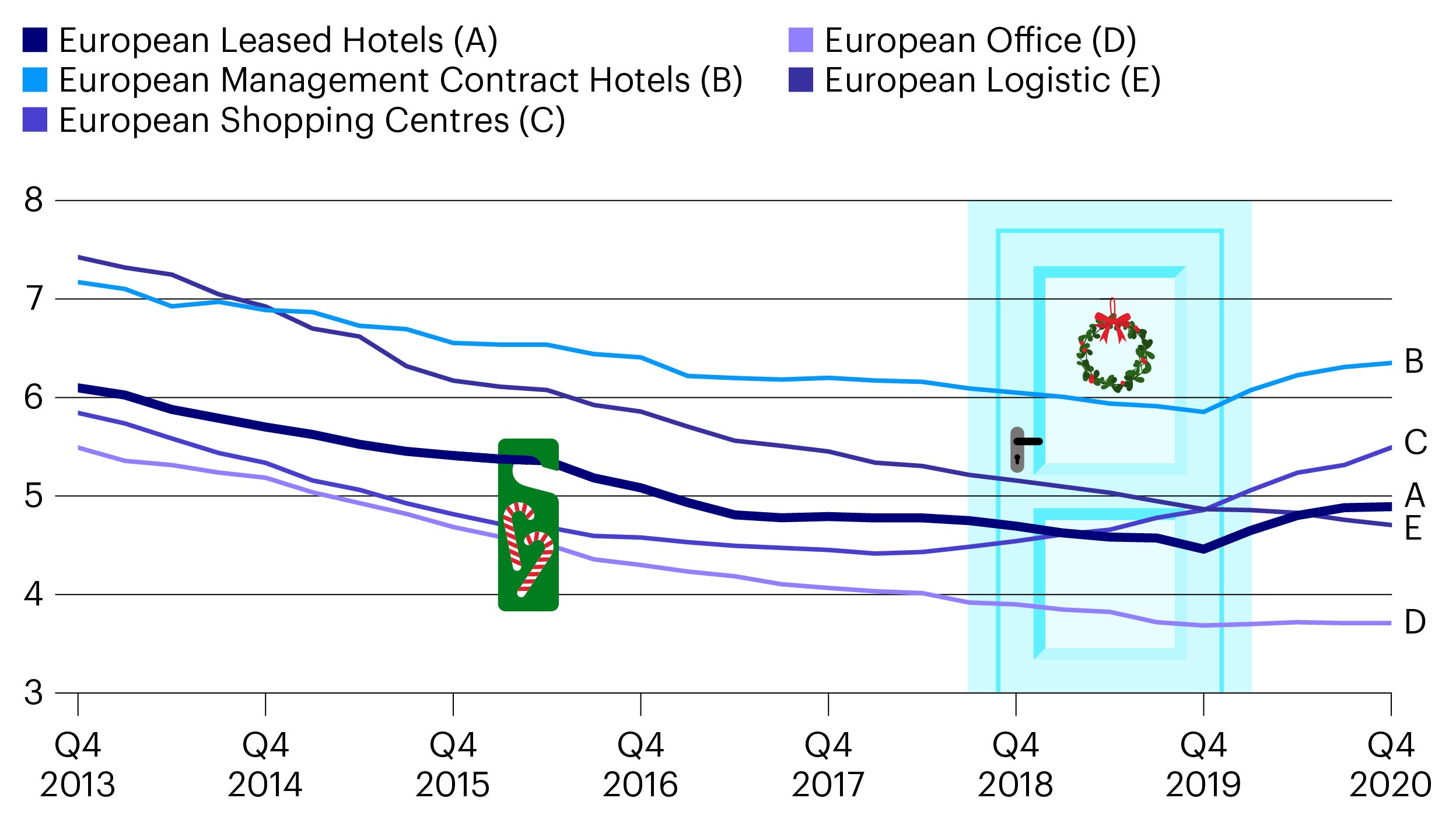

No room at the inn: opportunities in European hotels

The latest COVID-19 variant has caused concerns about the broader economic recovery story.

However, we continue to believe that the recent repricing of European hotels presents good opportunities. For example, the opportunity to acquire core hotels for a long-term hold, or value-add projects following a manage-to-core strategy.

Source: Invesco Real Estate as of March 2021.

Although the sector has been hit hard by the COVID-19 pandemic, we believe this is a short-term shock rather than a reversal of long-term positive trends.

Indeed, between 2000 and 2019, the sector’s revenues grew by approximately 3% per annum compared to consumer price inflation of 2%1.

The early stages of the recovery in the third quarter of this year suggest that pent-up demand for tourism, and the slightly later recovery of business travel, will be key drivers for the sector going forward.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Related insights

Sources

-

1Source: Oxford Economics, 2021.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.