What is the point of Relative Value?

Over the past few years, we have been regularly asked, what is the point of investing in relative value ideas? Prior to Covid-19, investors benefited from world markets that were more directional, where volatility was low and/or falling and with many investors incessant search for yield, there was an argument to be made that relative value investing could potentially dampen returns.

Our absolute return portfolios1 have moved towards holding more relative value ideas over the last few years. Equity valuations haven’t been categorically cheap, in our view, so to help reduce some of the risks associated with the potential for more sustained periods of equity market falls, we have looked for alternative ways to express our investment ideas in our portfolios. Whilst we have generated good returns from many relative value ideas, with the benefit of hindsight, tilting the portfolios to more equity exposure in the last few years would have been very profitable. However, 2020 has been an important reminder on the usefulness of relative value investing; had we increased our directional tilt in the portfolios, it would have hampered our ability to preserve capital to the extent we did during the extreme volatility brought about by Covid-19 in Q1 2020.

It is important to emphasise, we do not aim to be a proxy equity strategy, rather we invest with a set of objectives in mind, which aims to deliver targeted returns with less than half of the volatility of global equities, over rolling three year periods. Inherent in these targets is our goal to stay below the volatility target in all market environments, by building a truly diversified portfolio that aims to preserve capital during crisis periods.

Following numerous questions from our clients around relative value ideas, we have asked Steve Hawes, Multi Asset Deputy Fund Manager, to answer some of the most frequently asked ones. He directly relates his answers to ideas included in our Invesco Global Targeted Return strategy.

Q. If all equity markets are moving higher, can you really make money in equity relative value ideas?

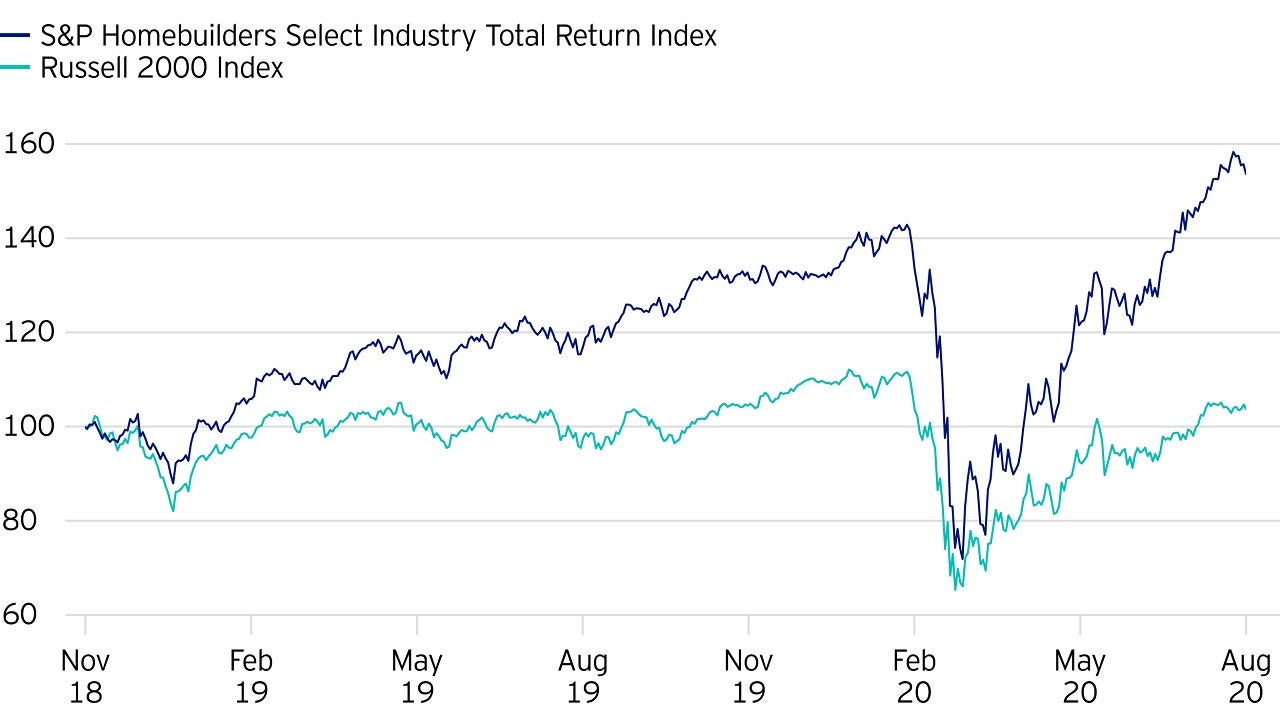

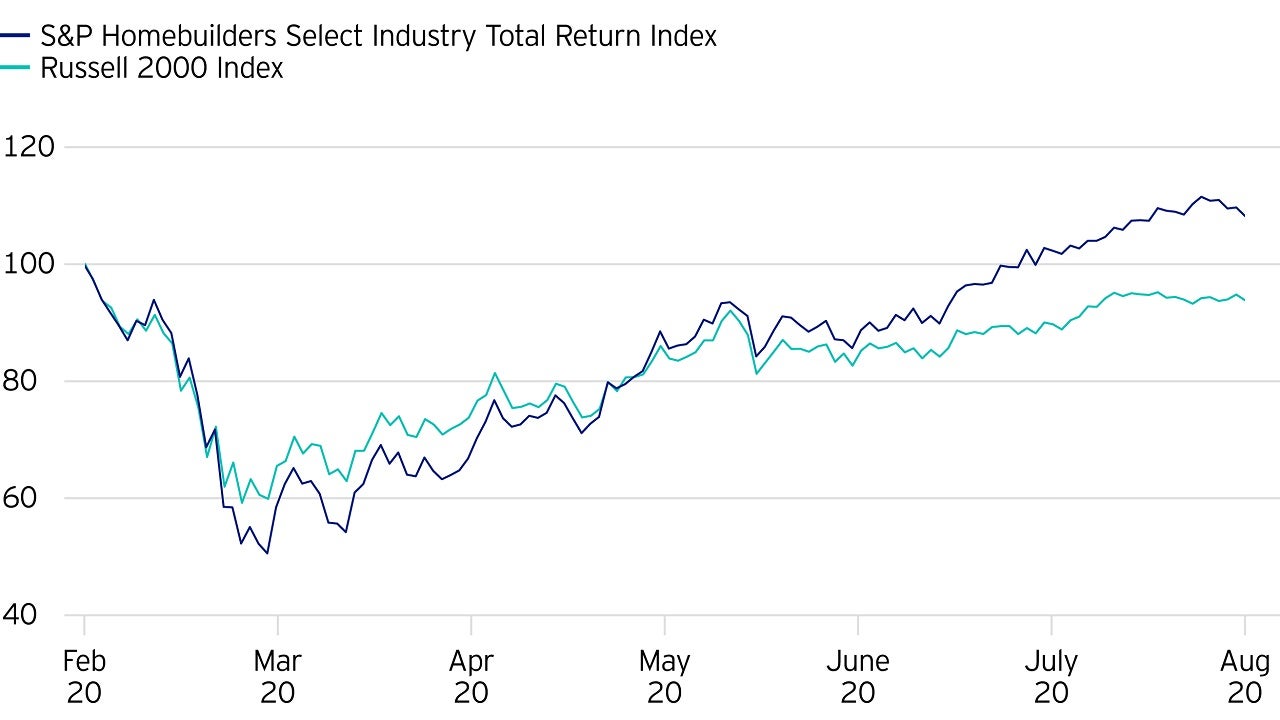

A. One idea initiated in October 2018 included buying US homebuilders relative to selling US Small caps. At the time, housing data in the US was very poor and many believed that it didn’t have much chance of improving. However, we thought the homebuilders equity index was significantly undervalued. Even if the poor fundamentals remained, the sector was unloved and in an equity rally, we believed the homebuilders could outperform. Additionally, we judged that housing data in the US would pick up whilst mortgage rates would remain lower to help support the consumer and this gave us reason to believe there was additional upside to the idea. However, we understood that in an equity downturn, the US homebuilders index could be highly sensitive, even with its depressed valuations. As such we paired it against the Russell 2000 index, where we believe a number of the smaller companies in the index have fairly weak balance sheets and expensive valuations.

Since initiating the idea, the homebuilders index has made 51% whilst the Russell 2000 is up 2% (to 04/08/20), which means the relative value idea of buying the homebuilders index versus the Russell 2000 has returned 49%; a stellar performance2. During the fall in H1 2020, an outright long in the Homebuilders fell 42% whereas our relative value idea only fell 9%, demonstrating its risk mitigation characteristics – it proved to be very useful in the downturn. By pinpointing the exposure in this relative value idea, we didn’t have to try and time the bottom in the market or tactically trade in and out of our position. Rather, this pairing has enabled us to stick to our usual 2-3 year timeframe and has resulted in us benefiting from homebuilders outperforming the Russell 2000 by 13% from the peak of the equity markets in February 2020 (to 04/08/20).

Q. How do you make money from interest rates with rates so low in many large bond markets?

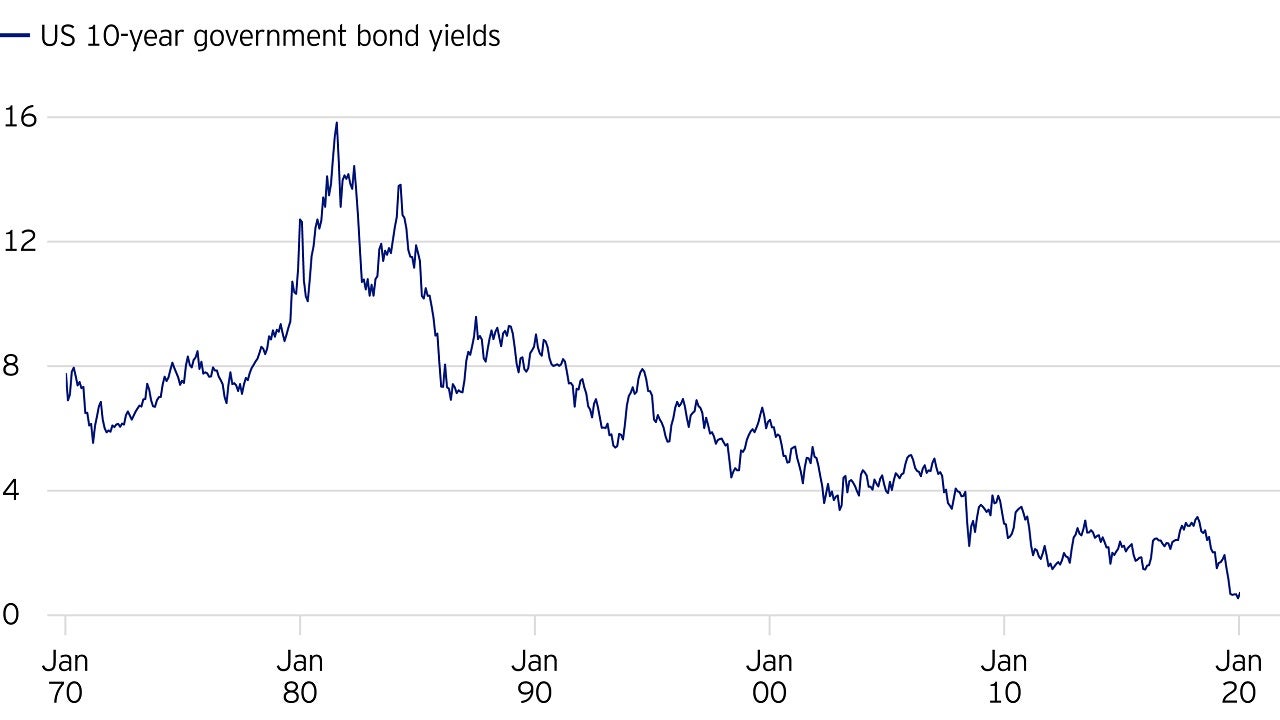

A. We have maintained our long held ‘lower for longer’ interest rate view which at times has been very consensus, and at times has felt we were fighting the crowd. Interest Rates have been rallying since the early 1980’s when US 10-year government bond yields peaked at around 16%, however over that timeframe there have been mini cycles where interest rates moved higher. This has been a point of great debate within the team and between the team and our broker counterparts, but we have maintained our view that despite bond yields marching boldly past the lows of the global financial crisis in 2008/9, there was room for them to move even lower.

Taking advantage of anomalies – Interest Rates: Yield compression

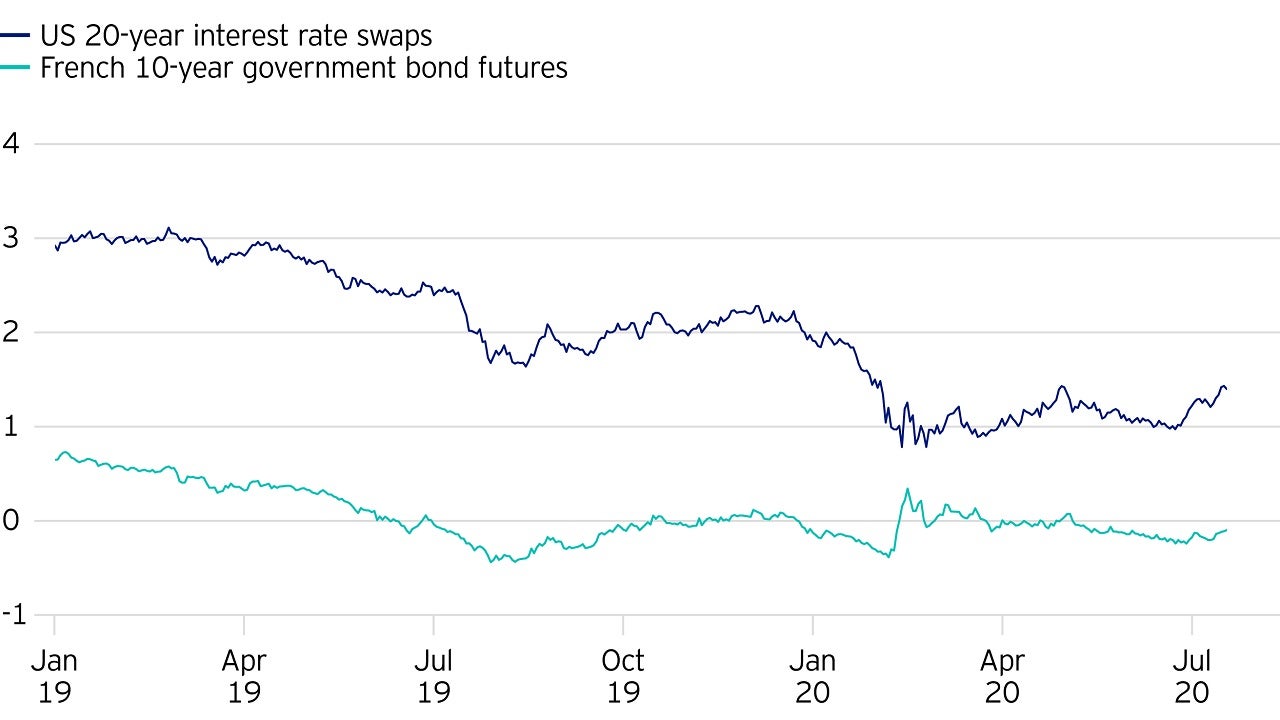

We could of course be wrong on our lower for longer view through a more dynamic growth outlook being priced into markets or dare we say it some inflation starting to come back into the global economic system. Therefore instead of being too fixated on continuing to express our lower for longer view in our portfolios, a relative value idea which takes advantage of ‘anomalies’ in interest rate markets made a lot of sense to us. We identified that the long end of the US yield curve looked attractive in terms of the outright levels of yields given the US curve looked steep and bank rates still potentially had further to fall. We took a long position in US 20-year interest rate swaps and paired this with a short position in French 10-year government bond futures. We believed European bank rates had likely troughed, the French versus German spread was tight, and with the Gilet Jaunes protests continuing, French yields looked vulnerable and were a prime candidate to move higher.

This steadily worked in our favour throughout 2019 when yields fell and again, aggressively worked for us as the Covid-19 crisis hit and the Federal Reserve significantly cut the Fed-funds rate. Whilst the spread compression has reversed a little from the lows in March 2020 the idea has made a healthy return as the spread compressed by circa 120bps in Q1 2020. We have since changed the implementation of this idea.

Q. Given the incessant search for yield, why dampen yield potential by using relative value?

A. Granted, when looking for yield, using relative value trades often reduces the amount of yield that is available because you receive the yield on the instrument you are buying, but pay out the yield on the instrument you are selling. However, a significant benefit is that this approach allows you to take positions in ideas which you might be unwilling to pursue as a pure directional idea, due to the higher levels of risk that it would be adding to your portfolio. To illustrate, in a lower growth, lower rates world we found opportunities to take relative value positions in what we deemed ‘good’ Emerging Markets vs ‘bad’ Emerging Markets, thereby looking to profit in positive and negative scenarios both globally and for Emerging Markets.

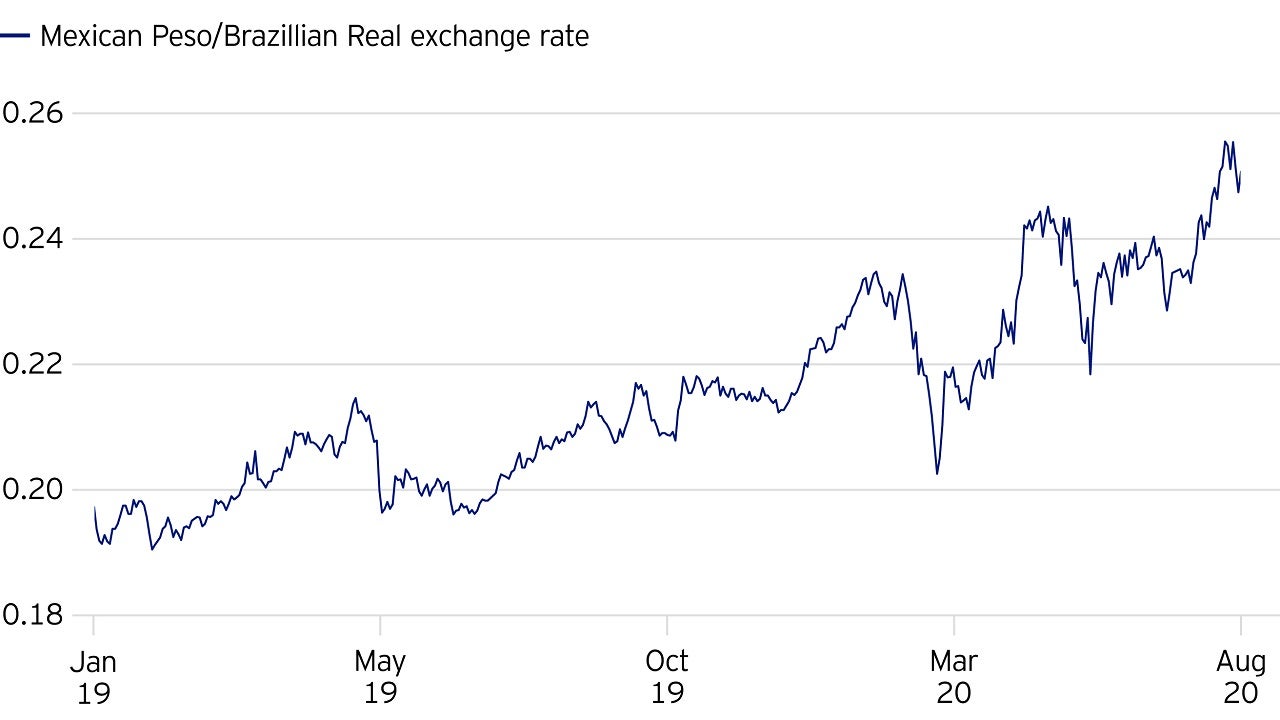

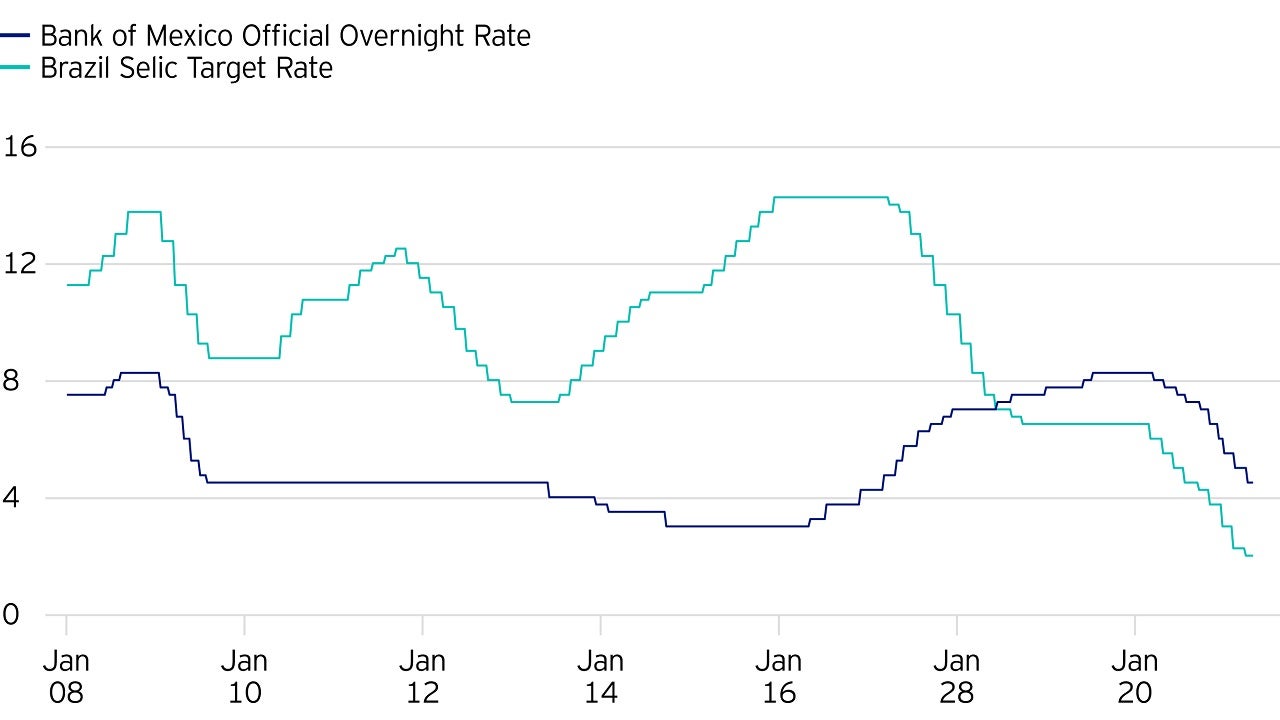

Search for yield – Currency: Mexican Peso vs Brazilian Real

The Mexican central bank hiked rates aggressively from 3% to 8.75% from 2015-2018 with the aim of protecting the Mexican Peso from a further large sell off on the back of President Trump’s election win, but also to attempt to stave off any further inflationary pressure from a weak Mexican Peso and localised gasoline tax hikes. At the time, market reaction to President AMLO’s appointment was negative and against a backdrop of low growth and inflation starting to fall, we established there was an opportunity to take advantage of the high yield on offer with the potential off some capital gain.

Importantly, we were cautious on Emerging Markets and aware of a number of issues relating to Latin America, which could de-rail our thesis. To mitigate these concerns, we paired the Mexican Peso long with a short position in the Brazilian Real, which conversely had all-time low interest rates which were falling, sentiment was at all-time highs following the election of President Bolsonaro and the currency had strengthened. Moreover, we were in a unique position to take advantage of this pair trade yielding positively because interest rates were higher in Mexico versus Brazil, whilst also taking advantage of anti-consensus dynamics which we felt would reverse in our favour.

In 2019, this currency pair moved in our favour, delivering 10% capital gains and yielding 2.75%. Interestingly, for 2020 calendar year to date (to 4/8/20), despite the Mexican Peso having lost 17%, the currency pair has made 10% capital, again with an annualised yield of 2.75%. By comparison, had we held the long Mexican Peso versus the US Dollar, whilst we would have earned a higher yield, the total return including the yield would have been circa -10% (to 4/8/20).

Multi asset investing is tough, but in our view one way to navigate these challenging market conditions is to have as many tools in the toolkit as possible – relative value investing is just one, but is a very important one which we are using more and more to express our ideas in the portfolio.

In conclusion, we have clearly been through a volatile period in 2020 and these examples of relative value ideas performing their dual functions of providing positive returns and reduced volatility compared to more directional expressions, demonstrates the value of including this form of implementation in a portfolio.

Relative value trades remain an important part of our toolkit as we foresee continued volatility and variable market outcomes going forward, which provides us with greater chance of achieving our strategy objectives in any market/macro outcome.

Footnotes

-

1 This consists of portfolios managed under the Invesco Global Targeted Returns strategy.

2 Performance is based on USD returns of the index. All returns stated in this article are gross of fees.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Changes in interest rates will result in fluctuations in value.

The strategy uses derivatives (complex instruments) for investment purposes, which may result in a portfolio being significantly leveraged and may result in large fluctuations in value. The strategy may hold debt instruments which are of lower credit quality which may result in large fluctuations in value.

As a portion of the strategy may be exposed to less developed countries, you should be prepared to accept large fluctuations in value.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.