Invesco Global Investment Grade Corporate Bond Strategy Insights

T

he summer period saw risk markets perform well with corporate bonds outperforming their government counterparts. However in September, rising Covid-19 case numbers in Europe and an increase in mobility restrictions across a number of major European cities were front and centre. Alongside this, geo-political risk factors, namely Brexit – where negotiations continued to stall – and the prospect of a closely contested US election resulted in uncertainty causing a moderate risk off tone toward the end of the period, though it was short lived, highlighting the desire of market participants to ‘buy the dip’ in credit given strong inflows to the asset class.

Performance

Here is an update of the market impact of some of our themes during the quarter:

China rebalancing theme

The strategy invests in the hard currency offshore bonds of investment grade State Owned Enterprises alongside the technology giants such as Alibaba and Baidu which we expect to play a key role in the rebalancing of the Chinese economy from manufacturing led to consumption driven

Despite Asia credit experiencing weakness towards the end of September, it outperformed the US (we are underweight) over the quarter, aiding relative performance

For context, the weakness at the end of September was partly due to headlines surrounding the high yield real estate developer Evergrande. The strategy does not and has not held any Evergrande bonds

Japanification of Europe / financial deleveraging themes

The strategy has a preference for higher Beta (corporate hybrids and subordinated financials) bonds of high-quality investment grade rated European companies. These further enhanced returns over the quarter as they continued to play catch up to the broader market rally whilst generating additional carry

Strategy and Outlook

Since the end of the first quarter, Global Investment Grade corporate spreads have tightened significantly from their wides, with the US leading the rally. Whilst it is clear that much of the broad rally is behind us, we still consider there to be a lot of value given the level of dispersion from a regional perspective, as well as from a capital structure perspective. Whilst we don’t expect benchmark spread levels to repeat the rally to the same degree as seen in Q2 or Q3, we do still remain positive on the credit Beta. Here we see a wide dispersion of thematic opportunities within the asset class which we look to capture through relative value positioning. This view is underpinned by our financial repression/secular stagnation view on the macroeconomic backdrop – a view that low growth and low inflation combined with extremely accommodative monetary policy will remain in place for the foreseeable future. Indeed, the pandemic has re-enforced this, and we believe that high quality carry assets, namely Global Investment Grade Credit, will perform well versus other asset classes in this ongoing environment.

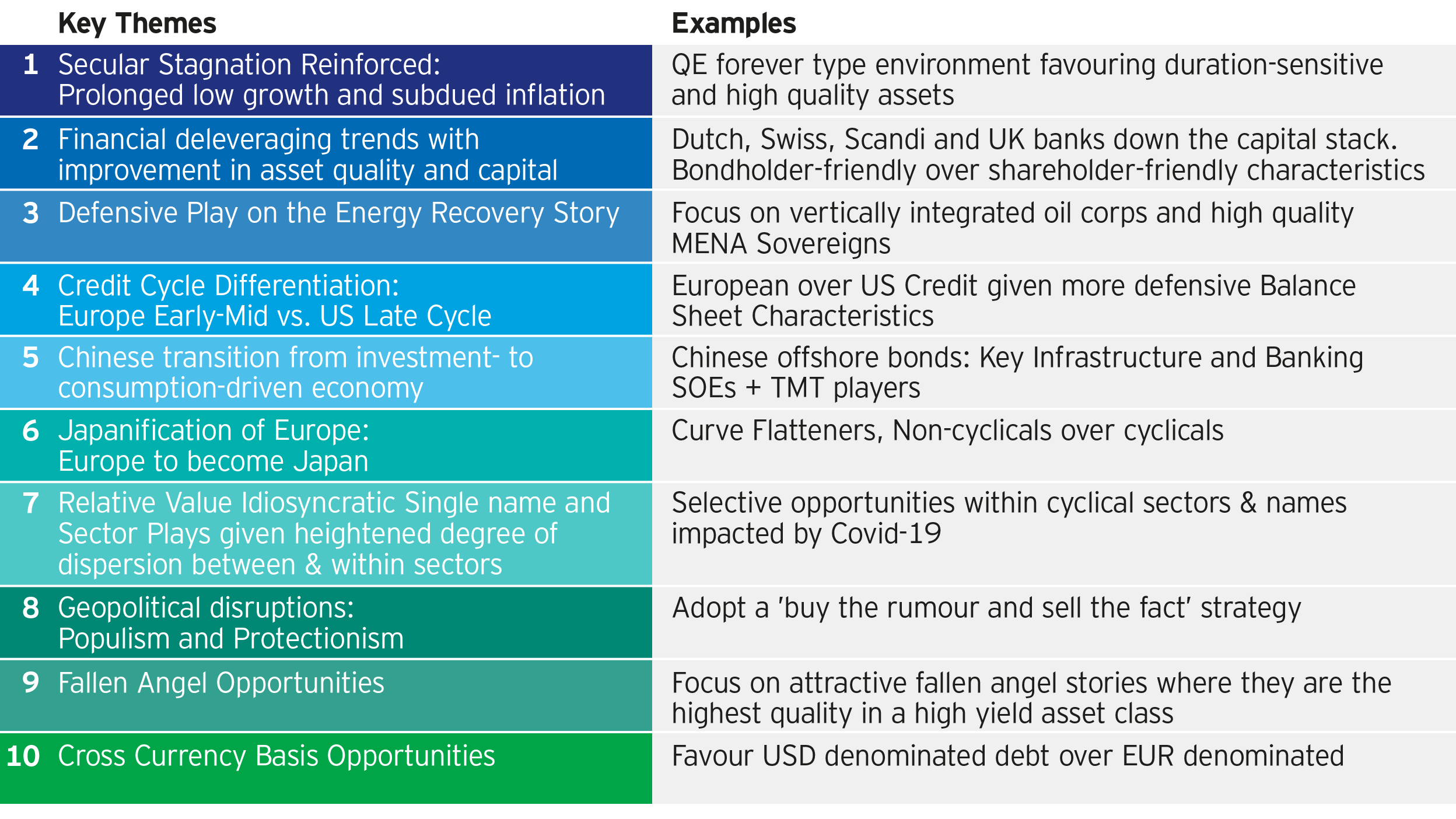

Please see below the current Investment Themes within the strategy which drive the strategy’s relative value positioning versus the benchmark across the Thematic Risk Factors (region, sector, capital structure, credit curve term structure and currency basis):

A closer look at some of the Thematic Risk Factors:

Region – Preference for Europe and Asia over US

We retain our preference for European corporates versus the US driven by the Credit Cycle differentiation theme. In Europe, balance-sheet preservation trends remain positive whilst corporate balance sheets were broadly in better shape as we entered the pandemic. We believe that Europe is now firmly in an early credit cycle phase, where the focus of CFO activity will continue to be on reducing costs, increasing cashflow and reducing leverage rather than focusing on shareholder friendly activity; hence the mid- term corporate fundamental picture remains reasonable in our opinion.

We expect technicals to remain positive across European credit markets into year end. The ECB is currently buying around €10 billion of corporate bonds per month, equating to just over 1% of the eligible index, which at this pace they will end up owning close to 30% of all eligible debt at the end of the scheduled programme. Meanwhile, inflows into the asset class, whilst slowing, remain positive as investors “follow the central banks” which will provide ongoing spread tightening support for the market. Given the global Central Bank backstop, we believe that the risk of spreads materially re-widening remains low.

The strategy does have a small overweight to UK corporates as part of the financial deleveraging and energy recovery themes. Here we hold large well capitalised banks such as HSBC, Lloyds and Nationwide as well as vertically integrated energy names such as BP & Shell. In addition, we also have exposure to the Pharmaceutical sector via names like AstraZeneca and Glaxo Smith Kline which further diversifies the holdings. With regard to BREXIT, we continue to view the base case to be that the UK and EU will agree a deal in time to a avoid a no-deal scenario. That being said, the risk remains that this is not the case which will result in volatility being introduced into both markets. Hence, we remain extremely selective in the UK names we own with a preference for the well diversified less-cyclical global businesses, versus those operating in more domestic cyclical sectors. These names are well placed to weather any volatility given their robust balance sheets, whilst also offering better value due to the BREXIT premia.

Capital Structure – Preference for Subordinated bonds over Senior

The strategy’s overweight to subordinated debt across both financial and non-financial issuers is driven by the Japanification of Europe and financial deleveraging themes. We continue to identify attractive opportunities in these instruments which help to increase the yield and carry profile of the strategy. In addition, we prefer to move down the capital structure in companies we fundamentally like to increase yield as opposed to purchasing lower credit rated issuers or investing in sectors which we still feel could be fundamentally changed in a post Covid-19 world (i.e. travel/leisure companies).

Why we are bullish on Cocos: Deep dive

We continue to see compelling value in this area of the market, which when combined with a highly selective approach and blended into a well-diversified global portfolio of corporate bonds, leads us to conclude that Cocos can continue to help the strategy deliver attractive risk adjusted returns.

Cocos are subordinated capital instrument used by banks, which maybe written down or converted to equity based on “capital levels”. Hence, they are linked to the “balance sheet” health of the banks (which is strong, so positive from a credit perspective) and not linked to its profitability (which is not as strong, but this is more relevant for equity investors). In other words, Cocos are a credit investment predicated on strong bank balance sheets, not an equity investment such as convertible bonds.

We are constructive on Cocos given the balance sheet strength across the Financial sector despite this period of heightened growth uncertainty caused by COVID-19. In fact, even during this period, banks have continued to demonstrate resilience and bondholder friendly activity by calling and replacing their Cocos throughout whilst suspending dividends (also positive for bond investors as more proceeds to shore up balance sheets). We currently have around 7% invested in Cocos split between 6% Additional Tier 1 and 1% Tier 2 (i.e. old-style Cocos which are being grandfathered) bonds.

To ensure idiosyncratic risk is minimised, this exposure is well-diversified across circa 60 issues (no more than 30bps in any issue) and circa 30 issuers (no more than 60bps in any issuer), whilst we are highly selective in what issuer and specific issues we invest in.

Even though our view on the asset class is positive, we are very selective in what issuers and issues to invest in. Within our credit research process, we not only evaluate the fundamental qualities of the issuer but analyse the specific language of each issue whilst undertaking additional valuation evaluations to ensure any risks are appropriately being rewarded.

Summary

In what has been a rollercoaster year for financial markets, with all asset classes impacted by the global pandemic, we continue to work extremely closely with our global team of credit research analysts to ensure every bond we purchase is underpinned by fundamental credit research. This has helped to insulate the strategy against the first round of downgrades enacted by rating agencies. Whilst agencies now seem more content to ‘wait and see’ we believe the strategy is well placed to weather another wave of both the pandemic and the potential ratings agency action that follows. The average credit quality of the strategy has actually improved since the onset of the pandemic from BBB to BBB+, whilst corporates have been extremely effective in cutting costs and building cash balances.

This, combined with the ongoing support of central banks and governments, lead us to believe that any period of risk off will be reasonably well contained. Despite the move lower in core interest rates year to date, we believe the secular stagnation backdrop combined with the central bank support will anchor rates at these low levels for quite some time yet. As such, interest rate duration in the strategy remains broadly neutral against the benchmark at around 7.1 years as we continue to view it as the most effective hedge to the credit Beta of the strategy should sentiment deteriorate (specifically US duration).

Active risk (as measured by ex-ante tracking error) has continued to fall throughout the third quarter, though this is not being driven by any real shift in positioning but is instead a reflection of volatility in markets falling. As mentioned, we believe this environment lends itself to high quality carry assets with investment grade corporate bonds therefore set to benefit. The strategy continues to deliver positive carry against the benchmark of around 70bps.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The strategy will invest in derivatives (complex instruments) which will result in leverage and may result in large fluctuations in value. Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date. Investments in debt instruments which are of lower credit quality may result in large fluctuations in value.

Changes in interest rates will result in fluctuations in value. The strategy may invest in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events.

Important information

-

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.