Measuring climate risk

Traditionally, assessing a location’s vulnerability to future climate events was the remit of a handful of skilled professionals, such as actuaries or academics. It required access to private datasets plugged into specialised software.

Today, awareness of climate risk – and interest in it – is growing. This has broadened the demand for these tools.

Recent advancements in geospatial modelling techniques coupled with the emergence of open-source data and software has helped proliferate the climate risk services available to businesses and organisations.

To understand the exposure of Invesco Real Estate's (IRE's) global property portfolio to climate change risk, we needed a tool which could provide consistent and robust scoring across countries, regions and sectors.

Moody’s ESG Solutions (previously Four Twenty Seven) is a leading provider of physical climate and environmental risk analysis. Its climate risk application is well suited to a globally diversified asset manager like IRE. We introduce its methodology below.

Third-party ESG data

Moody’s methodology is data driven and draws on large public and private databases to generate more than 25 underlying risk indicators. Each of these is linked to a known business consequence of climate change.

Scores are forward-looking and focus on thresholds near the tail end of the risk distribution. This is because such events are the most likely sources of disruption and damage – especially as extreme events grow in severity and frequency.

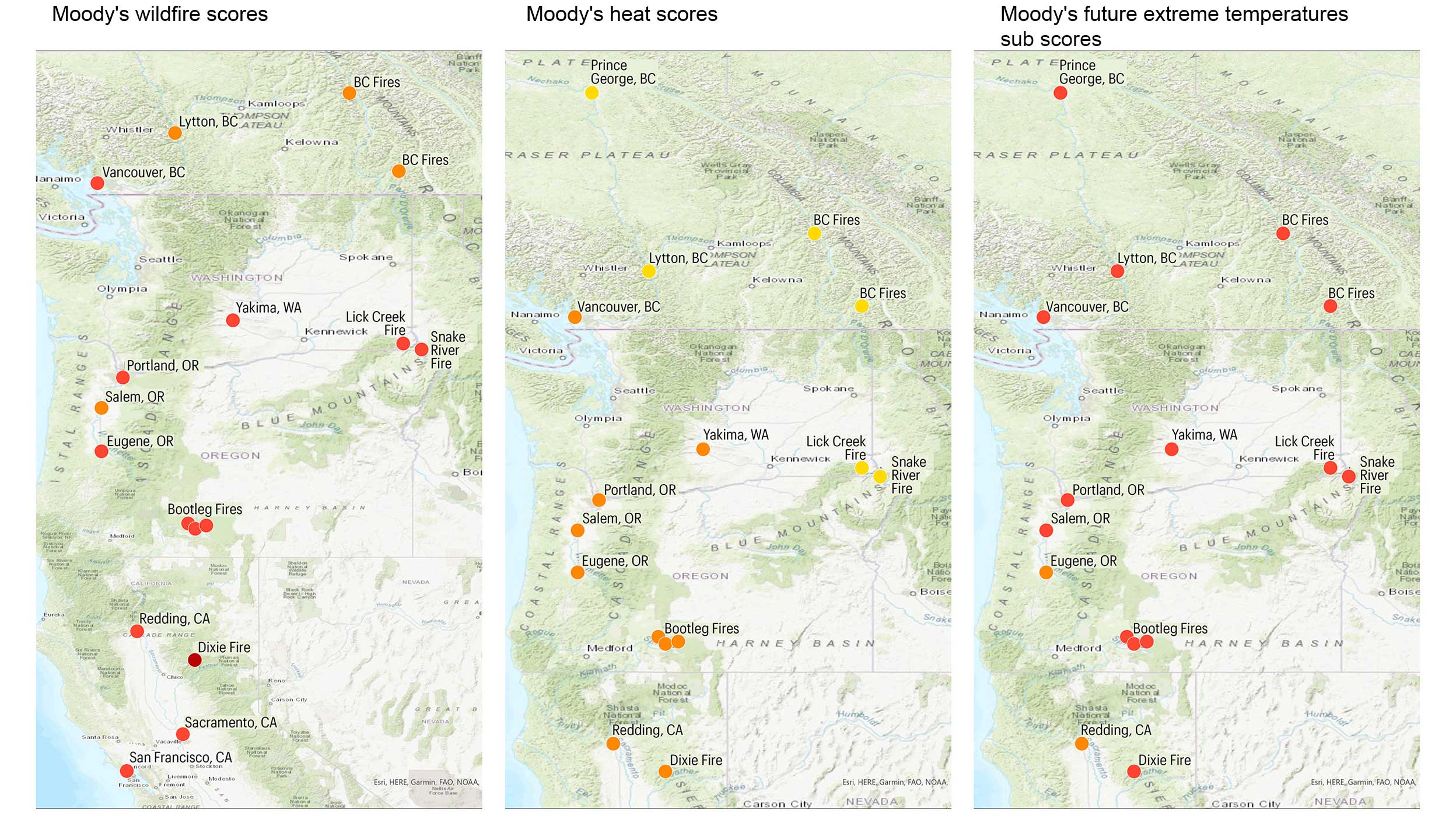

High level risk indicators in Moody’s service include exposure to floods, heat stress, hurricanes and typhoons, sea level rise, water stress, wildfires, and earthquakes. Earthquakes are a geological hazard rather than a climate risk, but they have also been included in response to client demand.

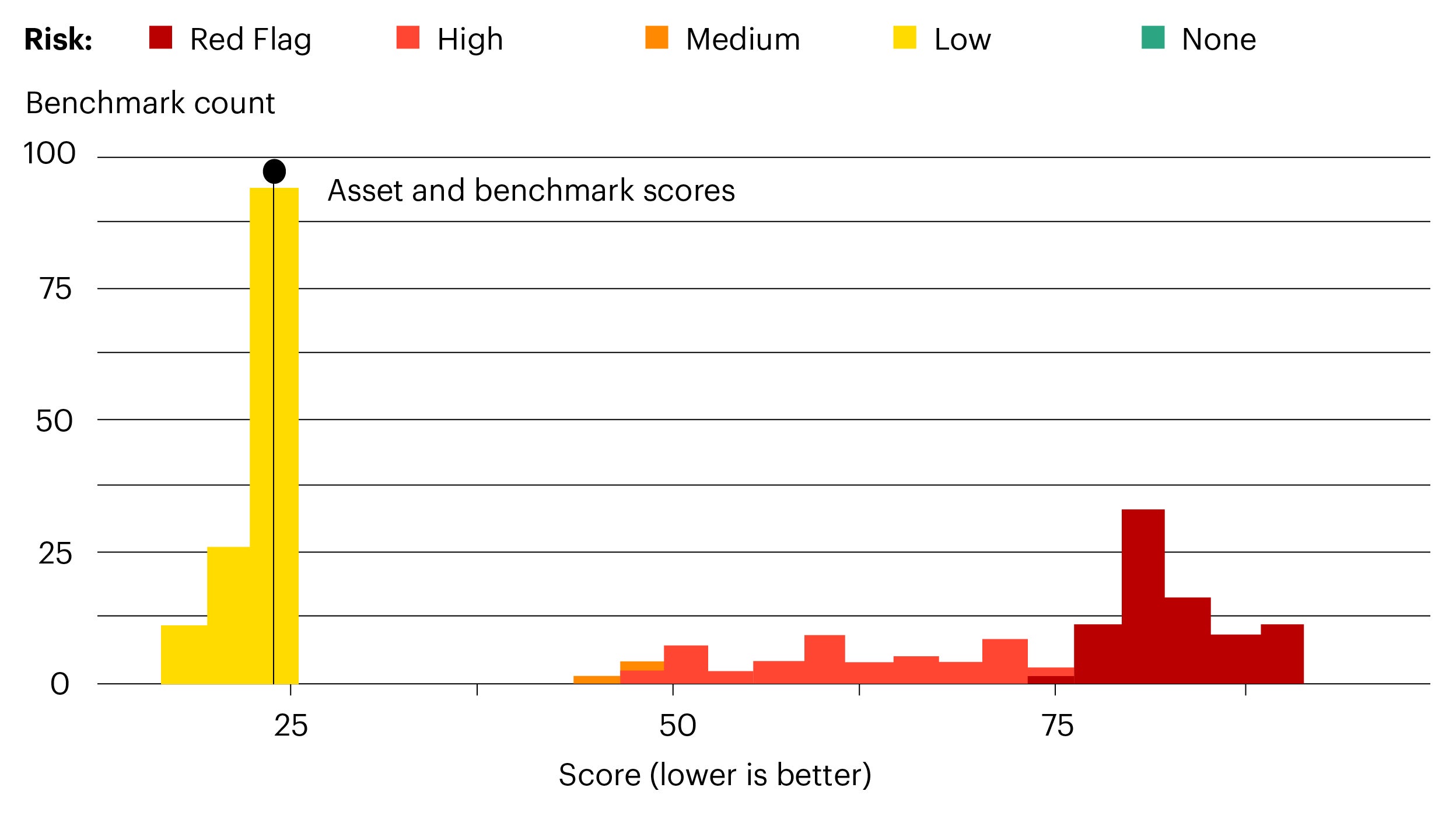

Moody’s risk scores are standardised (ranging from 0 to 100) and globally comparable. The assigned risk levels (none, low, medium, high, red flag) aid interpretability. For example, a flood risk score of 70/100 is high-risk. It means a location is susceptible to some flooding and inundation during rainfall or riverine flood events.

Subcategory metrics are also available. These include expected flood return period (i.e., flood frequency in years), rainfall intensity and inundation level from a one-in-one-hundred-year flood.

Democratising climate risk data

The Moody’s tool can be used to evaluate climate risk exposure in almost any location across the globe. We can use it for all of IRE’s direct real estate holdings. This equates to more than 500 commercial assets across North America, Asia, Oceania and Europe.

Moody’s subscription-based model allows users to generate location-specific climate risk scorecards. These reports are detailed and valuable. However, at IRE, we have optimised their use by building additional tools to better visualise and disseminate the data.

Previously, the information could not be easily accessed by the wider IRE teams, who did not have a Moody’s ESG login.

To leverage the information for better investment and asset management decision-making, we needed to democratise our climate risk process.

This meant streamlining the delivery of information to our transaction teams (who appraise asset acquisitions) and our fund management teams (who look after existing assets and funds).

The solution found by IRE’s strategic analytics team was a climate risk dashboard. This links directly to Moody’s database and allows users to instantly identify the climate risk exposure of each location they enter.

The dashboard displays the risks that relate to our portfolio assets. It also summarises and filters the risks by fund, using maps and charts to highlight key information.

Benchmarking asset risk

Investments do not exist in a vacuum.

While the clear first step is to democratise the asset-level data, we can gain insight into the relative risk by considering how one investment compares to another. We can achieve this by benchmarking an asset’s climate risk against other locations in the surrounding area.

A well-located property with access to plenty of amenities might see its locational benefits outweigh its climate risk. However, it might be more ideal to own a relatively less risky asset in the same area to minimise the climate risk while enjoying the benefits of the amenities.

We benchmark our assets using Moody’s ESG scoring system, applying it to strategically generated sample points within a boundary of interest (submarket, block group, and so on).

With a series of sample points now available, the scores can be summarised at the defined boundary levels, with individual asset scores placed within the distribution.

Figure 4 shows a building in Tokyo and how its flood risk compares to the surrounding area. In this location, the low score suggests the asset is not particularly exposed to flood risk.

However, as the distribution in Figure 4 shows, there are parts of Tokyo with high-risk values. This suggests that the sample building is a well-positioned asset, close to amenities, but far enough away from low-lying areas to avoid being too risky.