Global reflation and this year’s best performing bond market

A global recovery is well underway, with growth estimates for 2021 being raised across the board. Our own growth estimates for the US, eurozone, and some emerging market countries have been well above a slow-moving consensus. This indicates our growing confidence that this year’s global growth could be the best in over a decade. While the initial upswing is being led by the US and emerging markets, especially Asia and China, an expected upswing in Europe will probably extend the recovery to a true, global reflationary period.

Easy monetary and fiscal policy to continue for the foreseeable future

The global monetary and fiscal policy response to the pandemic has been overwhelming and will likely continue to be so. We expect the US Federal Reserve (Fed), the European Central Bank (ECB), and other developed market central banks to maintain very easy monetary policy to both support the ongoing recovery and put a floor under inflation expectations that have drifted down over recent decades. The best way to achieve this is an overly easy monetary policy that reacts to actual inflation increases with a lag. We believe central banks will – and should – look through recent inflation increases as transient.

In emerging markets, we have seen some changes, including the Central Bank of Brazil’s first interest rate increase in six years, suggesting that current extraordinarily easy monetary conditions may no longer be needed. In addition to Brazil, there may be a few countries that reduce policy accommodation over the next 12 months, but these actions should not change market expectations that monetary policy will remain generally accommodative globally. When central banks finally do move to raise interest rates, we believe it is unlikely that any bank will surprise markets with policy tightening significantly beyond market expectations. The future path of rate increases will likely be critical in extracting excess returns from markets. We believe excess premia that are priced in (in response to a rapid monetary policy reaction) would likely be easily extracted from the market, though with higher volatility than optimally desired.

Within this framework of global growth recovery supported by accommodative monetary and fiscal policy, the market pricing of risk and the path of interest rate increases will likely be critical in generating excess returns going forward. Our investment theme for the current environment is reflation and growth. In the absence of tightening financial conditions, we believe that all growth will remain “good” growth for reflationary assets. Reflationary assets include emerging market equities, currencies, rates, and to a lesser extent, credit. We believe commodity-based assets and assets that benefit from steeper yield curves, such as banks, will be the largest beneficiaries of reflationary conditions.

Emerging markets may offer opportunities in rates and currencies

In emerging markets, mainly due to “recency bias,” there tends to be a perpetual fear that global growth will lead to policy responses that will result in negative asset performance. We believe this pervasive fear has kept emerging market premia too high and can be extracted within our investment horizon. Emerging markets of today are not the emerging markets of 2013. Their external accounts are in significantly better shape, currencies are at attractive valuations, in our view, and capital flows were quite negative in 2020, creating less potential for capital flight.

In 2013, the narrative centered on high current account deficits among the socalled “fragile five” (Brazil, India, Indonesia, South Africa, and Turkey), a group of countries considered highly dependent on foreign investment for growth. Today, in contrast, India, for example, is receiving record foreign direct investment, and the Reserve Bank of India has managed to increase its foreign exchange reserves by USD100 billion in just the last year.1

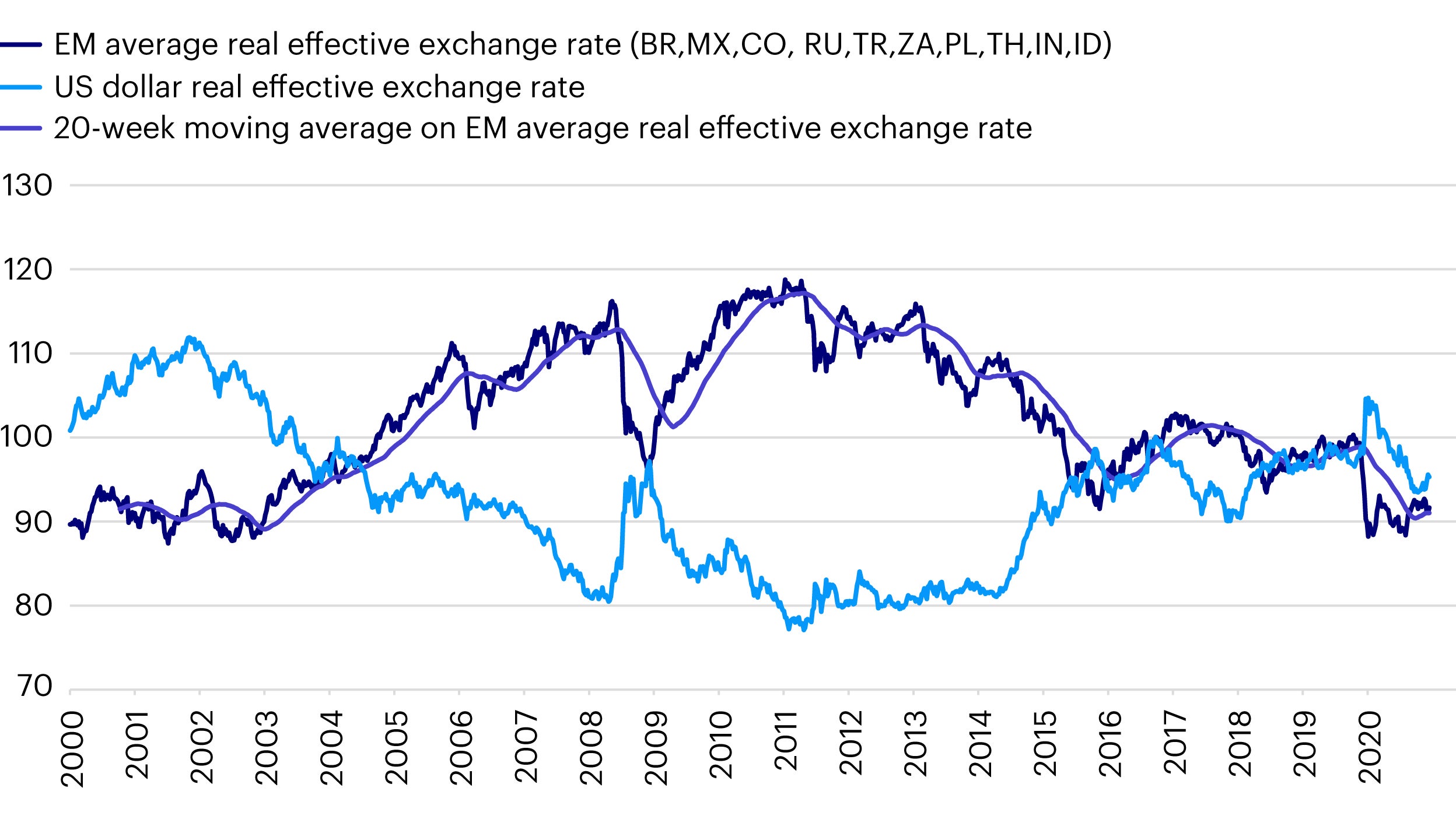

Also, in 2013, there were large misallocations of resources in emerging markets due to large capital inflows, which led their currencies to become expensive on a real effective exchange rate basis. That is not the case today. Emerging market currencies remain close to multi-decade lows on a real effective basis. As Figure 1 shows, not only were emerging market currencies expensive in 2013, but the US dollar was very cheap on a real basis. Today, while the US dollar is not at its highs, it is expensive on a real effective exchange rate basis, in our view. Absent an early policy tightening in the US (essentially a policy error by the Fed), we believe valuations in emerging market currencies offer potentially compelling opportunities and returns.

Aggregate pricing in emerging market rates is also compelling, in our view. After the recent wobbles led by increases in US interest rates and matched by most emerging markets, yield curves have steepened to decade-highs and offer attractive carry and roll down, (i.e., “static return”), in our view. While we believe steepening yield curves in developed markets are required and welcome, emerging market yield curves were already very steep, and this latest steepening has created attractive potential value, in our view.

In addition to emerging market assets, we believe other assets linked to the reflationary theme, such as commodities, will benefit. Given the low level of real and nominal interest rates in developed markets, we believe return premia can best be extracted through the equity and currency markets, and to some extent, credit, which will likely be negatively impacted by persistent interest rate volatility. Commodity-sensitive countries such as Australia, Korea, Chile, and Canada will likely especially benefit from the global reflation currently underway.

The Chinese bond market

China also offers a unique investment opportunity for global fixed income investors against this backdrop. The Chinese local bond market is the secondlargest single-country domestic bond market in the world after the US,2 with a total size of close to USD 17 trillion.3 Approximately 34% of the market consists of central government and policy bank bonds that make up the risk-free portion of the Chinese market and that are easily accessed by offshore investors.4 The credit sectors and local government sectors make up most of the balance of the market but require specialized credit skills and are more difficult for offshore investors to access. We see value for US investors in central government and policy bank bonds, which offer high credit quality and very good liquidity. Indeed, this is also the part of the Chinese bond market that is now included in some government bond indices, including the Bloomberg Barclays Global Aggregate Index. The Chinese government and policy bank bonds now yield over 3% and offer positive real yields.5

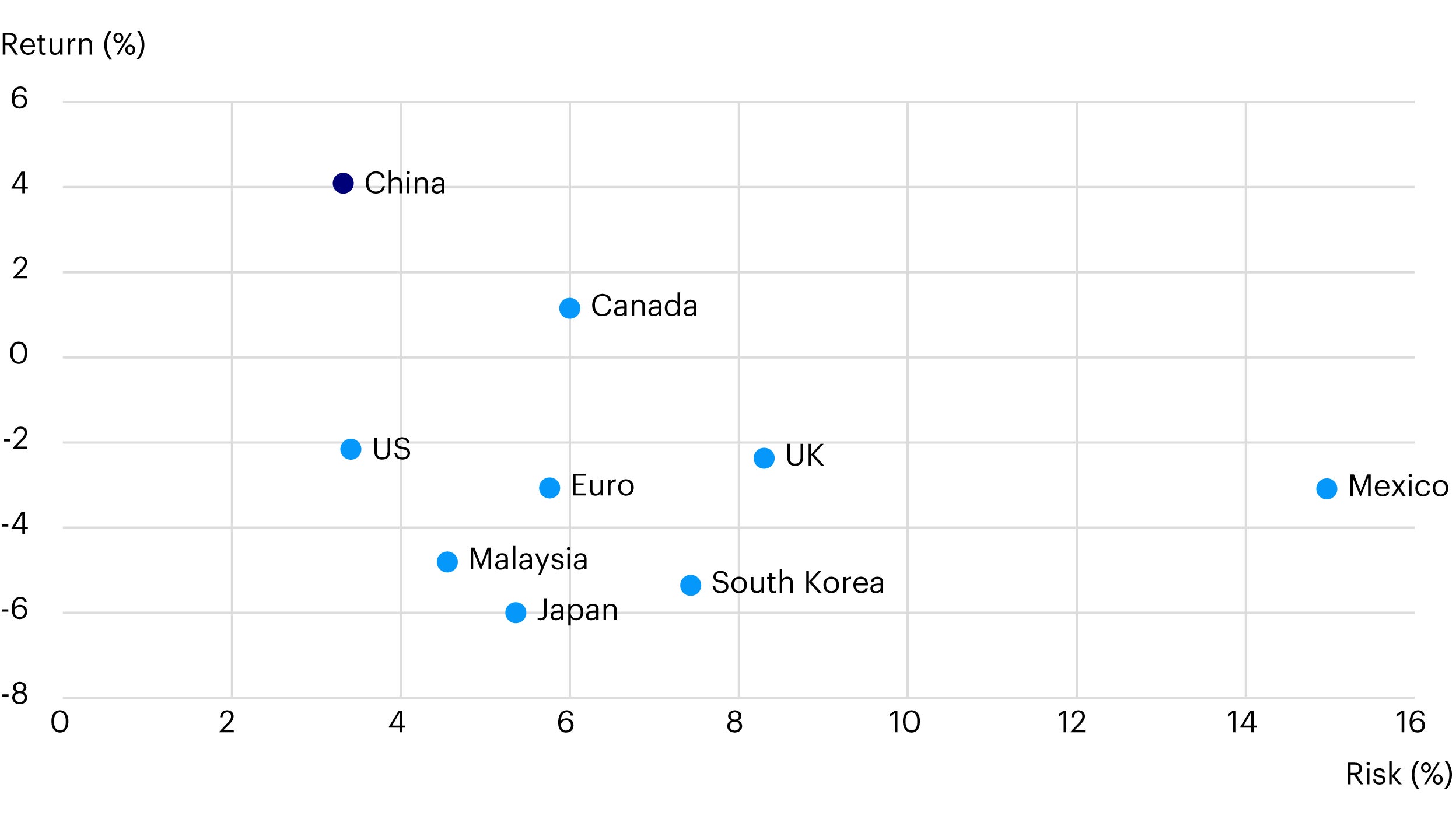

The Chinese economy is a large and domestically focused economy. While tied to the global economic cycle, it can show significant divergence from the global cycle, and this can be a benefit to investors through diversification.6 The path of the global economy through the COVID-19 shock is a perfect example of the benefits of this diversification. The Chinese economy was the first to slow but also bounced back more quickly than any western economy. The US and Europe are both still in the early stages of recovery from the COVID-19 shutdown, while China is well ahead, to the extent that policymakers are already removing stimulus. China is on a different cycle than the rest of the developed world – that is good news for investors in China right now. Demonstrating the value of this diversity of economic cycle is the fact that China has been the best performing major currency bond market year-to-date (Figure 3).7 With our expectation for global reflation and easy developed market central banks, that trend may continue.

Related articles

Footnotes

-

1Source: Reserve Bank of India. Data as of June 18, 2021.

-

2Source: Sifma, April 14, 2021, https://www. sifma.org/resources/research/researchquarterly- fixed-income-issuance-and-tradingfirst- quarter-2021/.

-

3Source: Wind. Data as of Feb. 28, 2021. Based on CNY 115.3 trillion, exchange rate USD/ CNY=6.5.

-

4Source: Wind. Data as of Feb. 28, 2021.

-

5Sources: ChinaBond, Bloomberg L.P. Data as of June. 8, 2021.

-

6Diversification is not a guarantee of profit nor eliminates the risk of loss.

-

7See our publication, Is the best performing fixed income market year-to-date in your portfolio? Rob Waldner, June 6, 2021.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date.

Investments in debt instruments which are of lower credit quality may result in large fluctuations in value.

Changes in interest rates will result in fluctuations in value.

Important information

-

Data as of June 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.