ETC

Why invest in gold with Invesco?

Investing in Gold? Our Invesco Physical Gold ETC is one of the largest gold products, with among the lowest overall cost exposures to the gold price in Europe. Find out more.

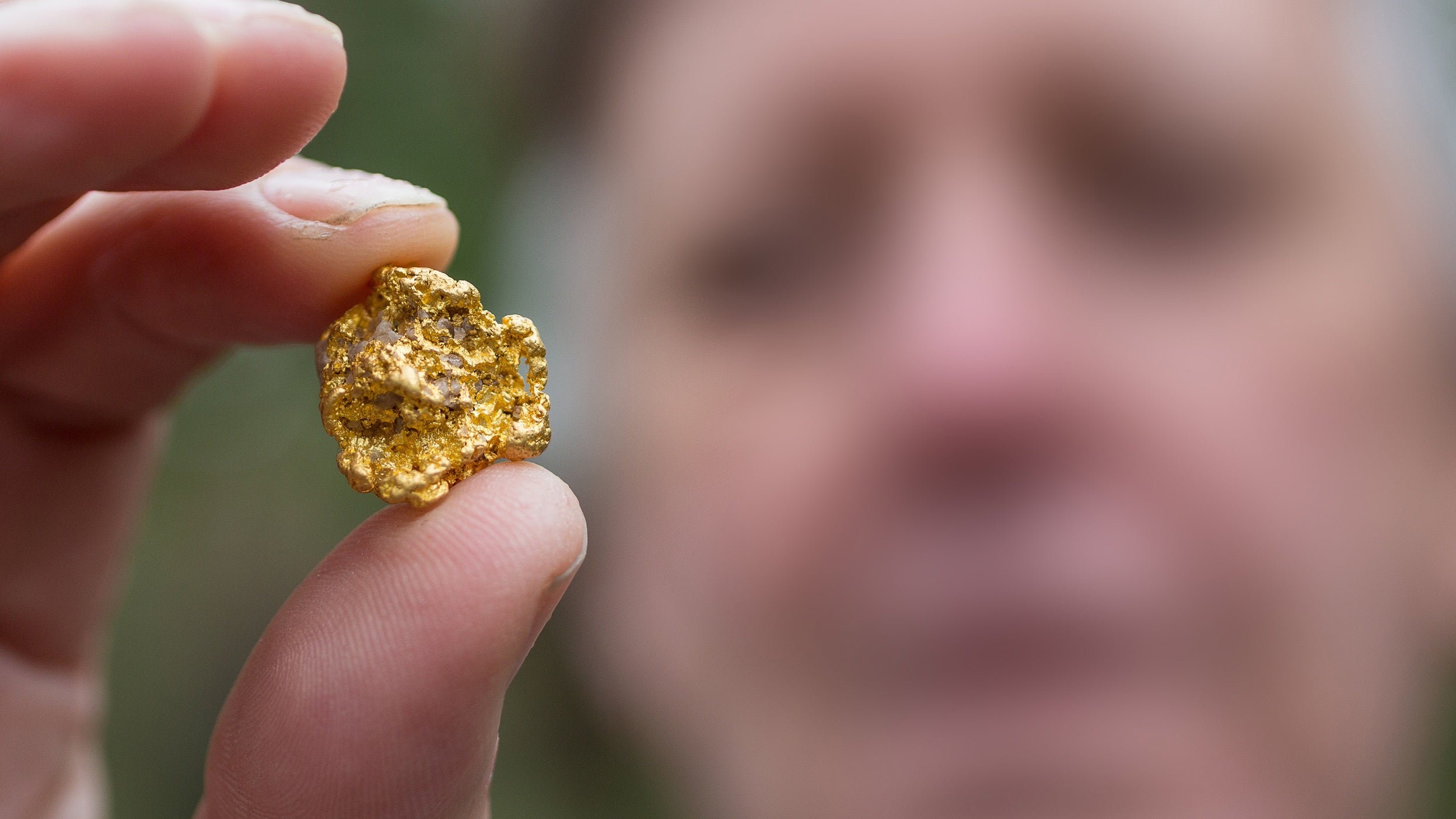

Gold has been one of the most treasured and sought-after commodities throughout history – whether as a show of wealth, or a bartering tool. Early on, it was used to trade for goods and services, later being made into coins. Then, it was used to back many of the world’s currencies in what was known as the ‘gold standard’.

That system was officially abandoned when President Nixon cut ties between gold and the US Dollar in 1971. Nevertheless, to many people, gold has remained a valuable and in-demand precious metal.

Gold tends to behave differently than traditional assets like stocks and bonds. A common perception is that it’s a ‘safe haven’ asset. In reality though, it’s tricky to say a true ‘safe haven’ exists. Valuations can dramatically fluctuate, and every investment comes with some level of risk.

First, there’s its cultural significance across Asia, but particularly in India and China. Jewellery makes up roughly half of the annual gold demand, with technological uses sitting at about 8%. In these sectors, demand tends to be stable. Central banks and investments account for the remaining demand. The difference is that for the latter two sectors, needs may fluctuate from year to year and are often driven by uncertainty and fear.

Source: Bloomberg, to the end of 2022

In 2022, a record amount of 1,135 tonnes of gold was bought by central banks, almost a quarter of the total demand for the metal. This was particularly high in emerging market regions, where banks sought to diversify their reserves and help manage geopolitical risks.

Today, gold still plays an important part in some investors’ portfolios, for a variety of reasons. Just as central banks want to diversify their reserves, many individuals want to diversify their portfolios and hold physical assets that may retain value over time.

Over the last couple years, we’ve seen how the gold price can been impacted by economic and political conditions. For example, when Russia first invaded Ukraine in February 2022, some investors looked to mitigate risk with perceived ‘safe havens’ like gold, driving the price higher.

Now, with the escalating conflict in the Middle East following the attacks by Hamas in Israel, the volatility-hedging characteristics of gold could continue to attract investors.

Gold can offer good diversification benefits, for investors and central banks alike, because it tends to behave differently to other assets. Gold can also help investors manage risk in times of heightened volatility and global uncertainty.

Gold has typically done well in times of triumph and turbulence, as investors have looked to perceived ‘safe havens’ to offset riskier assets. Recent conflicts have pushed the gold price near historic highs.

Gold can also be useful when inflation is high and rising. This is particularly true when high inflation has been caused by an economic slowdown or sudden unexpected crisis. It tends to be less desirable when rising inflation is offset by rising interest rates and bond yields.

Over these past 50 years, gold has produced positive real and nominal growth in periods of high inflation, stagflation, and recession. It has also made smaller, positive returns when conditions have been more stable.

Gold exchange-traded commodities (ETCs) can be a simple and efficient way for investors to get exposure to the gold price.

Gold ETCs are usually backed by physical gold. This means the ETC will buy gold bars (stored in secure bank vaults) which match the total value of the ETC.

One of the main benefits of an ETC is that the heavy lifting is done by the ETC – sourcing, transporting, storage and insurance of the physical gold bars. It also means that the bars can be bought and sold throughout the day like regular stocks and shares. The unit price is set against a standard benchmark, like the London Bullion Market Association (LBMA) gold price.

For complete information on risks, refer to the legal documents.

Applies to Invesco Physical Gold ETC, Invesco Physical Gold EUR Hedged ETC and Invesco Physical Gold GBP Hedged ETC - Value fluctuation, Limited recourse, Commodities.

Applies to only Invesco Physical Gold EUR Hedged ETC and Invesco Physical Gold GBP Hedged ETC - Currency hedging - ETFs

Typically, you’d access one of our exchange-traded products through an online trading platform directly. You could also buy and sell through a stockbroker, or through your financial adviser, just like ordinary stocks and shares.

Monthly gold update

The gold price rose 5.2% in July, setting a new record month-end price. Discover insights into the key macro events and what we think you should be keeping your eyes on in the near term.

Our commitment towards responsible gold

As a responsible asset manager, 100% of the gold bars held in the Invesco Physical Gold ETC adhere to the LBMA's Responsible Gold Guidance.

Gold’s supply and demand in Q1 2023

In this second part of the Gold Report, we explore the various sources of supply and demand to further explain recent movements in the gold price.

1Source: World Gold Council

Value fluctuation: The value of investments, and any income from them, will fluctuate. This may partly be the result of changes in exchange rates. Investors may not get back the full amount invested.

Limited recourse: If the issuer cannot pay the specified return, the proceeds from the sale of the precious metal will be used to repay investors. Investors will have no claim on the other assets of the issuer.

Commodities: Instruments providing exposure to commodities are generally considered to be high risk which means there is a greater risk of large fluctuations in the value of the instrument.

Currency hedging – ETCs: Currency hedging between the currency in which the underlying precious metal is typically quoted and the currency of the certificates may not completely eliminate the currency fluctuations between those two currencies and may affect the performance of the certificates.

Data as at 31.10.2023, unless otherwise stated. This is marketing material and not financial advice. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Views and opinions are based on current market conditions and are subject to change. All investment decisions must be based only on the most up to date legal offering documents. The legal offering documents (Key Information Document (KID), Base Prospectus and financial statements) are available free of charge at our website www.invesco.eu and from the issuers.