Investing beyond Brexit – Multi Asset opportunities

Uncertainty has weighed on UK assets since the Brexit referendum back in 2016. The broad issues are threefold: What will be the ultimate impact on growth, will consumers and companies have to absorb higher costs via tariffs and thirdly will foreign inflows into the UK wane in light of our separation from the EU. These three issues will impact all UK asset types – equities, bonds, currency and inflation.

However, growth, inflation and the relative attractiveness of UK assets are also impacted by the ongoing Covid-19 situation which means even beyond the Brexit deadline there is still a high degree of uncertainty, but also investment opportunities.

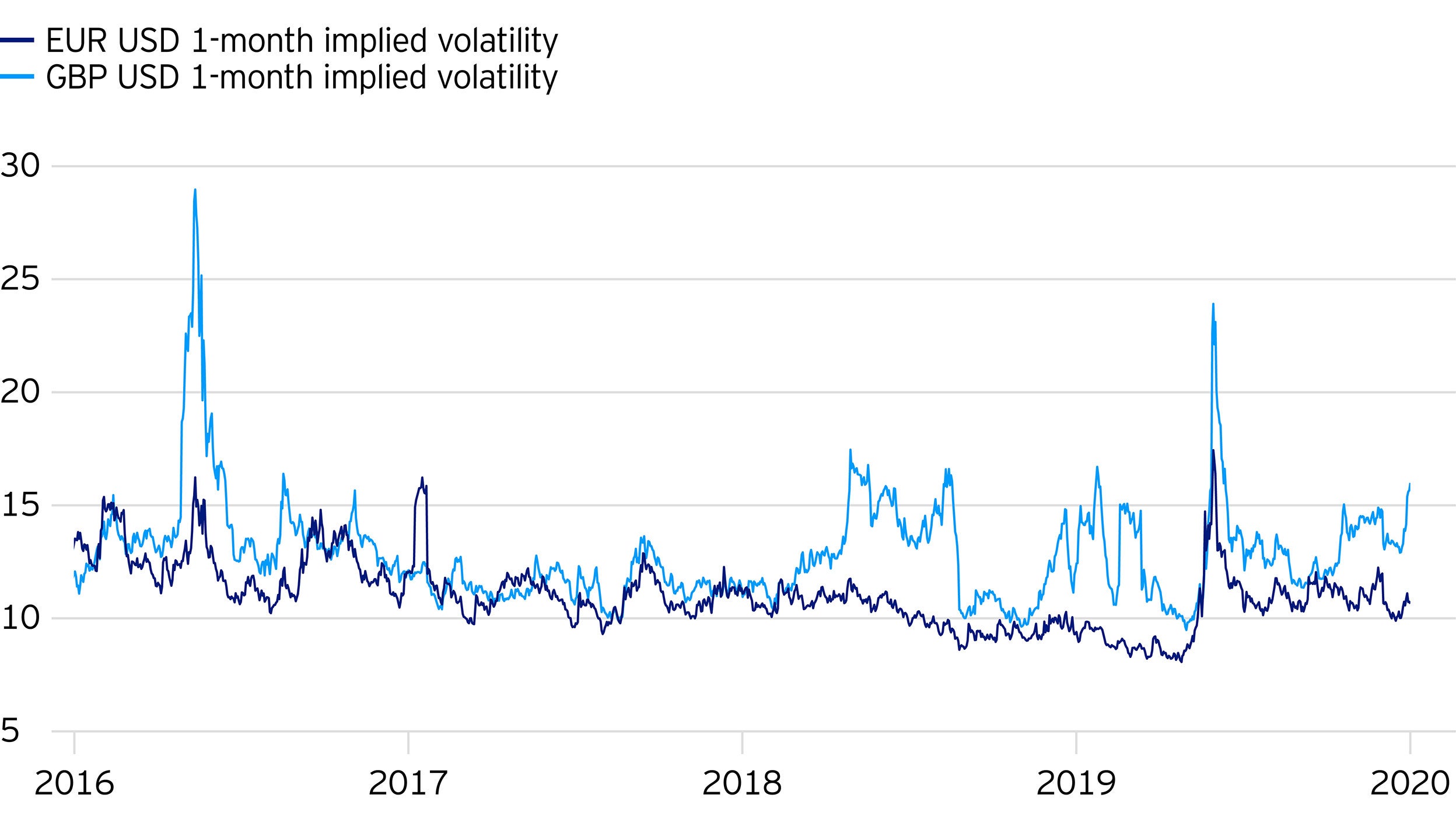

In our view, sterling has best reflected shifts in sentiment on the ultimate Brexit outcome which is captured in higher volatility being priced into sterling versus US dollar relative to other currency pairs such as euro versus the US dollar. Figure 1 shows 1-month implied volatility from the options market for both currency pairs – the volatility of sterling versus US dollar is almost twice the level of euro versus US dollar.

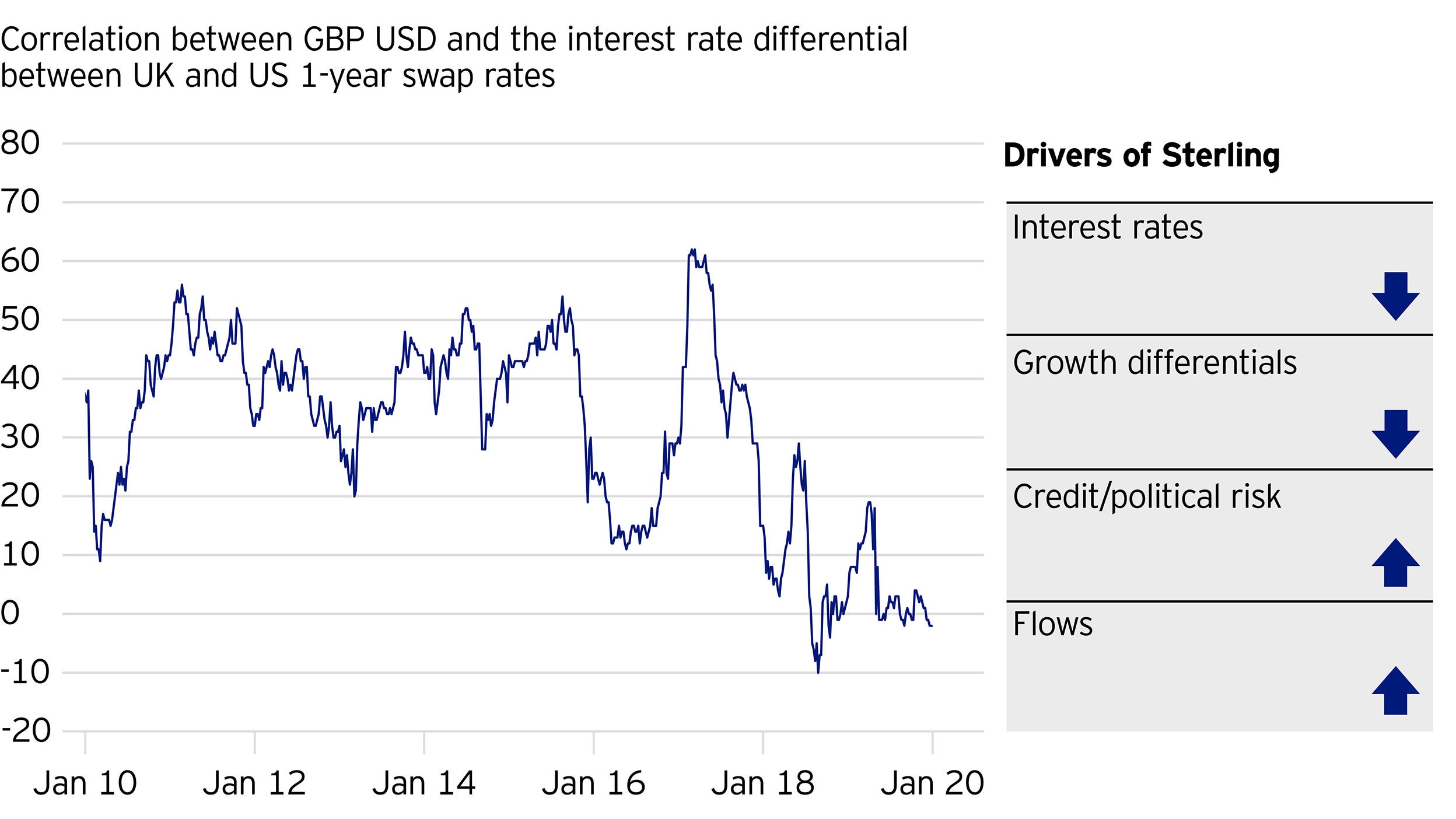

For currencies there are broadly speaking four key drivers. Firstly, what interest rate are you receiving in one country versus another – the ‘carry’ available. Secondly, what is the potential growth available in the country which could then drive another important component of taking a view on currencies which is the flow of money around the world. And finally, what political risks could weigh on a currency and cause capital to exit a country, or at the very least, force investors to demand a cheaper valuation of the currency to tempt them back into that market. Figure 2 on the left shows that interest rate differentials are not a key driver currently – the correlation between interest rate differentials and moves in the currency is now around zero. This makes sense in a world where interest rates in so many developed market countries have converged to around zero. This then places more emphasis on flows, growth and political risk as drivers of currency moves. Given ongoing Brexit uncertainty coupled with economic pressures from Covid-19, we believe sterling could remain weak until some of the uncertainty starts to meaningfully reduce. In our view despite a potential deal being done by end December, the economic consequences of Brexit remain unclear.

Aside from sterling there are differences in what is priced in more broadly for European versus UK assets. From an equity market perspective, UK equities do stand out as cheaper than their European counterparts. This is likely reflecting some concern over Brexit but equally the sector make-up of the UK market is different to Europe and the underperformance globally of Energy has acted as a drag on the UK market. In addition, some of the consumer oriented stocks have been particularly impacted by the pandemic. However, if sterling does remain relatively weak, this could provide a support for the UK equity market given the overseas exposures of so many of the UK listed companies.

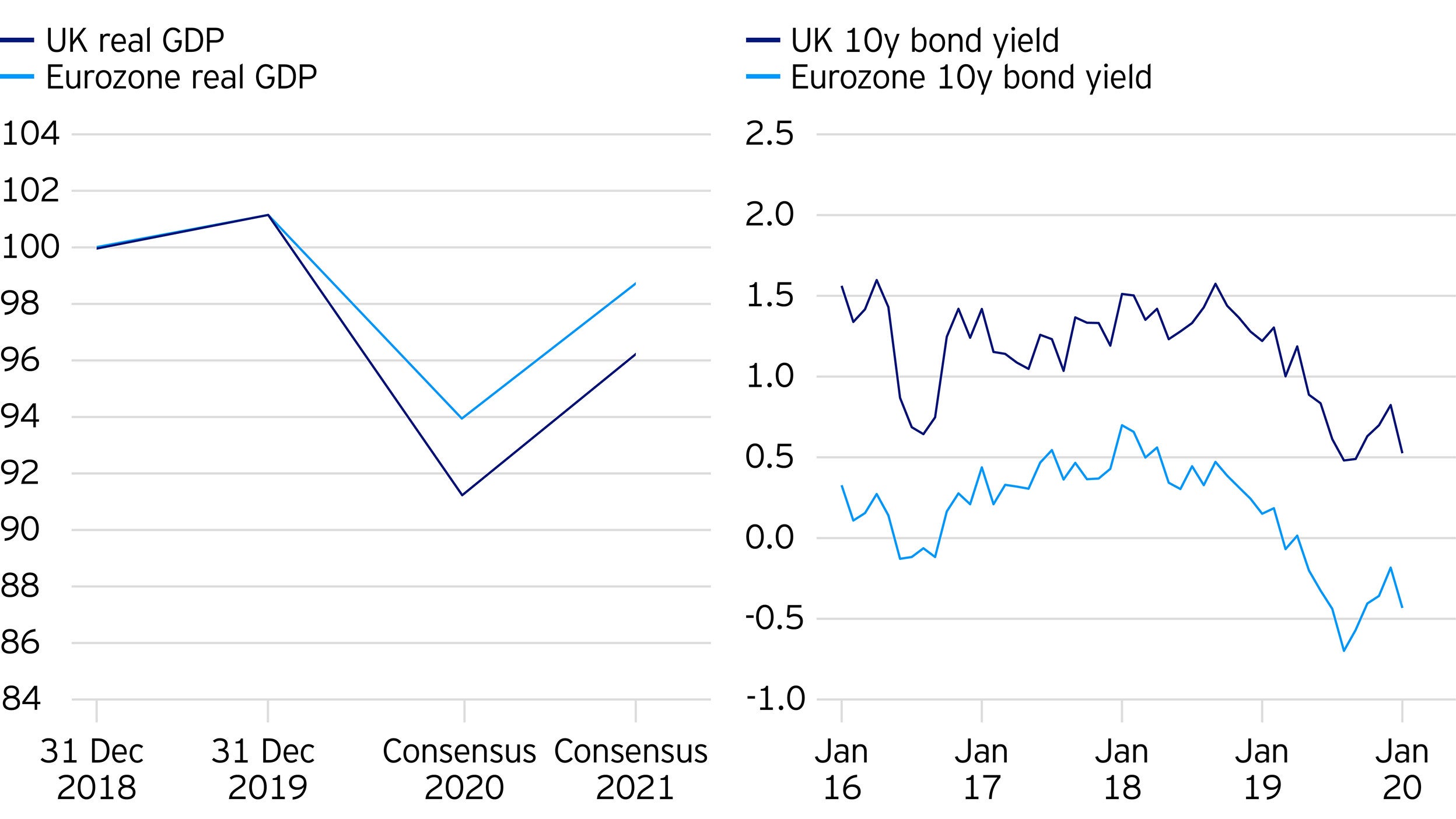

The difference between the UK and Eurozone bond market is also interesting. Figure 3 shows that economic data change is negative in the UK but now positive in Germany and the Euro Area as a whole. European policy rates look to already be at their lower bound, a claim backed up by the fact that the European Central Bank have not cut rates at all this year. The Bank of England on the other hand has been sounding very dovish in recent statements and there has been a lot of talk about the potential for negative rates in the UK. It is also likely they will continue their Quantitative Easing program, so we believe any substantial sell-off in gilts is unlikely and the gap between UK and Eurozone bond yields could start to narrow.

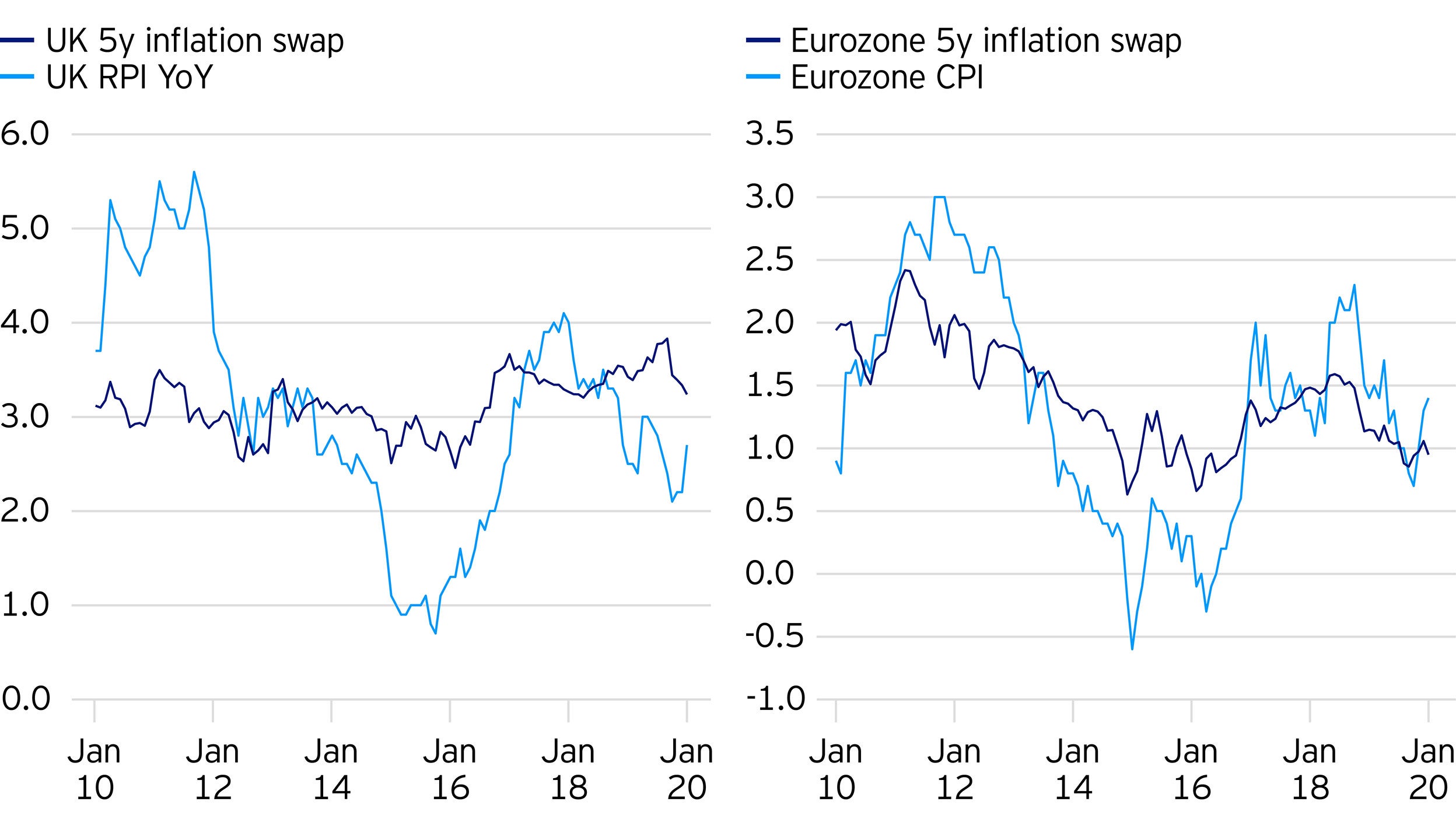

The Covid-19 downturn is overwhelmingly disinflationary in our view as demand has been hit while supply constraints have not materialised. We also believe that the increase in money-supply has simply filled a hole left by the private sector, and thus do not think it will lead to inflation down the line. In places like the Eurozone, inflation expectations are aligned with these realities.

In contrast, as illustrated in figure 4, UK inflation expectations have been higher than we think they should be for some time now, despite actual inflation falling. It has looked “wrong” ever since the collapse in sterling following the Brexit referendum. While any foreign exchange passthrough from this will have fallen out of the numbers by now, Brexit could still have an effect if the UK has to pay more for imports because of the lack of free trade, though this should be a step-change rather than a shift to structurally higher ongoing inflation. Moreover, The UK economy has weakened again into Q4 as the second wave of Covid-19 has taken hold and renewed lockdown restrictions have been introduced. Therefore, we believe these elevated UK inflation expectations are somewhat of an anomaly and should come down, closing the gap with the economic reality of a persistent lower inflation environment.

Risk warnings

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.