I saw three ships: peak inflation in the UK?

‘I saw three ships come sailing in / On Christmas Day, on Christmas Day / I saw three ships come sailing in / On Christmas Day in the morning’

When we talk to UK companies, a consistent theme is that logistical challenges around shipping are a key driver of inflation. There simply isn’t the availability of products and materials that rely on international trade.

Fundamentally the world’s shipping fleet hasn’t suddenly gone missing. It is just tied up in the wrong places, or else is struggling to move. But it will do, eventually.

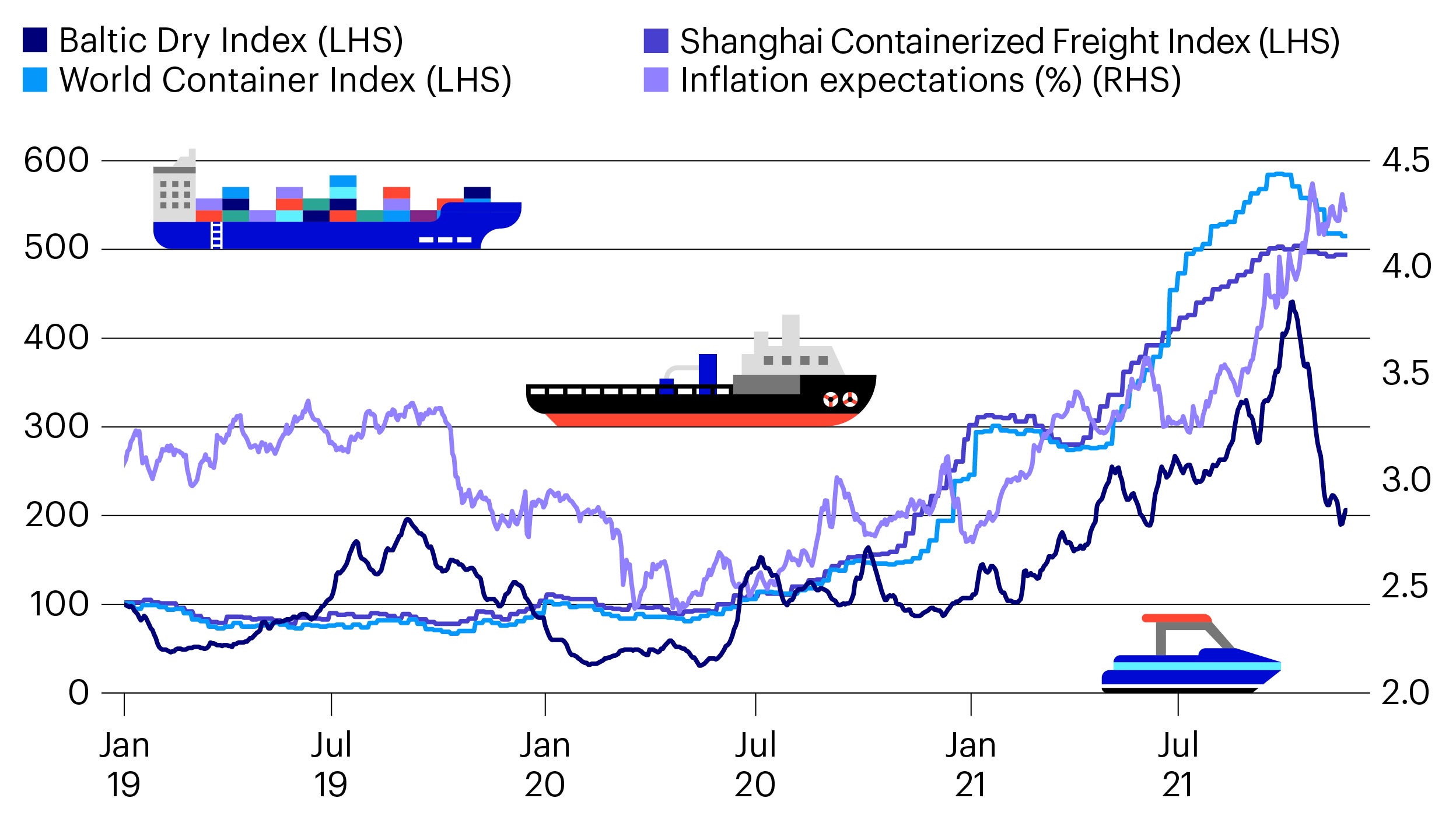

Figure 1 shows three key shipping price indices: the Baltic Dry Index, the World Container Index, and the Shanghai Containerized Freight Index. This data suggests that logistics pricing may have just peaked.

If this is the case, then there is at least cause for hope that UK inflation data will start to come down soon after the seasonal decorations.

Source: Bloomberg as of 23 November 2021. Shipping data (LHS) all indexed to 1 Jan 2019 =100. UK Breakeven 5 Year Index (RHS) represents inflation expectations.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Related insights

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.