Bonds: shaken not stirred

Since reaching a low of just over 0.5% in August last year, 10-year Treasury yields have risen by about 1%, with an acceleration in the sell-off this year. The question investors are asking themselves now is whether this is merely a cyclical response to the opening up of the US economy, overlaid with a fiscal package of about 10% of GDP, or is it the end of the long-term bond bull market that began 40 years ago? In our opinion, proclamations of the latter are premature.

Comparison with previous sell-offs

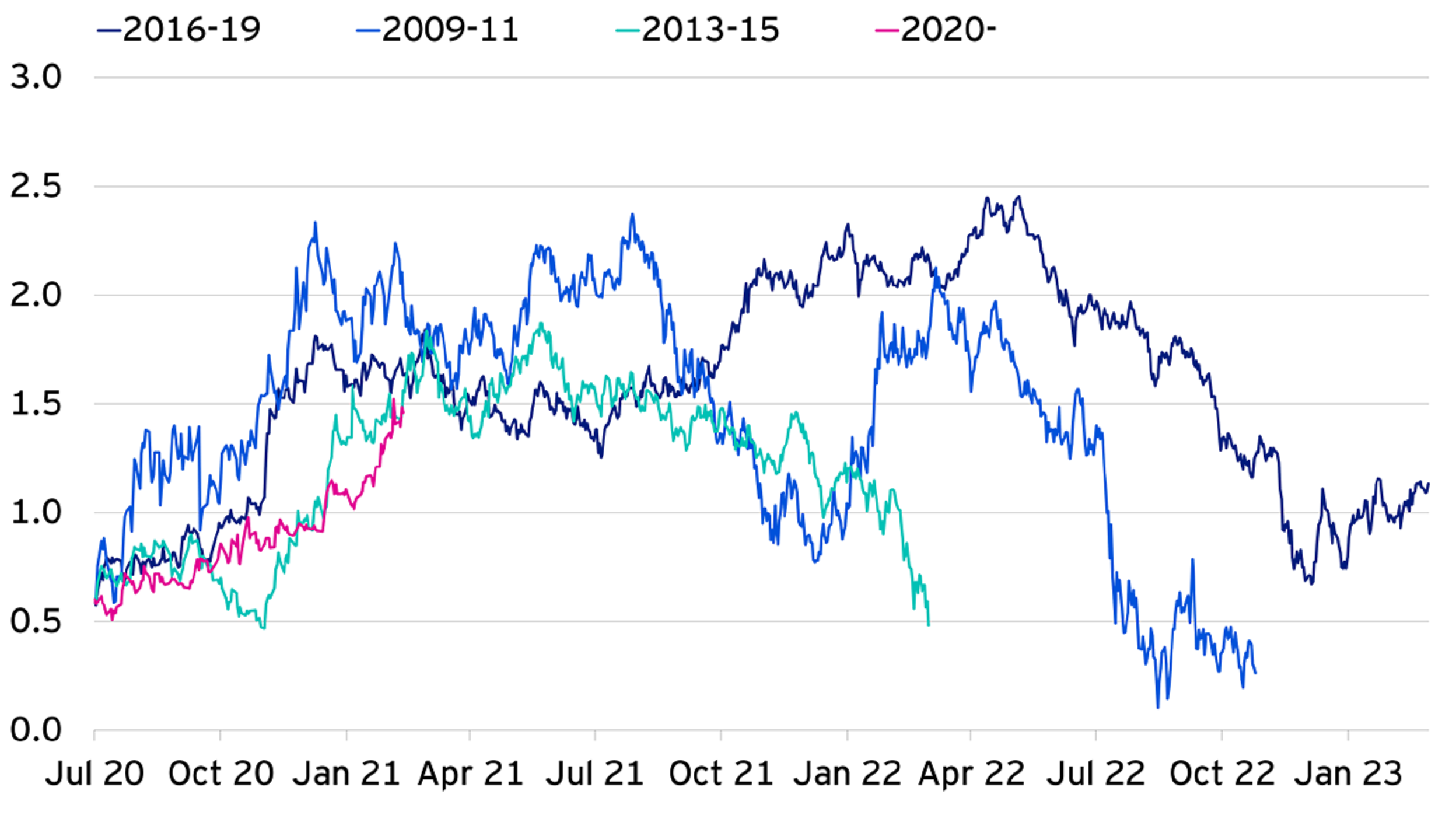

The chart below compares the recent rise in 10-year US Treasury yields with three previous sell-offs. So far, the sell-off has been no more rapid than those episodes and a further rise in the 10-year yield to perhaps 2.5% is possible without necessarily challenging the long-term downtrend. The 2009-11 and 2016-19 experiences share some characteristics with the current situation, particularly a large fiscal stimulus on top of a recovering economy, although the magnitudes vary. 2013-15 was different in that the rise in yields was triggered by the Federal Reserve hinting at slowing the pace of Quantitative Easing (QE) despite a still fragile economy.

This time is different?

Some economists have argued that this time, the rise in Treasury yields will be more severe than previous episodes and represent a structural break in the 40-year downtrend. There are a number of reasons given but most centre around the combination of extraordinarily expansive fiscal policy and extremely accommodative monetary policy that is driving a sustained expansion in broad money growth. This is an important difference with the post-Global Financial Crisis (GFC) experience, during which Quantitative Easing (QE) led to an increase in narrow money but had little impact on broader measures, as the reserves created simply stayed in the financial system rather than percolating into the real economy.

However, we would strike a note of caution here. It’s important to recognise the deep scarring caused by the pandemic and, as a result, caution on the part of households and companies. Official monetary and fiscal support to households and companies represents replacement for lost earnings and income. Evidence from consumer and business surveys suggests that while some of the transfers will be spent, most will be saved as a precautionary measure. Unless monetary financed fiscal stimulus remains in place for a sustained period, concurrent with a decline in private sector caution, one is merely stepping in for the other.

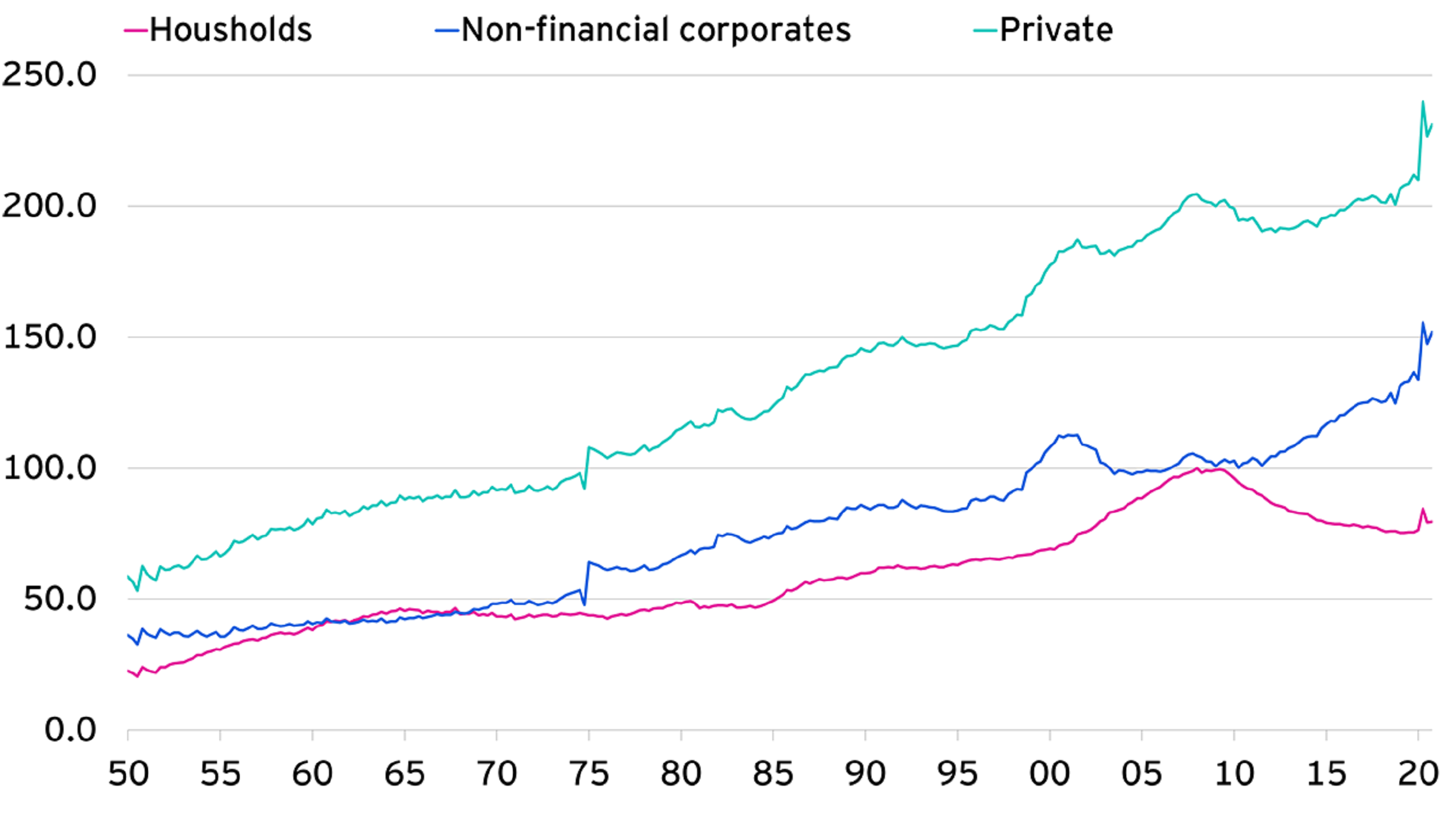

Another reason to expect the rise in US bond yields to be limited is the burden of debt carried by the private sector. US households have reduced debt steadily since the GFC but this has been more than offset by an increase in corporate debt. Although debt servicing costs remain low for now, that is dependent on yields remaining low; a further significant rise in yields would increase the burden of corporate debt. Moreover, the housing market has been an area of strength but even though the rise in mortgage rates has lagged the rise in Treasury yields, mortgage applications have already started to roll over.

Value starting to emerge

As well as economic arguments, there are technical reasons to expect a limit to the extent US Treasury yields might rise. The commitment of the Federal Reserve to keep short term rates low for an extended period has meant that the yield curve has steepened, increasing the carry and roll available from buying and holding medium to longer dated Treasuries. In addition, the attractiveness of Treasuries relative to other global bond markets has increased markedly over the last year. For example, even on an hedged currency basis, 10-year Treasuries offer a 1% premium over German Bunds; unhedged the premium is close to 2%.

Keep the Faith

It’s understandable that a cyclical recovery in Treasury yields is underway as the economy re-opens and rebounds, a large fiscal package is implemented and monetary policy remains accommodative. But so far, the increase in yields is no greater than previous upswings within the longer-term downtrend. Fiscal support will be scaled back significantly after this year, while high private sector debt limits the extent that interest rates can rise before acting as a brake on growth. Higher yields in the US are also pulling yields higher in even more vulnerable areas of the world such as the euro area. Proclamations of the end of the long-term bull market in bonds are premature.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This marketing document is exclusively for use by Professional Clients and Financial Advisers in Continental Europe as defined below, Qualified Investors in Switzerland, Qualified Clients/Sophisticated Investors in Israel and Professional Clients in Dubai, Ireland, Isle of Man, Jersey, Guernsey and the UK. It is not intended for and should not be distributed to, or relied upon, by the public. By accepting this document, you consent to communicate with us in English, unless you inform us otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.

For the distribution of this document, Continental Europe is defined as Austria, Belgium, Croatia, Czech Republic, Finland, France, Germany, Hungary, Italy, Liechtenstein, Luxembourg, The Netherlands, Norway, Spain and Sweden.

Issued by Invesco Management S.A., President Building, 37A Avenue JF Kennedy, L-1855 Luxembourg, regulated by the Commission de Surveillance du Secteur Financier, Luxembourg; Invesco Asset Management, (Schweiz) AG, Talacker 34, 8001 Zurich, Switzerland; Invesco Asset Management Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority; Invesco Asset Management Deutschland GmbH, An der Welle 5, 60322 Frankfurt am Main, Germany.

Israel: This document may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have been sent. Nothing in this document should be considered investment advice or investment marketing as defined in the Regulation of Investment Advice, Investment Marketing and Portfolio Management Law, 1995 (“the Investment Advice Law”). Investors are encouraged to seek competent investment advice from a locally licensed investment advisor prior to making any investment. Neither Invesco Ltd. Nor its subsidiaries are licensed under the Investment Advice Law, nor does it carry the insurance as required of a licensee thereunder.