Navigating troubled waters with liquid alternatives

Asset allocators are faced with developed market government bonds yielding virtually zero and developed equity markets trading on more than 20 times historic 2019 earnings. We believe this means alternative assets, both liquid and illiquid, can have an increasing role to play within portfolios – for their return profile but also to diversify against the inherent risks of expensive traditional asset classes.

For global investment markets, the past decade has seen a number of structural themes play out. These have included: the dominance of the central bank reaction function; big tech (which favours US over non-US stocks); the Japanification of developed economy bond markets; and, less production and investment demand for the commodity complex.

The impact of Covid-19 reinforced some of these themes when in the second quarter of 2020, investors witnessed some of the strongest rallies in 30 years in benchmark indices for US large caps, US tech stocks and US investment grade credit. Within this context, we explore the outlook for liquid alternatives.

The Japanification of bond markets

A significant structural positive for both traditional and many alternative assets (both liquid and illiquid) has been unabating march of government bond yields towards zero. This Japanification of developed economy bond markets has continued and been accelerated by the Covid-19 crisis - the average 10-year interest rate for major developed economies is now sub 1%, curves are flat and bond volatility is low.1

As a result, income-producing assets should be in vogue. In public markets, this can be seen in the compression of investment grade and, to some extent, high yield spreads. However, alternative strategies such as long/short, multi strategy, event driven, CTA funds/managed futures, arbitrage, macro, real estate, infrastructure and natural resources are also partly sought for long-term income streams and as such should gain attention and assets.

It should be flagged that the current low level of yields underpins a deflationary bias of investors or at least a view that inflation is not a risk. The short-term loss in aggregate demand brought about by the Covid-19 lockdowns is likely to be the overriding factor in the inflation outlook. We believe that fiscal spending, even of the magnitude normally reserved for war time, is unlikely to have the equivalent inflationary impulse given that fiscal spending is replacing lost demand rather than increasing overall demand.

As such this could be a structural hindrance to real estate, infrastructure and commodities given the muted requirement for inflation protection.

Private Credit could be a beneficiary of the continued search for yield, however, balance sheet quality in private credit is likely to remain a pressing issue. For example, over the past few years, nearly 50% of the US issuance in levered loans has been at close to 9x net debt / EBITDA, once you strip out EBITDA writebacks.2

While the post-Covid-19 environment may diminish the appeal of some alternatives, it could strengthen the case for some. The negative economic outlook could undermine Private Equity and Credit as earnings falls, default risk and funding costs rise and the IPO market becomes more challenging, especially given the huge variation in sector / stock valuations between public and private markets.

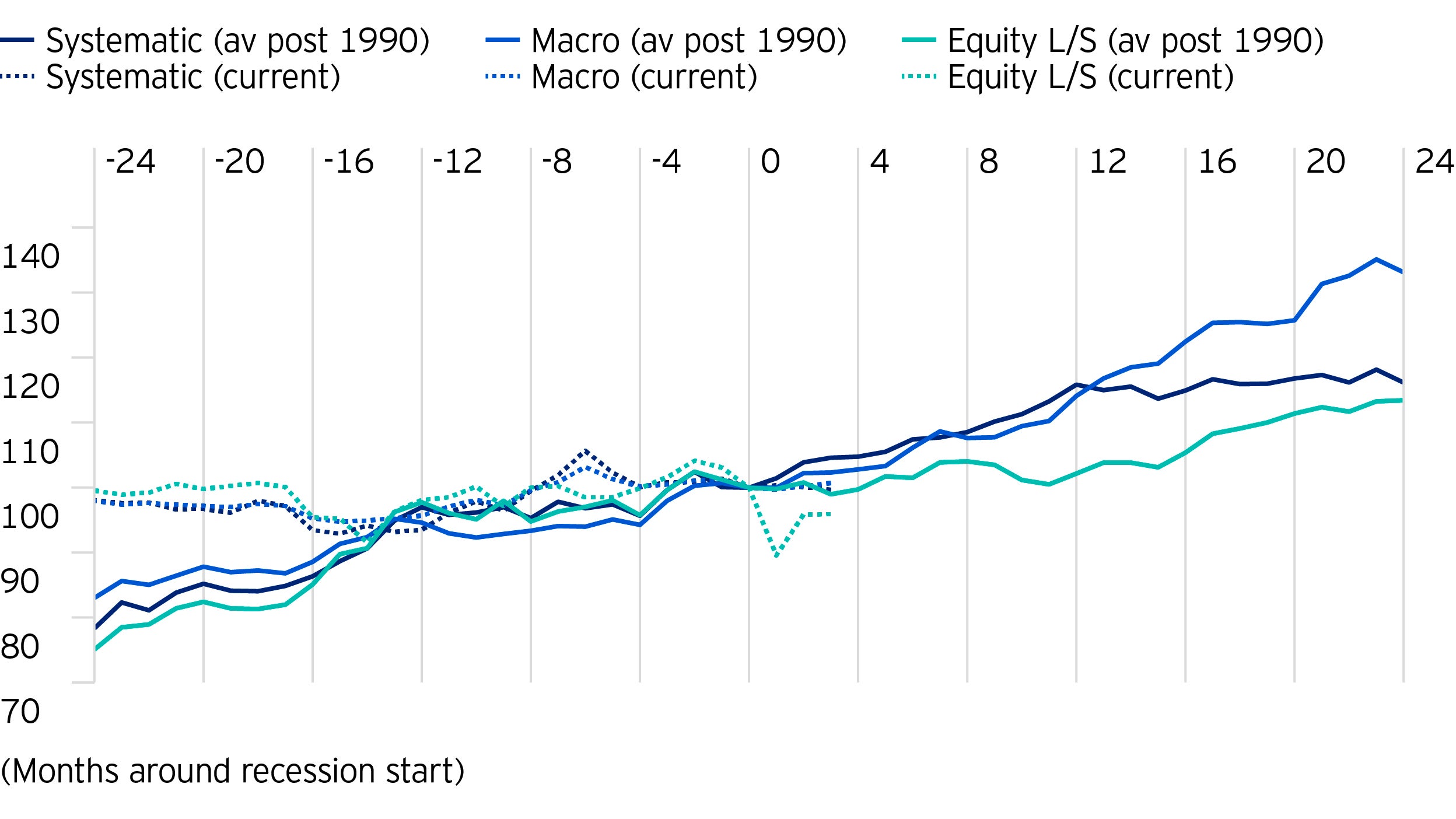

By contrast, this cyclical environment could prove more profitable for styles with more flexible investment mandates. This could explain why some strategies, like Global Macro strategies, have generated stable returns during recessions and stronger ones thereafter, which is supported by some recent research by the investment bank, J.P. Morgan.

The chart below provides an interesting narrative that Global Macro strategies tend to underperform heading into a recessionary environment but outperform post. There could be numerous reasons for this aggregated performance.

However, one theory is that the increasing caution of macro investors towards the end of a cycle limits their participation in the last throes of financial markets but makes them better placed and positioned to benefit from a recessionary environment when it starts.

Liquid vs illiquid alternatives: drawing the distinctions

Assets under management for private markets tripled in the last expansion (2009-20), exactly as hedge fund assets tripled during 2001-08. Though private debt and private equity both doubled over the last five years, it was Private Equity that accounted for most of the nominal growth, with an estimated AUM of about $4.5trn up from $2.2trn at the end 2014 - now a third larger than Hedge fund AUM of $3.2trn as at 31 July 2020.3

Over the last decade, institutional investors such as pension funds, sovereign wealth funds and US endowments have warehoused more illiquidity risk. While warehousing more illiquidity risk is not a problem for such long-term investors in normal market conditions, the lesson from 2008 is that it can become a big problem during crises.

At the time, certain institutional investors facing cash flow problems were forced to offload illiquid investments such as private equity at very high discounts to net asset value, sometimes as high as 50%.

The quest for private assets over the past few years not only reflects the search for yield by pension funds, which have been seeing the income from their fixed income investments diminishing rapidly in recent years, but it also reflects an effort to diversify public investments. Importantly, this should also be true for liquid alternatives given their ability to diversify traditional asset class exposures of equities and fixed income.

Time will tell whether the Covid-19 experience increases investor preference for liquidity in the interest of building resiliency. The severity, depth and breadth of the economic recession coupled with the incredible moves in financial markets and ongoing higher levels of volatility, are bound to have a lasting impact on risk perceptions, especially as traditionally non-cyclical sectors have also lost their immunity to this virus-led economic downturn. De-risking and a move into liquid assets can be seen clearly in US fund flows where there has been a 19.4% increase in money market fund AUM year-to-date.4

In addition, if the alpha of private markets stumbles over the next few years, either under the weight of its own asset growth, as occurred with hedge funds post their AUM growth, or due to the economic and market situation that arises over coming years, then allocations to illiquid alternatives may not continue along the trend seen over the past decade. Against that backdrop, one would expect liquid alternatives should return to the spotlight.

Though the diversification benefits of alternatives have been a cause for debate in investment literature, we believe that a liquid alternative, could help clients diversify and mitigate risk.

Footnotes

-

1Source: Bloomberg.

2Source: UBS.

3Source: JP Morgan.

4Source: BofA Merrill Lynch.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.