How Blockchain could improve Supply Chain Management

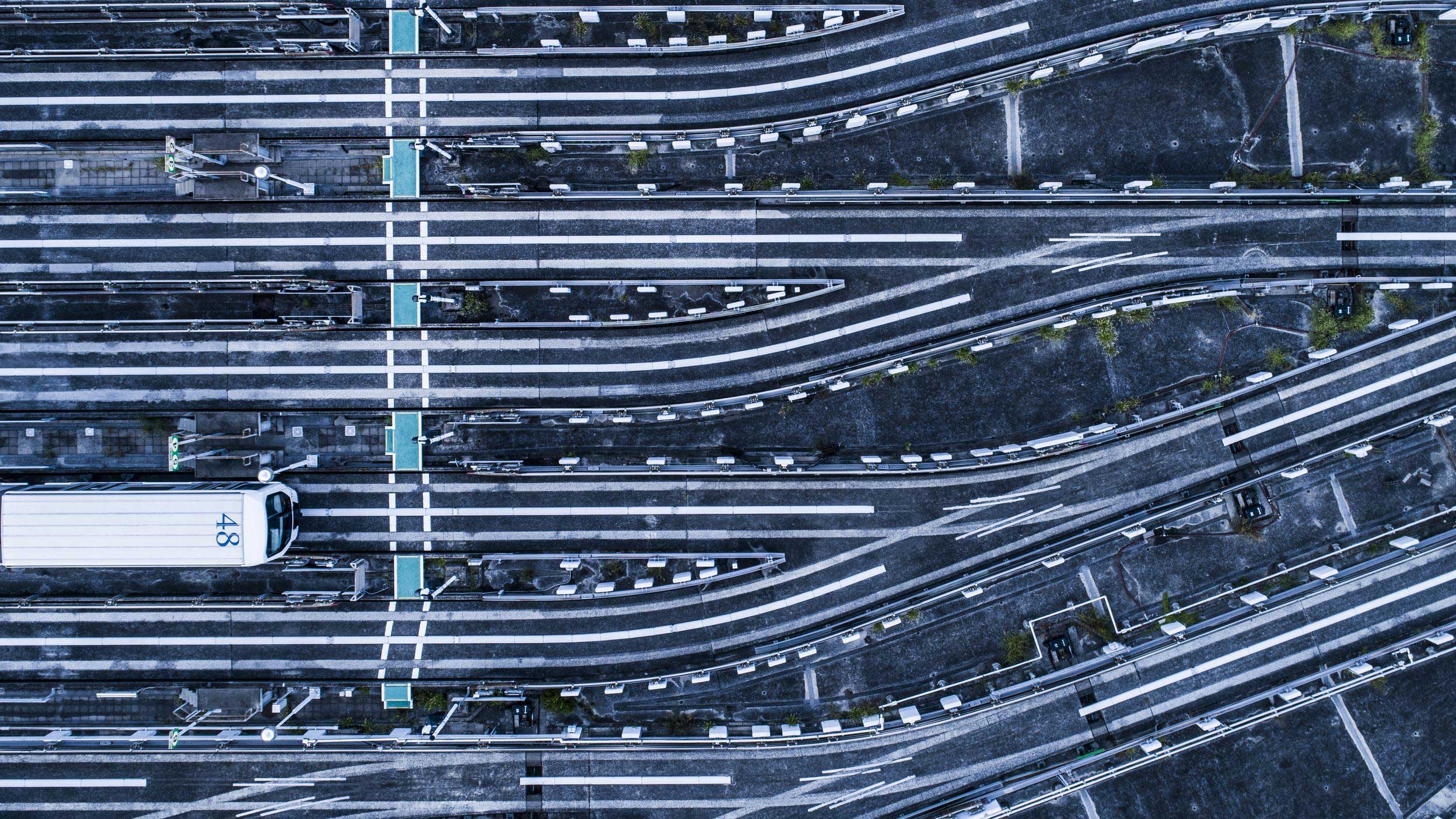

Supply chains can be considered the “Eighth Wonder of the World”. Today's historically unprecedented level of prosperity, which is enjoyed by more and more people all around the globe is highly dependent on functioning supply chains. Incidents like COVID-19 or the Suez Canal blockage have shown this in an impressive way.

In order to function as seamless as it does, supply chain management has grown into a Herculean task accomplished by a variety of actors within an ever-expanding ecosystem. The complexity involved, however, exacts its toll. A major pain point aching contemporary supply chain management is the lack of sufficient transparency, which translates into inflexibility and inefficiency for ecosystem participants. Because today’s supply chain management necessitates a great amount of collaboration trust issues abound adding to the overall logistics costs of supply chain systems.

Blockchain to the Rescue

As the digitization of our economy is moving forward, the advent of blockchain technology has been hailed as a potent tool to remedy some of the supply chain industry’s challenges. Representing a new form of reaching consensus over a set of values, states and actions in a digitized context, the reliance on blockchain technology – sometimes also more generally dubbed “Distributed ledger technology” – makes it possible for documentations of supply chain activity to flow transparently yet securely among participants like supplier, vendor, trading companies, banks, insurance companies as well as any other network participants.

A blockchain is upheld and maintained in a distributed fashion by its network participants, which are technically called nodes. Due to its distributed nature, transactions and states recorded on a blockchain show great tamper resistance. A timestamp and a unique cryptographic signature associated with every transaction creates an easily comprehensible transaction history. Every node in the system with the permission to read (and write) can access the same, simultaneously updated information that is transparently shared among all participants.

Enhancing Trust

Introducing blockchain technology into supply chain management enhances trust among its participants as they all share the latest, identical state of things. While a blockchain is no panacea to prevent fraud of any kind, it offers a new technological arbiter to turn to in case of potential fraud. Concretely speaking, if any of the supply chain management participants were to cheat, because the entire life cycle of the good in questions is represented on the blockchain, time and origination of a fraud can be detected and penalized after the fact. This transparency and with it the tamper-evidence the blockchain brings to goods moving along the supply chain has hitherto hardly been present and is now changing incentives for everyone.

Solutions in Action

Blockchain implementation in supply chain management are now longer theoretical wishful thinking. Already back in 2018, the container shipping giant Maersk and IBM with its blockchain solution Hyperledger have started TradeLens. This platform enables various trading participants to securely share relevant shipping information, thereby establishing a single shared view of a shipping supply chain activity without compromising details, privacy and confidentiality.

With 16 banks across 15 countries, we.trade is the largest network for Trade Finance in Europe. Also built on IBM’s Hyperledger solution, the implementation of blockchain technology simplifies cross-border trading. Invoicing can be done real-time through the blockchain. Correspondent banks might not be needed as trade finance can be automatically settled on the blockchain. As matter of fact, with we.trade’s solution, supply chain payments are triggered automatically as soon as pre-agreed conditions programed into smart contracts are met. This diminishes counterparty risks just like the tracking of bills of lading through the blockchain does.

Another prominent use case is pursued by Adresta, a fintech from Switzerland. The founders behind the startup have targeted the watchmaking industry and its issues around counterfeits. According to official numbers, in 2018 23.7 million Swiss watches were exported. At the same time, around 40 million Chinese fake watches were going around, making the amount of phony watches circulating almost twice as high. By having watch makers store a digital certificate’s hash of every watch produced on the Swiss Trust Chain – a permissioned blockchain run by Swisscom and Swiss Post – trust and transparency is increased. With every step from manufacturing, through distribution to end consumers and owners changing repeatedly being securely stored on the blockchain, the actual status can be verified reducing the possibility for fraud.

Blockchain insights

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

Important information

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Investment strategies involve numerous risks. Investors should note that the price of your investment may go down as well as up. As a result you may not get back the amount of capital you invest.

Important information

-

This marketing communication is for discussion purposes only and is exclusively for use by professional investors in Austria, Germany and Switzerland. It is not intended for and should not be distributed to, or relied upon, by the public.

By accepting this material, you consent to communicate with us in English, unless you inform us otherwise.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Data as at 18.08.2021, unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This material has been communicated by Invesco Investment Management Limited, Central Quay, Riverside IV, Sir John Rogerson’s Quay, Dublin 2, Ireland, Invesco Asset Management (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland.