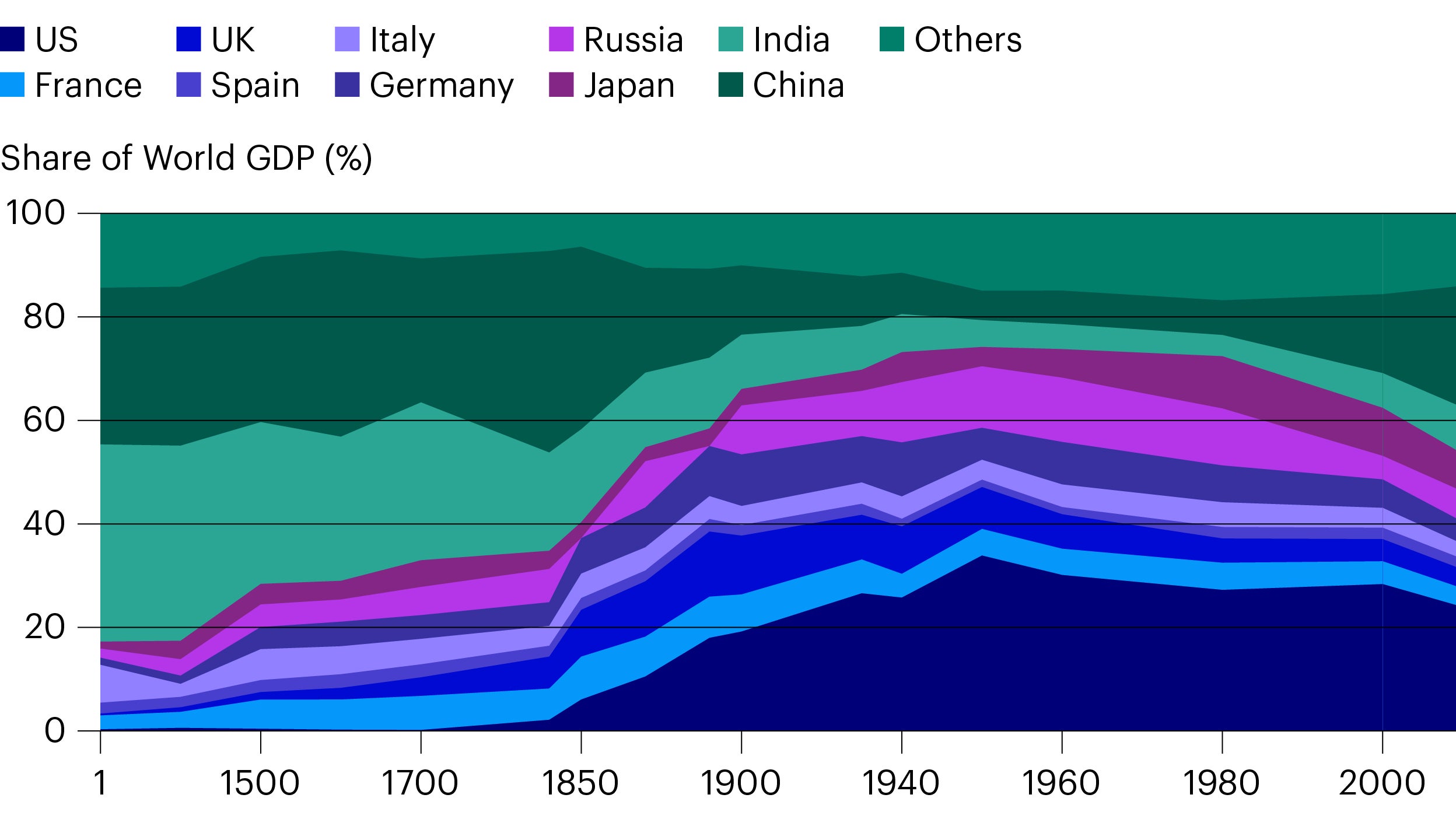

Until about 1500 CE, India was the world’s largest economy, when China and India drew roughly even. Back then, global GDP shares boiled down to demographics, given limited innovation and similar productivity growth everywhere. Successive Industrial Revolutions accelerated shifts in global activity and wealth.

In the 1700s, China became the largest economy with colonization, de-industrialization and famines in India and industrial revolutions in Europe. In 1873, the US took the lead with rapid post-Civil War reconstruction and industrialization. After political turmoil in the 1900s, China and India turned inward, languishing in slow growth.

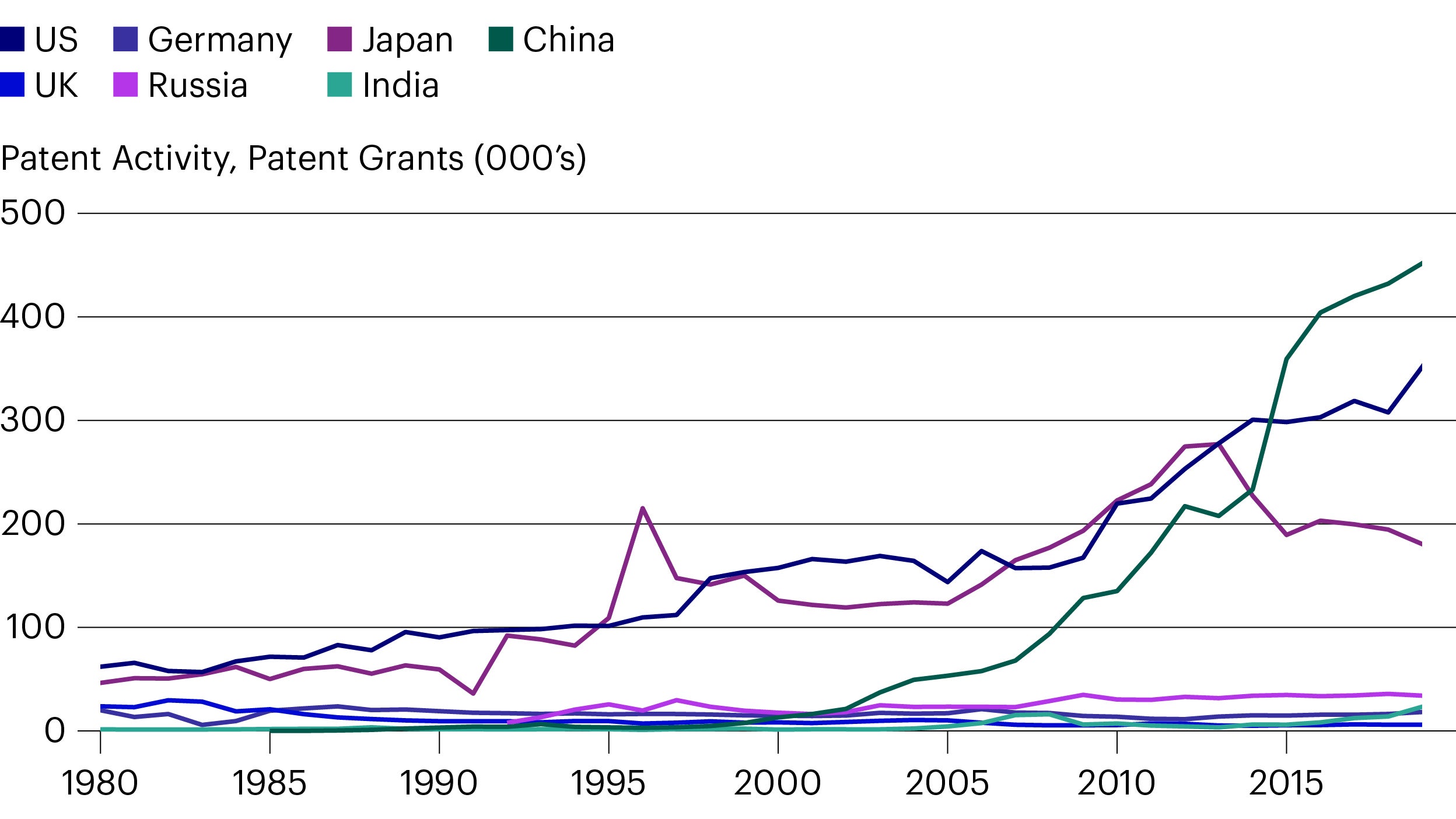

Three decades later, China again leapt forward in 1979, with reform, re-industrialization, reopening to global trade and capex with WTO membership in 2000, significantly raising productivity. As a result of adopting the technologies and techniques of the first three Industrial Revolutions across the economy, China has rapidly regained a large share of global activity. With financial deepening and opening from the 2010s, China’s weight in global markets has also accelerated sharply. With its long, rapid march to the technological frontier, China could become as innovative and productive as leading DMs, with commensurate economic and financial scale.

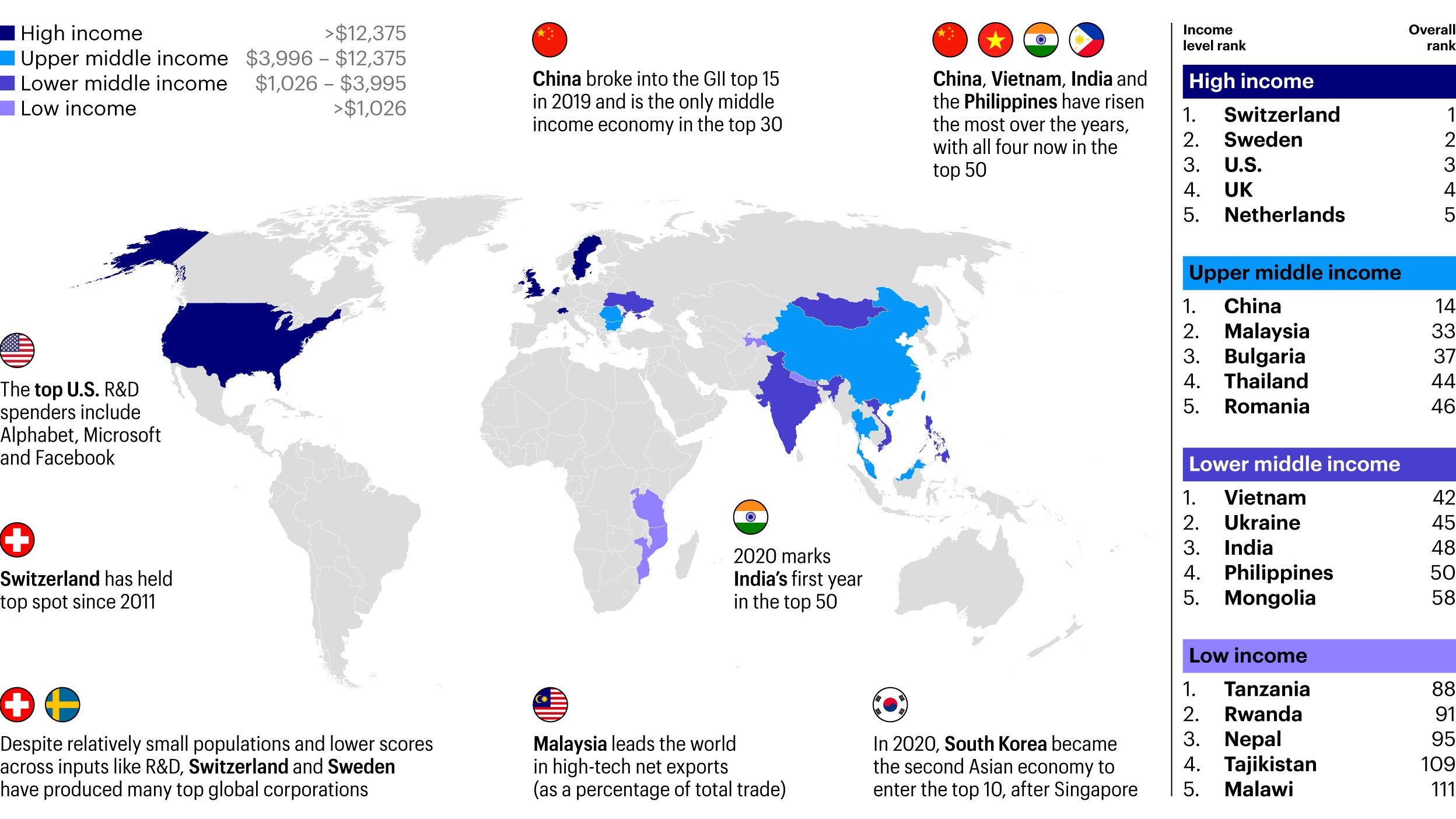

But not all EMs are created equal. No other modern EM has yet become anywhere near as innovative and effective as China, though some have the potential – scale, dynamism or strategic significance – to make their mark on the global economy, markets, and by extension, investment portfolios (Figure 3).