The Just Transition

Inequality can manifest in multiple ways, including ethnicity, gender and race and many others. When we think about Economic, or Income inequality, we see a renewed political will post COVID to address the issue. Actions taken will have important economic and investment consequences.

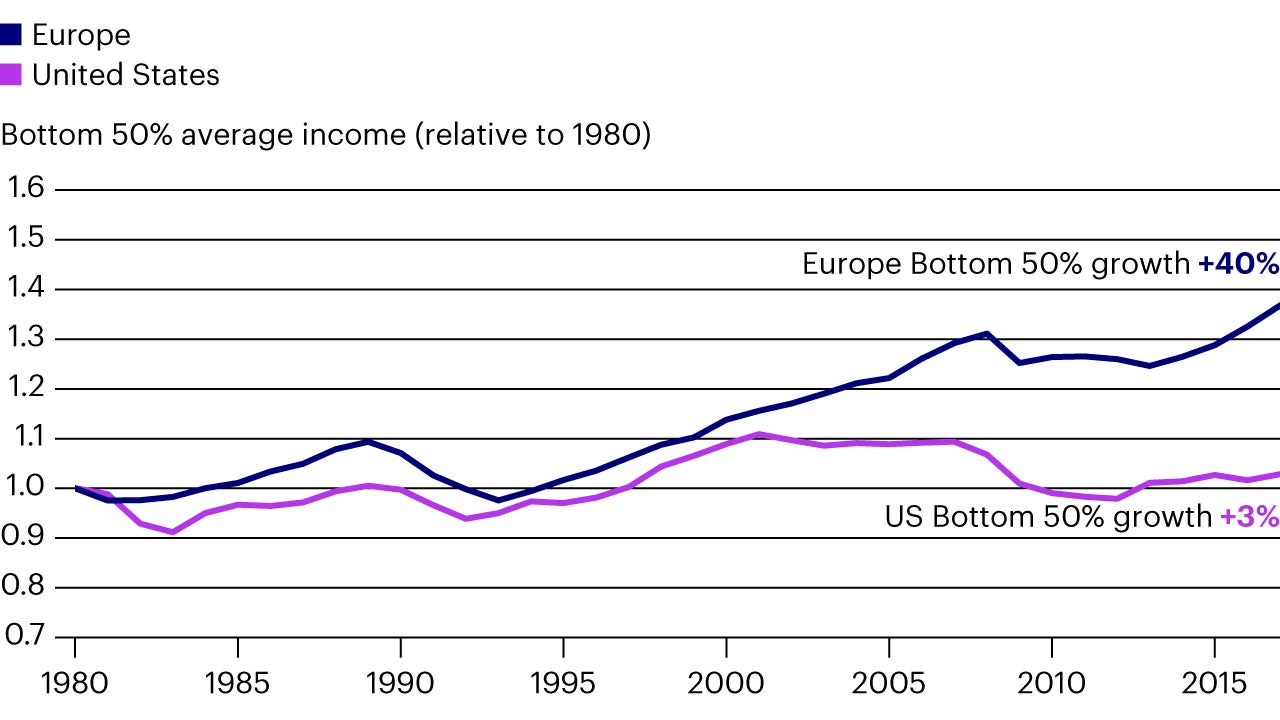

Income inequality is nothing new and reviewing the data in Europe over the last 40 years, Blanchet et al concluded a mixed picture. On the one hand across Europe the top decile clearly took a rising share of national income whilst on the other European enlargement had clearly led to more rapid growth in Eastern Europe and, unlike in the US, at least the lower half of income earners have at least seen income growth (Figure 1).

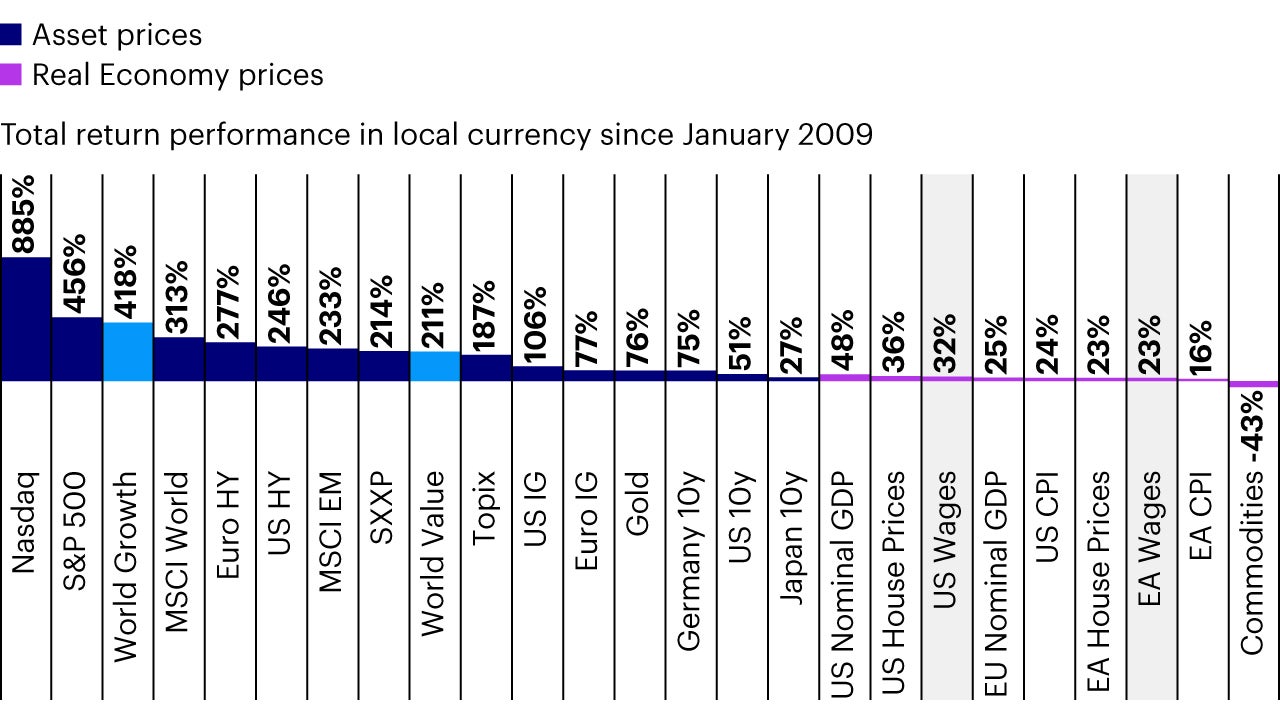

What is clearer, is that the over reliance on monetary policy, combined with austerity, as the solution to the Global Financial Crisis (GFC) has exacerbated these inequalities, particularly if you broaden the analysis away from just income to consider wealth (assets) too. From this perspective, asset owners have done rather better than income earners since 2009 (Figure 2).

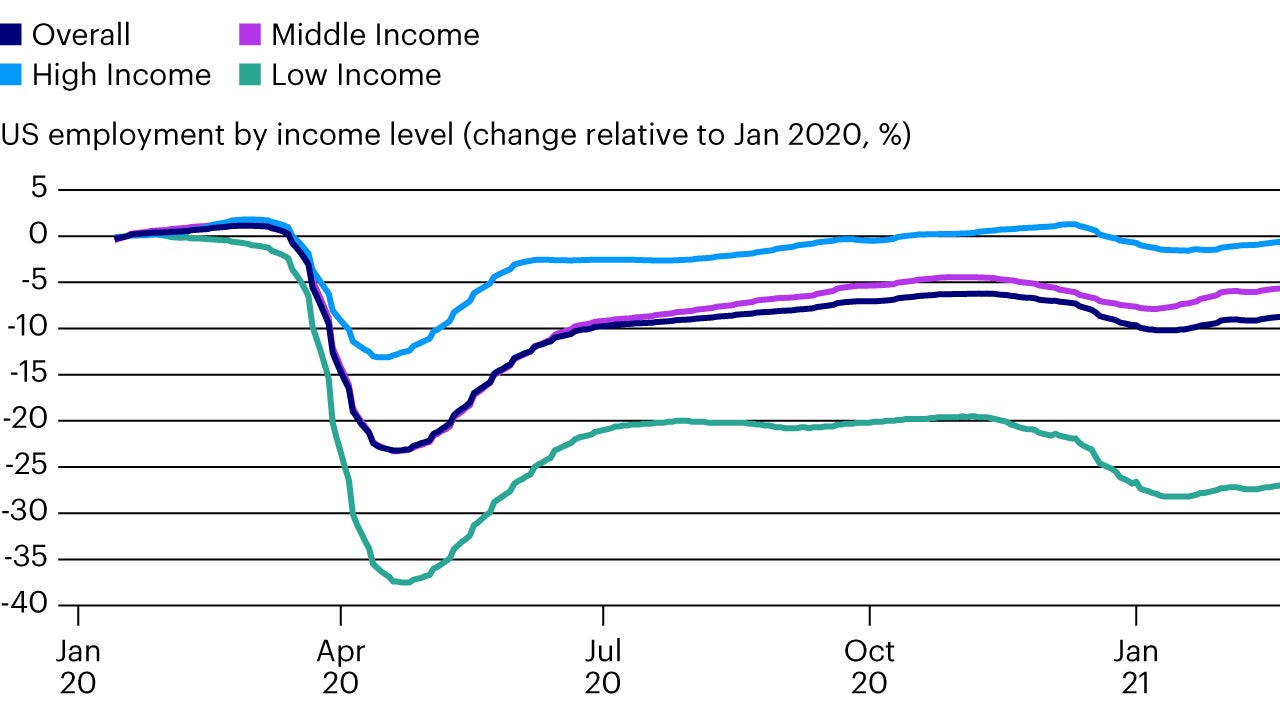

Unfortunately, COVID-19 has stretched this further. Again, the initial policy response came through a further loosening of monetary policy, supporting asset prices, as well as directly impacting those least able to afford it the most. A clear illustration of the unequal impact is to look at how unemployment trends have changed by income bands. The low-income band has clearly suffered the most as these jobs either do not transition to a work-from-home environment or require some level of physical contact (Figure 3).

As Jerome Powell put it in June 2020: “The burden of the downturn has not fallen equally on all Americans. Instead, those least able to withstand the downturn have been affected the most.” Turning to the eurozone, a similar picture with Lagarde highlighting that the labour force contracted by almost 7% for people with low skills and rose by 3.3% for those with high skills.

There are signs of encouragement as we emerge from COVID-19. Inequality, along with climate change, is now at the very top of the political agenda. The narrative has moved towards redistribution. This will likely impact investment decisions for the years ahead.

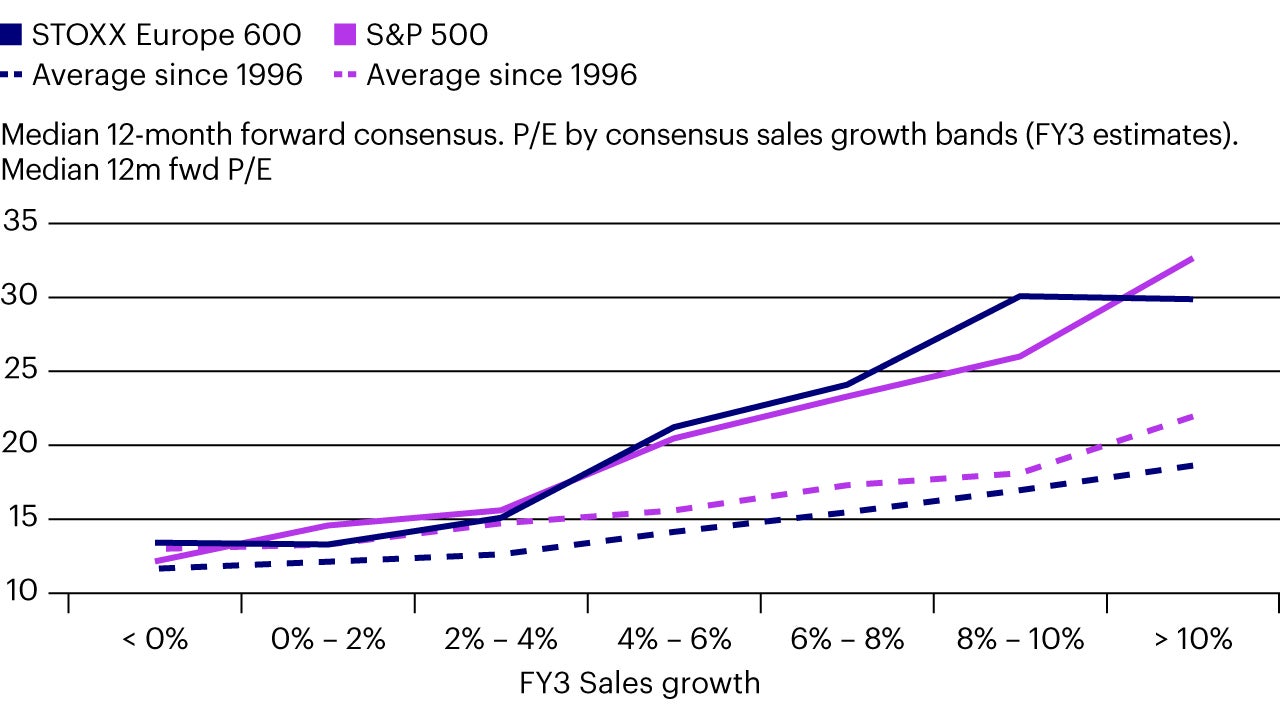

The single biggest change is likely to be a shift to sustained fiscal expansion. This is a dramatic shift from the austerity of the post GFC world and will likely have the biggest impact from a portfolio point of view as the “lower forever” narrative is likely to be tested. Low interest rates have supported the dominance of capital over labour as well as the markets predilection for duration assets (Figure 4). Could the tide reverse?

The emergence of ESG has given rise to not only the “Green Transition” but also the “Just Transition” to ensure that the benefits are widely shared. The Solidarity and Just Transition Silesia Declaration signed by 50 countries at COP24, which states that: “a just transition of the workforce and the creation of decent work and quality jobs are crucial to ensure an effective and inclusive transition”. We would expect more headlines along the lines of “Ex-steelworks to make wind farm parts in plan for 6,000 green jobs” (The Times, 21 March, 2020).

Reshoring or near shoring is likely to be high on the agenda of many corporates given potential issues highlighted with supply chains dominant in Asia. From a European perspective, this is likely to benefit the economies of Eastern Europe. Governments could help accelerate that with policies to encourage this and bring employment back into Europe.

A final change that appears highly likely is a global deal on digital tax with Yellen recently dropping a contentious part of the proposal (that it was voluntary) had been a stumbling block. Whilst there is still a long way to go, this could be a step towards levelling the playing field.

There is now an opportunity presenting itself to today’s politicians that was denied to governments in Europe during GFC due to the financial constraints resulting from the sovereign crisis. By using fiscal policy as well as monetary tools there is an opportunity to have a more robust economic recovery from the COVID-19 crisis than we saw in Europe from the GFC.

An environment of a period of above trend growth in Europe, aided by fiscal expansion, will likely provide a different investment backdrop than we have become used to over the last decade of anaemic growth and low inflation. We discuss some of these opportunities in our other pieces.

There is a delicious irony that responding to the impact of climate change (caused partly by the pursuit of economic growth) will require significant investment to transition our economies that can accelerate economic growth potentially for an extended period. Arguments about income inequality are unlikely to go away but they will likely diminish if we see investment in new economy job creation and rising incomes and wealth for all rather than a few.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 28 February 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.