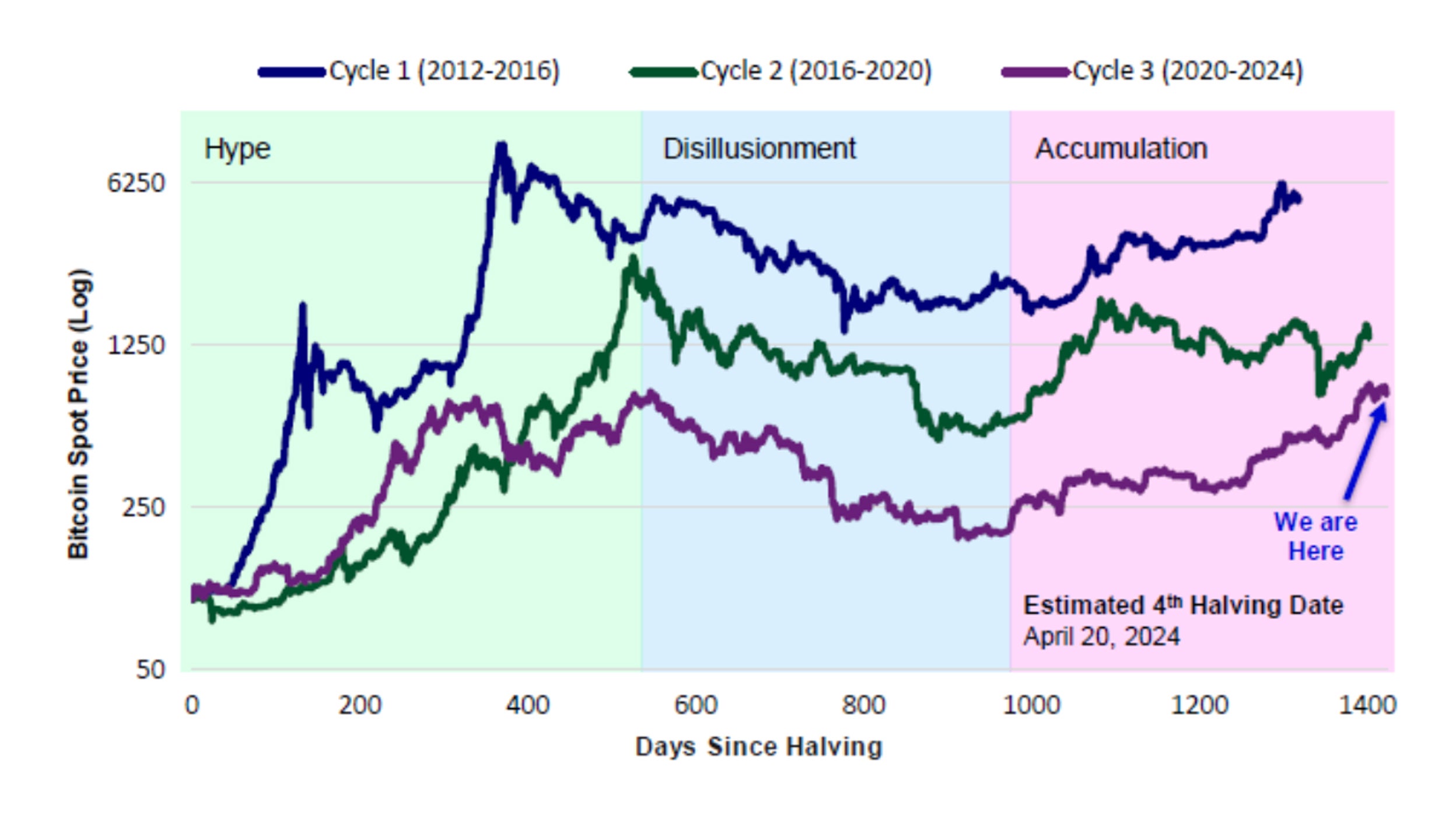

As can be seen in the chart, the Bitcoin price rallied in the lead-up to each of the previous halving events (the right side of each timeline), including the one that’s just about to take place. The price rose even more strongly after each event, from a near-immediate response to the initial halving in 2012 to slightly more delayed reactions in both 2016 and 2020.

How much is already in the price?

Bitcoin is trading around US$63,000 at the time of writing (16 April 2024), after reaching an all-time high of $73,750 in March. Today’s price represents a year-to-date increase of 43% and 107% in the past 12 months. Several factors have driven this spectacular price rise, starting with the Fed ending its rate-hiking cycle, followed by the launch of the first Bitcoin ETFs in the US, and now the market’s anticipation ahead of the next halving event. That the event is well-known in advance, even if the precise date is less certain, and given the market has several previous instances to analyse, you could reasonably assume that at least some of the impact of the halving is already reflected in the price.

Bitcoin: a long-term hold?

The real question for investors is around the longer-term prospects. Bitcoin should benefit from lower interest rates and falling bond yields, as the opportunity cost of holding this non-yielding digital asset diminishes. Bitcoin may also play a key role in helping diversify a portfolio. It has shown very low correlation to equities in particular and, although it has higher volatility than traditional asset classes, a small allocation to Bitcoin could potentially improve the risk-adjusted performance profile of a typical portfolio.

Watch our recent webinar to learn more about Bitcoin, including why regular rebalancing is important for reducing volatility.