On the fifth day of Christmas...

Does jewellery pop into your head when thinking of gold? Especially around the festive season, when ‘five gold rings’ belts out and surprises in tiny little boxes wait patiently for those special someones to unwrap.

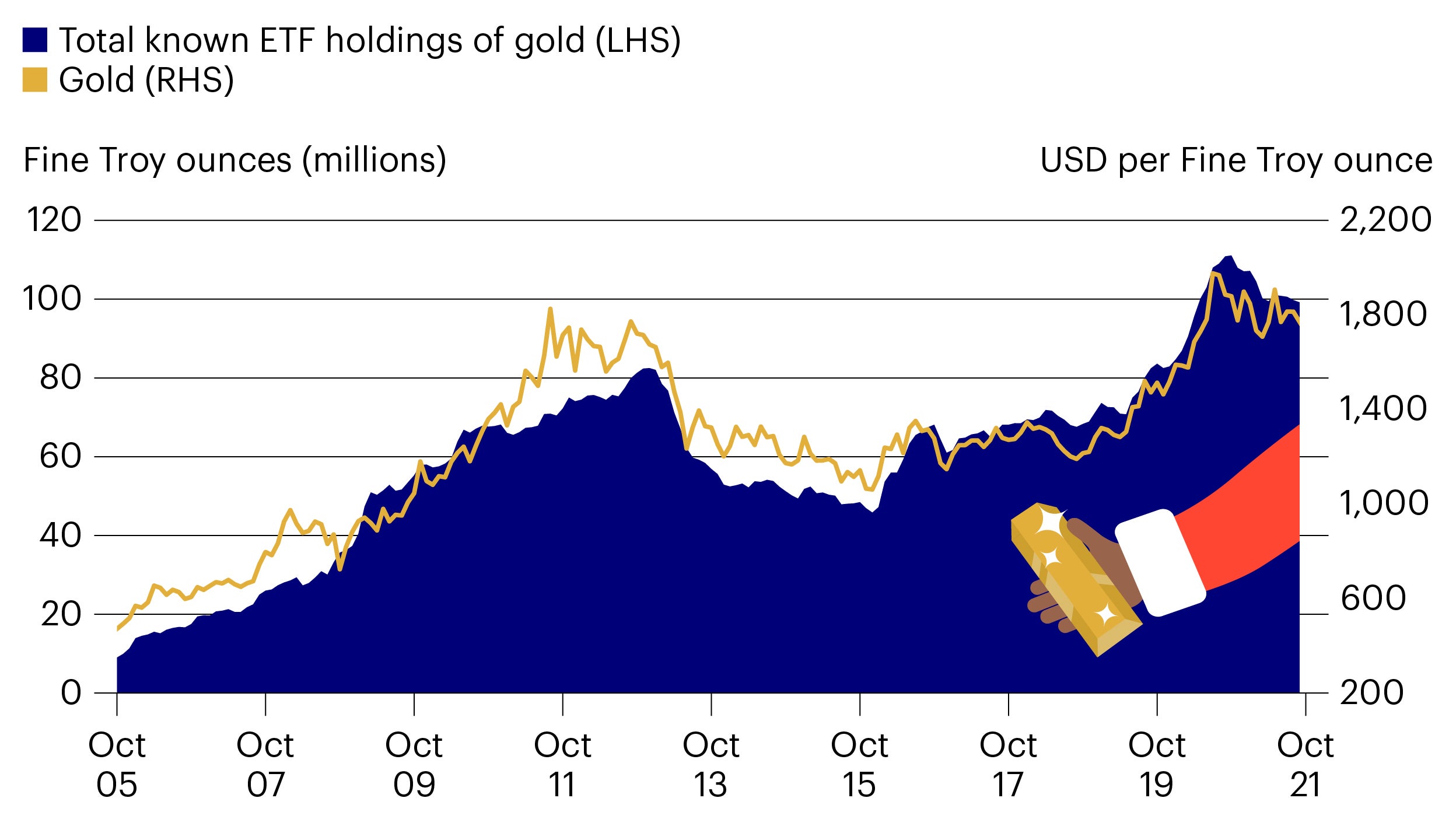

The jewellery market accounts for around half of all gold demand, but the precious metal has other admirers, including a host of industries and investors.

It makes a nice surprise when given as a gift at Christmas. When less desirable events surprise investors (economic or geopolitical shocks, stock market crashes, and so on), gold can be even more appealing.

Just look at 2020 when the amount held in gold exchange-traded products hit record highs.

Gold: a welcomed surprise for all seasons. Ho ho ho!

Source: Invesco as of 30 September 2021.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Related insights

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.