Four areas of focus: how is your firm responding to the ESG regulation challenge?

The incoming regulations will accelerate the paradigm shift towards sustainability that is already underway in the investment industry. Getting ready for these new regulatory requirements will require significant changes for firms but these are likely to be quickly superseded by new market standards, with firms seeking to position themselves as leaders going beyond these minimum requirements in order to position themselves for success.

Responding to this dynamic market and regulatory landscape will require firms to take a holistic review across the following four strategic areas of focus:

- Redefining leadership, purpose and culture

- Reassessing the firm’s strategic value proposition

- Embedding ESG as a core pillar of risk management

- Addressing the reporting and data challenges.

Leadership, purpose and culture

One of the main take-aways from the regulatory changes underway is that it will require a concerted effort across the entire organisation, from the Board room down and across every facet of the organisation rather than being a niche discipline. For those seeking to differentiate themselves and take on a leadership position, they may wish to re-orient their strategic purpose to align with sustainability goals, such as adopting a Net Zero carbon emission target or setting targets aligned with UN Sustainable Development Goals.

In our view, a critical success factor will be firms’ ability to embed ESG in their corporate culture to ensure seamless collaboration across the business to deliver client-centric sustainability solutions. A bottom-up approach based on firm-wide education and training to build ESG knowledge and expertise will be foundational to complement a top-down strategic vision and to enable firms to move up the ESG maturity scale:

- Understand: all business functions will need to understand the buildings blocks of ESG factors and strategies and how they relate to their role and responsibilities.

- Adopt: firms will need to begin adopting and embedding ESG principles in their way of working, in particular to enable compliance with EU rules. This may start with high-level qualitative approaches or a focus on specific issues (e.g. climate) or asset classes.

- Deepen: firms wishing to move beyond the regulatory minimum will gradually need to progress towards more quantitative and forward-looking approaches that puts sustainability at the core of the process.

- Lead: as a leader, firms will need to embrace sustainability as foundational to their purpose and philosophy that transcends all dimensions of the business internally, while also being a strong advocate for change externally to lead the transformation beyond their own business.

Embedding ESG into risk management

The transition to sustainability will require firms to adopt increasingly sophisticated approaches to risk management. The need to capture ESG risks is likely to galvanize firms from measuring risks in a qualitative fashion to a quantitative fashion and measure risk rather than exposure and are based on forward-looking data rather than historical data.

While approaches to broad ESG risks are currently constrained by data gaps, this shift is already well underway in the area of climate risk analysis, with new tools and methodologies being developed to enable firms to measure the long-term climate risks of their portfolios as well as the temperature alignment.

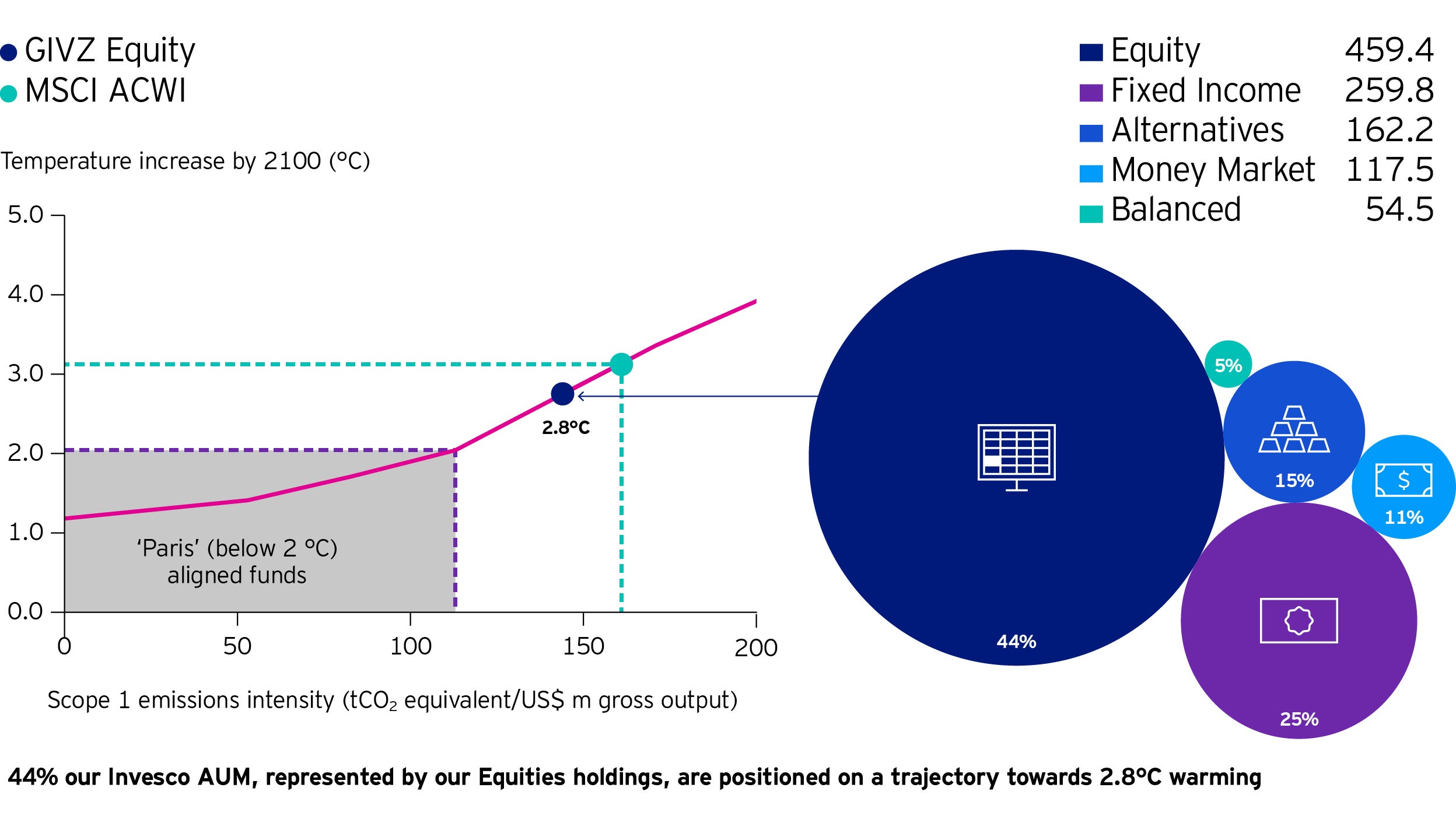

At Invesco, as part of our 2019 Climate Change Report, we undertook a pilot project to assess our equity and bond holdings against various climate scenarios as part of our commitment to addressing climate risks. Our scenario analysis exercise offered evidence and clear directions to address climate change risks and opportunities for our clients and their investments:

- Identify overall risk from climate change across Invesco portfolios using a suitable scenario analysis approach: Based on the analysis from Vivid Economics, Invesco is developing a view of the overall risk of climate change to key portfolio holdings. This forms a useful first step as it allows Invesco to put the overall risk into context and prioritise where to focus further efforts.

- Isolate sources of risk within individual portfolios by examining individual security results: In order to gain insights into the sources of risk for individual portfolios, Invesco will then aim to drill down to the security level. This will include isolating the assets most exposed to physical and transition risk, as well as more granular categories, such as the risks from demand destruction. Invesco plans to conduct security level analysis of climate change risk over the coming year.

- Action remaining sources of risk where appropriate: Following the analysis of security level risks over the next year, Invesco will determine the appropriate actions to take on high sources of risk within portfolio holdings. This may include engagement with issuers of relevant securities, or reduction of exposure to segments associated with high levels of climate risk.

For more information on our approach to climate risk and scenario analysis, please see our Climate Change report.

Addressing the reporting and data challenge

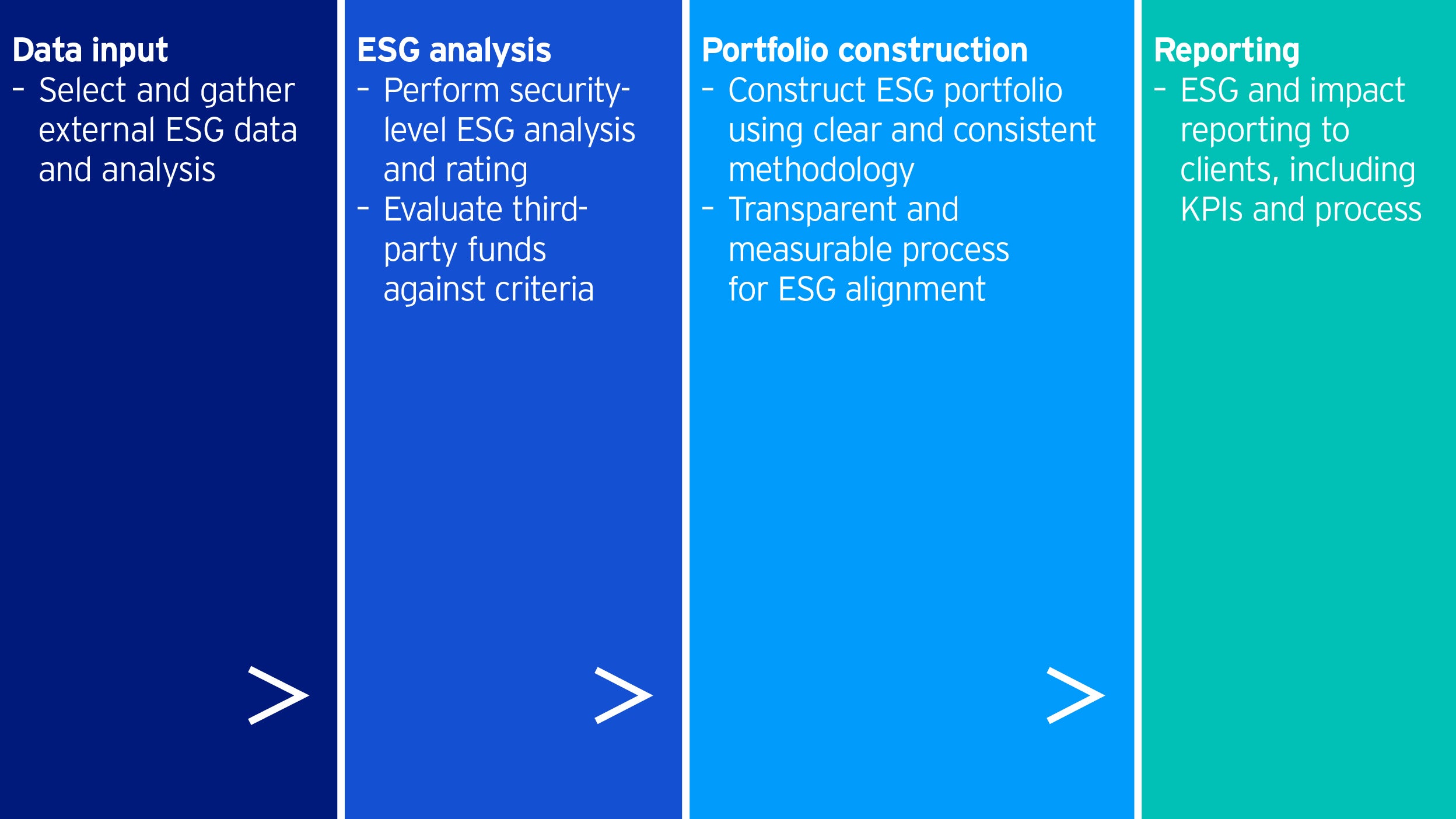

Underpinning all of these changes is the ever-increasing need for reliable and comparable ESG data across the organisation, from investment analysis to product structuring and client reporting. Incoming regulatory requirements such as the EU Taxonomy and the Sustainable Finance Disclosures Regulation will also drive ESG data demands in order to comply with these disclosure obligations, making data management and assurance an increasingly important element of ESG integration. Improvements in corporate reporting are likely to provide new insights and data sources for investors but capturing and aggregating this information remains challenging.

External providers are increasingly relied upon by the industry to provide the necessary data and reporting tools for investors, but the regulation is likely to drive firms to enhance their oversight and understanding of the ESG data they consume and reconsider how they measure and report on their sustainability performance to clients. For those looking to deepen their approach to ESG integration, this may include developing proprietary view on ESG issues to support sustainability risk integration and potentially product development.

At Invesco, we have been addressing the reporting and data challenge through the launch of ESGintel, our proprietary tool that provides environmental, social and governance (ESG) insights, metrics, data points and direction of change to our investment managers. ESGintel provides our managers with an internal rating, a rating trend, and a rank in sector using the GICS sectors. The approach takes a sector materiality focus to select indicators to ensure a targeted focus on the issues that matter most for sustainable value creation and risk management. This provides a holistic view on how a company’s value chain is impacted in different ways by various ESG topics which each individually have around 3-4 supporting data points.

The above article is an excerpt from our recent whitepaper, which you can download in full here: Shifting Gears: Preparing for the new sustainable finance regulations in Europe.

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.