Economic recovery – three scenarios

John Greenwood. Chief Economist, Invesco Ltd and Adam Burton. Assistant Economist

Key takeaways

In April we set out three scenarios for economic recovery after the Covid-19 pandemic – base, optimistic and pessimistic.

At that stage we had relatively limited understanding of the factors that would drive the shape of recovery in different economies.

We have now revisited those scenarios and updated them in the light of our improved understanding of the impact of the pandemic-driven recession, and the possible shapes that the recovery might take.

As yet the outlook is still dominated by a high degree of uncertainty, especially concerning the course the pandemic itself will take, and beyond that the economic response of governments and monetary authorities in different countries.

It has become the mantra of politicians and central bankers that monetary and fiscal policy can only do a certain amount to help ensure a rapid return to normality after the Covid-19 pandemic.

Specifically, monetary policy can ensure that there is enough money or purchasing power in the economy to avoid any unwarranted contraction of economic activity, and central banks can, by their transactions or by their statements, ensure that financial markets return reasonably quickly to normal functioning.

By means of fiscal policy the government can provide temporary grants, loans, or loan guarantees to individuals and businesses to ensure that they have sufficient resources to make it through to the point where the pandemic has largely subsided and the economy begins to grow again.

However, from this point onwards, the shape of the recovery will depend to a significant degree on “real” factors, particularly the mobility and adaptability of the labour force, and the inherent competitive advantages of the specific economy.

Base case

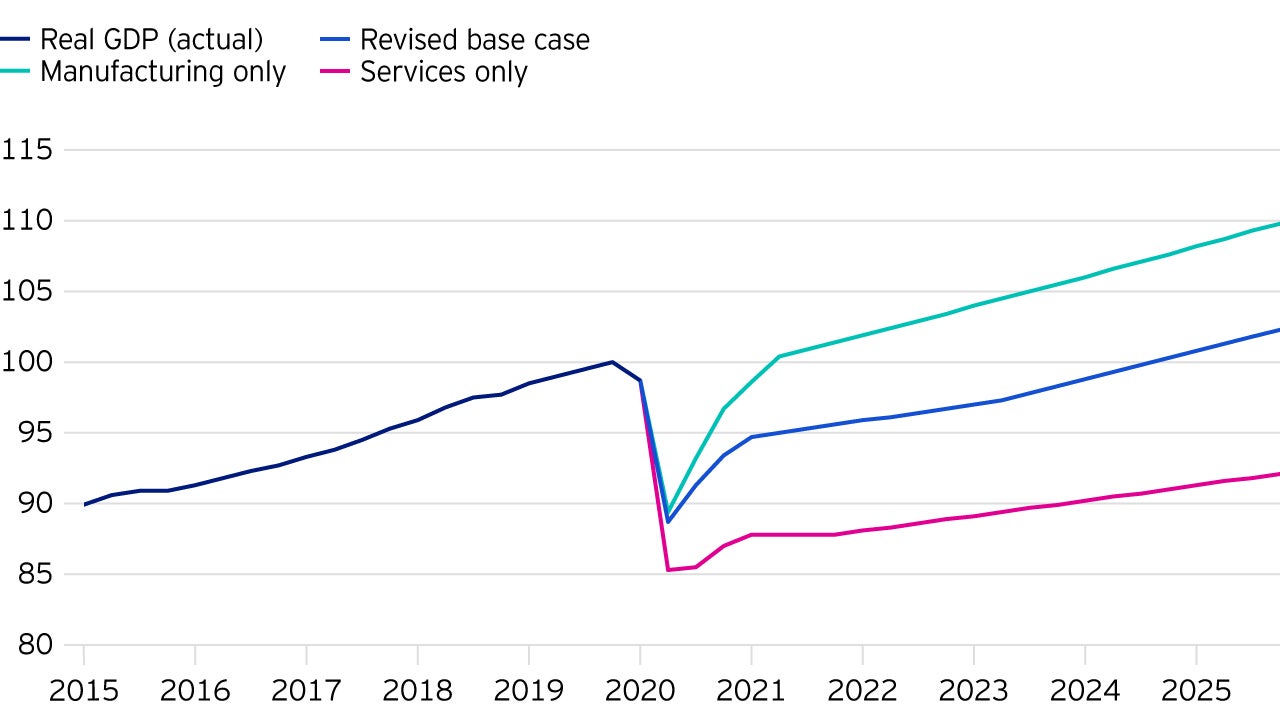

In the three possible outcomes shown in Figure 1, our base case plots a course which shows an initial V-shaped recovery to 95% of the pre-pandemic level of GDP, but then the recovery slows for a few quarters while businesses and individuals figure out their “comparative advantage” – i.e. the activities in which they can successfully compete in the future.

In the chart we have assumed a 1.2% p.a. growth rate for the US for two years until this process of capital and labour re-allocation is worked out.

Thereafter the economy in the chart resumes a growth rate of just over 2% p.a.

In this scenario the economy returns to its pre-Covid level in 2024 Q4.

This shape of recovery is sometimes referred to as a “square root” shape.

Manufacturing-led economy

A more optimistic template assumes there is comparatively little re-allocation of capital and labour required.

For example, the economy may be heavily concentrated in manufacturing and its factories are already making precisely the mix of products - from food products to all kinds of hardware and software - that prove to be in demand post-pandemic.

In this case, the entire recovery looks more V-shaped, and the economy returns to its pre-pandemic level in 2021 Q2.

Service-led economy

A more pessimistic template assumes that the economy is largely a service economy and has therefore been hit hard by the pandemic.

Surveys of income, expenditure and unemployment by income group in the US have shown that it is the in-person services that have been especially vulnerable to the ravages of the virus.

Not only did higher income groups who accounted for the bulk of consumer spending pre-pandemic have the income and properties to enable them to shelter for longer from the worst effects of the pandemic, but since they tend to employ numerous lower income service providers directly (e.g. drivers or gardeners) or indirectly (e.g. waiters, cooks etc. at the restaurants where they eat) it is those economies with higher concentrations on service activities that have fared worst and the most likely to continue to so going forward.

In an economy of this kind, either a large amount of re-allocation of capital and labour will be required, or alternatively it may take much longer for these lower-income, service providers to return to employment.

The economy is more severely “scarred” and as a result it grows more slowly in the aftermath of the pandemic (we have assumed 1.2% p.a.). In this template (our “service only” economy in dark blue) the economy stalls for a longer period after its initial, but more modest bounce-back, and only returns to its pre-pandemic level many years later.

Conclusion

To conclude, all economies consist of a mixture of manufacturing and service activities.

It follows that few will experience either of the two extreme cases; almost all will experience some middle course that reflects their particular mix of natural and human endowments.

Currently, many economies appear to be coming to the end of the “liquidity phase” of the crisis.

Over the coming months as government support starts to be withdrawn and firms face the headwinds of weak demand and continuing high overheads, companies and individuals will be entering the “solvency phase”.

If our three templates are broadly correct, at least in concept, there will be greater differentiation among economies, or states within the United States or the eurozone, as the next stage of the global pandemic evolves.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

Where John Greenwood and Adam Burton have expressed opinions, they are based on current market conditions, may differ from those of other investment professionals and are subject to change without notice.