Baidu – from contrarian to popular

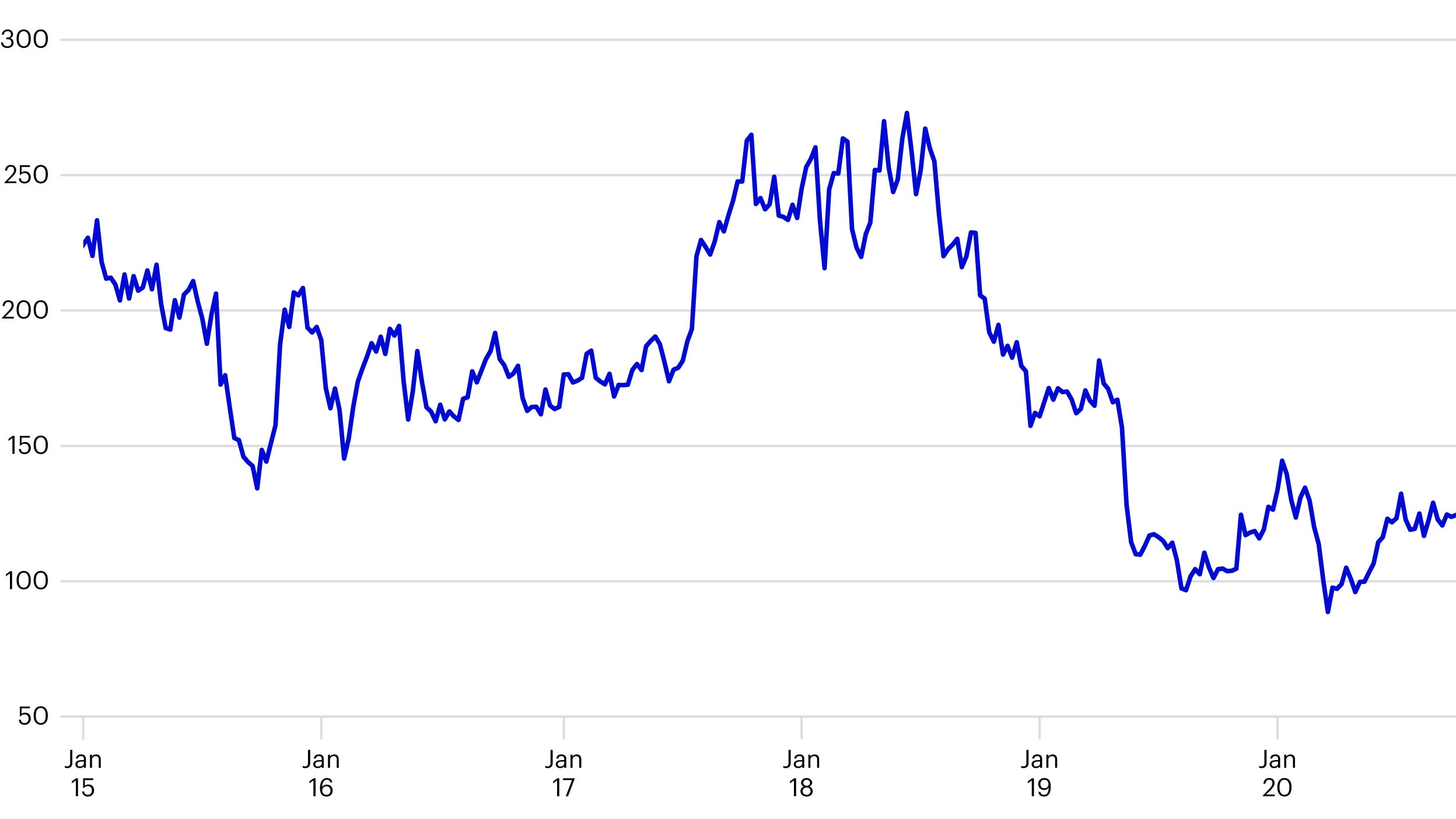

Baidu is a stock which has rapidly moved from being contrarian to popular. It was seen as a contrarian idea because the shares had fallen about 50% since 2018. Over this period, the company had been struggling to grow their core search business due to competition for advertising spending from new apps such as Douyin (TikTok in China). At the same time, Baidu were making large losses in long-form video, as well as expanding into new unprofitable areas of artificial intelligence (AI), such as autonomous driving.

Given this backdrop and after excluding significant cash and investments, Mr Market was only willing to pay a single digit PE multiple for Baidu’s core business, and on our estimation, assigned no value to the loss making AI businesses. At the time, we commented that “this is the sort of multiple reserved for Chinese State Owned Enterprises (SOEs), businesses in steep decline, or where profitability is deemed unsustainable”. To us a 10-12X PE multiple for Baidu’s core business has always felt more appropriate given their market leading position and the potential growth opportunities.

Figure 2. Baidu’s sum of the parts valuation

| Baidu sum of parts valuation | USD | % of market cap |

|---|---|---|

| Market cap | 42,576 | |

| Net cash and equity stakes | 17,744 | 41.7% |

| Net cash & short term investments | 11,452 | 26.9% |

| iQiyi stake value @ 50% discount | 5,101 | 12.0% |

| CTRIP stake value @ 50% discount | 1,191 | 2.8% |

| Implied value of core | 24,832 | 58.3% |

| Trailing 12m earnings from core (non-GAAP) | 3,893 | |

| Implied PE of core | 6.4 |

Source: Invesco as at 30 September 2020

Mr Market was positive about Baidu thanks to the belief that the growth of its business was underpinned by a successfully migration of traffic to its app from browser, as well as reduced competition and signs of a recovery in China’s advertising market. Furthermore, Baidu’s long-form video subsidiary (iQiyi – think Netflix of China) was reducing content spending and thereby boosting Baidu’s earnings. Finally, analysts were very excited about some of Baidu’s nascent AI businesses such as Apollo, its autonomous driving unit. As a result, shares in Baidu have risen rapidly to over $300 per share and sell side analysts had begun to increase their price targets.

To us, this example again reaffirms the strengths of a contrarian approach to investing – we like to buy shares in unpopular areas of the market because this is where we believe discounts to intrinsic value are most likely to be found. We don’t try to predict how and when the valuation anomaly is likely to be rectified, we simply believe that given the fullness of time, shares will trade at their intrinsic value. Indeed Baidu’s remarkable rise should act as a cautionary tale for analysts constantly on the lookout for “catalysts” to make Mr Market reappraise a company’s intrinsic value. To quote a sell-side analyst from the 17th of September 2020 when their price target was $130, “Any positive structural catalyst for Baidu – long promised, never delivered – remains too uncertain to forecast, while its execution track record is clearly poor”. To us this entirely misses the point and we would point to a quote from Anthony Bolton that explains why; “in my experience it’s very unusual to see a significant [valuation] anomaly and at the same time the catalyst that will correct it – if it was that obvious the anomaly wouldn’t be there in the first place”; we wholeheartedly agree.

Related articles

Keep up-to-date

Sign up to receive the latest insights from Invesco’s global team of experts and details about on demand and upcoming online events.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

As a large portion of the strategy is invested in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Important information

-

Data as of 31 January 2021 unless stated otherwise.

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.