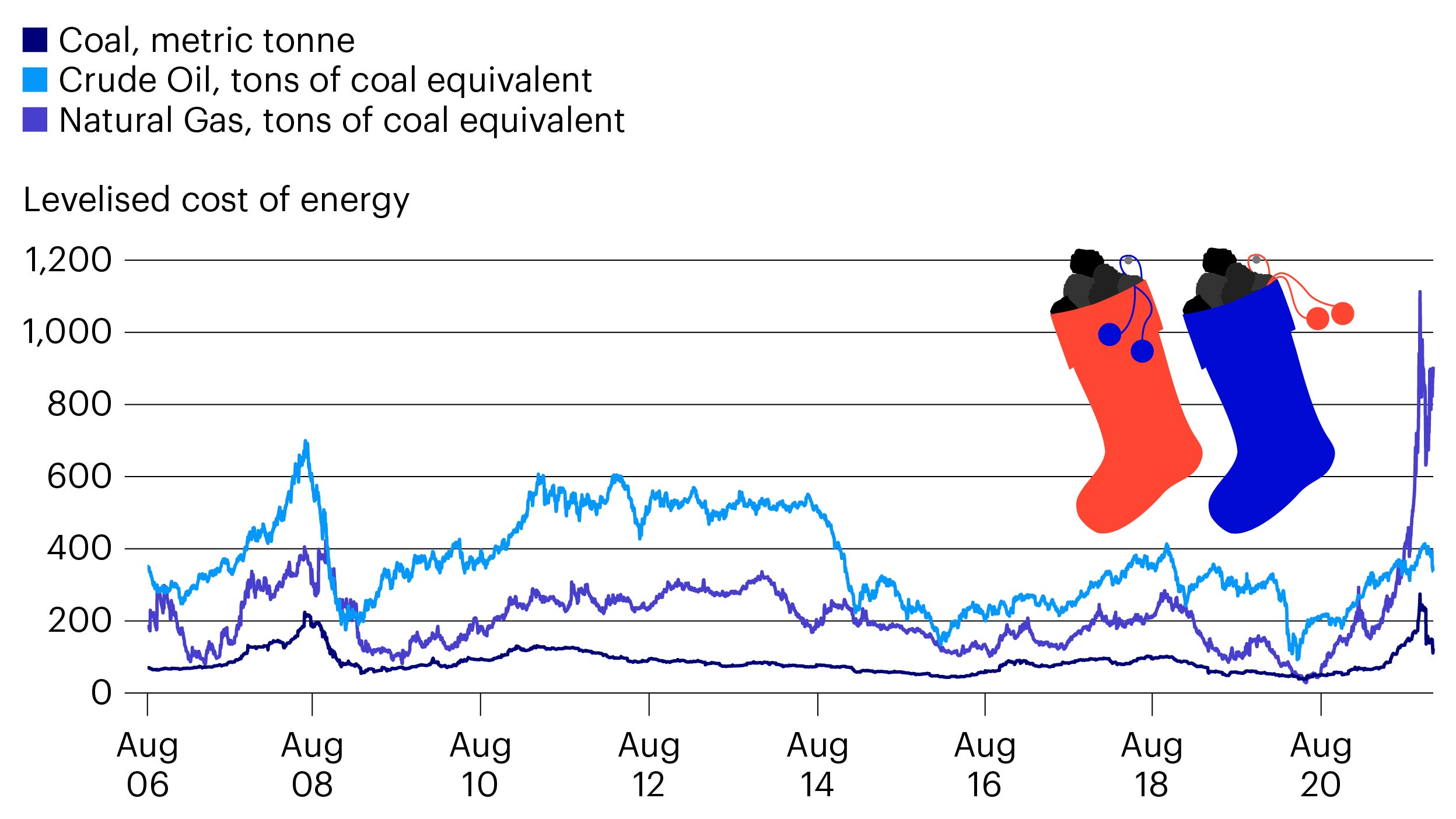

Should we be asking for coal this Christmas?

Natural gas has stolen the spotlight in recent months from oil, but only because of the shifts to decarbonisation. If we look at price based on the energy density of different hydrocarbon resources, coal is the most attractive by far.

The combination of coal’s relative energy richness and its abundance helps explain why it has been such a popular energy resource in the past – and still is in many countries. And it remains quite cheap.

So should we be asking for coal this Christmas?

In short, probably not. When we consider the environmental impact of the resource, we appreciate why getting coal from Santa is no good fate at all. Burning coal emits 72% more carbon than natural gas and 40% more carbon than crude oil.

In a world of increasing attention drawn to the effects of climate change, reducing coal in our energy composition – and in our stockings – is a growing priority.

Source: Macrobond, US Energy Information Administration, US Environmental Protection Agency, and Invesco. Tons of coal equivalent is a measurement to make comparable the amount of energy produced through burning other resources such as natural gas and oil. One ton of coal equivalent is equal to one metric tonne of coal, or 4.79 barrels of crude oil, or 277.86 therms of natural gas. Levelized costs were calculated using prices of different resources based on the Intercontinental Exchange (ICE) one-month futures contracts for coal (ICE Rotterdam Coal), crude (ICE Brent Crude), and natural gas (ICE UK Natural Gas) and multiplied by the corresponding ton of coal equivalent coefficient. All energy measurements are estimated values and may be different based on the quality and origin of a given natural resource. Estimates do not include carbon emissions involved in the acquisition, storage, transportation, and processing of resources.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Related insights

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.