Economic Transition Monitor: the path to net-zero

Welcome to our Economic Transition Monitor (ETM). In this report we track global efforts to reach net zero emissions and attempts to limit the impact of climate change.

Our analysis focuses on the C20, which are largest CO2 emitter countries in the world. Of those, 18 have established net-zero (or equivalent) targets.

Recent trends aren’t encouraging. And new for this edition, nor are our projections to the end of the century. In short, the CO2 intensity of economic activity needs to fall dramatically – far more than in recent decades – if we’re to achieve net zero.

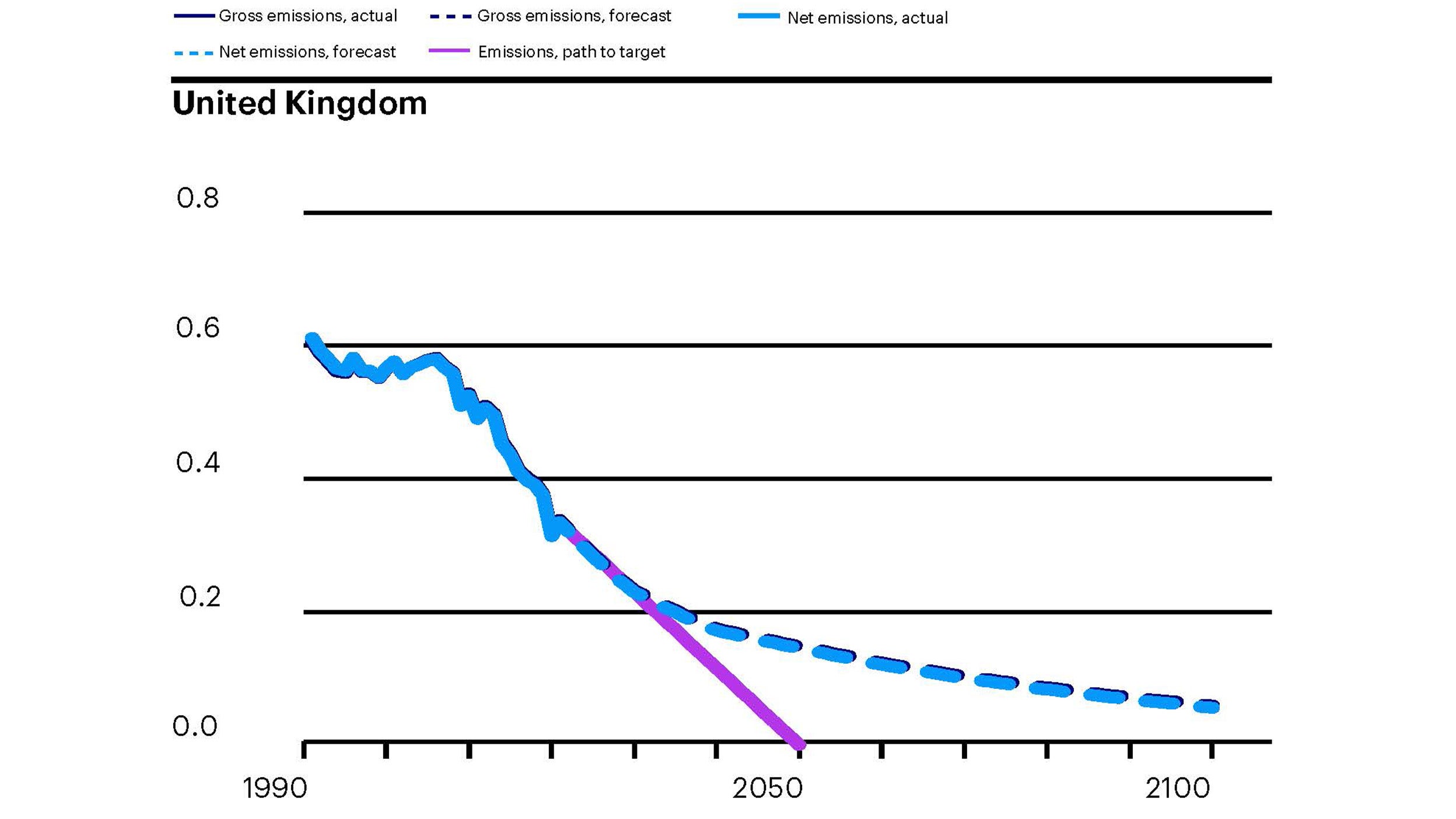

The first edition of the ETM showed that at trend the UK would meet its net zero target by 2050. But a lot has changed since then.

Russia’s war in Ukraine has raised questions about energy security in the UK and beyond. It’s also pushed countries to reset their energy mix with a greater focus on hydrocarbons.

The new British government has also launched a review into how its net zero goals can support its pro-growth and pro-business agenda. Although the UK has made rapid progress in reducing its carbon intensity, it may struggle to maintain this trajectory.

Success stories – such as the UK, which has, for example, emerged as a leader in wind power – aren’t a guide to future progress.

Sources: BP Statistical Review of World Energy 2022, IMF, United Nations, World Bank, Refinitiv Datastream and Invesco.

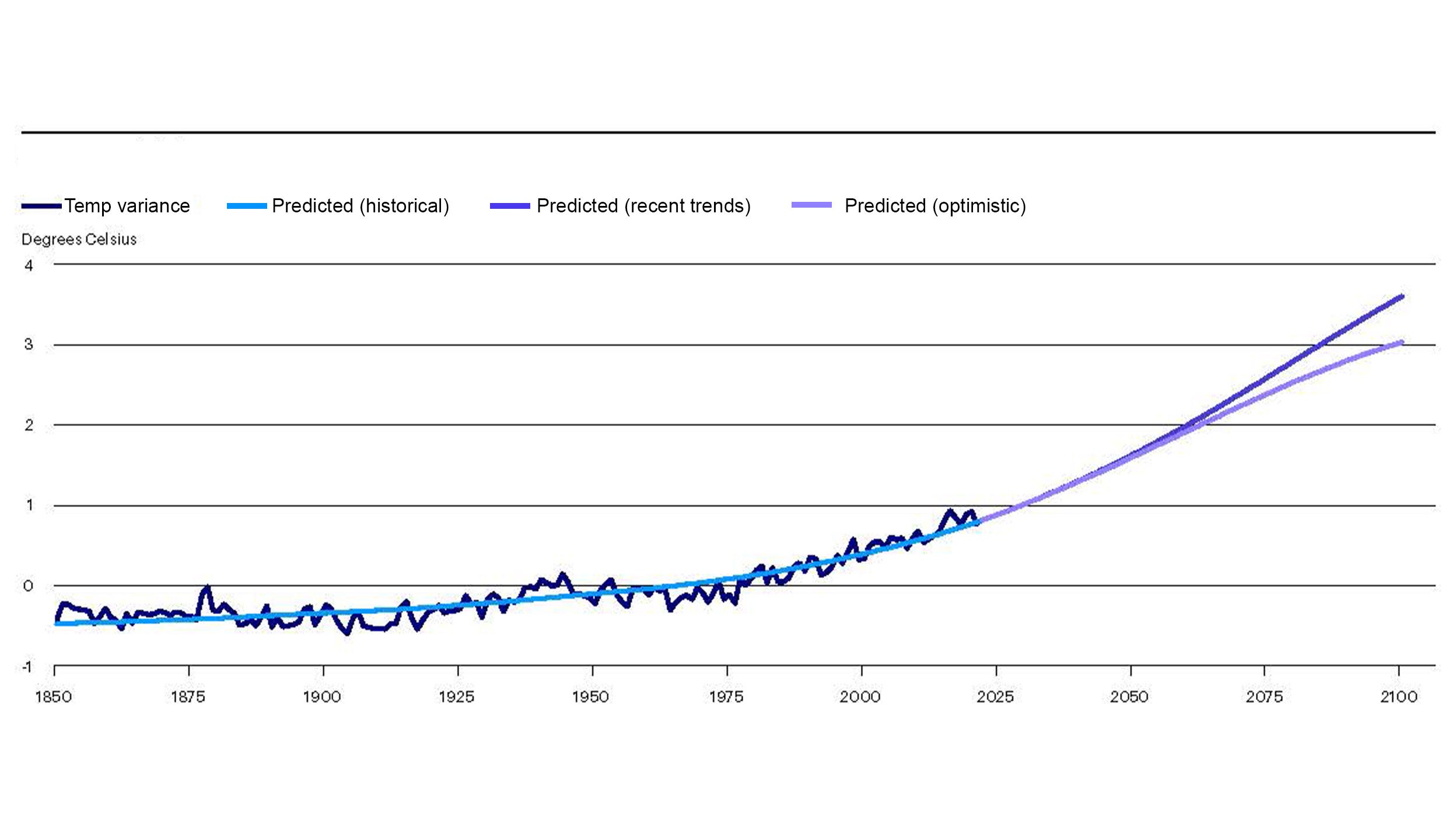

Unfortunately, global emissions continue to rise and we think it’s unlikely that temperature change can be limited to 1.5°C. The challenge remains to limit the overshoot (we think 3-4°C is possible).

This chimes with what we found in the first edition that temperature change is unlikely to be limited to the objectives outlined in the Paris Agreement.

Source: NOAA, Our World in Data, UK Meteorological Office, United Nations, World Bank, Refinitiv Datastream and Invesco.

The war in Ukraine underscored Europe’s dependency on Russian gas. As a result, we think that countries will, in the short term, focus on energy resilience rather than the energy transition.

While Europe can survive without Russian energy, it is fair to suggest cut-offs and slowdowns have re-sensitised European nations to those dependencies and their long-term strategic impacts.

As countries face-up to fragility, we consider how they’re beginning to show an increased interest in resiliency, and how emerging energy technologies will play a role.

We also review the broad range of alternative energies, like wind, solar and hydroelectric. We also look at oceanic sources and alternative fuels. Both are largely in the early stages of development, but we think could offer great potential.

Economic Transition Monitor: the path to net-zero

Welcome to our Economic Transition Monitor (ETM). In this report we track global efforts to reach net zero emissions and attempts to limit the impact of climate change.

Opportunity or caution? The outlook for European real estate

Kevin Grundy, Managing Director, Fund Management, Europe, Invesco Real Estate, discusses the broader market environments in the region and where he is finding the most compelling investment potential for value-add and opportunistic strategies.

Appetite for Change Part IV: The quest for food security

Despite the scale of the challenge amid a “perfect storm”, there is growing reason to believe the quest to feed all of humanity can at last be achieved.

2022 Global TCFD Report

Our fourth annual TCFD Report provides a comparable, investor-relevant disclosure on our activities and capabilities in climate-aware investing. Find out more.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.