Whither Brazil?

Recent headlines from Brazil have been very disappointing for those looking for continued signs that the government is committed to economic reform and liberalisation.

For those who missed it, following plans by the national oil company Petrobras to increase fuel prices, President Bolsonaro used Twitter to fire the CEO and declare that Brazil’s state-controlled companies should have a “social vision”.

This brought back memories of previous administration’s efforts to control fuel prices which HSBC estimate cost Petrobras between 50 and 80 billion US dollars in losses from 2011-14.

This has since led to a 23% decline in the market value of Petrobras and a ~7% decline in the value of the currency.

Before talking more about Petrobras and what this means for our positioning in Brazil, I thought it might be worth just reminding ourselves of the recent history of Brazilian equities.

The context

Ten years ago, Brazil was the largest single country weighting in the MSCI Emerging Markets Index, at over 16%.

Petrobras was the largest stock in the benchmark, with the market riding high on the back of surging oil prices.

Investors in Brazilian equities had just enjoyed a stellar 10-year return of over 400% in USD; nearly 18% per annum.

I daresay few then would have envisaged the following ten years being so painful.

Fast forward to today and Brazil constitutes little more than 4% of the benchmark and is smaller than each of the 4 mega-cap Asian technology companies (Alibaba, Samsung, Tencent and TSMC).

Lower commodity prices and a government corruption scandal have hit the market hard, which has fallen over 50% in USD terms over the last ten years.

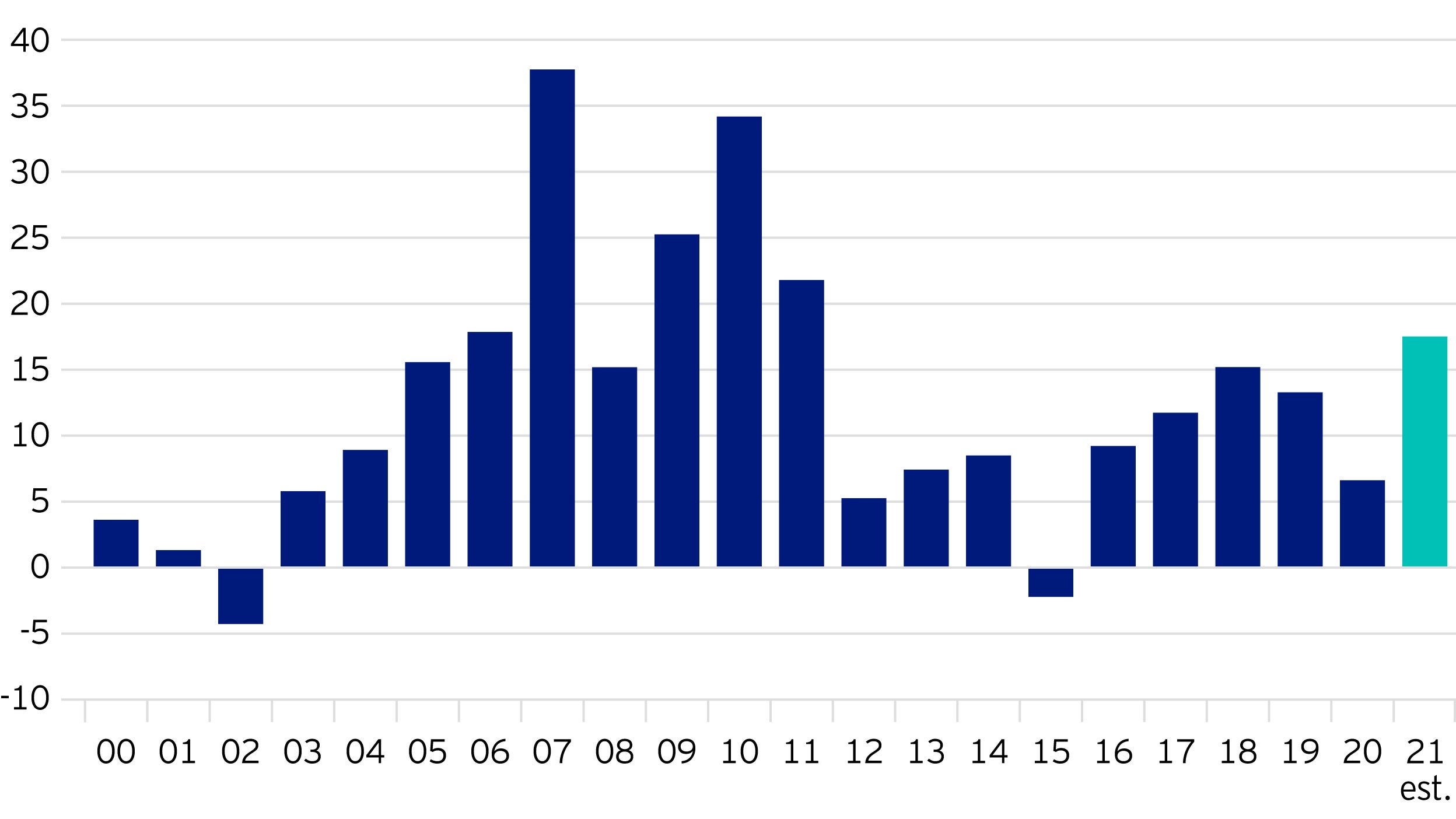

What’s remarkable is that the combined USD earnings of companies in the Brazilian index is expected to be roughly the same in 2021 as it was in 2006, capping 15 years of earnings stagnation.

Indeed, the decline in USD earnings over the last decade corresponds closely with the decline in the market: down more than 50%.

Positioning

Given this backdrop and our view that it is usually in unloved parts of the market where the best opportunities are found, we added two new Brazilian stocks to the Invesco Global Emerging Markets strategy in recent months.

Ambev is Brazil’s largest brewer and trades on a ~7% yield of normalised free cash flow, a big discount to global and emerging market brewers, whilst also having a net cash balance sheet.

Telefonica Brasil is Brazil’s largest telecoms company and is well positioned should we see market consolidation.

The stock trades on a 10% free cash flow yield with a ~7% dividend yield, again a discount to global and emerging market peers, whilst also having a lowly geared balance sheet, net debt is only 0.4X EBITDA.

Following these two purchases, taking the number of Brazilian stocks in the strategy to four (Petrobras and Banco Do Brasil were the other two), the strategy had been very slightly overweight Brazil before the Petrobras debacle.

Petrobras

The investment case for Petrobras was built on the idea that there were huge improvements to be had, if the new management team were allowed to grasp them.

These included focussing on their extremely low-cost pre-salt wells, disposing of their volatile refining assets, cutting costs, improving its ESG standing and ultimately cutting debt so that Petrobras could return to paying a dividend to shareholders.

Given that President Bolsonaro was elected on an explicit mandate for economic reform, and Petrobras was the most obvious candidate, we felt that this ultimately was likely to be good for the company, its governance and its shareholders.

Indeed, up until very recently the company had been following the new strategy clearly and was making good progress on these initiatives, until President Bolsonaro’s intervention.

The new CEO of Petrobras will be a former army general who has no experience in the oil industry.

With hindsight, it’s probably fair to say that the investment case ultimately relied on a belief that “this time it’s different”; apparently the four most dangerous words in investing according to John Templeton.

The company possesses world class assets and trades at a large discount to most global oil companies.

Nevertheless, we felt that the investment case had changed and so we decided to sell, even at a substantial loss.

Looking forward

The future for Brazil and its equity market feels closely entwined with the effectiveness of government.

With a weak fiscal position, we believe the currency is vulnerable to policy errors and this prevents investment in the economy.

As such, the importance of a continued push for economic reform that cuts costs for businesses and leads to greater investment, cannot be overstated in our view.

As ever our positioning will be led by bottom-up considerations and if there is one lesson from our investment in Petrobras, it would be to focus on companies in Brazil who have a greater degree of control over their own destiny.

Related articles

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Past performance is not a guide to future returns.

As a large portion of the Global Emerging Markets strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in the value of the strategy. The Global Emerging Markets strategy may invest in certain securities listed in China which can involve significant regulatory constraints that may affect the liquidity and/or the investment performance of the strategy.

The strategy may use derivatives (complex instruments) in an attempt to reduce the overall risk of its investments, reduce the costs of investing and/or generate additional capital or income, although this may not be achieved. The use of such complex instruments may result in greater fluctuations of the value of a portfolio. The Manager, however, will ensure that the use of derivatives does not materially alter the overall risk profile of the strategy.

Important information

-

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where Charles Bond has expressed opinions, they are based on current market conditions, may differ from those of other investment professionals and are subject to change without notice.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.