Driving home for Christmas: the shift to e-vehicles

If you find yourself top to toe in tailbacks this Christmas, take a leaf out of Chris Rea’s book. Take a look at the driver next to you. Is he (or she) just the same?

If you’re driving a combustion engine vehicle, the answer could well be ‘no’.

The shift to electric vehicles is now underway, with traditional car manufacturers expanding their range of hybrid and fully electric vehicles.

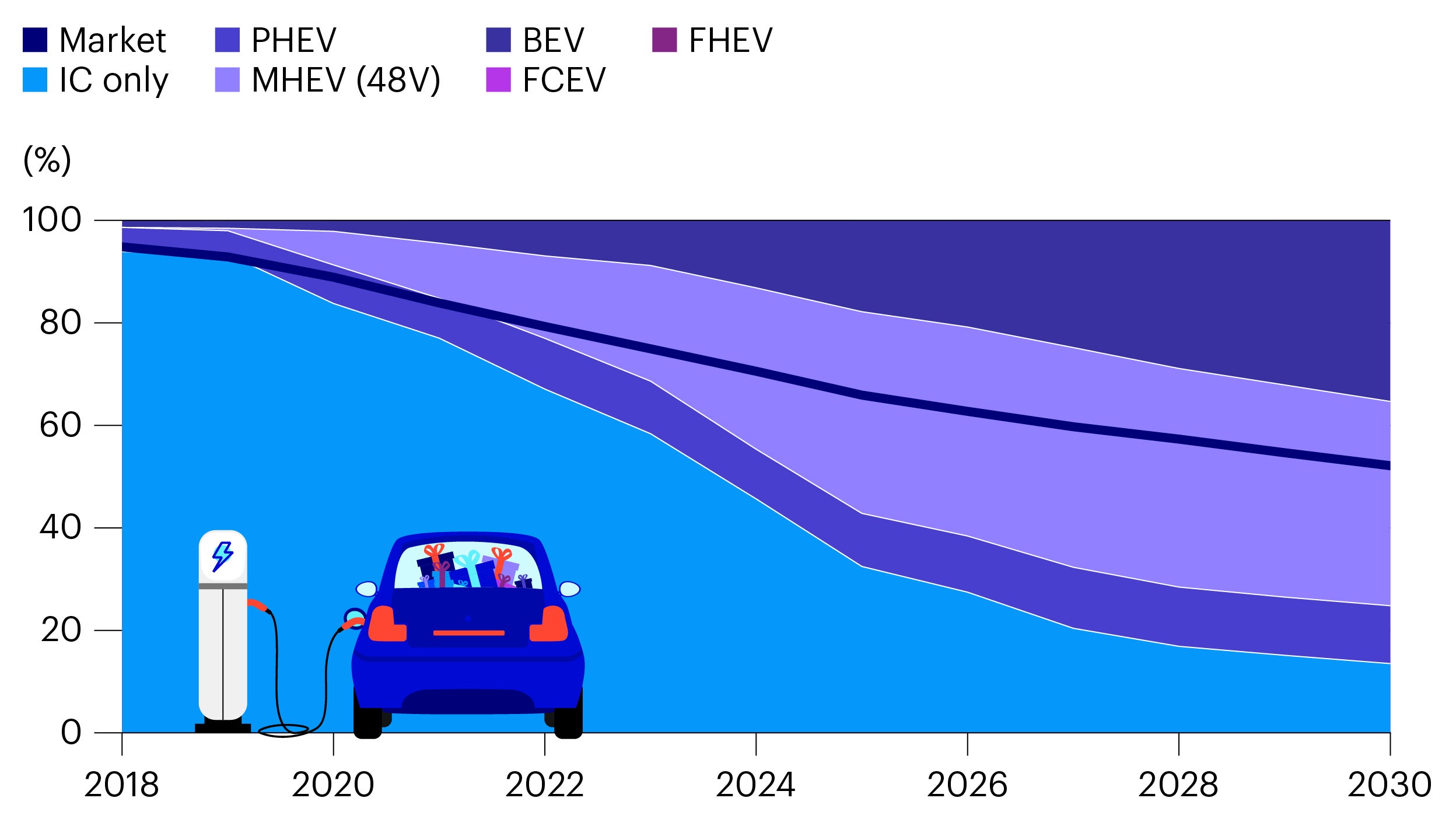

The more ambitious companies are aiming to shift half their global production to electric vehicles by 2030, as shown in the below chart.

Some smaller volume manufacturers have pledged to go further still.

Source: Wards Automotive, BMW. For illustrative purposes only.

A number of our strategies invest in auto manufacturers that are participating in the shift to electric vehicles. For example, our new ECO Bond Strategy aims to identify those manufacturers that are going a step further than their peers in this transition.

Want to read more about electric vehicles? Take a look at the related insights below.

Count down to Christmas with our festive charts as we publish a new piece each day. Recognise the images that feature on our calendar windows? Each corresponds to a city where an Invesco office is based.

Related insights

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

The Invesco ECO Bond Strategy will invest in derivatives (complex instruments) which will result in leverage and may result in large fluctuations in value. The strategy may invest in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events. The strategy may invest in distressed securities which carry a significant risk of capital loss. Debt instruments are exposed to credit risk which is the ability of the borrower to repay the interest and capital on the redemption date. Investments in debt instruments which are of lower credit quality may result in large fluctuations in value. Changes in interest rates will result in fluctuations in value. The strategy may invest in a dynamic way across assets/asset classes, which may result in periodic changes in the risk profile, underperformance and/or higher transaction costs. As a portion of the strategy may be exposed to less developed countries, you should be prepared to accept large fluctuations in value. The strategy intends to invest in securities of issuers that manage their Environmental, Social and Governance (ESG) exposures better relative to their peers. This may affect exposure to certain issuers and cause the strategy to forego certain investment opportunities. The strategy may perform differently to others, including underperforming other strategies that do not seek to invest in securities of issuers based on their ESG ratings.

Important information

-

All data is provided as at the dates shown, sourced from Invesco unless otherwise stated.

When using an external link you will be leaving the Invesco website. Any views and opinions expressed subsequently are not those of Invesco.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.